The Social Security Administration (SSA) has announced a 2.8% cost-of-living adjustment (COLA) for 2026, raising benefits across all major programs including retirement, disability, survivor, and Supplemental Security Income (SSI).

The increase — collectively referenced as the 2026 Social Security Increases — will affect more than 75 million Americans starting in January 2026. The adjustment reflects a year of moderate but persistent inflation and wage growth, alongside the SSA’s statutory mandate to prevent long-term erosion in beneficiary purchasing power.

2026 Social Security Increases

| Key Fact | Detail |

|---|---|

| 2026 COLA | 2.8% increase |

| Average Retiree Benefit | ~$2,071/month |

| Average Disabled Worker Benefit | ~$1,630/month |

| Maximum Taxable Earnings | $184,500 |

| Earnings Limit (<FRA) | $24,480 |

2026 Social Security Increases — What the 2.8% Adjustment Means

The 2026 Social Security Increases encompasses all changes the SSA is implementing for 2026: benefit increases, taxable wage adjustments, and changes to earnings limits. The 2.8% increase applies uniformly across core benefit categories.

Affected groups include:

- Retired workers

- Disabled workers (SSDI)

- Survivors (widows, widowers, dependents)

- SSI recipients

- Spouses and auxiliary beneficiaries

The COLA is based on the CPI-W index measured from Q3 2024 to Q3 2025. This matches the statutory formula adopted in 1975.

Updated 2026 Benefit Amounts

- Retired worker average: ~$2,071/month

- Retired couple (both eligible): ~$3,208/month

- Widow(er) benefits: ~$1,919/month

- Disabled worker average: ~$1,630/month

- SSI unmarried individual: $994/moanth

These amounts represent averages — actual payments vary depending on earnings history, claiming age, and lifetime contributions.

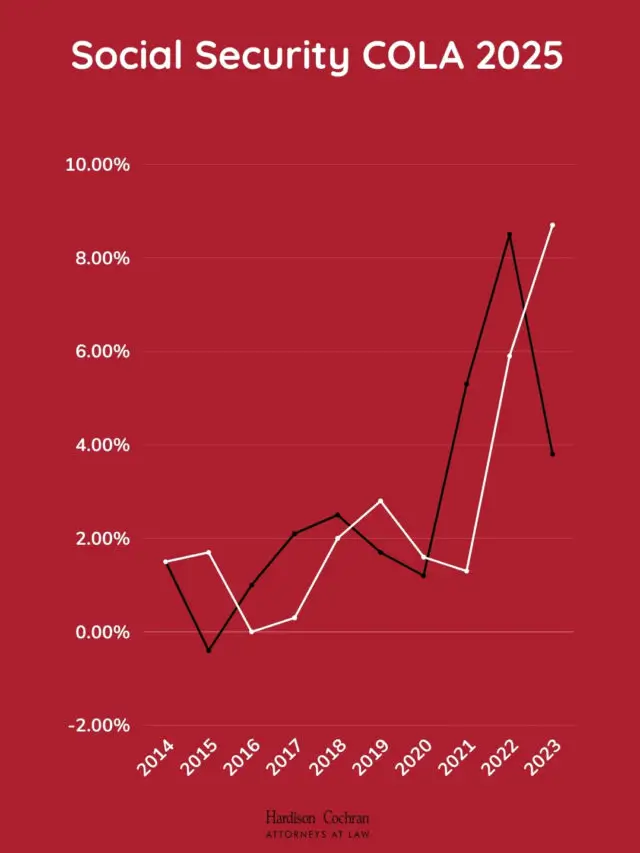

Historical Context — How 2026 Compares with Prior COLAs

COLAs over 20 years have fluctuated sharply:

- High years: 2023 (8.7%), 2022 (5.9%)

- Moderate years: 2019 (2.8%), 2018 (2.0%)

- Zero COLA years: 2010, 2011, 2016

A 2.8% increase places the 2026 COLA slightly above the long-term average, reflecting inflation that has cooled from pandemic-era highs but remains elevated in certain cost categories.

Substantial Rule Changes Beyond the COLA

1. Increased Taxable Wage Base

The maximum taxable earnings subject to Social Security payroll tax will rise to $184,500, up from $176,100 in 2025.

