U.S. homeowners have a limited-time opportunity to receive up to $2,000 through a federal heat pump rebate when replacing outdated appliances with certified energy-efficient systems. The incentive, authorized under the Inflation Reduction Act (IRA), rewards homeowners who upgrade by December 31, 2025, with the dual goal of lowering household energy costs and cutting nationwide carbon emissions.

Get Up to $2,000 Back If You Replace This Appliance Before Year-End

| Key Fact | Detail |

|---|---|

| Maximum Credit | $2,000 or 30% of qualified installation cost |

| Eligible Systems | Air-source and geothermal heat pumps, heat pump water heaters |

| Program Duration | Until December 31, 2025 |

| Claim Method | IRS Form 5695, “Residential Energy Credits” |

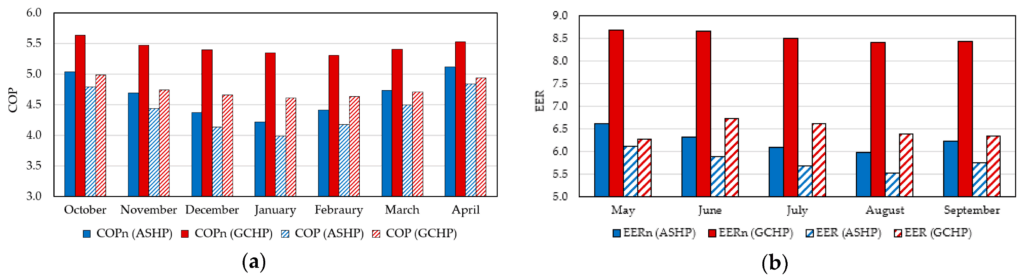

| Typical Savings | 25% – 65% lower energy consumption vs. electric or gas heating |

Understanding the Heat Pump Rebate Program

The federal heat pump rebate, officially called the Energy Efficient Home Improvement Credit, allows homeowners to claim up to 30 percent of the cost of installing eligible heat pumps, capped at $2,000 per year. The credit applies to both space-heating and water-heating systems that meet ENERGY STAR certification requirements.

The initiative aims to speed America’s transition away from fossil-fuel-based home energy toward electric systems powered by cleaner grids. According to the U.S. Department of Energy, a modern air-source heat pump can deliver two to three times more heat energy than the electricity it consumes, significantly improving efficiency.

Why the Program Matters

Reducing Household Energy Costs

Heat pumps both heat and cool homes efficiently. When replacing an electric furnace, oil burner, or propane system, homeowners can save hundreds of dollars annually on utility bills. The Department of Energy estimates typical energy reductions of 25 – 50 percent depending on climate, insulation, and equipment type.

Lowering Carbon Emissions

Beyond personal savings, widespread adoption helps curb national greenhouse-gas emissions. Heat pumps generate no direct combustion emissions, unlike oil or gas furnaces. When paired with renewable electricity, they can nearly eliminate a home’s heating-related carbon footprint.

Stimulating Clean-Energy Jobs

The Inflation Reduction Act set aside approximately $369 billion for climate and energy programs. Industry groups report that demand for trained HVAC technicians and manufacturing jobs in electric heating systems has surged since the IRA’s passage in 2022. This aligns with broader federal goals to strengthen domestic clean-energy production.

Who Qualifies and How

Eligibility Criteria

- Residency: The property must be located within the United States and serve as the owner’s primary or secondary residence. Rental properties typically do not qualify.

- Installation Date: Equipment must be placed in service between January 1, 2023 and December 31, 2025.

- Certification: Systems must meet ENERGY STAR performance standards.

- Professional Installation: Work should be performed by a licensed contractor to ensure code compliance and warranty validity.

Excluded Properties

- New construction homes not yet occupied.

- Purely rental or commercial properties (unless program is expanded).

- Installations completed after 2025 without an extension in federal law.

Credit Limitations

The $2,000 limit applies to heat pump and heat pump water-heater installations. Other improvements—such as insulation, doors, and windows—have smaller annual caps (usually $250 – $1,200). The credit is non-refundable, meaning it cannot exceed the taxpayer’s federal liability, though it may carry forward to the next tax year.

How to Claim the Rebate

- Choose a qualifying system — verify ENERGY STAR certification.

- Hire a licensed installer and ensure compliance with state and local permits.

- Collect documentation: invoice, certification statement, product model number, and proof of payment.

- File IRS Form 5695 with your federal tax return.

- Claim the credit—30% of total eligible cost, up to $2,000 per year.

Tax advisors recommend keeping all paperwork for at least three years in case of IRS review.

