The 2026 Social Security Update brings a 2.8% cost-of-living adjustment (COLA) that will increase average monthly benefits by about $56 beginning in January.

The Social Security Administration (SSA) based the adjustment on inflation trends, but analysts caution that the modest rise may not fully offset higher costs for housing, health care, and everyday essentials. Millions of retirees may still face tight budgets in the coming year.

2026 Social Security Update

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA Increase | 2.8% |

| Average Monthly Benefit Rise | ~$56 |

| Total Beneficiaries Affected | ~75 million |

| New Social Security Taxable Wage Base | $184,500 |

| New Earnings Limit (under FRA) | $24,480 annually |

Why the 2026 Social Security Update Matters Now

The 2026 Social Security Update arrives during a period of persistent inflation and rising medical expenses. Many Americans receiving Social Security rely heavily on these payments, with about half of retired households depending on the program for at least 50% of their income, according to research from the Pew Research Center.

While the raise is automatic and welcome, the additional income may offer limited relief. As Dr. Helen Ortiz, an economist at Georgetown University, notes, “Inflation has cooled, but the cost structure facing most retirees — housing, utilities, medicine — remains significantly higher than five years ago.”

Understanding How 2026 Social Security COLA Is Calculated

The annual COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). When the CPI-W rises year-over-year, Social Security benefits increase accordingly.

Limitations of CPI-W

Retiree advocates argue that CPI-W underestimates the real costs seniors face. Older adults typically spend more on health care and less on transportation and work-related expenses, which affects how accurately CPI-W captures their experiences.

Some economists prefer an alternative index known as CPI-E, which weights spending categories differently and has historically shown faster cost growth for older Americans.

How Much More Money You Can Expect Each Month

The 2.8% COLA translates into different increases depending on individual benefit levels:

- Average retired worker: +~$56 per month

- Typical retired couple (both receiving benefits): +~$92 per month

- Disability beneficiaries: +~$47 per month

- SSI recipients: +~$30 per month

These increases will appear automatically in payments sent out beginning January 2026, with SSI beneficiaries receiving their adjustment on December 31, 2025.

Why the COLA May Not Cover Rising Household Expenses

Although benefits are increasing, many Americans may find the boost insufficient.

Housing Costs Are Still Climbing

According to the Department of Labor, shelter inflation has outpaced the overall consumer price index every year since 2021. Seniors who rent — a growing group — face particular pressure because rents have risen faster than wages.

Healthcare Remains a Major Financial Burden

Even small increases in Medicare Part B premiums can swallow a large share of a retiree’s COLA.

Health-care inflation remains one of the most persistent sources of budget strain for older adults.

Everyday Essentials Cost More Than Two Years Ago

Food, electricity, home insurance, and prescription drugs continue to rise.

While inflation has slowed, prices remain elevated, meaning a 2.8% raise may only help retirees “catch up,” not get ahead.

Impact on Different Groups of 2026 Social Security Beneficiaries

Retirees on Fixed or Limited Incomes

For retirees relying solely on Social Security — over 40%, per SSA data — even modest changes in everyday prices can affect budget stability. Many households say the raise provides “some relief but not security,” according to a survey conducted by AARP.

Supplemental Security Income (SSI) Recipients

SSI recipients, many of whom have significant disabilities or limited work histories, often live close to the poverty line. The 2.8% increase offers meaningful support, but rising rent and food prices still represent substantial challenges.

Working Beneficiaries and Earnings Limits

The KW2 topic of earnings limits affects millions of early claimants:

- Workers under full retirement age (FRA) can earn $24,480 without reducing benefits.

- Beyond that amount, $1 in benefits is withheld for every $2 earned.

- In the year a worker reaches FRA, the limit is higher and the penalty lower.

These rules often surprise working seniors, who may not realize earnings tests are temporary and disappear once they reach FRA.

