Extra $150 OAS Payment: If you’ve been hearing chatter about an extra $150 Old Age Security (OAS) payment hitting Canadian seniors’ bank accounts in November 2025, it’s time to cut through the noise and get the facts straight up. The OAS payments are a vital part of retirement income for many Canadians aged 65 and older. In this article, we’ll break down everything you need to know about the OAS benefits, the November 2025 payment details, who’s eligible, and how much you can expect to receive.

You’ll get the full scoop with clear examples, official data, and practical advice—no fluff, no hype. Whether you’re a retiree, planning retirement, or a financial pro helping clients navigate these waters, this guide is built for you. Plus, we keep it easy enough that even a ten-year-old could follow along.

Extra $150 OAS Payment

The Old Age Security (OAS) program remains a vital pillar of retirement security for Canadian seniors, supporting basic expenses through steady monthly payments that keep pace with inflation. While rumors about an extra $150 payment in November 2025 are unfounded, eligible seniors will receive their usual adjusted benefit on November 26, 2025. Knowing your eligibility requirements, understanding potential tax implications, and following practical tips will help you maximize your OAS benefits and enjoy your retirement years with confidence, dignity, and peace of mind.

| Topic | Detail |

|---|---|

| OAS Regular Payment for Nov 2025 | Scheduled for November 26, 2025 |

| Expected OAS Payment Increase | 0.7% inflation adjustment for Q4 2025 |

| Maximum Monthly OAS (65-74 yrs) | Up to $740.09 |

| Maximum Monthly OAS (75+ yrs) | Up to $814.10 (includes permanent 10% top-up for seniors 75+) |

| Extra $150 Payment | No confirmed extra one-time $150 payment; rumors not backed by official government announcements |

| Eligibility Age | Must be 65 years or older |

| Residency Requirement | Minimum of 10 years living in Canada after age 18 for partial benefits; 40 years for full |

| Payment Method | Direct deposit or cheque |

| Official Info Source | Canada.ca Old Age Security (OAS) |

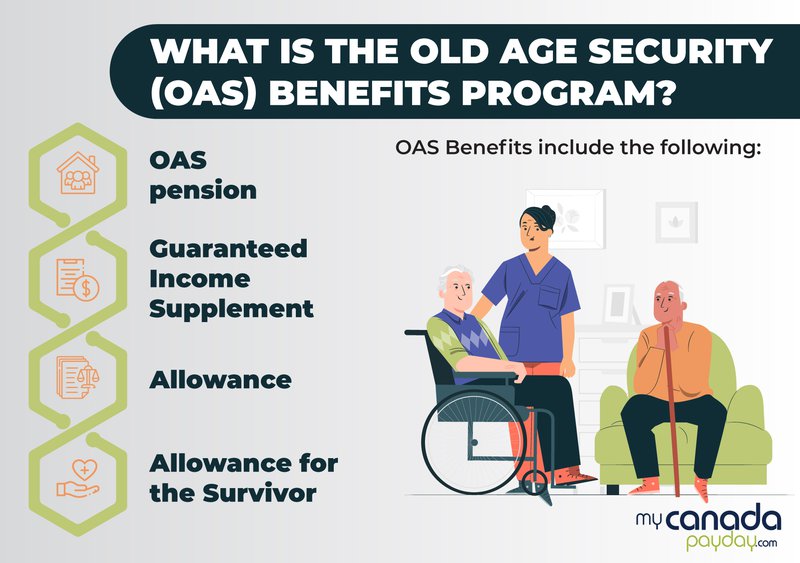

What Is Old Age Security (OAS)?

Old Age Security is a federal government pension program in Canada designed to provide monthly income to seniors aged 65 and up. It’s a foundational benefit that helps cover living costs like groceries, bills, and basic healthcare that often come with retirement.

Unlike the Canada Pension Plan (CPP), which depends on your earnings and contributions during your working years, OAS is primarily based on residency. This means you don’t have to contribute directly to receive it, as long as you meet the age and residency requirements.

