In January 2026, Social Security beneficiaries will see higher payments thanks to a 2.8% cost-of-living adjustment (COLA), bringing monthly checks for many recipients up to $2,700 to $2,800. However, only those who meet specific eligibility criteria—such as lifetime earnings and claiming age—will qualify for these higher amounts.

This article explores how the Social Security system works, who qualifies for the highest monthly payments, and what changes to expect for 2026.

$2,700–$2,800 Social Security Payments

| Key Fact | Detail |

|---|---|

| Average Social Security Payment | $2,072/month after a 2.8% COLA increase |

| Maximum Benefit for Full Retirement Age | $3,627/month if claiming at age 66-67 |

| Maximum Benefit at Age 70 | Up to $5,251/month for delayed claims |

| Monthly Payments for $2,700–$2,800 | Available to high earners who delay retirement or with long work histories |

| COLA Increase for 2026 | 2.8% rise in Social Security benefits |

How Social Security Payments Are Determined

The Role of the Cost‑of‑Living Adjustment (COLA)

Each year, Social Security benefits are adjusted to account for inflation through the cost-of-living adjustment (COLA). The 2.8% COLA for 2026 is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures price changes for a typical basket of goods and services.

In recent years, COLAs have ranged from minimal increases (e.g., 1.3% in 2021) to more significant hikes, like the 5.9% increase in 2022, reflecting higher inflation rates in some years.

While a 2.8% increase may seem modest, it marks an important adjustment given rising costs in healthcare, housing, and everyday goods. It’s important for beneficiaries to understand how this increase will directly affect their benefit levels and purchasing power.

Factors Affecting Social Security Benefits

Social Security benefits are primarily based on an individual’s work history, specifically the highest 35 years of earnings subject to Social Security taxes. Other factors, such as the age at which benefits are claimed, also play a significant role in determining the amount.

Workers who have earned the maximum taxable income each year can qualify for the highest monthly benefit amounts.

Who Can Expect $2,700–$2,800 Monthly Payments?

While the average Social Security benefit in 2026 is approximately $2,072 per month, some beneficiaries will qualify for higher payments. Here’s a closer look at who qualifies for the $2,700 to $2,800 range:

1. High Lifetime Earners

The maximum taxable earnings for Social Security in 2026 is $160,200. This figure is adjusted annually for inflation. Individuals who have earned at or near this amount throughout their careers can expect higher monthly benefits.

These beneficiaries will likely see payments in the $2,700–$2,800 range. Social Security uses a formula called the Primary Insurance Amount (PIA) to calculate benefits, which factors in an individual’s 35 highest earning years.

2. Delayed Claimants (Age 70)

Social Security benefits can be claimed as early as age 62, but for every year an individual delays claiming benefits beyond their Full Retirement Age (FRA) (typically 66 or 67), their monthly benefit increases by 8% per year until age 70.

By waiting until age 70 to start receiving Social Security, retirees can maximize their monthly benefits. This delayed claiming strategy is especially beneficial for those aiming for payments in the $2,700–$2,800 range or higher.

For example, a person who would normally receive $2,400 per month at their FRA could see their payment increase to $3,200 per month if they wait until age 70. However, those who claim at FRA or earlier would see a reduction in their monthly payments.

3. Spousal and Survivor Benefits

If you are married and your spouse is a higher earner, you may be eligible for spousal benefits based on their earnings history. A spouse can receive up to 50% of the higher-earning spouse’s Social Security benefits.

Additionally, survivors of high earners can claim survivor benefits based on their late spouse’s earnings, which can also be substantial, potentially placing monthly checks in the $2,700–$2,800 range. These benefits apply regardless of whether the spouse worked outside the home, making them an important consideration for many households.

4. Couples Combining Benefits

For married couples, Social Security payments can be significantly higher than for single individuals. Married couples can receive both spousal and survivor benefits if eligible, which means their combined monthly Social Security payments may be in the $2,700–$2,800 range or even higher.

If both spouses qualify for high Social Security payments based on their individual work records, their household total can exceed these figures.

Understanding the Full Retirement Age and Claiming Strategies

The Full Retirement Age (FRA) is the age at which you can claim your Social Security benefits without penalty. For those born between 1943 and 1954, FRA is 66. For those born later, FRA increases incrementally to 67. Claiming benefits before FRA results in a reduction in monthly payments.

The $2,700–$2,800 monthly payments are typically associated with individuals who have reached FRA or have chosen to delay their benefits to age 70.

The Role of Medicare Premiums and Other Deductions

One important factor to consider with Social Security payments is the Medicare premium. Medicare premiums are automatically deducted from Social Security payments, reducing the net amount beneficiaries receive.

For 2026, the standard Medicare Part B premium is projected to be $202.90 per month, a slight increase from 2025. This deduction can impact the overall benefit amount, especially for beneficiaries in higher payment brackets.

Potential Changes to Social Security

Although $2,700–$2,800 payments will continue for many beneficiaries in 2026, long-term challenges facing the Social Security Trust Fund have prompted discussions about future reforms. If the Social Security system faces further financial pressure, there could be changes to the eligibility thresholds or COLA adjustments.

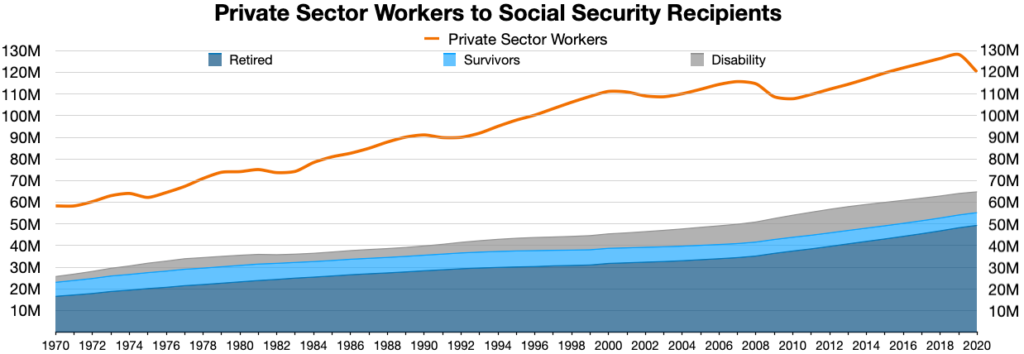

Social Security Trust Fund Solvency

The Social Security Board of Trustees has projected that the fund will be depleted by 2035 unless changes are made to boost revenue (e.g., higher payroll taxes) or reduce benefits (e.g., raising the retirement age). While expansion proposals are under debate, no significant reforms have been enacted at this time.

Proposals to Expand Benefits

Several lawmakers have proposed expanding Social Security benefits, including increasing the minimum benefit and providing larger annual COLAs. If such reforms pass, they could lead to larger monthly payments for beneficiaries in future years.

Related Links

IRS Announces $2,000 Direct Deposit Payments in January 2026 – Are You on the List?

Social Security COLA Estimates: What’s Next for Beneficiaries

In January 2026, Social Security recipients will benefit from a 2.8% COLA increase, with many individuals qualifying for $2,700–$2,800 payments based on their work history, earnings, and claiming decisions.

While higher earners and those who delay claiming benefits will see the largest increases, spouses and survivors also stand to receive significant amounts through spousal and survivor benefits.

With changes to Social Security funding and potential future reforms on the horizon, beneficiaries are advised to stay informed about eligibility rules, claiming strategies, and any relevant legislative changes. By understanding how payments are calculated and maximizing their benefits, Social Security recipients can ensure they are well-prepared for their retirement years.