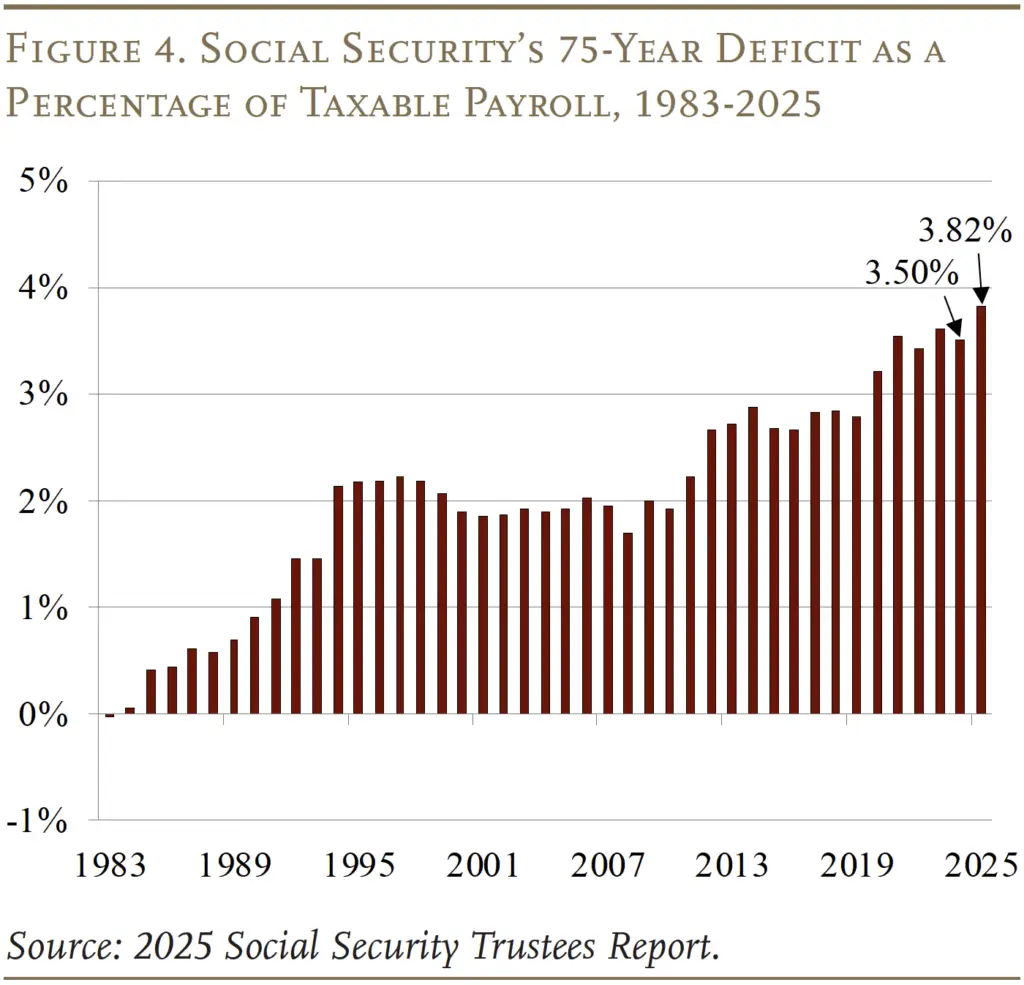

The Bigger Picture — Long-Term Pressures on Social Security

Trust Fund Solvency Concerns

The KW3 discussion of Social Security’s finances remains urgent.

Current projections show the program’s trust funds could face shortfalls within the next decade if Congress takes no corrective action. Possible reforms being debated include:

- Raising the taxable wage cap

- Adjusting benefit formulas

- Gradually increasing full retirement age

- Introducing alternative inflation measures such as CPI-E

Each proposal carries political and economic trade-offs.

Demographic Shifts Are Accelerating Pressure

The U.S. population is aging rapidly. By 2034, adults aged 65 and older will outnumber children for the first time in American history, according to Census Bureau projections. A smaller workforce supporting a larger retiree population creates structural strains that COLA adjustments alone cannot resolve.

How Households Can Prepare for 2026

Financial planners recommend several steps to help households adjust to the changing landscape of KW4 and retirement benefits.

Review and Adjust Your Annual Budget

Evaluate recurring costs such as rent, utilities, insurance premiums, and medical costs.

A 2.8% raise may help, but preparing for rising living expenses is essential.

Check Medicare Premium Announcements

Medicare typically releases premium and deductible updates in November.

These changes will determine how much of the COLA increase you actually keep.

Consider Timing of Part-Time Work

If you plan to work while receiving benefits, understand the earnings test.

Some seniors choose to delay work or shift earnings into the year they reach full retirement age.

Strengthen Emergency Savings

Unexpected expenses — appliance failures, car repairs, or medical bills — often hit retirees hardest.

Experts recommend building an emergency fund equal to at least three months of essential expenses, if possible.

Historical Context — How 2026 Compares to Previous COLAs

The chart below would show how COLA adjustments have fluctuated since 2010:

- 2022: 5.9%

- 2023: 8.7%

- 2024: 3.2%

- 2025: 2.5%

- 2026: 2.8%

The return to modest adjustments signals cooling inflation — but also raises questions about whether COLA methodology truly reflects retiree needs.

Expert Perspectives and What Comes Next

Dr. Michael Lund, a policy analyst at the American Enterprise Institute, stresses that the size of COLA matters less than its accuracy:

“A 2.8% adjustment is appropriate for national inflation averages, but it’s not tailored to what older Americans experience. Health-care inflation alone can outpace COLA year after year.”

Meanwhile, former SSA officials say the system requires modernization.

Elaine Randall, a retired SSA regional director, notes:

“COLA is meant to protect purchasing power, not improve living standards. But when inflation accumulates over a decade, retiree budgets weaken even with annual adjustments.”

Related Links

December 2025 Social Security Overview: Full Schedule and Expected Benefit Amounts

Forward-Looking Statement About 2026 Social Security

As the 2026 Social Security Update takes effect, retirees and policymakers alike face questions about long-term affordability and financial stability. Whether the 2.8% COLA meaningfully improves budgets will depend on inflation, Medicare premiums, and broader economic trends. For now, millions of Americans await January’s checks with cautious optimism.

FAQs About 2026 Social Security

Will the 2026 COLA raise my Medicare premiums?

Not directly, but Medicare’s annual premium changes may offset part of your COLA increase.

Does the COLA affect taxes on Social Security benefits?

Possibly. Higher annual income may push some retirees over thresholds that trigger taxation of benefits.

Is this the final COLA amount for 2026?

Yes. Once announced in October, the COLA figure is final.

Will Congress change how COLA is calculated?

There are proposals to adopt CPI-E, but no legislative action has been taken.