The debate over whether the United States will issue a new round of direct federal payments has intensified, as lawmakers evaluate proposals that include a potential $2,000 Stimulus Update for millions of Americans.

The discussion has raised important questions about automatic eligibility, particularly for individuals receiving Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), and benefits from the Department of Veterans Affairs (VA). While public interest is growing, federal officials emphasize that no new stimulus legislation has been approved.

$2,000 Stimulus Update

| Key Fact | Detail |

|---|---|

| Federal Approval Status | No $2,000 stimulus payment currently authorized. |

| Potential Automatic Eligibility | Likely for SSI, SSDI, and VA if modeled after previous stimulus programs. |

| Economic Context | Inflation and household debt pressures driving debate. |

The Current Status of the $2,000 Stimulus Update

The $2,000 Stimulus Update is not yet a formal government program. Instead, it represents a series of proposals circulating among lawmakers, policy analysts, and interest groups who argue that American households continue to face economic pressure.

According to recent public briefings from the U.S. Department of the Treasury, discussions remain “active” but incomplete. Several members of Congress from both parties have acknowledged the idea of new relief payments, yet no unified legislative text has emerged.

Economists and policy analysts attribute ongoing interest in stimulus policy to high consumer prices, rising housing costs, and persistent household debt.

“The inflation rate has slowed but remains elevated relative to pre-pandemic levels,” said Dr. Evelyn Hart, a senior economist at the Brookings Institution. “These pressures are especially difficult for low-income and fixed-income households.”

Historical Context: How Past Stimulus Programs Worked

Understanding the new proposal requires examining the programs created during the COVID-19 pandemic.

Between 2020 and 2021, the federal government issued three rounds of stimulus checks totaling $1,200, $600, and $1,400. Data from the Internal Revenue Service (IRS) and the Social Security Administration (SSA) show that more than 160 million payments were distributed across the country.

A key feature of past programs was automatic payment eligibility for:

- SSI recipients

- SSDI beneficiaries

- Social Security retirement recipients

- VA disability and survivor benefit recipients

This automatic distribution was possible due to existing federal payment databases, which allowed the Treasury Department to issue funds without requiring additional paperwork.

“The federal government has the infrastructure to distribute large-scale relief quickly,” said Jason Miller, policy analyst at the Tax Policy Center. “This creates strong precedent for future programs to use the same mechanisms.”

Would SSI, SSDI, and VA Recipients Automatically Qualify?

Although no bill is finalized, experts widely expect that if Congress approves a $2,000 stimulus payment, individuals receiving federal benefits would likely be automatically included.

SSI Beneficiaries

SSI provides financial support to Americans with limited income or resources. These individuals historically received stimulus checks automatically because the government already maintains their direct deposit and identity information.

“SSI households often have very limited financial margins,” said Dr. Laura Cheng of the Urban Institute. “Rapid payment would be essential.”

SSDI Beneficiaries

SSDI recipients, who qualify through work history and disability status, were also prioritized in past relief efforts. During earlier stimulus rounds, SSDI beneficiaries received payments within days of Social Security recipients.

VA Benefits Recipients

Veterans receiving disability compensation, pension payments, or education-related benefits typically qualify for automatic federal payments. The Department of Veterans Affairs works directly with the IRS to verify identities and reduce administrative delays.

“Veterans and their families rely on predictable federal payment systems,” said Col. Thomas Avery (Ret.), advisor at the Center for a New American Security. “Automatic stimulus distribution would be consistent with prior practice.”

Income Thresholds Under Consideration

While Congress has not formalized eligibility thresholds, previous stimulus programs provide clues.

Historical thresholds included:

- $75,000 for single filers

- $112,500 for heads of household

- $150,000 for married couples filing jointly

These thresholds were designed to target low- and middle-income households. Analysts believe any new stimulus structure would likely use comparable guidelines.

A congressional aide speaking to Reuters recently noted that “income targeting remains under review, and no final language exists.”

What Economic Conditions Are Driving the Debate?

Inflation and Cost of Living

The Bureau of Labor Statistics reports that food prices have risen more than 20 percent since 2021. Housing costs—including rent and mortgage rates—have increased sharply, especially in major metro areas.

Household Debt Growth

The Federal Reserve Bank of New York reported record-high credit card balances in late 2024. Many households increasingly rely on credit for essential expenses.

“Debt pressure is pushing more families toward financial instability,” said Dr. Miles Donovan of the Harvard Kennedy School. “Relief payments could provide short-term stabilization.”

Political Pressure

With a growing number of constituents advocating for economic relief, lawmakers face demands to explore direct assistance, tax adjustments, or expanded social benefits.

Federal vs. State-Level Relief Programs

Some states have created their own relief measures, including tax rebates, rent assistance, or energy affordability programs. However, these programs vary widely.

Experts emphasize that state-level assistance cannot match the scale or uniformity of federal stimulus payments. “State relief programs help but cannot fully substitute for nationwide assistance,” said Dr. Rina Gupta of Cornell University. “Federal checks have a broader economic footprint.”