A Brief History and Purpose

The OAS program began in 1952 as part of Canada’s effort to provide a safety net for seniors who might otherwise struggle financially after retirement. It was established under the Old Age Security Act and has evolved since then to include supplements and inflation adjustments. The purpose of OAS is to promote dignity and financial stability for elderly Canadians, regardless of their work history or income.

In its early days, the program replaced means-tested benefits which often were humiliating and inconsistent across provinces. OAS introduced a universal flat-rate pension accessible to most seniors meeting residency requirements. It is not designed to fully replace income, but rather to form a reliable base for retirement income that private savings and CPP ideally supplement.

The Truth About the Extra $150 OAS Payment

There have been widespread rumors about a one-time extra $150 payment hitting seniors’ accounts in November 2025. Let’s set the record straight—official government sources have not confirmed this. Seniors will receive their regular inflation-adjusted OAS payment, increased by 0.7% for the October to December 2025 quarter in line with the Consumer Price Index (CPI).

The $150 bonus or special payment is a rumor, often spread through social media or unofficial sites. It’s essential to verify claims against credible sources like Service Canada or the Canada Revenue Agency (CRA) to avoid misinformation.

How Much Will You Receive in November 2025?

For November 2025, your OAS payment depends on your age and residency history:

- Seniors aged 65 to 74 will receive up to $740.09 per month.

- Seniors aged 75 and older receive an additional 10% boost, bringing the total up to $814.10 per month.

The OAS payments are taxable income, and higher-income seniors may have their payments reduced or clawed back if their net income exceeds roughly $90,997 in 2025.

Example in Action

Mary, aged 70, receives a maximum OAS payment of $740. Due to the quarterly inflation adjustment, her payment may slightly increase this November. Her payments help cover basic expenses, and the incremental adjustment ensures the OAS keeps pace with inflation.

How Does OAS Compare with Other Canadian Retirement Benefits?

Canada’s retirement system includes several key programs:

| Benefit | Basis of Payment | Eligibility Age | Need to Contribute? | Income Tested? |

|---|---|---|---|---|

| Old Age Security (OAS) | Residency | 65+ | No | Yes (Clawback above income threshold) |

| Canada Pension Plan (CPP) | Contributions from earnings | 60-70 | Yes | No |

| Guaranteed Income Supplement (GIS) | Income for low-income seniors | 65+ | No | Yes (For low-income seniors only) |

OAS provides a residency-based foundation for seniors. CPP depends on work history and contributions, and GIS offers additional means-tested support for low-income seniors. Many retirees combine these benefits for a more secure income.

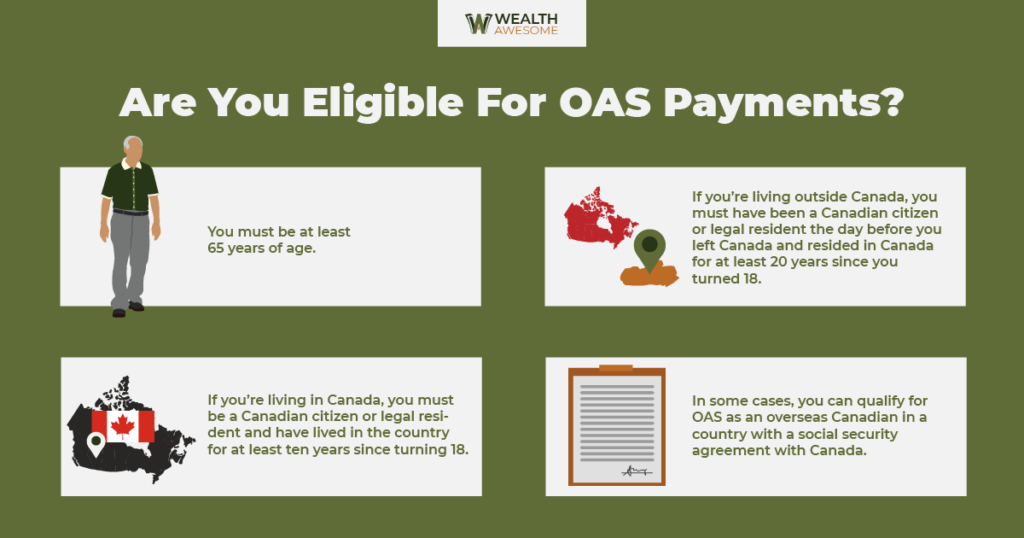

Who Qualifies For Extra $150 OAS Payment?

