If you rely on Social Security to pay the bills, the 2026 Social Security raise is not just a headline, it is your real life budget. The big question many people are asking is this: 2026 Social Security Raise: Which Groups Receive The Increased Payment Before Everyone Else, and how does that timing affect my cash flow at the start of the year? Knowing exactly when your higher benefit lands can help you avoid overdrafts, plan your rent and stay ahead of rising prices.

Put simply, the 2026 Social Security raise brings a 2.8 percent boost to monthly payments, but that raise does not show up for everyone on the same day. That is why understanding 2026 Social Security Raise: Which Groups Receive The Increased Payment Before Everyone Else is so important. Some people, especially those on Supplemental Security Income, see the increased amount before New Year’s Day, while others have to wait for their usual second, third or fourth Wednesday payment.

2026 Social Security Raise

| Key Point | 2026 Detail |

|---|---|

| COLA Increase | 2.8 percent cost of living raise for Social Security & SSI benefits |

| First Group to Get Higher Amount | SSI recipients with the January payment paid on December 31, 2025 |

| Main Reason for Early SSI Payment | January 1 is a federal holiday, so payments move to the prior business day |

| Programs Affected | Retirement, disability, survivors, spousal benefits & SSI |

| Average Retired Worker Benefit | Increases by around a few dozen dollars per month after the raise |

| Who Gets Paid on the Third of the Month | Long term beneficiaries & some people who receive both Social Security & SSI |

| Who Is Paid on Wednesdays | Most people who started benefits May 1997 or later, based on birth date |

| Total People Impacted | More than 70 million beneficiaries across all programs |

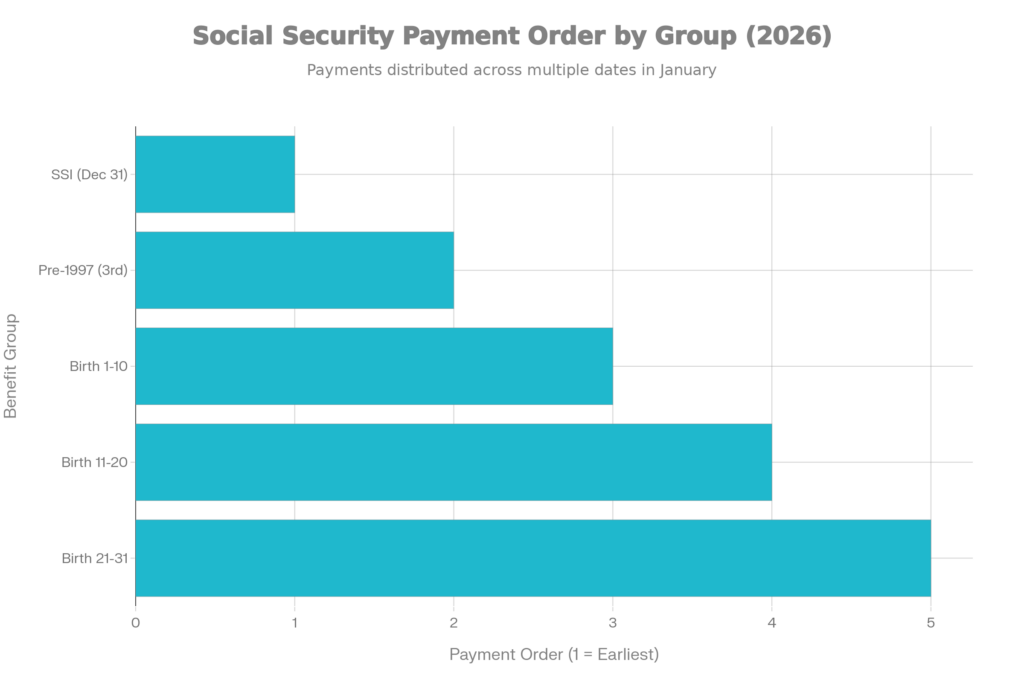

When you look past the technical jargon, this topic really comes down to timing and categories. The 2026 Social Security raise applies to tens of millions of retirees, disabled workers, survivors and low-income SSI recipients, but the money is released following different rules. Some groups are paid based on the first of the month, some on the third, and many on a specific Wednesday tied to their birth date. Because of weekends and holidays, that system can push certain payments forward, effectively letting some people enjoy the increased amount days or even a week earlier than others. Understanding where you fit in that structure is the key to knowing when your higher 2026 benefit will actually appear in your bank account.

Overview Of The 2026 Social Security Raise

The 2026 raise comes from the automatic cost of living adjustment, or COLA, which is based on inflation data from the previous year. When prices go up, Social Security uses that index to decide how much to lift monthly checks so that benefits do not fall too far behind the cost of food, housing, transport and other essentials. For 2026, that calculation produced a 2.8 percent increase, which is modest but still meaningful for people living on a fixed income.

You do not need to apply for this increase or fill out any extra paperwork. The Social Security Administration updates your benefit behind the scenes and folds the new amount into payments that are due in January 2026. The only thing you really need to track is when your specific benefit type is scheduled, so you know when you will first see the higher figure hit your account.

