The Social Security Administration (SSA) has confirmed that its November 2025 payment schedule adheres to the so-called “Wednesday Rule,” with monthly benefit payments set for November 12, 19, and 26. Knowing which date applies to you based on your birth-date is critical for effective budgeting and planning.

Social Security Follows the Wednesday Rule

| Key Fact | Detail / Statistic | Source |

|---|---|---|

| Payment dates in November 2025 | Nov 12, Nov 19, Nov 26 for most retirement/disability beneficiaries. | SSA schedule & Investopedia. (Investopedia) |

| Why three dates? | Payments are distributed on the second, third or fourth Wednesday depending on birth-date. | Investopedia. |

| SSI payment shift | Supplemental Security Income (SSI) payments for November arrive on Oct 31 since Nov 1 falls on a Saturday. | Economic Times article. |

| Government-shutdown impact | Social Security payments are unaffected by federal shutdowns as they are mandatory spending. | CBS News article. |

How the Wednesday Rule Works

Payments for most retirement, disability and survivor benefits are scheduled according to the beneficiary’s birth-date. If you began receiving benefits on or after May 1, 1997, then:

- Birthdays 1 st–10 th of the month → payment on the second Wednesday of the month.

- Birthdays 11 th–20 th → payment on the third Wednesday.

- Birthdays 21 st–31 st → payment on the fourth Wednesday.

For November 2025, that translates into payment dates of Nov 12, Nov 19 and Nov 26 respectively.If you started receiving benefits before May 1997 or receive both Social Security benefits and SSI, then you may be on a different schedule (often the 3rd of each month or alternate date).

Additionally, SSI – which serves low-income seniors and individuals with disabilities – typically pays on the first of each month. In 2025, because Nov 1 falls on a weekend, the SSI benefit for November will be deposited on Friday, Oct 31.

Why the November Dates Matter

For many retirees, these benefit payments are their primary source of income. According to the SSA, tens of millions of Americans depend on Social Security for half or more of their retirement income.

Knowing the exact deposit date allows beneficiaries to align bill payments, rent, prescriptions and other outflows. Because the payment schedule varies monthly and by birthday, mismatches can occur: for example, your benefit may arrive after a large bill is due. Financial advisers point out that such mismatches can cause avoidable financial stress.

Further, the early SSI payment (Oct 31) means some recipients will go five weeks between payments (Oct 31 to Dec 1). Awareness of this gap is crucial for budgeting.

Legislative and Payment-Mechanics Updates

Cost-of-Living Adjustment (COLA)

The average monthly Social Security benefit increased by 2.5% in 2025, following the annual COLA adjustment. The maximum federal SSI payment for 2025 is $967 for an individual and $1,450 for an eligible couple. For 2026 these amounts are set to rise to $994 and $1,491 respectively.

Electronic Payments Only

Nearly all benefits are now paid via direct deposit or the Government’s prepaid “Direct Express” debit card. Paper checks have been effectively phased out, reducing delays due to mail or holidays.

Shutdown Safeguards

Because Social Security benefits fall under mandatory spending, monthly payments continue even during federal government shutdowns. However, the SSA warns that certain services – like benefit verification letters or in-office appointments – may be delayed.

Related Links

How Beneficiaries Can Prepare

Here are practical steps to ensure smooth receipt of benefits:

- Verify your payment date based on your birth-date and benefit type.

- Check your bank account on the scheduled date — if there’s no deposit within three business days, contact your financial institution and then the SSA at 1-800-772-1213 (TTY 1-800-325-0778).

- For SSI recipients: note that the next payment arrives Dec 1, so plan for a longer interval.

- Build a cushion in your checking account to cover when your benefit arrives after a bill or if payments fall later in the month.

- Confirm your bank information and update it via your My Social Security account or local field office.

- Stay abreast of developments: legislative changes (e.g., repeal of the Windfall Elimination Provision or Government Pension Offset) may affect benefit amounts or eligibility.

Looking Ahead: What to Watch

While the Wednesday-based payment schedule is stable, several broader issues could influence retirees:

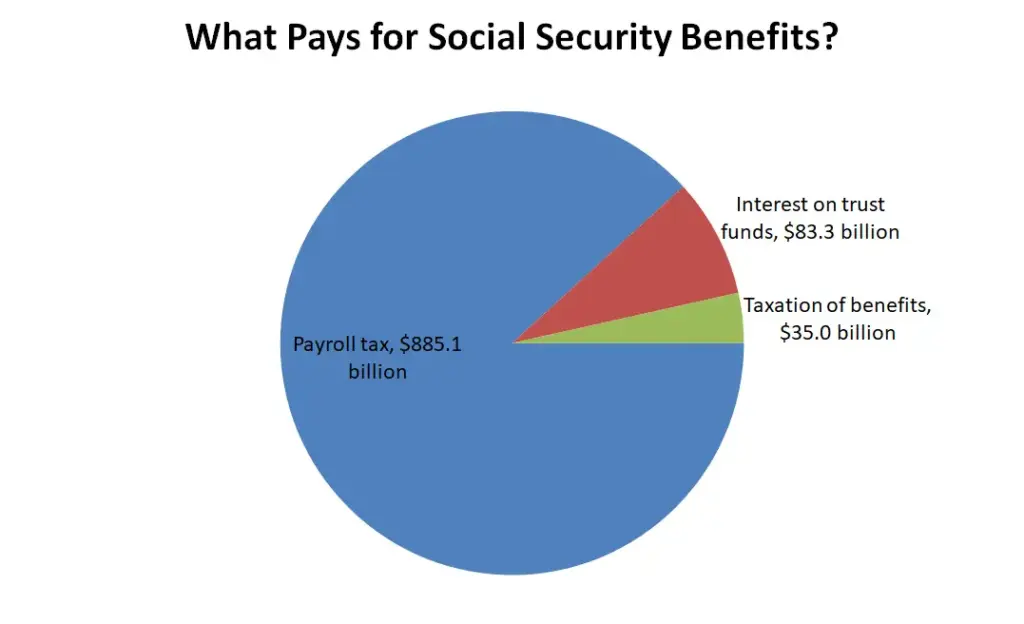

- The long-term solvency of the Social Security trust funds remains a topic of debate; unless addressed, current projections show benefits could be reduced in future decades.

- Future COLA adjustments will depend on inflation trends, meaning retirement income may vary more than expected.

- Legislative proposals to expand benefits, overhaul taxation of benefits, or adjust retirement age may surface ahead of upcoming elections.

- For SSI recipients and those receiving both SSI and Social Security, calendar shifts (weekends/holidays) will continue to affect payment timing.