The renewed $2000 stimulus check talks circulating online have drawn public attention, but U.S. officials say no new payments are approved or imminent. While the White House has floated a proposal tied to tariff revenue, Congress has not authorized funding, and economists warn the plan faces major legal, fiscal, and political barriers.

$2000 Stimulus Check

| Key Fact | Detail |

|---|---|

| New $2,000 checks approved? | No legislation passed |

| White House position | Proposal only, not policy |

| Funding source discussed | Tariff revenue |

| IRS payment confirmed | No |

For Americans following the headlines, the distinction between proposals and policy remains critical. Without congressional authorization, $2,000 stimulus check talks cannot translate into payments. As one senior Treasury official told the Associated Press, “Ideas may shape debate, but only laws move money.”

What Is Driving the $2000 Stimulus Check Talks

The current wave of $2000 stimulus check speculation is not the result of new legislation or emergency economic action. Instead, it traces back to a series of public remarks by President Donald Trump, who suggested that revenue generated from tariffs could be returned to Americans in the form of direct payments.

The concept, described by administration officials as a “tariff dividend,” has been framed as a way to offset higher consumer costs linked to trade policies. However, officials have stressed that the idea remains exploratory rather than operational.

Kevin Hassett, director of the National Economic Council, emphasized in multiple interviews that the executive branch does not have unilateral authority to issue such payments. “There is no mechanism to do this without Congress,” Hassett said, according to Reuters. “This is not something the executive branch can do on its own.”

The remarks, while limited in scope, were amplified across social media platforms and video-sharing sites, where they were frequently stripped of caveats and presented as confirmation of imminent payments.

No Congressional Action, No Payments

Despite the heightened public interest, Congress has not introduced, debated, or passed any bill authorizing new stimulus payments. Under U.S. law, federal spending must be approved by Congress, and no existing statute allows the Treasury Department to issue checks based on tariff collections alone.

The Internal Revenue Service (IRS), which distributed pandemic-era stimulus checks, has confirmed it has received no directive or funding authorization to prepare new payments. Officials have warned that misinformation may raise false expectations among households already under financial strain.

According to the Congressional Research Service, the pandemic stimulus checks were authorized under emergency legislation tied to public health and economic collapse. Without a similar crisis declaration, lawmakers would need to justify new spending through the regular budget or reconciliation process.

Tariff Revenue Falls Short of Funding Needs

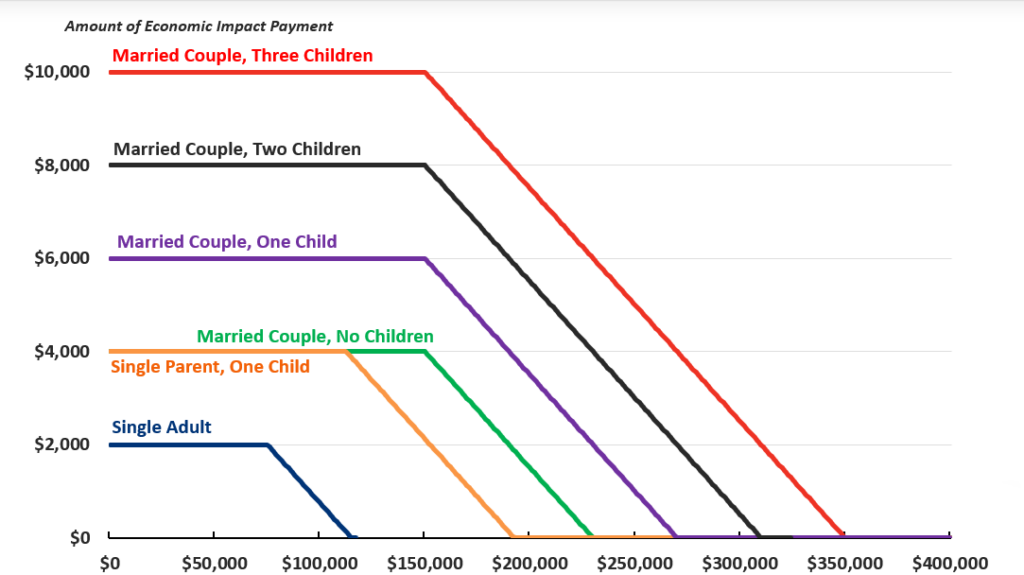

A central challenge to the proposal is funding. Tariffs generate tens of billions of dollars annually, but a universal $2000 stimulus check program would cost several hundred billion dollars, depending on eligibility limits.

