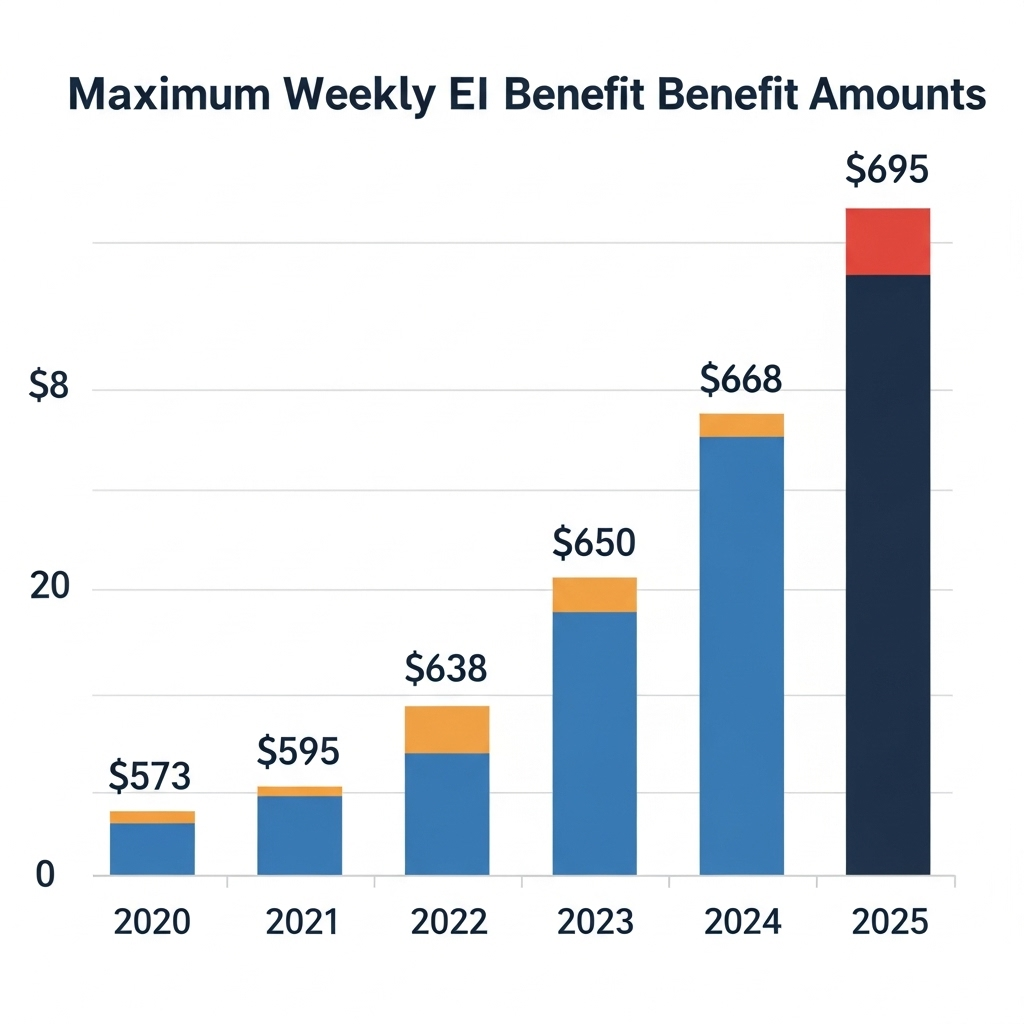

As July 2025 approaches, Canadian caregivers are encouraged to review the updated eligibility criteria and payment dates for Employment Insurance (EI) caregiving benefits. These vital federal programs provide financial assistance to individuals who must temporarily leave their jobs to care for a critically ill or injured family member, or someone requiring end-of-life care, potentially offering up to $695 per week in support.

The Government of Canada’s EI program aims to ease the financial burden on caregivers, recognizing their essential role in the healthcare system. Recent temporary measures have further enhanced accessibility, including a waiver of the traditional one-week waiting period for claims filed between March 30, 2025, and October 11, 2025, offering quicker access to support.

Understanding EI Caregiving Benefits

Employment Insurance caregiving benefits are a cornerstone of Canada’s social safety net, designed to provide temporary income replacement for eligible individuals. There are primarily three types of EI caregiving benefits:

- Benefits for caregivers of children: Provides up to 35 weeks of benefits for those caring for a critically ill or injured person under 18.

- Benefits for caregivers of adults: Offers up to 15 weeks of benefits for those providing care or support to a critically ill or injured person 18 or over.

- Compassionate care benefits: Allows for up to 26 weeks of benefits for individuals providing end-of-life care to a person of any age.

These benefits can be shared among eligible caregivers, either concurrently or consecutively, within a 52-week period following the medical certification of the person in need of care.

Eligibility Criteria for July 2025

To qualify for EI caregiving benefits, applicants must meet specific requirements, which have seen some temporary adjustments for 2025:

- Insured Hours: Applicants must have accumulated a minimum of 600 insurable hours of work in the 52 weeks before the start of their claim or since their last EI claim, whichever is shorter. This is a crucial threshold for eligibility.

