The 2026 Social Security check is expected to rise by about 2.8 percent next year, but economists warn that the adjustment will not keep pace with the rising costs of housing, medical care, and consumer goods. Analysts say millions of U.S. seniors who rely heavily on Social Security may need new strategies, policy changes, or additional income sources to maintain financial stability.

3 Smart Ways to Make Your 2026 Social Security Check Last Longer

| Key Fact | Detail |

|---|---|

| 2026 COLA estimate | Approx. 2.8% increase |

| Average monthly benefit | From ~$2,015 → ~$2,071 |

| Inflation forecast | Rising faster in health care & housing sectors |

| Medicare premiums | Expected increase in 2026 |

| Seniors reporting financial stress | Over 70% |

Why the 2026 Social Security Check Increase Is Falling Short

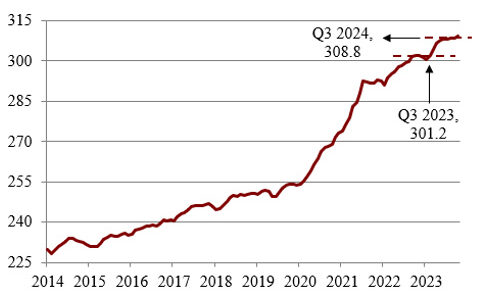

The Social Security Cost-of-Living Adjustment (COLA) for 2026 is determined by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Over the past year, CPI-W grew modestly, producing a relatively small COLA compared with the high-inflation years of 2022 and 2023.

However, inflation remains far higher in categories that matter most for seniors.

“Older adults face a different inflation reality,” said Dr. Amanda Lewis, senior economist at the Center for Budget and Policy Priorities (CBPP).

“Medical costs, rent, and essential services are climbing faster than the overall index, which erodes real purchasing power.”

This mismatch has created what analysts describe as a “benefit gap”—the widening difference between what Social Security pays and what seniors need to cover basic expenses.

A Decade of COLA Trends Highlights the Growing Disparity

While COLA rose sharply in 2022 and 2023 due to historic inflation, the past decade shows long periods of low increases:

- 2016: 0%

- 2017–2020: Ranged from 0.3% to 2.8%

- 2021: 1.3%

- 2022: 5.9%

- 2023: 8.7%

- 2024: 3.2%

- 2025: 2.6%

- 2026 (projected): 2.8%

However, health care inflation averaged 4–6% annually, according to BLS, outpacing Social Security increases nearly every year.

Impact on Different Groups of U.S. Seniors

Low-income retirees

According to the National Council on Aging (NCOA), nearly 40 percent of older adults depend on Social Security for 90 percent or more of their income. For these individuals, even minor price increases can cause significant hardship.

Retirees with chronic medical conditions

Costs for Medicare Part B, prescription drugs, and specialist visits continue to rise. CMS warns that premiums could increase again in 2026 because of higher outpatient spending.

Seniors without retirement savings

A 2023 Federal Reserve report found that 35 percent of Americans approaching retirement have no private savings. This group is especially vulnerable to cost increases.

Rural seniors

Transportation costs and limited access to health care can lead to higher out-of-pocket expenses for rural retirees.

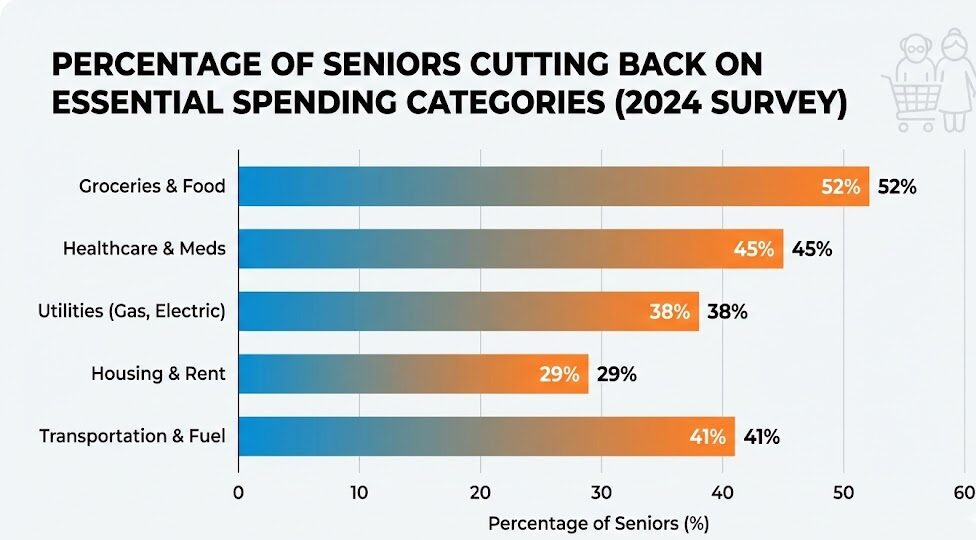

Rising Costs Are Tightening Household Budgets

Several national surveys show mounting pressure:

