Concerns about the long-term solvency of the U.S. Social Security program are persistent, leading many to question the security of their future benefits. While headlines may suggest a sharp Social Security reduction in 2025, official reports indicate a more nuanced situation, with significant adjustments projected further into the future if no legislative action is taken.

The Current State of Social Security Trust Funds

Social Security benefits are primarily funded through payroll taxes contributed by current workers and their employers, along with interest earned on the program’s trust fund reserves. The system operates on a “pay-as-you-go” basis, meaning current contributions largely pay for current retirees’ benefits.

According to the 2025 Social Security Board of Trustees’ annual report, the Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivor benefits, is projected to be depleted by 2033. If no legislative changes occur before then, the program would be able to pay approximately 77% of scheduled benefits from ongoing tax revenues. This potential shortfall translates to an estimated 23% benefit cut for beneficiaries at that point, rather than a 15% reduction in 2025.

The Disability Insurance (DI) Trust Fund, on the other hand, is projected to remain solvent through at least 2099. If the OASI and DI trust funds were combined, the projected depletion date for the combined fund (OASDI) would be 2034, leading to a projected 19% benefit cut at that time.

Why the Concern? Demographic Shifts and Economic Realities

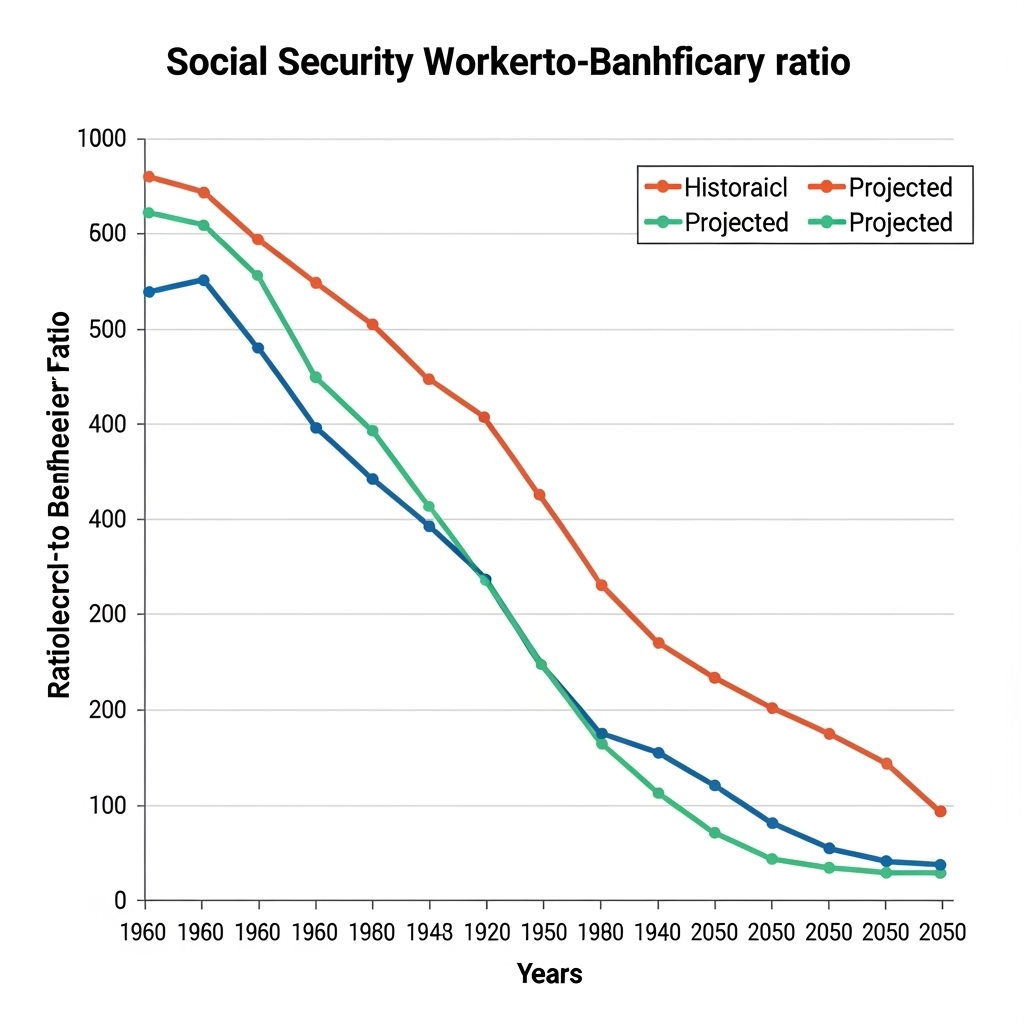

The primary drivers behind Social Security’s long-term financial challenges are demographic shifts. The ratio of workers contributing to the system compared to the number of beneficiaries has steadily declined. In 1960, there were more than five workers for every Social Security beneficiary. Today, that ratio has dropped to roughly three-to-one and is projected to fall below 2.5-to-one by mid-century, according to the Bipartisan Policy Center.

