A $2,000 stimulus proposal has garnered significant attention as a potential financial lifeline for millions of U.S. citizens. Initially introduced by the administration in late 2025, the $2,000 Stimulus Proposal Reviewed payment aims to provide relief through tariff revenues, but its status remains uncertain.

While payment dates and eligibility criteria are still unclear, we review what’s known so far about the proposal and the likely path forward.

$2,000 Stimulus Proposal Reviewed

| Key Fact | Detail/Statistic |

|---|---|

| Proposed Payment Amount | $2,000 per eligible individual |

| Eligibility Criteria | Likely household income cap of $100,000 |

| Proposed Payment Date | Mid-2026 if legislation is passed |

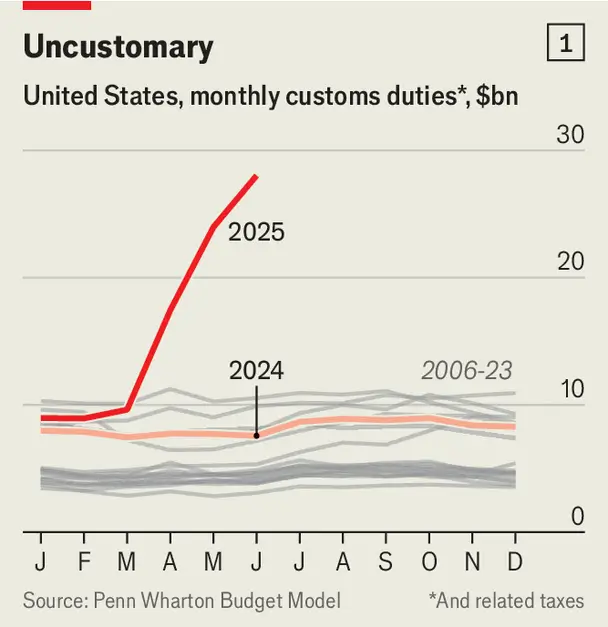

| Funding Source | Revenue from tariffs on imports |

| Legislation Status | Not yet passed; proposal still under review |

The $2,000 Stimulus Proposal — What We Know

The “Tariff Dividend” Concept

The $2,000 stimulus proposal centers around a “tariff dividend,” a concept that suggests distributing surplus funds collected through U.S. import tariffs to American citizens. Proponents argue that this funding source could provide a one-time economic stimulus to lower- and middle-income households, especially those affected by rising costs of living due to inflation.

This would allow the government to return some of the tariff revenues directly to consumers, who could use the funds for essential expenses. The idea of using tariff revenue for this purpose draws on similar policies implemented during the COVID-19 pandemic when the U.S. government issued relief checks to citizens in response to widespread economic hardship.

Advocates see the tariff dividend as a necessary mechanism for distributing surplus funds back to the American people.

Key Proposal Details and Timeline

If approved, the $2,000 payment would be distributed to individuals earning under an estimated threshold of $100,000 per year. The exact criteria for eligibility have not been finalized, but the current administration suggests the payments would target moderate-income households. If the plan proceeds, payments could begin as early as mid-2026, depending on when the legislation passes.

However, before this can happen, Congress must pass enabling legislation, and the IRS must establish a system to distribute the payments. As of now, nothing has been officially scheduled, and taxpayers should not expect immediate action.

Challenges and Uncertainties For $2,000 Stimulus Proposal

No Formal Legislation Yet

Despite significant media coverage, the $2,000 payment is not a sure thing. While the proposal has received attention, no bill has been introduced or passed by Congress to authorize the payment. Without legislative approval, the plan remains hypothetical.

Additionally, the IRS has not announced a distribution plan or set up any official payment systems.

Financial Feasibility Under Scrutiny

One of the biggest points of contention surrounding the proposal is its financial sustainability. Critics argue that the revenue from tariffs may not be enough to fund such widespread payments. Tariff revenues fluctuate depending on trade policies, and there’s concern that this could lead to budget shortfalls.