- Kaiser Family Foundation: 70% of seniors say Social Security does not keep up with household expenses.

- Pew Research Center: Nearly 33% of older adults have reduced spending on food, medical visits, or transportation.

- AARP: Reports that seniors face higher utility costs and rising property insurance premiums across many states.

Strategies to Stretch the 2026 Social Security Check

1. Adjusting Household Budgets

Financial planners recommend reviewing monthly spending and identifying small savings.

“Even small recurring cuts, such as switching phone plans or reviewing prescription costs, can create meaningful annual savings,” said Rachel Porter, a certified financial planner at AARP’s Public Policy Institute.

2. Exploring Part-Time Work or Flexible Income

The Department of Labor reports a rise in the number of workers aged 65 and older. Many take part-time or remote jobs that allow them to supplement their income without affecting benefits once they reach full retirement age.

3. Delaying Benefit Claims

The SSA notes that delaying benefits beyond full retirement age increases payments by up to 8% per year until age 70. Experts say this is one of the most effective ways to increase lifetime retirement income.

4. Considering State and Federal Assistance Programs

Thousands of seniors qualify for programs such as:

- Supplemental Nutrition Assistance Program (SNAP)

- Low-Income Home Energy Assistance Program (LIHEAP)

- Medicare Savings Programs

- State Property Tax Relief Programs

Yet millions who qualify do not apply.

5. Managing Debt and Large Expenses

Consumer credit researchers warn that rising credit card usage among seniors is a growing concern.

“High-interest debt can quickly overwhelm retirees on fixed incomes,” said Dr. Laura Chen of the University of Michigan’s Retirement Research Center.

Policy Debate: Could Changes to Social Security Improve Outcomes?

Several proposed reforms seek to modernize how COLA is calculated.

1. Switching from CPI-W to CPI-E

The Consumer Price Index for the Elderly (CPI-E) better reflects senior spending habits. Studies from the Government Accountability Office (GAO) show CPI-E grows faster than CPI-W in most years.

2. Expanding minimum benefit levels

Some lawmakers propose raising the minimum Social Security benefit for lifetime low-wage earners.

3. Tax reforms to strengthen long-term solvency

Options under discussion include:

- Raising or removing the wage cap

- Adjusting payroll tax rates

- Revising benefit formulas

While several bills have been introduced, none have gained bipartisan support.

International Context: How the U.S. Compares

Compared to other advanced economies:

- Canada and the U.K. provide supplemental retirement credits to offset inflation for lower-income seniors.

- Japan and Germany tie pension adjustments to wage growth rather than inflation.

- The OECD reports that the U.S. replaces a smaller share of pre-retirement income than many European countries.

Economists say this comparison underscores the vulnerability of Americans who depend primarily on Social Security.

Financial Planning Experts Urge Early and Proactive Preparation

Retirement specialists emphasize that planning before financial strain develops is essential.

“The earlier retirees evaluate options—budgeting, work opportunities, benefit timing—the more control they have over long-term security,” said Marcus Hill, a retirement policy analyst at the Urban Institute.

Experts increasingly recommend that seniors use:

- Financial counseling services

- Benefit calculators

- State aging agencies

- Senior-focused nonprofit organizations

SNAP Benefits: Simple Ways to Increase Your Monthly Deposit Amount

Public Reaction: Frustration But Growing Awareness

Interviews conducted by advocacy groups indicate:

- Many seniors feel that government benefits no longer reflect real living costs.

- There is rising support for legislative changes to how COLA is calculated.

- Seniors are increasingly turning to financial education workshops and online tools.

What Comes Next?

As inflation trends evolve, economists say the coming year will be pivotal. Much depends on policy decisions, medical cost growth, and the overall economic outlook. Analysts caution that unless broader reforms occur, annual COLA increases may continue to lag behind the real costs seniors face.