This demographic imbalance is exacerbated by increased life expectancy. People are living longer in retirement, drawing benefits for extended periods. While a positive societal development, it places additional strain on a system designed when life expectancies were significantly shorter.

“Social Security is a cornerstone of retirement planning for millions of people, and the public is clearly paying attention to what the Trustees are saying,” stated David Duley, Founder and CEO of PlanGap, following the release of the 2025 Trustees’ Report. He highlighted that confidence in the program’s full benefits being preserved remains low among many Americans.

2025 Adjustments: COLA and Earnings Limits

While a broad 15% Social Security reduction is not anticipated for 2025, several adjustments are indeed taking effect. The Social Security Administration (SSA) announced a 2.5% Cost-of-Living Adjustment (COLA) for 2025. This increase aims to help benefits keep pace with inflation, and it will be applied to payments beginning in January 2025 for most beneficiaries.6

Additionally, the maximum amount of earnings subject to Social Security tax (the taxable maximum) is increasing to $176,100 in 2025, up from $168,600 in 2024.7 This means higher earners will contribute more in Social Security taxes.

For individuals who claim Social Security benefits before reaching their full retirement age (FRA) and continue to work, the earnings limit will also see an increase. In 2025, those under full retirement age can earn up to $23,400 before their benefits are reduced by $1 for every $2 earned above the limit. For those reaching their FRA in 2025, the limit is $62,160, with a $1 reduction for every $3 earned over this amount until the month they reach their full retirement age. It is important to note that any benefits withheld due to exceeding these earnings limits are not permanently lost; they lead to a recalculation and potentially higher future benefits once the beneficiary reaches full retirement age.

