The 2026 COLA increase officially takes effect this month, raising Social Security payments for more than 70 million Americans as January benefits are distributed on a staggered schedule. The annual cost-of-living adjustment, designed to offset inflation, applies automatically and reflects changes in consumer prices measured last year by federal data.

For retirees, disabled workers, and low-income Americans who rely heavily on monthly benefits, the increase arrives amid continued pressure from housing, healthcare, and insurance costs, even as inflation has moderated from recent highs.

2026 COLA Increase

| Key Fact | Detail |

|---|---|

| 2026 COLA rate | 2.8% increase in benefits |

| First higher payment | January 2026 (SSI begins Dec. 31, 2025) |

| Beneficiaries affected | ~71 million Social Security recipients |

| Official Website | Social Security Administration |

How the 2026 COLA Increase Works

The 2026 COLA increase raises monthly Social Security and Supplemental Security Income (SSI) payments by 2.8%, according to the Social Security Administration (SSA). The adjustment is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), calculated by the Bureau of Labor Statistics.

Under federal law, the SSA compares average CPI-W inflation data from the third quarter of the previous year with the same period one year earlier. If prices rise, benefits are adjusted upward accordingly. If prices do not rise, no COLA is applied, as occurred in 2010, 2011, and 2016.

COLAs are intended to preserve purchasing power as prices rise. Federal law requires the SSA to apply the adjustment automatically, meaning beneficiaries do not need to apply or take any action.

“This adjustment reflects measured inflation, not projected inflation,” the SSA said in its annual COLA announcement, emphasizing that the formula is set by statute and applied uniformly.

A Brief History of COLAs

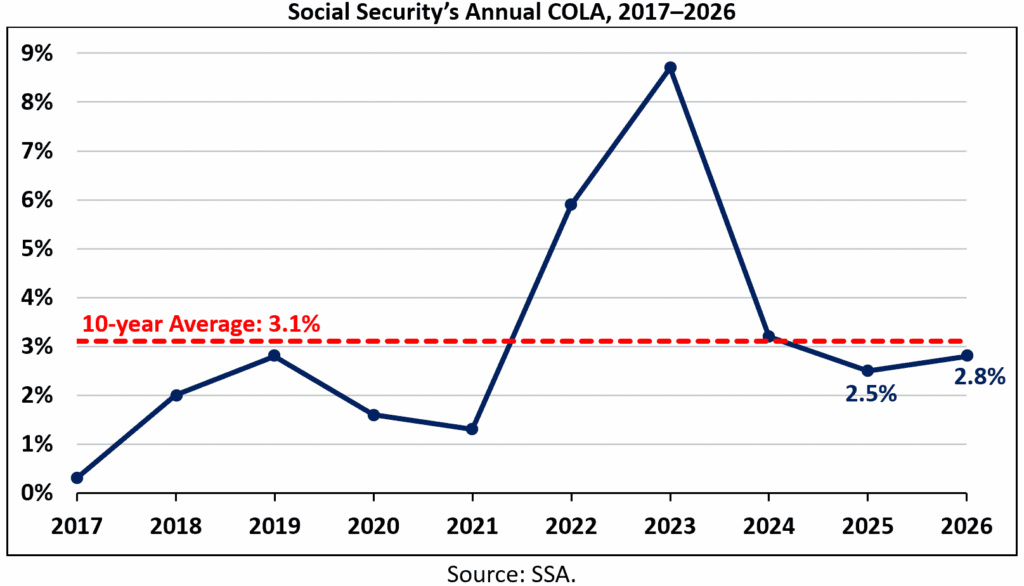

Automatic COLAs were introduced in 1975, replacing an earlier system in which Congress had to approve benefit increases manually. Since then, COLAs have varied widely—from increases exceeding 10% during the high-inflation years of the early 1980s to near-zero adjustments during periods of low inflation.

The 2.8% COLA for 2026 is smaller than the historically large adjustments seen in 2022 and 2023, when inflation surged following the pandemic, but remains above the long-term average of roughly 2.6%.

January 2026 Social Security Payment Schedule

Social Security benefits are paid on a rolling schedule determined by a recipient’s birth date or when they first began receiving benefits.

The SSA uses this staggered system to manage cash flow and reduce administrative strain, distributing payments across multiple Wednesdays each month.

Standard Retirement and Disability Benefits

For beneficiaries who started receiving Social Security after May 1997, January payments follow this schedule:

- January 14, 2026 – Birthdays on the 1st–10th

- January 21, 2026 – Birthdays on the 11th–20th

- January 28, 2026 – Birthdays on the 21st–31st

Recipients who began receiving benefits before May 1997, as well as those who receive both SSI and Social Security, are paid earlier.

