Millions of Canadians who rely on federal pension and income support benefits can expect their payments for the Canada Pension Plan (CPP), Old Age Security (OAS), and Guaranteed Income Supplement (GIS) to be distributed in the last week of June. The Government of Canada has confirmed the CPP, OAS & GIS June 2025 Payment Schedule, with payments for CPP and OAS slated for June 26, 2025.1 This article provides a comprehensive overview of eligibility requirements and anticipated payment amounts for these key benefits.

CPP, OAS & GIS June 2025 Payment Schedule

| Key Fact | Detail/Statistic |

| June 2025 Payment Date | CPP and OAS payments will be issued on Thursday, June 26, 2025. |

| OAS Maximum Monthly Payment (Apr-Jun 2025) | Up to $727.67 (ages 65-74) and $800.44 (age 75+) |

| GIS Maximum Monthly Payment (Apr-Jun 2025) | Up to $1,086.88 for single individuals |

| 2025 CPP Maximum Pensionable Earnings | The maximum annual pensionable earnings for 2025 is approximately $71,300. |

Understanding Your June 2025 Payments

The federal government provides a suite of benefits to support Canadians in their retirement and to assist those with low incomes. These programs, administered by Employment and Social Development Canada, are crucial for the financial stability of millions of seniors. The payments are typically made in the last week of each month.

Canada Pension Plan (CPP) Retirement Pension

The Canada Pension Plan is a monthly, taxable benefit that replaces a portion of your income when you retire. The amount you receive is based on your earnings throughout your working life, the contributions you made to the plan, and the age you decide to start your pension.

Description: A clear and simple flowchart detailing the path to CPP eligibility. It should start with the minimum age (60), show the requirement of at least one valid contribution, and branch out to explain how starting at different ages (60, 65, 70) affects the payment amount.

To be eligible for the CPP retirement pension, you must:

- Be at least 60 years old.

- Have made at least one valid contribution to the CPP.

Valid contributions can come from work you did in Canada or as credits received from a former spouse or common-law partner after a separation. While the standard age to start receiving the full pension is 65, you can begin as early as your 60th birthday for a permanently reduced amount, or delay it until age 70 for a permanently increased amount.

For 2025, the maximum monthly CPP retirement pension for new recipients at age 65 is approximately $1,364.60. However, the average payment is typically lower, as it depends on individual contribution histories.

Old Age Security (OAS) and Associated Benefits

Old Age Security is one of the cornerstones of Canada’s retirement income system. Unlike the CPP, eligibility for OAS is not based on employment history. It is a monthly payment available to most Canadians aged 65 or older who meet the legal status and residence requirements.

OAS Eligibility

To qualify for the Old Age Security pension, you must:

- Be 65 years of age or older.

- Be a Canadian citizen or a legal resident at the time your OAS pension application is approved.

- Have resided in Canada for at least 10 years since the age of 18.

For the period of April to June 2025, the maximum monthly OAS payment for individuals aged 65 to 74 is $727.67. For those aged 75 and over, this amount increases to $800.44, reflecting a 10% increase for the older cohort that was previously implemented.

It is important to note that OAS benefits are taxable and are subject to a recovery tax, often called the “OAS clawback,” if your annual income exceeds a certain threshold ($90,997 for 2025).

Guaranteed Income Supplement (GIS)

The Guaranteed Income Supplement provides an additional, non-taxable monthly payment to low-income OAS pensioners living in Canada. To receive the GIS, you must:

- Be receiving the OAS pension.

- Have an annual income below the maximum threshold for the supplement.

