The 2026 Social Security COLA will raise benefits by 2.8 percent starting in January, offering an average increase of about US$56 per month for retired workers. Yet rising Medicare premiums, higher medical deductibles, and continued inflation may offset much of that gain, leaving many retirees with a far smaller net increase than the headline figure suggests.

2026 Social Security COLA Raises Benefits

| Key Fact | Detail |

|---|---|

| 2026 COLA increase | 2.8% inflation adjustment |

| Average retiree benefit gain | About US$56 per month |

| Medicare Part B premium rise | Up US$17.90 from previous year |

| Expected net gain for many | US$38–40 per month |

| Main concerns | Healthcare inflation, rising deductibles |

SSA officials will continue issuing updates as the 2026 benefit changes approach, while advocacy groups prepare new campaigns urging Congress to review the COLA formula. Many retirees say they hope next year’s adjustments will more closely match the real expenses older Americans face. For now, households are preparing for another year in which medical costs may outpace gains in federal benefits.

Understanding the 2026 Social Security COLA

The annual cost-of-living adjustment, known widely as COLA, is designed to prevent Social Security payments from losing value as consumer prices rise. The 2.8 percent increase for 2026 is based on the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a metric the government has used for nearly half a century.

According to the Social Security Administration, more than 71 million Americans will receive higher payments as a result of the new COLA. This group includes retired workers, disabled individuals, surviving spouses, and Supplemental Security Income recipients.

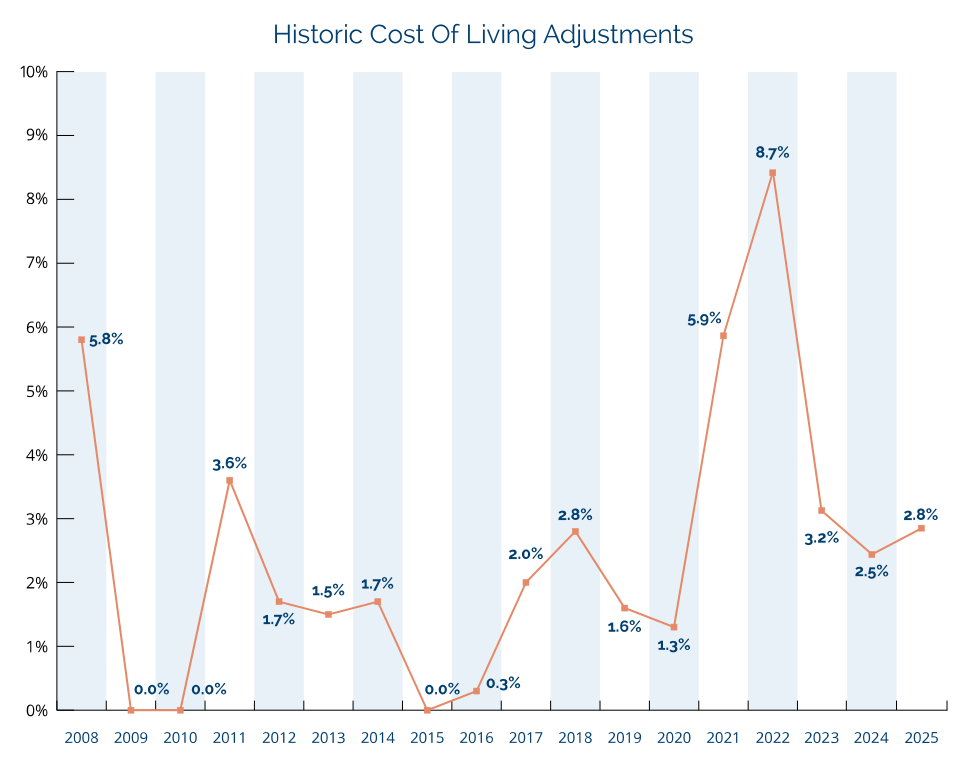

The 2026 Social Security COLA is slightly higher than the 2.5 percent increase granted in 2025 but remains far below the historic 5.9 percent and 8.7 percent increases announced in 2022 and 2023. Those larger adjustments were driven by rapid inflation during the pandemic recovery period.

Why Medicare Premiums Reduce Real Gains From the COLA

Sharp rise in Medicare Part B premiums

While the COLA increases gross monthly benefits, it does not necessarily translate into higher take-home income. Most retirees have Medicare Part B premiums deducted directly from their Social Security checks. In 2026, those premiums will increase by nearly US$18 per month, representing one of the largest year-over-year increases in recent cycles.

The higher premium reduces the net gain for millions of beneficiaries. For many, the 2.8 percent adjustment will shrink to a far smaller amount once healthcare deductions are applied.

Medicare deductible increases add further pressure

In addition to the higher monthly premium, the annual Medicare Part B deductible will also rise. Beneficiaries must meet this deductible before coverage begins, creating additional out-of-pocket pressure. For older adults who rely heavily on physician visits, tests, and outpatient care, the increased deductible may quickly consume a portion of the COLA.

Healthcare organizations warn that inflation in medical services continues to outpace general inflation, driven by rising labor costs, prescription drug spending, and growing demand for long-term support services. These structural shifts contribute to the widening gap between Social Security benefit increases and retirees’ actual expenses.