The Path to Long-Term Solvency: Proposed Solutions

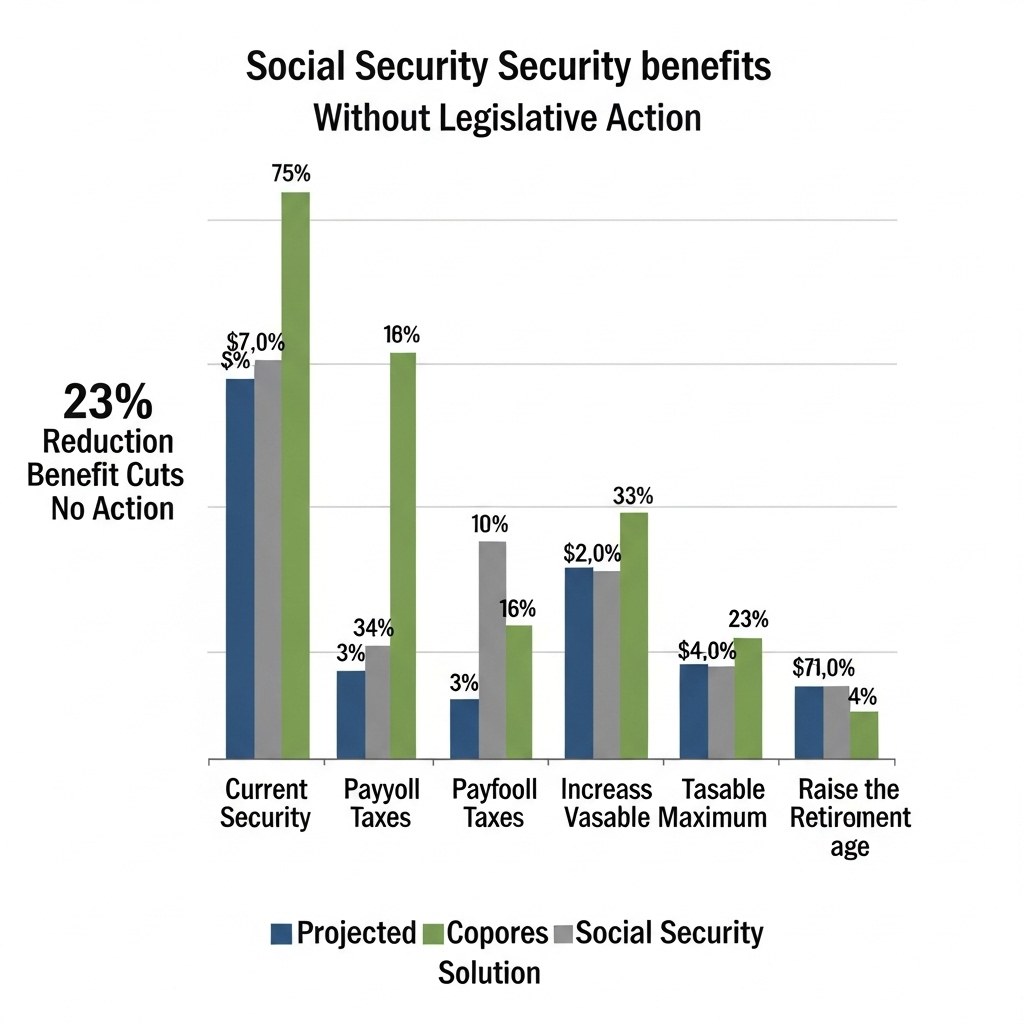

Addressing Social Security’s long-term financial challenges requires legislative action. Broadly, proposed solutions fall into two categories: increasing revenue or reducing benefits.

Revenue-Side Proposals:

- Raising the Payroll Tax Rate: A modest increase in the current 12.4% payroll tax rate (split between employee and employer) would generate more income for the trust funds.

- Increasing the Taxable Maximum: Lifting or eliminating the cap on earnings subject to Social Security taxes would require higher earners to contribute on a larger portion of their income. This is a frequently cited solution by advocates like Nancy Altman, President of Social Security Works, who emphasizes that polls consistently show public support for wealthier individuals paying “their fair share.”

- General Revenue Transfers: Some proposals suggest using general Treasury funds to supplement Social Security revenues, though this approach is often viewed as a departure from the program’s dedicated funding model.

Benefit-Side Proposals

- Raising the Full Retirement Age (FRA): Gradually increasing the age at which individuals can receive their full Social Security benefits is often proposed to reflect longer life expectancies. The FRA is already increasing incrementally for those born between 1955 and 1960, reaching 67 for those born in 1960 or later. Further increases are debated.

- Adjusting the COLA Formula: Modifying how the annual Cost-of-Living Adjustment (COLA) is calculated, perhaps using a different inflation measure, could result in smaller annual benefit increases.

- Means-Testing Benefits: Introducing an income threshold above which Social Security benefits would be reduced for wealthier individuals has also been discussed.

Description: A bar chart comparing the projected impact of different reform proposals (e.g., raising payroll tax, increasing taxable maximum, raising retirement age) on the Social Security trust fund solvency, alongside the projected benefit cut if no action is taken.

Congressional Action and Future Outlook

The 2025 Trustees’ Report serves as a renewed call to action for lawmakers. The consensus among experts is that the longer Congress delays in addressing the funding shortfall, the more difficult and drastic the solutions will become. Advocates for seniors, such as Myechia Minter-Jordan, CEO of AARP, are urging Congress to “act to protect and strengthen the Social Security that Americans have earned and paid into throughout their working lives.”

While the notion of a 15% Social Security reduction in 2025 is not supported by current official projections, the potential for significant benefit cuts in the next decade remains a critical concern. The timing and nature of any changes will depend on bipartisan legislative efforts to ensure the program’s long-term viability for future generations of retirees. The debate over how to shore up Social Security’s finances continues, with various stakeholders emphasizing the urgency of a sustainable resolution.

FAQ

Q1: Will Social Security benefits be cut by 15% in 2025?

A: No, official projections from the 2025 Social Security Board of Trustees’ report do not indicate a 15% benefit cut in 2025. A more significant reduction, estimated at 23%, is projected for 2033 if Congress does not enact reforms.

Q2: What is the Cost-of-Living Adjustment (COLA) for Social Security in 2025?

A: The Social Security Administration has announced a 2.5% Cost-of-Living Adjustment (COLA) for 2025, which will increase benefits for most recipients starting in January 2025.14

Q3: What is the primary reason for concerns about Social Security’s financial future?

A: The main concern stems from demographic shifts, specifically the declining ratio of workers paying into the system compared to the increasing number of retirees drawing benefits, coupled with longer life expectancies.

Q4: What are the main types of solutions being proposed to address Social Security’s shortfall?

A: Proposed solutions generally involve either increasing the program’s revenue (e.g., raising payroll taxes or the taxable earnings cap) or adjusting benefits (e.g., raising the full retirement age or modifying COLA calculations).