The Congressional Budget Office estimates that a payment of this size to most adult Americans would exceed $450 billion. By comparison, annual tariff revenue has fluctuated between $70 billion and $100 billion in recent years, much of which is already committed to existing federal programs.

Trade economists also caution that tariff revenue is inherently unstable. It varies with import volumes, trade disputes, and global economic conditions. Redirecting it to direct payments would introduce uncertainty into both trade policy and federal budgeting.

“Tariffs are not a reliable or scalable funding mechanism for recurring cash transfers,” said Chad Bown, a senior fellow at the Peterson Institute for International Economics. “They were never designed for that purpose.”

Why Economists Are Cautious

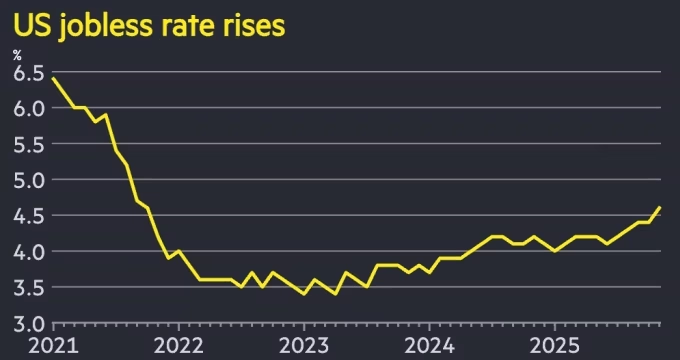

Beyond funding concerns, economists question whether broad stimulus checks are appropriate under current economic conditions. Unlike the early pandemic period, unemployment remains near historic lows, and consumer spending has shown resilience.

Data from the Department of Labor indicates that job growth has moderated but not collapsed. At the same time, inflation, while lower than its 2022 peak, remains a concern for policymakers focused on price stability.

Federal Reserve officials have repeatedly warned that large, untargeted cash transfers could increase demand faster than supply, potentially pushing prices higher. Such outcomes would disproportionately affect lower-income households, undermining the intended relief.

Historical Context: How Past Stimulus Checks Were Approved

Understanding the current debate requires looking at how previous stimulus checks were enacted. Between 2020 and 2021, Congress approved three rounds of payments totaling trillions of dollars as part of emergency pandemic legislation.

Those measures passed with bipartisan support during a period of unprecedented economic disruption. Lawmakers cited mass layoffs, business closures, and collapsing consumer demand as justification for direct cash assistance.

Today’s economic environment differs significantly. While household budgets remain under pressure from housing and healthcare costs, the absence of a recession makes sweeping stimulus politically difficult.

Former Treasury officials note that stimulus checks are among the most visible — and expensive — tools available, which makes them harder to justify outside of emergencies.

Political Dynamics and Public Sentiment

Politically, the $2000 stimulus check discussion reflects broader tensions over economic messaging. Public polling consistently shows strong voter interest in direct financial relief, even when support for specific funding mechanisms is mixed.

Lawmakers from fiscally conservative districts have voiced concerns about deficits and inflation, while others argue that targeted relief could help households facing rising costs despite steady employment.

Analysts say the tariff dividend idea may function more as a signaling device than a legislative roadmap. By floating the concept, political leaders can test public reaction without committing to detailed policy frameworks.

What Could Happen Next

While immediate payments remain unlikely, several alternative scenarios could emerge. Congress could consider targeted relief, such as refundable tax credits, child benefits, or energy rebates, which cost less and can be aimed at specific income groups.

IRS Enforcement Reminder: When Missed Tax Deadlines Can Lead to Account Seizures

Another possibility is that stimulus discussions resurface during budget negotiations or election cycles, particularly if economic indicators worsen. In that case, lawmakers might revisit direct payments as part of a broader fiscal package.

For now, administration officials stress that $2000 stimulus check talks are not connected to any active legislative timeline.

FAQs About $2000 Stimulus Check

Are $2000 stimulus checks approved right now?

No. Congress has not passed any law authorizing new stimulus checks.

Is the IRS preparing payments?

No. The IRS has confirmed it has no plans to issue new stimulus payments.

Could checks happen in 2026?

Only if Congress passes new legislation, identifies funding, and the president signs it into law.

Are tariffs currently being refunded to consumers?

No. Tariff revenue flows into the general Treasury and is not earmarked for individual payments.