- January 2, 2026 – Early payment due to the January 3 date falling on a weekend

Why Payment Dates Matter

For many households, Social Security income represents more than half of total monthly income. For about one in four beneficiaries, it accounts for at least 90%, according to SSA data. As a result, payment timing can directly affect rent payments, utility bills, and prescription refills.

Financial counselors advise beneficiaries to budget conservatively around months with holidays, when payments may arrive earlier or later than expected.

Supplemental Security Income Paid Early

SSI recipients will see their January benefit arrive on December 31, 2025, because New Year’s Day is a federal holiday. This early payment still reflects the 2026 COLA increase, the SSA confirmed.

According to agency data, about 7.5 million people receive SSI benefits, including older adults and individuals with disabilities who have limited income and resources.

SSI differs from Social Security retirement and disability benefits in that it is funded through general tax revenues rather than payroll taxes. Eligibility is based on financial need, and benefit amounts are significantly lower than average retirement payments.

Advocacy groups emphasize that even with COLAs, SSI benefits remain below the federal poverty line in most states.

What the 2026 COLA Increase Means in Dollar Terms

The SSA estimates that the average retired worker will receive approximately $50 to $60 more per month in 2026, though actual increases vary based on individual benefit levels.

For example:

- A retiree receiving $1,800 per month in 2025 would see an increase of about $50

- A beneficiary receiving $2,500 per month would see an increase closer to $70

Survivor and disability benefits follow the same percentage adjustment.

Policy analysts note that while the adjustment helps offset rising costs, it does not necessarily improve overall financial security.

“COLAs are designed to maintain purchasing power, not increase it,” said a senior analyst at the Urban Institute, noting that housing, healthcare, and insurance costs often rise faster than the CPI-W measure.

Healthcare costs, in particular, remain a concern for older Americans, especially as Medicare premiums and out-of-pocket expenses can offset part of the COLA gain.

Inflation, Policy, and Ongoing Debate

The 2026 COLA increase comes amid continued debate over whether the CPI-W accurately reflects the spending patterns of older Americans. The index emphasizes transportation, gasoline, and work-related expenses, while retirees spend proportionally more on healthcare, housing, and utilities.

Advocacy groups and some lawmakers have long argued for the use of an alternative index, such as the Consumer Price Index for the Elderly (CPI-E), which places greater weight on medical care and shelter costs.

Supporters of CPI-E say it would better protect seniors’ purchasing power. Critics argue it could accelerate the depletion of the Social Security trust funds unless accompanied by revenue increases or benefit reforms.

Lawmakers have introduced multiple bills over the years proposing changes to the COLA formula, though none have been enacted. The SSA has stated it can only implement the methodology set by Congress.

Impact on the Social Security Trust Funds

Although COLAs are essential for beneficiaries, they also increase long-term program costs. According to the most recent trustees’ report, the combined Social Security trust funds are projected to face depletion in the mid-2030s if no legislative changes are made.

If that occurs, incoming payroll taxes would still cover most benefits, but payments could be reduced by roughly 20% unless Congress acts.

Experts stress that COLAs themselves are not the primary driver of long-term funding challenges. Demographic trends—including the retirement of the baby boom generation and longer life expectancy—play a larger role.

What Beneficiaries Should Know

- COLA increases are automatic and require no application

- Direct deposit payments usually arrive on the scheduled date

- Mailed checks may take several additional days

- Benefit verification letters reflecting the 2026 COLA are available through SSA accounts

Beneficiaries are encouraged to review their updated benefit statements for accuracy and to report any discrepancies promptly.

Financial planners also recommend reassessing withholding for Medicare premiums and taxes, as changes in benefit levels can affect net monthly payments.

Looking Ahead

While the 2026 adjustment offers modest relief, economists caution that future COLAs will depend heavily on inflation trends in 2025. Slowing inflation could result in smaller increases, while renewed price pressures could push adjustments higher.

IRS Sending $1,390 Relief Payments in January 2026 — Check Your Eligibility & Payment Date

The SSA is expected to announce the 2027 COLA in October next year, following its annual review of price data. Until then, beneficiaries face a familiar challenge: balancing modest benefit growth against persistent cost pressures in everyday life.

FAQs About 2026 COLA Increase

What is the 2026 COLA increase?

It is a 2.8% adjustment applied to Social Security and SSI benefits to account for inflation.

When will I see the higher payment?

Most recipients will see the increase in January 2026, depending on their payment schedule.

Do I need to apply for the COLA?

No. The increase is applied automatically.

Does the COLA affect Medicare premiums?

COLAs can indirectly affect Medicare Part B premiums, which are typically deducted from Social Security payments.