- Reduced Earnings: Your regular weekly earnings from work must have decreased by more than 40% for at least one week due to time off taken to care for the family member.

- Medical Certificate: A medical doctor or nurse practitioner must certify that the person you are caring for is critically ill or injured, or requires end-of-life care. This medical certificate is a mandatory document for the application.

- Family Member Definition: You must be a family member or considered to be like a family member to the person needing care. This broad definition includes immediate family, as well as individuals considered to be family whether or not they are related by marriage, common-law, or any other legal parent-child relationship. For non-family members, an attestation form confirming the relationship is required.

- Waiver of Waiting Period: For claims initiated between March 30, 2025, and October 11, 2025, the usual one-week waiting period for EI benefits is waived. This temporary measure allows for earlier access to financial support.

It is important to note that EI caregiving benefits are distinct from the Canada Caregiver Credit, which is a non-refundable tax credit. While both aim to support caregivers, EI provides direct income replacement during a period of leave from employment.

Benefit Amount and Calculation

The maximum weekly benefit for EI payments, including caregiving benefits, is set at $695 per week for 2025. This amount is calculated as 55% of your average weekly insurable earnings, up to the maximum insurable earnings for the year. For 2025, the maximum insurable earnings are $65,700 per year. This means that if your weekly income was $1,263.46 or more, you would qualify for the full $695 per week.

For low-income families, a “Family Supplement” may increase the benefit rate to up to 80% of average insurable earnings, provided the family’s total annual income is less than $25,921 and they are receiving the Canada Child Benefit. However, the total weekly benefit, even with the Family Supplement, cannot exceed the maximum of $695.

Application Process and Payment Dates

Applying for EI caregiving benefits is primarily an online process through the Government of Canada’s website, Canada.ca. It is strongly recommended to apply as soon as you stop working or your earnings are significantly reduced, as delaying beyond four weeks from your last day of work could result in a loss of benefits.

Key steps in the application process include:

- Gathering Documents: This typically includes your Social Insurance Number (SIN), Records of Employment (ROEs) from all employers in the past 52 weeks, banking information for direct deposit, and the completed medical certificate from a doctor or nurse practitioner. If you are not a direct family member, the “Family Member Attestation Form” is also required.

- Online Application: Complete the application form via Canada.ca. The online portal allows for saving progress and submitting supporting documents electronically.

- Bi-weekly Reports: Once your claim is approved, you will be required to submit bi-weekly reports to Service Canada to continue receiving payments. These reports confirm your ongoing eligibility and caregiving activities.

While specific payment dates for individual EI caregiving benefit claims vary based on the application approval date, payments are generally issued every two weeks after the initial claim is processed. The first payment is typically received within 28 days of Service Canada receiving your complete application and all necessary documents.

Recent Changes and Future Outlook

The temporary waiver of the waiting period (March 30 to October 11, 2025) and adjustments to how separation earnings are handled represent significant, albeit temporary, enhancements to the EI program. These measures aim to provide more immediate financial relief to Canadians during periods of economic uncertainty.

Advocacy groups and labour organizations continue to call for more permanent reforms to the EI system to better reflect the evolving nature of work and caregiving responsibilities in Canada. The ongoing discussion around the future of EI benefits underscores the importance of this program for Canadian families.

FAQ

Q1: What are the different types of EI caregiving benefits available?

A1: There are three main types: Family caregiver benefits for children (up to 35 weeks for those under 18), Family caregiver benefits for adults (up to 15 weeks for those 18 or over), and Compassionate care benefits (up to 26 weeks for end-of-life care for a person of any age). These can be shared among eligible caregivers.

Q2: How much can I receive in EI caregiving benefits per week in July 2025?

A2: The maximum weekly benefit for EI caregiving benefits in 2025 is $695 per week. This is calculated as 55% of your average weekly insurable earnings, up to the maximum insurable earnings for the year ($65,700).

Q3: Is there a waiting period for EI caregiving benefits?

A3: Generally, there is a one-week waiting period before payments begin. However, for claims initiated between March 30, 2025, and October 11, 2025, this waiting period is temporarily waived.

Q4: What are the key eligibility requirements for EI caregiving benefits?

A4: You must have accumulated at least 600 insurable hours in the 52 weeks before your claim, your earnings must have decreased by more than 40% for at least one week due to caregiving, and a medical doctor or nurse practitioner must certify the need for care. You must also be a family member or considered to be like a family member to the person needing care.

Q5: How do I apply for EI caregiving benefits?

A5: Applications are primarily submitted online through the Government of Canada website (Canada.ca). You should apply as soon as you stop working or your earnings are significantly reduced, and typically within four weeks to avoid losing benefits. You will need your Social Insurance Number (SIN), Records of Employment (ROEs), banking information, and the medical certificate.

Q6: Can more than one person receive EI caregiving benefits for the same individual?

A6: Yes, the weeks of benefits can be shared among eligible caregivers, either at the same time or one after another. Each caregiver must submit their own separate application.