The 2026 Social Security payments will increase by 2.8%, the Social Security Administration (SSA) announced, raising monthly benefits for more than 75 million Americans beginning in January. The cost-of-living adjustment (COLA) aims to help beneficiaries keep pace with inflation, but rising Medicare Part B premiums mean that many retirees may see much smaller net gains than headline figures suggest.

2026 Social Security Payments

| Key Fact | Detail |

|---|---|

| Total Increase (COLA) | 2.8% |

| Beneficiaries Impacted | ~75 million |

| Average Monthly Increase | ~US$56 |

| Medicare Part B Premium (2026) | US$202.90/month |

| First Payment with COLA | Jan 2026 (SSI: Dec 31, 2025) |

| Official Website | SSA |

The 2026 COLA gives retirees and vulnerable Americans modest relief from inflation, but rising healthcare costs continue to erode purchasing power. As policymakers debate reforms and demographic trends reshape the U.S. economy, the value of Social Security benefits is likely to remain central to national discussions about retirement security.

What the 2026 Social Security Increase Means for Americans

The 2.8% COLA is meant to protect beneficiaries’ purchasing power after two years of easing inflation. According to the SSA, retirees will receive an average increase of about US$56 per month. Disabled workers, survivors, and SSI beneficiaries will also see their payments rise by the same percentage.

“These increases are essential for millions of Americans who rely on Social Security benefits as a major source of income,” said Dr. Alan Prescott, a senior analyst at the National Academy of Social Insurance, in an interview.

How COLA Is Calculated and Why It Matters

CPI-W and Inflation Trends

The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a metric that tracks inflation for a specific group of consumers.

If the third-quarter CPI-W rises year over year, Social Security benefits increase proportionally.

During 2024 and 2025, inflation moderated from earlier highs, resulting in a mid-range COLA for 2026—neither historically low nor unusually high.

How the Increase Breaks Down Across Beneficiary Groups

Retired Workers

- Average benefit before COLA: US$2,015

- Average after COLA: About US$2,071

Many retirees will welcome the increase but caution that rising medical costs continue to erode purchasing power.

Disabled Workers

Disabled workers typically receive lower payments than retirees.

- Average benefit before COLA: US$1,586

- Average after COLA: US$1,630

Advocates for disability rights say the increase still lags behind cost increases for specialized care, equipment, and medications.

Survivors, Spouses, and SSI Recipients

Eligible family members and low-income individuals receiving Supplemental Security Income will also benefit. SSI payments increase on December 31, 2025, one day earlier than Social Security.

Why Rising Medicare Costs Could Offset the 2026 COLA

The largest financial pressure facing retirees in 2026 is the substantial rise in Medicare Part B premiums, which are automatically deducted from Social Security checks.

- 2025 Part B Premium: US$185

- 2026 Premium: US$202.90

- Increase: Nearly 10%

Health policy specialist Dr. Meyra Johnston from the Kaiser Family Foundation said, “Premium increases are outpacing Social Security adjustments for many older adults, especially those with fixed incomes.”

For a retiree receiving US$2,071 per month, this premium rise can absorb a significant portion of the COLA increase.

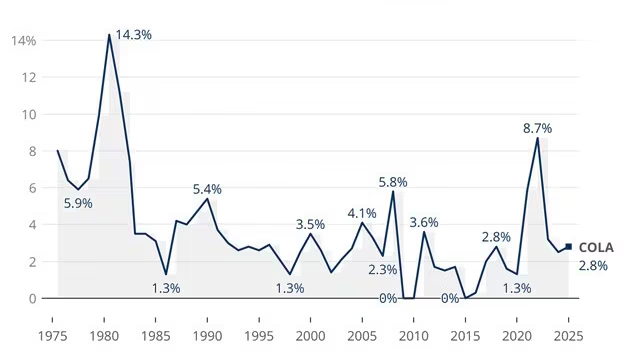

How the 2026 Increase Compares Historically

Historically, the average COLA since the 1970s is about 3.2%. The 2026 figure of 2.8% is slightly below this benchmark.

Notable historical comparisons:

- 2023: 8.7% (one of the highest ever)

- 2024: 3.2%

- 2025: 2.5%

- 2026: 2.8%

Inflation cooled significantly after the COVID-era surge, leading to smaller but more stable COLA adjustments.

The Struggle for Low-Income Seniors Continues

Despite the increase, low-income seniors continue to face challenges:

- Food prices remain elevated compared with pre-pandemic levels.

- Rent for senior housing has risen steadily.

- Out-of-pocket medical expenses have grown faster than Social Security benefits.

According to the Elder Economic Security Index, the average senior living alone often needs 25–30% more income than Social Security provides.

“Social Security keeps millions above the poverty line, but it is no longer enough by itself to guarantee stability,” said Dr. Lourdes Hammond, professor of gerontology at Boston College.

Broader Economic and Demographic Pressures

Aging Population

The United States is experiencing a demographic shift as tens of millions of Baby Boomers reach retirement age. By 2035, adults over 65 will outnumber children for the first time in U.S. history.

Social Security Trust Fund Concerns

Current projections from the Congressional Budget Office (CBO) suggest the Social Security trust fund could face partial depletion by 2033–2034, prompting policymakers to debate reforms.

Potential options include:

- Adjusting payroll taxes

- Raising the full retirement age

- Changing COLA to a different inflation measure

- Increasing the taxable earnings cap

No major legislation has passed, but bipartisan proposals continue to circulate.

Legislative Proposals That Could Impact Future COLAs

Several proposals in Congress aim to update or reform the COLA structure:

The CPI-E Proposal

Some lawmakers advocate replacing CPI-W with the Consumer Price Index for the Elderly (CPI-E), which better reflects seniors’ spending patterns.

Under CPI-E, COLAs would likely be 0.2–0.3 percentage points higher each year, according to the Bureau of Labor Statistics.

Expanding Benefits for the Most Vulnerable

Other proposals seek to boost the lowest benefit amounts or expand SSI eligibility.

What Beneficiaries Should Do Now

Financial planners recommend:

- Reviewing the SSA COLA notice arriving in late November or December.

- Checking Medicare premiums and considering supplemental plans.

- Adjusting monthly budgets to account for modest real-dollar benefit changes.

- Considering long-term financial planning in case future COLAs remain moderate.

New FRA Rule Takes Effect — Why Claiming Social Security at 62 Can Reduce Lifetime Benefits

A Global Perspective on Senior Support

Compared with other advanced economies:

- The U.S. provides moderate but not high public pension benefits.

- Nations like Germany and Japan index benefits to wages as well as inflation.

- Several Western nations also adjust benefits multiple times per year.

This context helps explain why many U.S. retirees rely heavily on personal savings, pensions, or continued part-time work.

The Outlook for 2027 and Beyond

Economists expect inflation to remain moderate in 2026, meaning the 2027 COLA could be similar unless new economic shocks occur.

“Much depends on energy prices, healthcare inflation, and the broader labor market,” said Dr. Elena Ruiz, economist at Moody’s Analytics.