Administrative Logistics: How Payments Would Be Delivered

If Congress approves the $2,000 Stimulus Update, federal agencies would need to coordinate:

- IRS: Processes payment eligibility

- SSA: Verifies Social Security, SSI, and SSDI beneficiaries

- VA: Confirms veteran benefit records

- Treasury: Issues payments

These agencies previously coordinated the transfer of more than 150 million payments in under 60 days.

“Logistically, the system works,” said Mark Fielding, former IRS operations manager. “It would require updates, but the framework is ready.”

Potential Risks, Scams, and Consumer Protection

As with prior stimulus rounds, fraud remains a concern. The Federal Trade Commission (FTC) recorded thousands of fraud reports during past stimulus cycles, including phishing attempts and fake “expedited payment” offers.

The IRS has already warned that scammers are using misinformation surrounding the proposed $2,000 Stimulus Update to target seniors and disabled Americans.

Consumers are urged to remember:

- The IRS never requests bank information by phone or email.

- Payments are automatic for eligible groups.

- Only IRS.gov posts official updates.

How a $2,000 Payment Would Affect the U.S. Economy

Economists offer mixed assessments:

Potential Benefits

- Increased consumer spending

- Short-term reduction in debt delinquency

- Support for low-income households facing inflation

“Relief checks can help stabilize economic activity during periods of financial strain,” said Dr. Hart.

Potential Risks

- Additional spending could increase inflation pressures

- Large federal outlays could increase the deficit

- Payments may not be evenly targeted to those in greatest need

“Economically, the design matters,” said Mark Feldstein of the American Enterprise Institute. “Stimulus must balance relief with fiscal responsibility.”

Congressional Divisions and the Road Ahead

Congress remains divided along economic and ideological lines.

- Some lawmakers advocate direct payments to combat rising living costs.

- Others prefer targeted tax credits or expanded safety-net programs.

- Budget-focused members have raised concern about adding to the national deficit.

The House Ways and Means Committee has confirmed the issue is under review, but legislative action is unlikely before later in 2025.

Global Context

Other countries—including Canada, Japan, and several European nations—have used targeted relief during inflationary periods. However, none has issued programs on the scale of U.S. stimulus payments from 2020–2021.

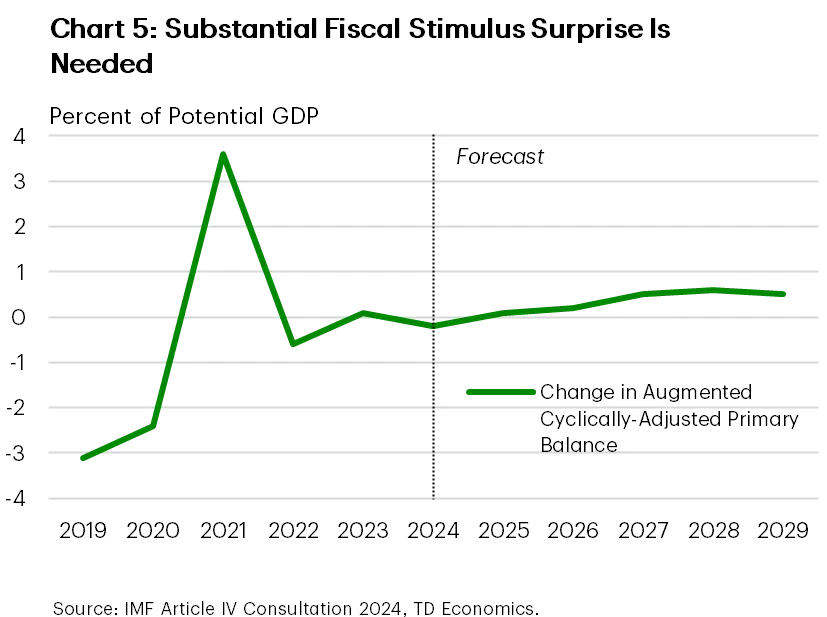

Comparative research from the International Monetary Fund (IMF) suggests that direct cash aid is most effective when paired with broader economic safeguards.

Related Links

Social Security & VA Beneficiaries Alert: New 2025 Scams You Need to Watch For

SSDI Payments for December 2025: The Three Deposit Dates You Should Mark Now

Public Perception and Misconceptions

The IRS has repeatedly emphasized that no stimulus payments are currently approved.

Misinformation circulating on social media has led to widespread confusion.

As Congress continues to debate economic relief options, the future of the $2,000 Stimulus Update remains uncertain. Lawmakers and economists agree that any final decision will hinge on economic conditions, inflation trends, and broader budget priorities. For now, federal officials encourage the public to rely on official updates and avoid misinformation as discussions move forward.

FAQs About $2,000 Stimulus Update

Has Congress approved a new $2,000 stimulus payment?

No. No new payments have been authorized.

Would SSI, SSDI, or VA recipients receive automatic payments?

Likely, if the program mirrors past stimulus structures.

Is a tax return required?

Historically, most beneficiaries did not need to file.

When could a decision be made?

Later in 2025, depending on congressional negotiations.