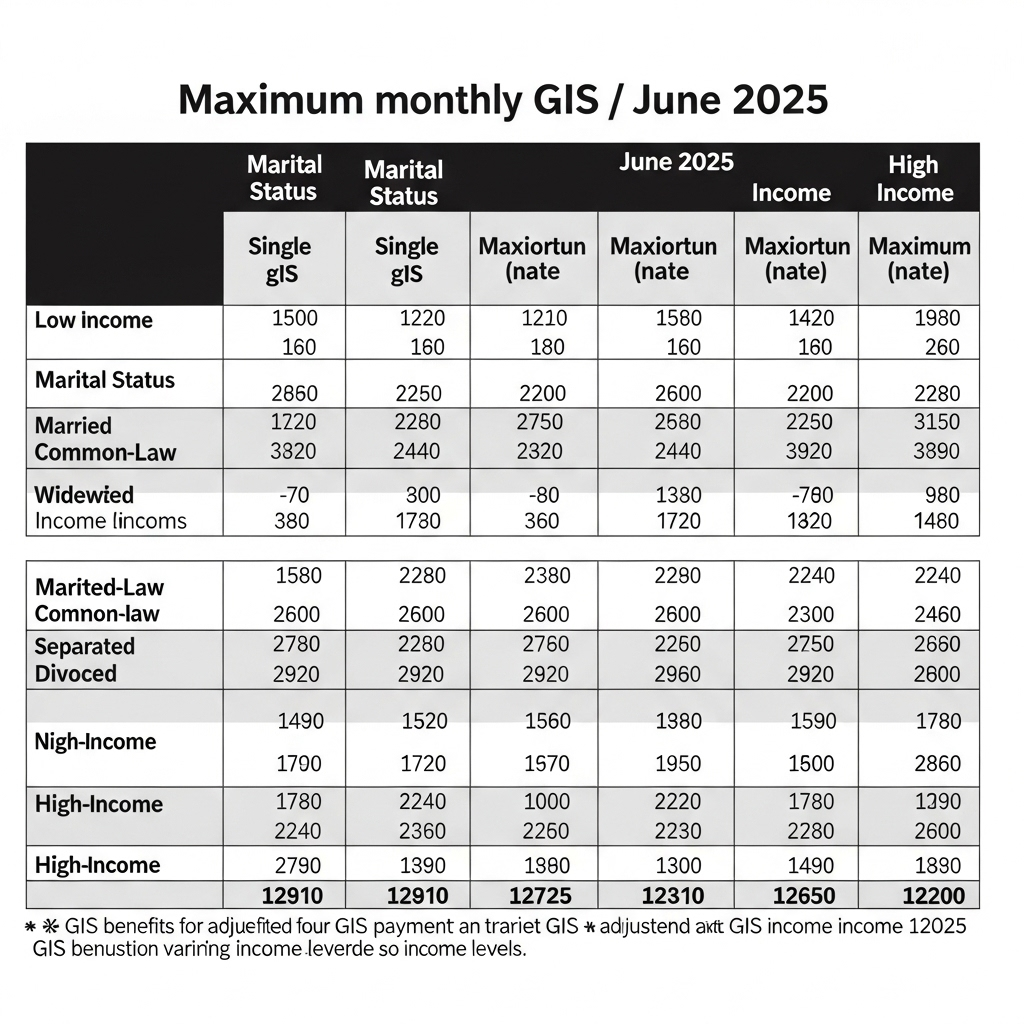

The GIS amount is determined by your marital status and your previous year’s income. For the April to June 2025 quarter, a single, widowed, or divorced pensioner could receive up to $1,086.88 per month. The income thresholds and maximum payments vary for couples, depending on whether both partners receive the full OAS pension.

Cost of Living Adjustments and Payment Dates

The government adjusts both CPP and OAS benefits to account for inflation. CPP payments are adjusted annually each January, based on the Consumer Price Index (CPI). For 2025, CPP benefits saw a 2.6% increase to reflect changes in the cost of living.

OAS benefits, including the GIS, are reviewed quarterly in January, April, July, and October. According to the Government of Canada, as the CPI did not increase over the previous three-month period, OAS benefits remained unchanged for the April to June 2025 quarter. However, a 1.0% increase is anticipated for the July to September 2025 quarter based on CPI data.

How to Manage Your Benefits?

Recipients are encouraged to set up direct deposit to ensure timely receipt of their payments. You can view your personal payment dates, update your banking information, and see your benefit details through your My Service Canada Account online.

If you believe there is a discrepancy in your payment or if you have not received it by the expected date, it is recommended to wait a few business days before contacting Service Canada.

The next scheduled payment for CPP and OAS after June will be on July 29, 2025.12 Ensuring your personal and financial information is up to date with both Service Canada and the Canada Revenue Agency is crucial to avoid any payment interruptions.

FAQ

Q1. What is the exact payment date for CPP and OAS in June 2025?

The official payment date is Thursday, June 26, 2025.

Q2. How are OAS payments calculated?

OAS payment amounts are determined by your age, how long you have lived in Canada after the age of 18, and your income.13 They are adjusted quarterly for inflation.

Q3. Do I have to apply for CPP and OAS?

You must apply for the CPP retirement pension. For OAS, enrollment is often automatic, and you should receive a notification letter the month after you turn 64.14 If you do not receive a letter, you will need to apply.

Q4. Can I receive these benefits if I still work?

Yes, you can receive CPP and OAS while still employed.15 However, your income can affect the amount of benefits you receive, particularly for OAS and GIS. If you are under 70 and working while receiving CPP, you can continue to contribute, which will increase your future benefits through the Post-Retirement Benefit.