Married retirees often assume Social Security benefits are straightforward, but five frequently overlooked rules can significantly change lifetime income.

These rules govern spousal benefits, survivor eligibility, early claiming reductions, divorce, and remarriage — and misunderstanding any one of them can permanently lower a couple’s financial security in retirement.

Why Social Security Is More Complicated for Married Couples

Social Security is calculated on individual earnings records, but marriage links two records together. Decisions made by one spouse — when to claim, whether to delay, or which benefit to choose — can affect the other spouse for decades, especially after one partner dies.

Unlike pensions, Social Security does not automatically optimize benefits for couples. The burden is largely on retirees to understand eligibility rules and make informed filing decisions.

Rule 1: Spousal Benefits Can Replace — Not Add to — Your Own Benefit

A married person may qualify for a spousal benefit of up to 50% of their spouse’s full retirement age (FRA) benefit, but many retirees misunderstand how it works.

Key facts:

- You do not receive your full benefit plus a spousal benefit

- Social Security pays the higher of the two, not both

- Your spouse must have filed for their own benefit

Example: If your own retirement benefit is $700 per month and your spouse’s FRA benefit is $2,000, your spousal benefit could raise your payment to $1,000 — but not to $1,700.

Why this matters: Many lower-earning spouses never claim spousal benefits, assuming their own benefit is all they are entitled to.

Rule 2: Claiming Early Permanently Reduces Spousal Benefits

Spousal benefits are especially sensitive to early claiming.

- Claiming at 62 instead of FRA can reduce spousal benefits by 25–30%

- The reduction is permanent

- Waiting until FRA is the only way to receive the full 50% spousal amount

A common misconception is that spousal benefits will “step up” later. They do not.

Why this matters: Early claiming may feel necessary, but it often locks in thousands of dollars in lost income over a long retirement.

Rule 3: Survivor Benefits Are Often the Most Important Benefit — and the Most Misunderstood

When one spouse dies, the surviving spouse may receive up to 100% of the deceased spouse’s benefit, but several rules apply:

- Survivor benefits replace the survivor’s own benefit

- Claiming survivor benefits early (before survivor FRA) permanently reduces them

- Survivor benefits can begin as early as age 60 (50 if disabled)

Crucially, the higher-earning spouse’s claiming decision affects survivor income. If the higher earner delays claiming, the survivor’s benefit is larger.

Why this matters: For many couples, survivor benefits become the only Social Security income later in life. Poor planning can reduce that income permanently.

Rule 4: Divorce Does Not Automatically End Eligibility

Divorced retirees frequently miss eligibility for divorced-spouse benefits.

You may qualify if:

- The marriage lasted at least 10 years

- You are unmarried

- You are 62 or older

- Your own benefit is smaller than the benefit based on your ex-spouse’s record

The ex-spouse’s benefit is not reduced, and in many cases they do not even need to be collecting yet.

Why this matters: Divorced-spouse benefits can be higher than a retiree’s own benefit, especially for those who spent years out of the workforce.

Rule 5: Remarriage Timing Can Eliminate Survivor Benefits

Remarriage has different effects depending on timing:

- Remarrying before age 60 usually ends survivor benefit eligibility

- Remarrying at 60 or later preserves survivor benefits

- For disabled survivors, the cutoff is age 50

For divorced-spouse benefits, remarriage typically ends eligibility unless the later marriage also ends.

Why this matters: Couples who remarry without understanding these rules can unknowingly forfeit lifetime benefits.

Newly Added Rule Context: Medicare and IRMAA Can Change the Net Benefit

Social Security decisions affect Medicare premiums for married couples.

- Medicare Part B premiums are deducted from Social Security checks

- Higher combined income can trigger IRMAA surcharges

- Survivor benefits may push a widow or widower into a higher premium bracket

Why this matters: A higher survivor benefit can still result in lower net income after Medicare deductions if planning is not coordinated.