Estimates suggest the cost of distributing $2,000 per individual would exceed the revenue generated from tariffs, especially if many Americans are eligible for the payment. Experts warn that without a stable funding model, the payments could place additional strain on the federal budget, leading to increased debt or borrowed funds.

Unclear Eligibility Criteria

While the proposal has mentioned a potential income cap of $100,000 per year for eligibility, no definitive eligibility criteria have been published. The lack of clarity surrounding who qualifies, how eligibility will be determined, and how dependents will factor into payment calculations has led to confusion.

It remains unclear whether people with higher incomes or families with multiple dependents will benefit from the payment.

Public Reaction: Mixed Responses

Supporters See Relief for Struggling Households

Many Americans, particularly those in the middle and lower income brackets, see the $2,000 payment as a much-needed financial boost. With inflation rising and the cost of goods increasing, advocates argue that these payments would help alleviate the strain on families, enabling them to cover essential expenses such as food, healthcare, and housing.

Additionally, supporters view the tariff dividend as a fair way to distribute the funds, as it directly ties payments to the revenue generated from tariffs, which are paid by foreign companies importing goods to the U.S. This could also provide immediate economic stimulus, encouraging spending and helping to stabilize local economies.

Critics Cite Fiscal Risks and Inefficiency

On the other hand, many economists and policymakers remain skeptical about the proposal. Critics warn that one-time payments like this do little to address the root causes of economic challenges, such as rising healthcare costs, stagnant wages, or the lack of affordable housing.

They argue that the payments are more of a temporary fix than a permanent solution to the nation’s economic issues. Furthermore, there is concern that such a proposal could exacerbate the country’s fiscal deficits by relying on a fluctuating funding source.

If tariff revenue does not meet expectations, the government would either need to borrow funds or scale back the payment.

How the $2,000 Payment Could Impact the U.S. Economy

Short-Term Economic Relief

If the $2,000 payments are authorized, they could provide immediate relief for millions of Americans. Similar payments during the COVID-19 pandemic boosted consumer spending, which helped stabilize sectors like retail, housing, and transportation.

If the stimulus is widely distributed, it could have a similar economic ripple effect, stimulating demand for goods and services.

Long-Term Effects: What Happens After the Payment?

While immediate relief is a key benefit, long-term economic growth will depend on addressing deeper systemic issues such as inflation, wage inequality, and the cost of living. Some economists argue that a one-time stimulus check does not provide the sustainable economic changes necessary to boost long-term prosperity.

Without comprehensive reform in other areas, a $2,000 check may only provide a temporary cushion, rather than a lasting solution to broader economic challenges.

Impact on Consumer Spending

The $2,000 stimulus could lead to an uptick in consumer spending. For many low- and moderate-income households, this money could be spent quickly on essential needs, such as groceries, medical expenses, and housing.

While this increased demand could help stimulate certain sectors, it may also lead to inflationary pressures if it outpaces supply.

Related Links

$500 Monthly Checks Extended Through 2026 – See If Your Zip Code Qualifies

Veterans Could Get Up to $4,544 in December Payments – But There’s a Catch

The Path Forward: What’s Next?

Legislation and Political Considerations

For the $2,000 payment to become a reality, Congress must pass the necessary legislation. Given the current political climate and budgetary constraints, it remains to be seen whether lawmakers will agree on the details of such a proposal.

As the midterm elections approach, politicians may reassess the proposal, with some seeking to leverage it for political gain. However, given the ongoing debates over the national deficit and spending priorities, some lawmakers may push for a more targeted approach, focusing on vulnerable populations rather than universal payments.

Keeping an Eye on Official Sources

For now, official information regarding the $2,000 stimulus proposal remains scarce. Americans should follow updates from the IRS, Congress, and other trusted news outlets to stay informed. Should the proposal move forward, details on how to apply for the payment, the eligibility criteria, and the timeline for distribution will be clarified.

In the meantime, Americans should prepare for possible delays and ensure that their financial information with the IRS is up-to-date if the payments are eventually authorized.