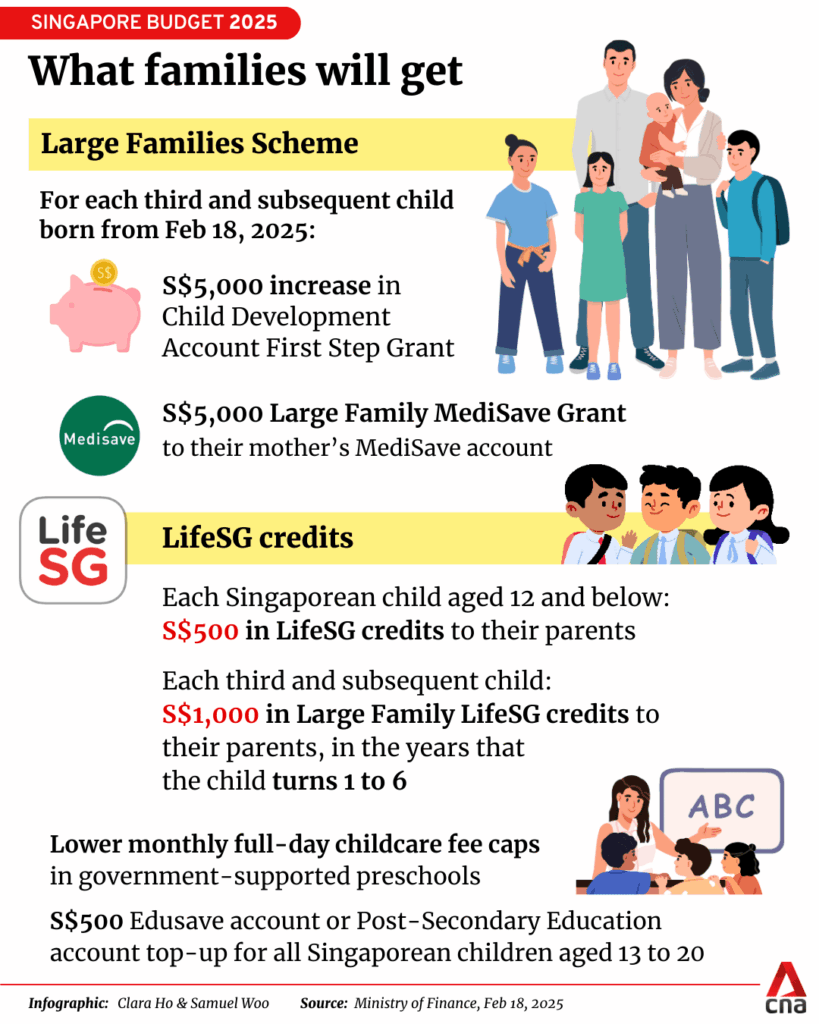

$16,000 Child Benefit Coming: Hey folks! Big news if you’re a Singaporean parent or planning a family — starting 2025, Singapore is rolling out a brand new $16,000 Child Benefit designed especially for families with three or more kiddos. This fresh government boost aims to lighten the financial load and encourage larger families. Whether you’re juggling bills or tracking government schemes professionally, this article breaks down all the good stuff for you in approachable, easy-to-grasp terms with a friendly, knowledgeable vibe.

So, what’s this $16,000 Child Benefit all about? It’s part of the Large Families Scheme (LFS) launched from February 18, 2025, offering cash gifts, savings grants, and ongoing credits to help support your child’s growth and your family’s finances. Parents get immediate help plus savings for future expenses like school and healthcare. Let’s unpack all you need to know — who qualifies, how to apply, what you get, and even some tips to maximize your benefits. Stick around; let’s make sense of this together.