This affects:

- High earners

- Employers

- Future benefit computation for workers nearing retirement

2. Earnings Limits for Working Beneficiaries

For those younger than full retirement age (FRA), the annual earnings limit rises to $24,480. For those reaching FRA in 2026, the limit becomes $65,160.

3. SSI Federal Benefit Rate Updates

SSI rates rise by the same COLA:

- Individuals: $994

- Couples: $1,491

Medicare’s Role — Why Net Benefits May Differ

Medicare Part B premiums are deducted from Social Security payments.

- The projected 2026 Part B premium is expected to rise approximately 10%, based on Medicare Trustees’ early estimates.

- This may absorb one-third or more of the COLA increase for some retirees.

Healthcare inflation — especially in prescription drugs, outpatient services, and long-term care — remains higher than baseline inflation, creating a “net-benefit squeeze” for many seniors.

Demographic Groups Most Affected by the 2026 Social Security Increases

Low-Income Retirees

Rely most heavily on Social Security as their primary source of income; the COLA provides meaningful support.

Disabled Beneficiaries

SSDI recipients are especially vulnerable to healthcare cost spikes; the COLA helps stabilize essential expenses.

Surviving Spouses

Often face single-income constraints; the increase helps offset rising housing and out-of-pocket medical costs.

Working Retirees

Higher earnings limits allow them to supplement income with less risk of benefit reduction.

Expert Analysis — What the Increase Means Long-Term

“The 2.8% COLA is moderate but essential. It ensures beneficiaries don’t fall behind inflation, but healthcare costs continue to outpace Social Security,”

says Dr. Alicia Munnell, Center for Retirement Research.

“Raising the taxable maximum improves long-run financing modestly, but the system still faces solvency concerns,”

adds Andrew G. Biggs, former SSA Principal Deputy Commissioner.

Program Solvency — The Larger Policy Backdrop

The 2026 increases occur as the Social Security Old-Age and Survivors Insurance (OASI) Trust Fund faces projected depletion between 2033 and 2034.

The 2026 COLA:

- Does not worsen solvency, as COLA changes are structurally neutral

- Reflects ongoing concerns about inflation risk

- Underscores the need for legislative reform (tax adjustments, benefit formula changes, retirement age shifts)

Political and Legislative Context

COLA adjustments are mandatory; they do not require congressional action. However, 2026 is emerging as a key year politically:

- Several proposals seek to reform the COLA formula (e.g., switching to CPI-E for elderly consumers).

- High-profile bills propose increasing benefits for low-income seniors or adding supplemental payments.

- Bipartisan committees are evaluating long-term Social Security solvency solutions.

Thus, the 2026 update sits within a larger national debate.

Related Links

California Sets 2026 Deadline to Remove Plastic Bags — Stores Face Fines Up to $5,000

SNAP Overhaul Announced — 42 Million Americans Required to Reapply Under New Rules

Practical Steps Beneficiaries Should Take Now

1. Review your “my Social Security” account

New benefit letters will be posted online in December 2025.

2. Estimate net benefits

Factor in:

- Part B premiums

- Part D premiums

- Withholding for taxes

- Any state-level benefits affected by income changes

3. Reassess retirement plans

Working beneficiaries should review how updated earnings limits may influence their decisions.

4. Beware of scams

COLA announcements often trigger fraudulent outreach. The SSA never calls unexpectedly asking for payments.

The 2026 Social Security increases provide meaningful relief across all major beneficiary categories, but the benefit of the 2.8% rise will vary depending on healthcare premiums, tax interactions, and individual cost pressures.

While the 2026 Social Security Increases reflects a stable and predictable COLA, it also highlights broader concerns about retirement affordability and the future of Social Security.

FAQ About 2026 Social Security Increases

Will every Social Security recipient receive the increase?

Yes. The COLA applies universally to retirement, disability, survivor, and SSI benefits.

Is the COLA taxable?

The increase may impact taxation if combined income exceeds IRS thresholds, but the COLA itself is not separately taxed.

Does the COLA affect Medicare premiums?

Indirectly. Higher income may change premium brackets for some beneficiaries.

Does the increase affect food, housing, or Medicaid eligibility?

SSI and Medicaid rules vary by state. Beneficiaries should confirm local thresholds.