To qualify for OAS, applicants must meet the following conditions:

- Be 65 years or older at application or payment date.

- Be a Canadian citizen or legal resident at the time their application is approved.

- Have lived in Canada for at least 10 years after age 18 if residing inside Canada, or 20 years for those living outside Canada.

- Full OAS payments require at least 40 years of residency in Canada after age 18.

Additional residency credits may apply if you worked abroad for certain Canadian employers, like the military or banks.

Social security agreements with certain foreign countries may also enable eligibility based on combined residency or contributions.

Tax Implications of OAS Benefits

OAS payments are taxable income. Higher-income Canadians (net income over approximately $90,997 in 2025) will face a partial repayment via the OAS Recovery Tax (colloquially called the clawback). This means some or all of the OAS payments could be reclaimed through the income tax system.

Tax Planning Tips

- Monitor your total income to understand how much of your OAS you get to keep.

- Tax planning with a professional can help you manage investment withdrawals and other income to minimize clawback impact.

- Filing timely and accurate tax returns is essential to maintain your benefit eligibility, especially if you receive supplementary payments like GIS.

What If You Miss a Payment or Have Questions?

In case you do not receive your OAS payment or suspect an error:

- Contact Service Canada immediately via phone or their official website.

- Ensure your banking information is correct if you receive direct deposits.

- Use the My Service Canada Account online portal to review your payment status and correspondence.

- Be vigilant about scams—never share personal information unless you’re sure you’re dealing with legitimate government representatives.

OAS and Living Outside Canada

If you plan to live outside Canada during retirement, consider this:

- You can keep your OAS payments if you lived in Canada for 20 years or more after turning 18, even if you move abroad.

- Less than 20 years? OAS payments will stop after six months of non-residency, unless covered by a social security agreement between Canada and your new country.

- You must apply to continue receiving OAS outside Canada and report address changes.

- Time spent working overseas with Canadian employers or in international organizations may also count toward residency.

When Will The November 2025 OAS Payment Hit Your Account?

The government processes OAS payments monthly, with the November 2025 payment scheduled for November 26, 2025. Payments are made via direct deposit or mailed cheque, so setting up direct deposit is recommended to avoid delays.

Practical Tips to Maximize Your Extra $150 OAS Payment

- Sign up for Direct Deposit: Most reliable and fastest payment method.

- Keep track of residency: Ensure you meet residency requirements and maintain documentation.

- Monitor income levels: Avoid triggering the clawback or adjust your income sources to minimize it.

- Stay updated on benefit changes: OAS payments adjust quarterly based on inflation metrics.

- Apply timely: Automatic enrollment occurs for many, but if you don’t get your notice after age 64, apply promptly.

- Consult professionals: Financial and tax advisors can help maximize your retirement income strategy.

The Importance of Financial Planning Around OAS

Although OAS provides a steady base income, it is typically insufficient as a sole source of retirement income. A balanced retirement plan includes CPP, personal savings, other investments, and private pensions.

Collaborate with trusted financial advisors to understand how OAS fits into your overall plan, focusing on tax efficiency, clawback avoidance, and income sustainability.

Future of OAS and Sustainability Concerns

Canada’s aging population means OAS payouts will grow in the coming decades, prompting government reviews of program sustainability. Recent and proposed changes include gradually increasing the eligibility age from 65 to 67 by the late 2020s. Staying informed on these developments will help you plan adequately.