Advocates warn of long-term erosion

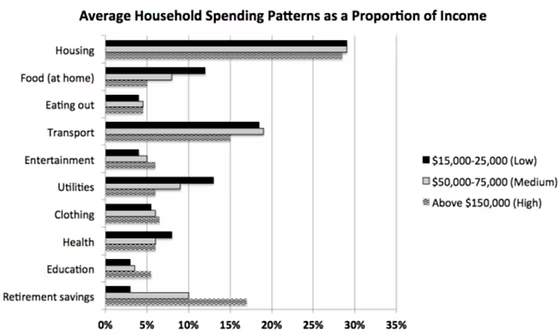

Senior advocacy groups have expressed concern that benefit adjustments have failed to keep up with older Americans’ cost profiles. “The COLA system does not reflect what seniors spend money on,” said a spokesperson for The Senior Citizens League, who noted that housing, prescription drugs, and medical premiums form a larger share of older households’ budgets than those used in the CPI-W calculation.

Inflation Still Outpaces the COLA for Many Households

Despite easing from earlier peaks, inflation continues to affect categories critical to retirees. Food prices remain elevated compared to pre-pandemic levels, while rents and utilities have risen steadily in many parts of the country.

A benefit increase that buys less

Economists emphasize that a nominal increase of 2.8 percent does not guarantee improved purchasing power. For many seniors, especially those living on fixed incomes, the COLA simply prevents benefits from falling further behind the true cost of living.

Some retirees will lose ground even after the adjustment, depending on where they live and what they spend money on. Rural residents, for example, may face higher transportation costs, while urban retirees encounter higher rents and medical service prices.

Historical Context: How the 2026 COLA Compares to Previous Years

Over the past decade, COLA increases have varied widely. The 2026 figure aligns more closely with the modest adjustments seen in the mid-2010s than the sharp increases of the early 2020s.

When inflation spiked in 2021 and 2022, beneficiaries received some of the largest COLAs in 40 years. While those adjustments offered temporary relief, they were quickly absorbed by rapid price growth in essential goods and services.

The return to a more moderate COLA reflects cooling inflation at the national level, but analysts stress that seniors’ inflation tends to remain higher than the general population’s. Medical care services, in particular, continue to rise at rates often exceeding the headline CPI.

Which Groups Will Feel the Impact Most By 2026 Social Security COLA Raises Benefits?

Low-income retirees

Households that rely almost entirely on Social Security for income will feel the effects of the COLA most acutely. For these beneficiaries, even small premium increases may offset the benefit adjustment entirely.

Disabled workers

Disabled Americans often require more frequent access to healthcare, meaning higher deductibles and premiums have a disproportionate effect on their budgets.

Surviving spouses

Widows and widowers receiving survivor benefits may see smaller increases in absolute terms, making healthcare inflation particularly challenging.

Rural seniors

In many rural regions, medical providers are scarce and transportation costs are higher. Even with the COLA, the real cost of accessing care continues to rise.

Urban seniors facing high housing costs

Rent increases in several metropolitan areas remain above national averages, consuming larger portions of fixed retirement income.

Policy Debate: Is the COLA Formula Outdated?

Policymakers and analysts continue to debate whether CPI-W accurately reflects older Americans’ spending. Critics argue that the index tracks workers’ expenses rather than retirees’, making it ill-suited for adjusting Social Security benefits.

The case for CPI-E

Some advocacy organizations support switching to the Consumer Price Index for the Elderly (CPI-E), which more heavily weighs healthcare and housing. Studies suggest CPI-E tends to rise faster than CPI-W in most years, meaning seniors would receive larger annual COLAs under this system.

Concerns about program solvency

Opponents warn that switching to CPI-E would accelerate the depletion of the Social Security trust fund, already projected to face funding gaps in the next decade. Higher annual benefit increases could worsen long-term solvency pressures.

Lawmakers remain divided

Several bipartisan proposals have explored COLA reform, but none have advanced to full congressional vote. The debate is expected to intensify as the U.S. population ages and the need for retirement income security grows.

Are $2000 Payments Really Coming to Georgia by Christmas? What We Know So Far

Tips for Beneficiaries Preparing for 2026

While journalists cannot provide individualized financial advice, beneficiaries may benefit from reviewing key items as 2026 approaches:

- Check monthly benefit statements once updated to confirm the net change after Medicare deductions.

- Review Medicare plan options, especially if supplemental coverage may offset increased deductibles.

- Assess annual medical needs, including prescription drug costs and expected appointments.

- Monitor local inflation trends, such as rising rents, food prices, and utility rates.

- Consider speaking with a certified financial professional for help navigating fixed-income budgeting.

Outlook for 2027 and Beyond

Economists say the trajectory of future COLAs will depend heavily on inflation trends, interest rates, and economic growth over the next several years. If healthcare inflation remains high relative to other categories, beneficiaries may continue to feel financial pressure even when inflation moderates.

Some analysts expect Medicare premiums to keep rising due to demographic shifts and increased demand for services. This trend could further limit the effectiveness of future COLAs.