What The 2.8 Percent COLA Really Means

A percentage can feel abstract, so it helps to translate that 2.8 percent into real numbers. For many retired workers, the raise will add roughly the equivalent of a couple of bags of groceries or a utility bill each month. Couples and people with a higher base benefit will see a larger dollar increase, since the percentage is applied to their existing payment.

At the same time, remember that rising Medicare Part B premiums and other deductions can reduce how much of that raise you actually feel in your pocket. Even so, the COLA is designed to prevent your net Social Security income from going backward, and for many households it provides a small but important cushion against everyday price increases.

Which Groups Receive the Increased 2026 Social Security Payment Before Everyone Else

Now to the part that most people care about: which groups receive the increased payment before everyone else. The earliest winners each year are almost always SSI recipients. That is because SSI is normally paid on the first of the month, but whenever that date lands on a weekend or federal holiday, the payment shifts to the previous business day. In the case of the 2026 Social Security raise, that means the January SSI payment is actually paid on December 31, 2025.

This early payment timing is a big deal for low income seniors and people with disabilities who depend on SSI. It effectively means they enter the new year with the higher 2026 rate already in place. For people who receive both SSI and Social Security, the increased SSI amount typically lands first, and the raised Social Security benefit follows on the usual Social Security schedule in January. In other words, this group is at the very front of the line for the 2026 raise.

How The 2026 Social Security Payment Schedule Works

Outside of SSI, Social Security follows two main payment structures. One is based on the third of the month, and the other is based on Wednesdays. People who have been receiving Social Security since before a certain cutoff year, along with some who receive both SSI and Social Security, are commonly paid on or around the third. Their 2026 Social Security raise shows up in that early month payment, adjusted slightly if the third falls on a weekend or holiday.

Everyone else, mainly those who started benefits in more recent decades, is paid on a Wednesday schedule tied to their date of birth. That is where you will find most retirees, survivors and disabled workers today. Their 2026 raise appears in their January payment, but whether that is early or late in the month depends entirely on where their birthday falls.

Who Gets Paid on Which Wednesday

If you are on the Wednesday system, your 2026 Social Security raise arrives according to this simple pattern. Birthdays on the first through the tenth are paid on the second Wednesday of each month. Birthdays on the eleventh through the twentieth are paid on the third Wednesday. Birthdays on the twenty first through the end of the month are paid on the fourth Wednesday.

That means two neighbors with the same type of benefit can see the 2026 Social Security raise at very different times. One might receive the higher payment in the second week of January, while the other waits until the fourth week, even though both are getting the same 2.8 percent increase. If you receive a spousal or survivor benefit, remember that your schedule is usually based on the worker’s date of birth, not your own.

Other 2026 Social Security Changes You Should Know

The 2026 Social Security raise is the headline, but it is not the only change that may affect your planning. The cap on earnings subject to Social Security payroll tax is set to rise, which mainly affects higher earners who are still working and paying into the system. There are also updated earnings limits for people who claim benefits before full retirement age but continue to work; crossing those limits can lead to temporary benefit withholdings.

On the healthcare side, Medicare Part B premiums are expected to be higher than in 2025. Since many retirees have those premiums deducted directly from their Social Security payments, this increase can chip away at the visible benefit of the COLA. The end result is that some people will see only a small net gain from the 2026 raise once all deductions are factored in.

Are $2000 Payments Really Coming to Georgia by Christmas? What We Know So Far

How To Check Your 2026 Benefit Amount

If you want a clear, personalized picture of how the 2026 Social Security raise will affect you, the best step is to review your benefit notice. These notices are usually sent late in the year and outline your new gross benefit, any deductions such as Medicare premiums, and the final amount you will actually receive. The notice also confirms your scheduled payment date.

For faster access, you can create or log in to your online account and view your updated benefit information there. This lets you see the impact of the 2026 Social Security raise without waiting for a paper letter. Taking a few minutes to check these numbers can help you plan for January, adjust your budget and avoid surprises when the first raised payment hits your bank or prepaid card.

FAQs on 2026 Social Security Raise

Will Everyone Automatically Receive The 2026 Social Security Raise?

Yes. If you are already receiving Social Security or SSI, the 2026 COLA is applied automatically. You do not have to call, apply or submit any new forms for the increase to show up in your payment.

Why Do Some People Get the Increased Payment Before Others?

It mostly comes down to the calendar and the program rules. SSI is paid on the first of the month, which shifts backwards when that date is a holiday, while most Social Security payments are tied either to the third of the month or to a Wednesday based on birth date.

How Can I Tell If I Am on the Third of the Month or Wednesday Schedule?

Look at your recent payment history. If your benefit always arrives around the third, you are likely on the early month schedule used by long term beneficiaries and some people who also get SSI.

What Should I Do If My Raised Payment Does Not Arrive on Time?

First, check your benefit notice and bank or card account to confirm the expected date and time. If the payment is a day late, sometimes it is a simple processing delay.