For millions of Americans, a $1,950 monthly Social Security benefit represents a critical share of retirement income. As 2026 approaches, that figure is expected to change due to inflation adjustments and related policy updates.

While most beneficiaries will see a higher gross payment, the final amount deposited each month will depend on Medicare premiums, taxes, earnings rules, and individual circumstances.

$1,950 From Social Security

| Key Issue | Why It Matters |

|---|---|

| Cost-of-living adjustments | Raise benefits to reflect inflation |

| Medicare premiums | Often deducted directly from checks |

| Taxes on benefits | Thresholds are not inflation-adjusted |

Why a $1,950 Social Security Check Is a Meaningful Benchmark

A monthly payment of about $1,950 is close to the national average retirement benefit. According to the Social Security Administration, Social Security provides at least half of total income for roughly 40% of retirees. For about one in five, it supplies nearly all income.

This makes even small annual changes significant. An increase of $40 or $50 a month may appear modest, but over a year it can help cover utilities, prescription drugs, or rising insurance costs. Conversely, unexpected deductions can strain fixed budgets.

How Cost-of-Living Adjustments Shape 2026 Payments

How COLAs work

Social Security benefits are adjusted annually through cost-of-living adjustments (COLAs). These are based on inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The adjustment is applied to December benefits, which are paid in January.

For someone receiving $1,950 per month, even a moderate COLA raises the gross benefit above $2,000. The precise amount depends on inflation data from the prior year.

Why COLAs may not feel sufficient

Although COLAs are designed to preserve purchasing power, many retirees say they fall short. Health care, housing, and insurance costs often rise faster than the inflation measure used for Social Security. As a result, higher checks do not always translate into improved financial security.

Medicare Premiums: The Most Common Offset

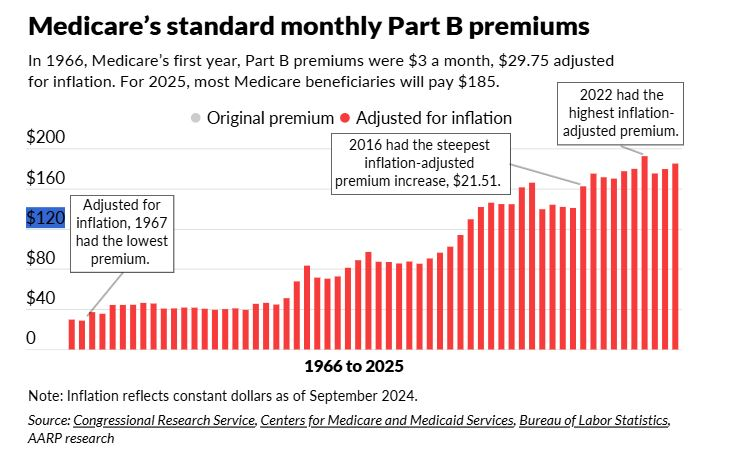

Most retirees have Medicare Part B premiums automatically deducted from their Social Security checks. Premiums tend to rise over time as medical costs increase. The Centers for Medicare & Medicaid Services administers these premiums, which can significantly reduce the net increase from a COLA.

Some beneficiaries are protected by the “hold harmless” rule, which prevents their net Social Security payment from falling year over year due solely to Part B increases. However, this protection does not apply to everyone, including higher-income enrollees or those new to Medicare.

Income-Related Medicare Surcharges (IRMAA)

Higher-income retirees may face additional Medicare surcharges known as Income-Related Monthly Adjustment Amounts, or IRMAA. These surcharges apply to Parts B and D and are based on tax returns from two years prior.

For recipients of a $1,950 benefit who also have significant retirement savings or investment income, IRMAA can consume a large share of any annual Social Security increase. Financial advisors often recommend reviewing income levels carefully to anticipate these costs.

Taxes on Social Security Benefits

Federal taxation rules

Social Security benefits may be subject to federal income tax once “combined income” exceeds certain thresholds. Combined income includes adjusted gross income, tax-exempt interest, and half of Social Security benefits.

According to the Internal Revenue Service, up to 85% of benefits can be taxable for higher-income households. These thresholds are not indexed to inflation, meaning more retirees become subject to taxation each year.

State taxes vary widely

In addition to federal taxes, state treatment of Social Security benefits varies. Many states exempt Social Security entirely, while others tax it under certain conditions. This variation can materially affect the net value of a $1,950 monthly benefit depending on where a retiree lives.

Working While Receiving a $1,950 From Social Security

Some retirees continue to work part time while collecting Social Security. Before full retirement age, earnings above an annual limit can temporarily reduce benefits. After reaching full retirement age, there is no earnings limit, and benefits are no longer reduced regardless of income.

Importantly, benefits withheld due to earnings limits are not lost. Once full retirement age is reached, Social Security recalculates payments to account for previously withheld amounts.

Payment Timing and Delivery in 2026

Social Security payments are issued monthly on a staggered schedule based on beneficiaries’ birth dates. Most recipients receive payments on the second, third, or fourth Wednesday of each month.

If a payment date falls on a weekend or federal holiday, it is typically issued on the prior business day. Direct deposit remains the most common and secure delivery method, reducing the risk of delays or theft.

Inflation, Purchasing Power, and Long-Term Reality

While COLAs help offset inflation, they do not guarantee that benefits will keep pace with retirees’ actual expenses. Studies by academic and policy groups have long questioned whether the CPI-W adequately reflects older Americans’ spending patterns.

For retirees receiving $1,950 per month, maximizing the base benefit through careful claiming decisions earlier in retirement often provides the strongest long-term protection against inflation.

Social Security’s Financial Outlook

Concerns about the program’s long-term finances continue to shape public debate. Trustees project that, without legislative changes, trust fund reserves could be depleted in the mid-2030s. At that point, payroll taxes would still cover most scheduled benefits, but not all.

Historically, lawmakers have avoided reducing benefits for current retirees. While no immediate changes are expected, uncertainty reinforces the importance of understanding how annual adjustments affect individual payments.

Protecting Your Benefits From Fraud and Errors

As benefit amounts rise, so does the risk of fraud. The SSA warns beneficiaries to be cautious of unsolicited calls or messages claiming to involve benefit changes. Reviewing annual benefit statements and monitoring bank accounts can help detect problems early.

Errors in earnings records or deductions can also affect payments. Beneficiaries are encouraged to review statements regularly and report discrepancies promptly.

Practical Steps for Beneficiaries Receiving $1,950 From Social Security

Financial planners often suggest several proactive measures:

- Review annual COLA notices and Medicare premium updates

- Estimate taxable income for the coming year

- Check eligibility for Medicare savings programs or supplemental coverage

- Confirm payment schedules and delivery methods

These steps can help retirees better anticipate net income changes.

Related Links

Items That May No Longer Be Allowed Under SNAP – Check EBT Card Rules Updates

New Law Could Push Average Tax Refunds Higher in 2026 — What Changed

For retirees receiving about $1,950 per month, 2026 is likely to bring a higher gross Social Security check. Whether that increase improves financial security will depend on health care costs, tax exposure, and personal income sources. Understanding these moving parts remains essential for navigating retirement on a fixed income.

FAQs About $1,950 From Social Security

Will everyone with a $1,950 benefit receive the same increase in 2026?

No. COLAs apply uniformly, but net payments vary based on Medicare premiums, taxes, and other deductions.

Can my net payment ever go down even if benefits increase?

Yes. Rising Medicare premiums or taxes can offset or exceed a COLA increase.

Does delaying retirement still matter once I’m already receiving benefits?

Claiming decisions made earlier permanently shape benefit levels, underscoring the importance of timing.