$16,000 Child Benefit Coming

Singapore’s $16,000 Child Benefit starting 2025 is a thoughtful, multi-faceted support system designed to help families with three or more children handle the rising costs of child-rearing. Through a mix of cash grants, medical savings, and ongoing credits, parents get a solid financial foundation that eases day-to-day pressures and helps secure a good future for their kids. If your family qualifies, don’t wait — open a Child Development Account, enroll in Baby Bonus via LifeSG, and claim these benefits. Raising a family just got a lot smoother and smarter in the Lion City.

| Feature | Details |

|---|---|

| Total Benefit Amount | Up to S$16,000 per eligible third or subsequent child |

| Eligibility | Child must be Singapore Citizen, born on or after 18 February 2025 |

| Family Income Threshold | Generally below S$150,000 combined annual income for full benefits |

| Key Components of Benefit | – $10,000 Child Development Account First Step Grant – $5,000 Large Family MediSave Grant – LifeSG Credits: $1,000 per year for 6 years ($6,000 total) |

| Additional Perks | Discounts and privileges from merchants supporting LFS |

| Disbursal Mode | Payments credited directly to Child Development Account & MediSave account |

| Official Info & Application | Baby Bonus Scheme – LifeSG |

What Is the $16,000 Child Benefit Coming?

The $16,000 Child Benefit isn’t just your usual government handout; it’s a significant upgrade aimed squarely at large families—those with three or more children. The scheme launches from February 18, 2025, and offers a combined package of cash gifts, long-term savings incentives, and annual credits geared toward helping families juggle the costs of raising kids.

Breaking down this hefty package:

- $10,000 Child Development Account First Step Grant (CDA FSG): This is a one-time boost doubled from the previous $5,000 for third and subsequent kids. Deposited directly into your child’s CDA, it’s earmarked for child-related expenses like preschool fees, healthcare costs for your child or siblings, and enrichment classes. Think of it as a financial first step to set your child up right from the get-go.

- $5,000 Large Family MediSave Grant (LFMG): This grant lands in the mother’s MediSave account to help offset pregnancy, delivery, and other medical expenses related to both the mother and child, easing the often hefty healthcare costs of childbirth and early childhood.

- $6,000 LifeSG Credits (LFLC): These are annual $1,000 credits given each year from a child’s 1st to 6th birthday, providing rolling financial support that helps with ongoing child-raising expenses. Eligible families access these credits via the LifeSG mobile app, making it super convenient.

All told, this adds up to a $16,000 support package for each third or subsequent Singapore Citizen child born on or after February 18, 2025. The combination of upfront cash plus continuous credits helps families plan not just for today but for years to come.

Who Qualifies for This Child Benefit?

The eligibility criteria for this benefit are fairly straightforward but important:

- Child Citizenship: The beneficiary child must be a Singapore Citizen born on or after February 18, 2025. This latest birthdate cutoff ensures the benefit targets newly expanded families.

- Third or Subsequent Child: The scheme focuses exclusively on third and later children to support families with larger size. This means the first and second child do not receive this enhanced package.

- Family Income Threshold: While Singapore offers generous support, full benefits are designed for families earning below S$150,000 combined annual income. Families earning over the threshold may still receive partial benefits, but full grants and credits apply mostly to lower- and middle-income groups.

- Enrollment in Baby Bonus Scheme: The child must be enrolled in the Baby Bonus Scheme and have an open Child Development Account (CDA) in a participating bank, such as POSB/DBS, OCBC, or UOB.

- Family Structure: The scheme covers children related by birth, adoption, or step-relations. Blended families with stepchildren are eligible if the children live with the family under the same CDA trustee.

- Annual Eligibility Reviews: Eligibility for ongoing LifeSG credits is assessed yearly, with March 1 as the cutoff date for continuing support throughout the year.

If all these points ring true for your family, it’s time to dive into the application process.

How to Apply for $16,000 Child Benefit Coming: A Step-By-Step Guide

Applying for the $16,000 Child Benefit doesn’t have to be a headache. Here’s what to do to get started:

Step 1: Confirm Your Child’s Eligibility

Make sure your kiddo was born on or after February 18, 2025, and is a Singapore Citizen. The government verifies this through the Birth Registry and citizenship records.

Step 2: Open a Child Development Account (CDA)

Soon after your child’s birth and citizenship registration, visit a designated bank (POSB/DBS, OCBC, UOB) to open a CDA. This account is special — it’s solely for saving funds matched or granted by the government to cover child-related expenses.

Step 3: Enroll in the Baby Bonus Scheme

Jump on the LifeSG website or use their mobile app to enroll your child into the Baby Bonus Scheme. This is mandatory to receive the grant and LifeSG credits.