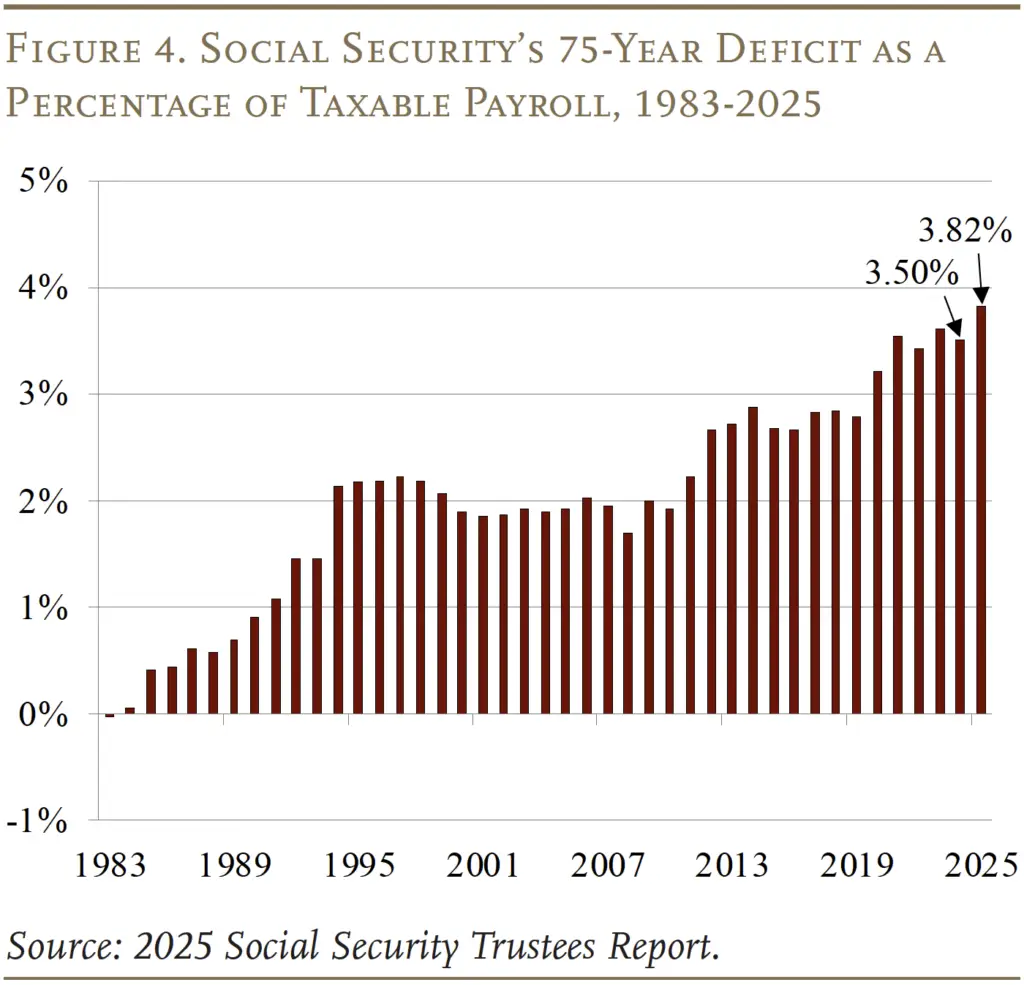

COLAs and Why They Magnify Early Mistakes

Cost-of-living adjustments (COLAs) apply as a percentage.

That means:

- A reduced benefit from early claiming stays reduced forever

- COLAs compound the loss every year

- Delayed claiming increases survivor benefits permanently

Why this matters: Mistakes made at 62 don’t just last one year — they echo for decades.

Switching Strategies Many Couples Miss

Some retirees can legally switch between benefit types:

- Claim your own reduced retirement benefit first

- Switch to survivor benefits later

- Or claim survivor benefits early and switch to your own later

These strategies are situation-specific but can significantly increase lifetime income when timed correctly.

Same-Sex Marriage and Retroactive Eligibility

Same-sex couples whose marriages were not previously recognized may still qualify for:

- Spousal benefits

- Survivor benefits

- Retroactive payments in some cases

Eligibility depends on marriage duration and filing history.

Common SSA Errors Married Couples Should Watch For

Mistakes do happen. Common issues include:

- Spousal benefits not applied correctly

- Survivor benefits paid at reduced rates incorrectly

- Divorce dates misrecorded

Couples can:

- Request a benefit recomputation

- File an appeal

- Provide marriage or divorce documentation

Practical Claiming Checklist for Married Retirees

Before filing, couples should:

- Review both earnings records

- Estimate benefits at 62, FRA, and 70

- Identify the higher-earning spouse

- Prioritize survivor income planning

- Consider Medicare and tax impacts

- Document marriages and divorces

Why These Rules Matter in Real Dollars

Even a $200 monthly difference equals:

- $2,400 per year

- $24,000 over 10 years

- $48,000 over 20 years

For many retirees, Social Security is the largest guaranteed income stream they will ever have.

Related Links

Pennsylvania Reopens Refund Window for Renters and Homeowners — How to Apply?

Texas SNAP Update: December Deposits Continue With Benefits Up to $1,789

Married retirees often miss critical Social Security rules that govern spousal, survivor, divorce, and remarriage benefits. These rules are not technical footnotes — they determine lifetime income, survivor security, and financial stability. Understanding them before claiming can prevent irreversible mistakes and protect retirement income for both spouses.

FAQs About 5 Social Security Rules

Can both spouses receive benefits at the same time?

Yes, but each receives only one benefit — their own or a spousal amount.

Do spousal benefits grow after FRA?

No. Only individual retirement benefits earn delayed credits.

Does Social Security automatically give the highest benefit?

Not always. Some benefits must be actively claimed.