The Social Security Administration (SSA) has released the full 2026 benefit payment schedule, giving millions of Americans a clear timeline for when their monthly checks will hit their accounts. This schedule is essential for budgeting, bill timing and financial planning under both retirement and disability benefit programs.

Social Security 2026 Payments

| Key Fact | Detail |

|---|---|

| Payment tiers | 2nd/3rd/4th Wednesday based on birthday range |

| SSI payment rule | 1st of month (or prior business day if weekend/holiday) |

| COLA for 2026 | 2.8% increase announced by SSA |

With the 2026 payment schedule now published, beneficiaries have the clarity needed to plan ahead. Ensuring your account details are correct, aligning expenses with your deposit date, and keeping informed about broader program changes will help you stay financially prepared as the new year begins.

Understanding the Social Security 2026 Payments Payment Schedule

How the Wednesday Tier System Works

For most retirement, survivors and disability benefits (under Title II), payment dates depend on your date of birth and when your benefits began. According to the SSA’s official schedule:

- Birthdays 1–10 → payment on the second Wednesday of each month.

- Birthdays 11–20 → payment on the third Wednesday of each month.

- Birthdays 21–31 → payment on the fourth Wednesday of each month.

Special Payment Groups

- If you began receiving benefits before May 1997, your payment generally arrives on the third day of each month.

- If you receive both Social Security and Supplemental Security Income (SSI), your Social Security credit typically follows the third-day schedule.

- SSI recipients generally receive returns on the 1st of each month (or the preceding business day if the 1st falls on a weekend or federal holiday).

Why It Matters for 2026

Knowing your payment date helps you align monthly obligations—rent, utilities, medical payments—and avoid surprises if processing is shifted by weekends or holidays. The schedule also interacts with the upcoming cost-of-living adjustment (COLA) and other policy changes.

Key Updates & 2026 Changes

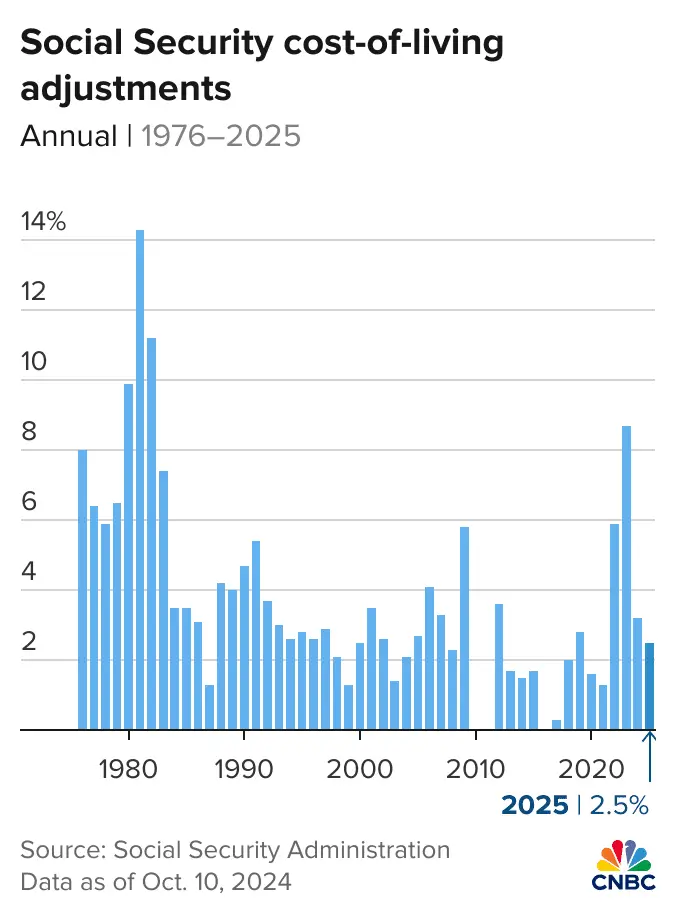

COLA and Benefit Amount Changes

The SSA announced a 2.8% COLA increase for 2026, applying to about 71 million beneficiaries. For the average retired worker, this adds roughly $56 per month.

Additional Policy Shifts

Several other changes impact the program:

- The taxable earnings cap for Social Security contributions will rise in 2026.

- Earnings limits for workers under full retirement age will adjust upward.

- The full retirement age (FRA) continues its gradual increase; for those born in 1960 or later it will be 67.

Practical Steps for Beneficiaries

Verify Your Exact Payment Date

The SSA provides two easy methods to check your specific schedule:

- Log in to your my Social Security account online and use the “View Benefit Payment Schedule” tool.

- Download and review the official PDF “Schedule of Social Security Benefit Payments – 2026” from SSA.

Manage Timing & Bank Holidays

- If your payment date falls on a weekend or federal holiday, expect the deposit on the preceding business day.

- Ensure your direct deposit information is accurate, as paper checks are nearly phased out.

- For SSI recipients, note possible “double-payment” months when the 1st falls on a weekend triggering an earlier payment.

Budgeting & Planning

Having the payment date means you can:

- Align monthly expenses confidently.

- Avoid overdrafts or payment delays.

- Plan for any hiatus in payments caused by calendar quirks (for example, payments arriving at month end rather than the 1st).

Related Links

SNAP Benefits 2025: How the New 80-Hour Work Rule Could Impact You

2026 Tax Reforms: Seniors Get Bigger Deductions and New Relief – Are You Eligible?

Broader Context & Program Longevity

The Wednesday-tiered payment schedule was introduced in 1997 to spread the workload across the month and avoid system congestion. While the schedule offers timing certainty, the long-term health of the Social Security program remains under review. According to financial analysts, without reforms the trust funds may face depletion in the coming decade.

FAQs About Social Security 2026 Payments

Q1: When will I receive my Social Security payment in 2026?

A1: It depends on your date of birth and benefit type—see the SSA’s Tuesday schedule or download the 2026 PDF.

Q2: What happens if my payment date falls on a weekend or holiday?

A2: The SSA generally issues the payment on the preceding business day.

Q3: How can I check my personal payment date?

A3: Log in to your my Social Security account or view the official SSA schedule PDF online.