Step 4: Submit Household Income Documents

Upload necessary proof to verify household income, such as tax documents or salary slips. This determines your eligibility tier for the benefit.

Step 5: Receive the Grants and Credits

- The $10,000 First Step Grant is automatically deposited into your child’s CDA about two weeks after account opening and scheme enrollment.

- The $5,000 MediSave Grant credits into the mother’s MediSave account for medical cost coverage.

- The $1,000 annual LifeSG Credits hit your LifeSG app wallet from your child’s first birthday and continue until age six, delivered annually via the app for easy use on approved expenses.

Step 6: Manage and Use Funds Responsibly

Remember, CDA funds can only be used for approved expenses like preschool fees, healthcare, enrichment classes, and approved childcare. Always keep receipts and documents for transparency.

The Baby Bonus Scheme and How It Works

The Baby Bonus is the backbone of Singapore’s family support. Before the Large Families Scheme, it provided cash gifts and child savings to help with the cost of raising kids.

The Baby Bonus Scheme includes:

- Baby Bonus Cash Gift (BBCG): This is a series of cash payments spread out every six months from your baby’s birth until about age 6.5 years. It helps offset everyday expenses like diapers, food, and baby gear.

- Child Development Account (CDA): This savings account is designed for child-related expenses. The government contributes a First Step Grant plus matches every dollar parents save up to a cap.

The Large Families Scheme builds on this by doubling the CDA First Step Grant for third+ children and adding new MediSave grants and LifeSG credits. It’s Singapore’s response to increasing family size costs and birthrate encouragement.

Extra Perks for Large Families

Singapore’s support goes beyond direct cash and accounts:

- Large Families Deals: More than 50 merchant partners offer special discounts on grocery shopping, transportation, educational courses, lifestyle and wellness services tailored for large families. The goal is to make family life more affordable and fun.

- Preschool Fee Reductions: Fees at Anchor Operator and Partner Operator preschools are discounted by $30-$40 monthly for families with multiple children, as part of subsidy programs linked with the Baby Bonus Scheme.

- Child LifeSG Credits for All: Every Singapore Citizen child aged 0-12 receives a one-time $500 credit to the LifeSG app to help with enrichment activities, education or healthcare, ensuring no kid gets left out.

These perks help families stretch their budget, giving room for quality time and experiences rather than just paperwork and bills.

Singapore $16,000 Child Benefit vs. US Child Tax Credit

For international comparisons, particularly for readers in the USA, here’s a useful look:

| Feature | Singapore $16,000 Benefit | US Child Tax Credit (CTC) |

|---|---|---|

| Purpose | Targeted support for large families with 3+ children | Financial support for families with children under 17 |

| Maximum Per Child | S$16,000 (approx. $12,000 USD) | Up to $2,000 annually per child (income-based) |

| Payment Type | Mix of lump sum grants, annual credits | Refundable tax credit from tax filings or monthly advances |

| Eligibility | Citizenship + income + 3rd+ child qualification | Child under 17, social security number, dependent |

| Payout Schedule | Lump sum + annual credits from age 1-6 | Most received yearly or as monthly advances in some periods |

Compared to the US tax credit, Singapore’s scheme provides more immediate assistance with direct outcomes aimed at childcare, healthcare, and education, rather than waiting for filing season tax returns.

Real-Life Scenario: How $16,000 Child Benefit Impacts Families

Meet the Lim family. They just welcomed their third baby in June 2025. Here’s a snapshot of how the $16,000 benefit changes their life:

- $10,000 First Step Grant: Deposited into their child’s CDA, they plan to pay for preschool costs starting next year.

- $5,000 MediSave Grant: The mother’s MediSave account gets topped up, easing expenses related to childbirth and pediatric visits.

- $1,000 yearly LifeSG Credits: For six years, starting when their baby turns one, this yearly credit helps cover extracurricular activities, educational toys, and childcare necessities.

This structured financial help means the Lims can focus more on their kids and less on budgeting nightmares. Stress relieved, family life elevated.

Government Confirms S$1,300 Cash Payout in November 2025 – Are You Getting Paid? Check Eligibility