The $1,776 military payments approved for distribution in late 2025 provide a one-time, tax-free cash bonus to eligible U.S. service members, funded through existing Department of Defense appropriations.

While framed as a symbolic recognition of military service, the payments have sparked scrutiny over eligibility limits, executive spending authority, and whether short-term bonuses can address deeper compensation challenges.

$1,776 Military Payments Explained

| Key Fact | Detail |

|---|---|

| Payment amount | $1,776 (one-time, tax-free) |

| Estimated recipients | ~1.45 million service members |

| Eligible ranks | Enlisted and officers up to O-6 |

| Funding source | Existing DoD personnel appropriations |

| Application required | No |

What Are the $1,776 Military Payments?

The $1,776 military payment is a single, discretionary bonus issued by the Department of Defense and delivered directly through the military pay system. Officials have emphasized that the payment is not a recurring benefit and does not alter base pay, allowances, or retirement formulas.

The amount was chosen for its historical symbolism, referencing the year of American independence. Pentagon officials describe the payment as a morale and recognition measure during a period of sustained operational demand, rather than a structural reform of military compensation.

Who Is Eligible For $1,776 Military Payments?

Active-Duty Service Members

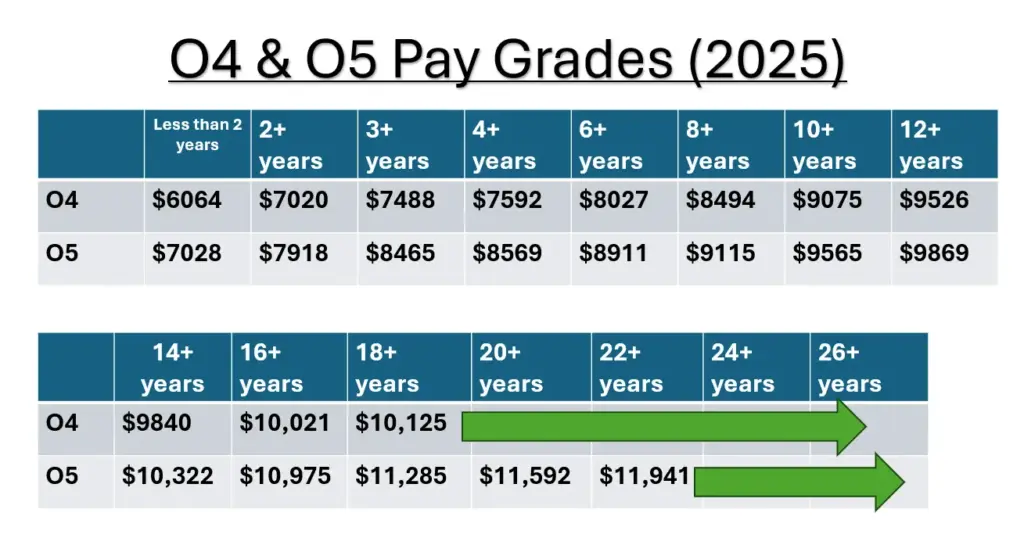

Eligibility extends to active-duty personnel in the Army, Navy, Air Force, Marine Corps, and Space Force serving in grades E-1 through O-6. Senior flag officers are excluded, a decision defense officials say reflects the program’s focus on junior and mid-career personnel.

Reserve Components

Members of the Reserve and National Guard qualify only if they were serving on federally funded active-duty orders for a minimum continuous period, generally exceeding 30 days, by the eligibility cutoff.

Exclusions

The payment does not apply to:

- Retirees and veterans no longer serving

- DoD civilian employees

- Guard members on state active duty

- Officers above O-6

How the $1,776 Military Payments Is Funded

Reprogramming Existing Funds

The payments are financed through previously appropriated defense funds, primarily from accounts designated for personnel support and housing-related expenses. Defense officials say the reallocation falls within the Pentagon’s lawful discretion to manage appropriated funds.

No new legislation was passed specifically authorizing the $1,776 payment, a fact that has drawn attention from lawmakers responsible for defense oversight.

Legal Authority and Oversight

Under federal law, the Department of Defense may reprogram funds within certain limits, provided the spending remains consistent with the general purpose approved by Congress. Large-scale reprogramming actions are typically reported to congressional defense committees.

Several lawmakers have indicated they will review the payment during upcoming budget hearings. The Pentagon’s inspector general also retains authority to audit the program for compliance and fiscal accountability.

Why the $1,776 Military Payments Are Tax-Free

The Internal Revenue Code allows certain military bonuses to be excluded from federal income taxation. By designating the $1,776 payment as non-taxable, the Pentagon ensured recipients receive the full amount without withholding, increasing its immediate financial impact.

When and How Payments Are Delivered

Payments are issued automatically via direct deposit, outside the regular monthly pay cycle. Service members do not need to submit paperwork or requests.

Defense payroll officials indicated that most eligible personnel received the payment before the end of December 2025.

Historical Context: How Unusual Is This?

One-time military bonuses are not unprecedented, but they are uncommon outside wartime or reenlistment initiatives. Past examples include targeted retention bonuses for critical skills and combat-zone supplemental pays.

Unlike those programs, the $1,776 payment applies broadly across services and occupations, making it one of the largest uniform bonus distributions in recent decades.

Economic Impact on Military Families

Short-Term Relief

For junior enlisted families, $1,776 may cover a month of groceries, utilities, or childcare costs. Advocacy groups note that many military households face persistent financial strain due to frequent relocations and high housing costs near installations.

Limits of One-Time Payments

Defense economists caution that one-time bonuses do little to offset long-term cost-of-living pressures. Structural pay adjustments and housing allowance reforms typically have a greater effect on retention and readiness.

Recruitment, Retention, and Readiness

Pentagon officials increasingly view short-term cash payments as flexible policy tools, particularly when recruitment and retention targets are strained. However, studies consistently show that predictable compensation and family stability weigh more heavily in long-term career decisions.

Addressing Misinformation

Defense officials have pushed back against online claims that:

- The payment is funded by tariffs or foreign revenues

- Veterans automatically qualify

- The bonus replaces housing allowances

None of these claims are supported by official guidance.

What the $1,776 Military Payments Does Not Do

- It does not raise base pay

- It does not count toward retirement

- It does not create an entitlement for future years

Related Links

State Tax Refunds Still Being Issued This Winter — Check Which 15 States Are Paying

One Social Security Update in 2026 May Reduce Take-Home Benefits — Here’s Why

What Comes Next

Congressional committees are expected to examine the payment during defense budget deliberations, particularly its funding mechanism. Whether similar bonuses appear in the future may depend on recruitment trends, fiscal constraints, and lawmakers’ appetite for executive discretion in military compensation.

For now, defense officials emphasize that the $1,776 military payment is complete, finite, and symbolic — not a shift in long-term pay policy.

FAQs About $1,776 Military Payments

Will this affect my taxes?

No. The payment is federally tax-free.

Do I need to apply?

No. Eligible service members receive it automatically.

Could this happen again?

There is no authorization for recurring payments.