WASHINGTON D.C. — Individuals relying on federal assistance programs may see payments of $967, $1450, and $2831 arriving on specific dates in 2025, primarily associated with Supplemental Security Income (SSI) and Social Security benefits. These amounts reflect the Cost-of-Living Adjustment (COLA) for the year, designed to help beneficiaries maintain purchasing power against inflation. Understanding the eligibility criteria for these Supplemental Security Income (SSI) and Social Security payments is crucial for recipients nationwide.

| Key Fact | Detail/Statistic |

| $967 Payment | Maximum monthly Federal Supplemental Security Income (SSI) for an eligible individual in 2025. |

| $1450 Payment | Maximum monthly Federal SSI for an eligible individual with an eligible spouse in 2025. |

| $2831 Payment | Maximum Social Security retirement benefit for those retiring at age 62 in 2025. |

| COLA for 2025 | 2.5% increase applied to Social Security and SSI benefits. |

Supplemental Security Income (SSI) Payments: $967 and $1450

The Supplemental Security Income (SSI) program, administered by the Social Security Administration (SSA), provides financial assistance to aged, blind, and disabled individuals who have limited income and resources. For 2025, the maximum federal SSI payment for an eligible individual is $967 per month. For an eligible individual with an eligible spouse, this amount increases to $1450 per month. These figures incorporate the 2.5% COLA effective from January 2025, as announced by the SSA.

Eligibility for SSI is determined by strict income and resource limits. In 2025, an individual generally must have resources valued at $2,000 or less, while a couple must have $3,000 or less. Countable income, which includes earned income, unearned income, and in-kind support, is deducted from the maximum federal benefit amount. State supplementary payments may also apply, increasing the total benefit received in certain states.

“The SSI program is a lifeline for millions of Americans with severe financial limitations,” stated Dr. Eleanor Vance, a senior economist at the Center for Budget and Policy Priorities. “The annual COLA adjustment, while modest, is vital in helping beneficiaries cope with rising living costs, particularly for necessities like food and housing.”

SSI payments are typically issued on the first day of each month. However, if the first of the month falls on a weekend or federal holiday, the payment is advanced to the last business day of the preceding month. For instance, the June 2025 SSI payment was disbursed on May 30, 2025, because June 1, 2025, was a Sunday.

Social Security Benefits: Understanding the $2831 Threshold

The Social Security program provides retirement, disability, and survivors’ benefits to eligible individuals and their families. The $2831 payment specifically refers to the maximum monthly retirement benefit for individuals who choose to claim their benefits at the earliest possible age of 62 in 2025.

It is important to note that the amount of Social Security retirement benefits an individual receives is largely dependent on their earnings history and the age at which they claim benefits. While $2831 is the maximum for those retiring at 62, the maximum benefit increases for those who wait until their full retirement age (FRA), which is 67 for most people born in 1960 or later. For those delaying retirement until age 70, the maximum monthly benefit can be as high as $5,108 in 2025 due to delayed retirement credits.15 The average monthly retirement benefit in 2025 is estimated to be around $1,976.

To be eligible for Social Security retirement benefits, individuals generally need to have accumulated 40 work credits, which equates to approximately 10 years of work. Eligibility for Social Security Disability Insurance (SSDI) has different work credit requirements based on age and disability onset.

Social Security payments are generally issued on the second, third, or fourth Wednesday of each month, based on the beneficiary’s birth date. Payments for those born between the 1st and 10th of the month are typically sent on the second Wednesday, those born between the 11th and 20th on the third Wednesday, and those born after the 20th on the fourth Wednesday. Exceptions exist for individuals who began receiving Social Security before May 1997, or those receiving both Social Security and SSI, who typically receive their payments on the 3rd of the month.

Broader Context of Federal Payments

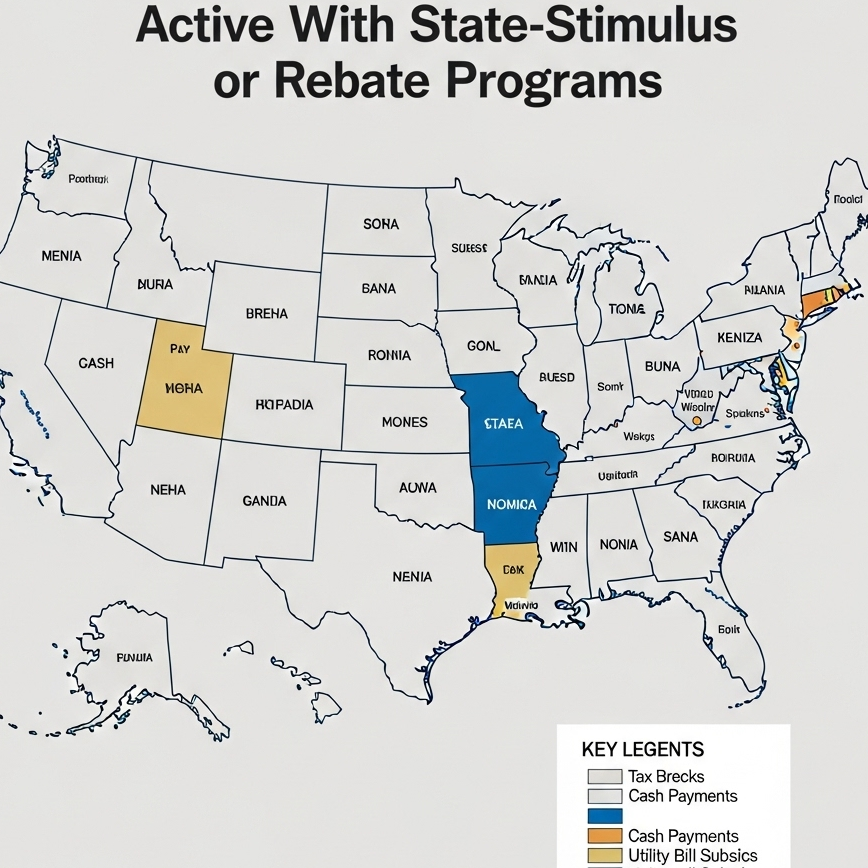

Beyond SSI and Social Security, various other federal and state-level programs provide financial assistance. While the amounts of $967, $1450, and $2831 are specific to SSI and Social Security, other initiatives exist. For example, some states have implemented their own stimulus or rebate programs in 2025, separate from federal initiatives. New York, for instance, is sending out inflation refund checks up to $400 in the fall of 2025 to eligible households based on 2023 tax filing criteria. Colorado also offers a Property Tax/Rent/Heat Credit (PTC) Rebate Program, with payments up to $1,154 for eligible lower-income residents who are older or disabled.

It is crucial for individuals to consult official government sources, such as the Social Security Administration’s website (SSA.gov), the Department of Veterans Affairs (VA.gov), or their respective state government portals, to verify specific eligibility requirements and payment schedules. The IRS has largely concluded pandemic-era direct relief payments, and there are no new federal stimulus checks broadly scheduled for 2025.

FAQs

Q1: What are the specific amounts ($967, $1450, $2831) and what do they represent?

A1: The $967 payment is the maximum monthly federal Supplemental Security Income (SSI) for an eligible individual in 2025. The $1450 payment is the maximum monthly federal SSI for an eligible individual with an eligible spouse in 2025. The $2831 payment represents the maximum monthly Social Security retirement benefit for individuals who claim their benefits at age 62 in 2025.

Q2: How do I determine my eligibility for SSI benefits?

A2: Eligibility for SSI benefits is based on having limited income and resources, and being aged 65 or older, blind, or disabled. The maximum resource limits are typically $2,000 for an individual and $3,000 for a couple. Your countable income, which includes earnings and other benefits, is also a factor. The best way to determine your specific eligibility is to visit the official Social Security Administration (SSA) website at SSA.gov or contact them directly.

Q3: When can I expect to receive my SSI payment in 2025?

A3: SSI payments are generally issued on the first day of each month. However, if the first of the month falls on a weekend or federal holiday, the payment is typically advanced to the last business day of the preceding month. For example, the June 2025 SSI payment was disbursed on May 30, 2025, because June 1, 2025, was a Sunday. It’s advisable to check the official SSA payment schedule for exact dates.

Q4: How are Social Security retirement benefits paid, and on what dates in 2025?

A4: Social Security retirement benefits are typically paid on the second, third, or fourth Wednesday of each month, based on the beneficiary’s birth date. For those born between the 1st and 10th of the month, payments are usually on the second Wednesday; between the 11th and 20th, on the third Wednesday; and between the 21st and 31st, on the fourth Wednesday. Exceptions include individuals who began receiving benefits before May 1997 or those receiving both Social Security and SSI, who usually receive payments on the 3rd of the month.