Beyond the Federal Credit: Stacking Incentives

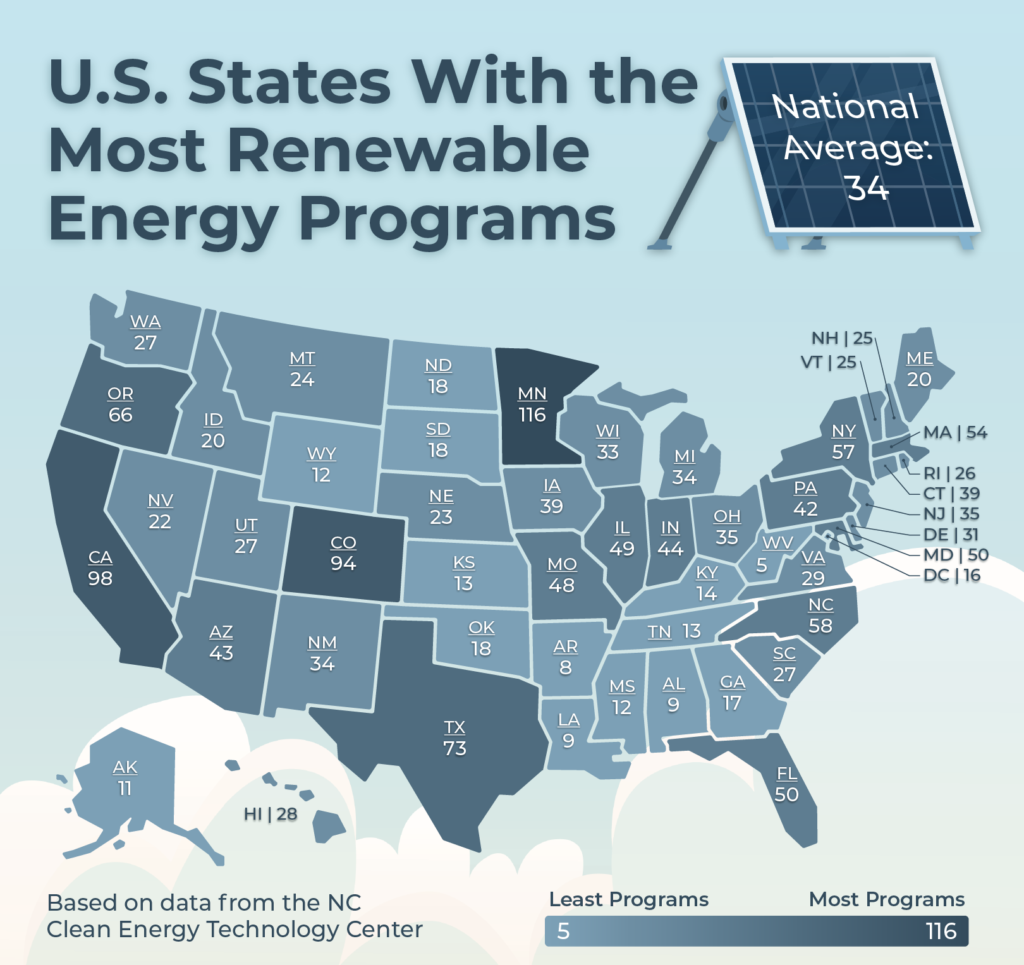

Many states and utilities layer their own rebate programs on top of the federal credit:

- California: Local utilities offer rebates from $1,000 to $3,000 for low-income households that switch from gas to electric heating.

- New York: NYSERDA’s “Heat Pump Ready” initiative adds up to $5,000 for whole-home installations.

- Massachusetts: The Mass Save program provides incentives reaching $10,000 for high-efficiency, all-electric conversions.

Combining state and federal benefits can reduce upfront costs by as much as 50 percent, significantly shortening the pay-back period.

Economic and Social Context

Addressing Energy Inequality

While the rebate is available to most homeowners, low-income families may struggle with initial installation costs. Critics note that the tax-credit format primarily benefits those with higher federal tax liability. Advocacy groups urge Congress to convert credits into direct-to-consumer rebates to ensure broader participation.

According to analysis from several nonprofit energy think tanks, households earning below $50,000 per year claim less than 15 percent of existing energy-efficiency credits. Expanding direct rebate mechanisms, possibly through state agencies, could help correct that imbalance.

Job Creation and Workforce Development

The HVAC sector anticipates adding tens of thousands of new jobs as heat pump adoption accelerates. Industry associations are investing in technician training programs to meet demand and maintain installation quality standards.

Case Studies: Savings in Action

- Ohio: A suburban homeowner replaced a 12-year-old propane furnace with a $7,000 heat pump system. The federal credit provided $2,000 back, and state incentives covered another $1,200. The family’s heating bill dropped by nearly 40 percent.

- Texas: A homeowner in Austin installed a heat pump water heater for $4,000, earning a $1,200 credit and saving $300 annually on electricity.

- Vermont: In colder climates, cold-weather heat pumps maintain performance at –15 °F. A Vermont couple replaced their oil furnace and now save $900 per year while reducing emissions by roughly three metric tons of CO₂.

Such examples illustrate how the combination of rebates, efficiency, and fuel-cost savings can offset initial investment within several years.

Step-by-Step: Planning Your Upgrade

- Evaluate current energy use — compare past heating bills to potential savings.

- Schedule a home energy audit — many utilities offer them for free.

- Consult multiple installers — verify experience with federal rebate documentation.

- Apply for state or utility pre-approval (if required).

- Plan for complementary upgrades (insulation or panel upgrades) to maximize efficiency.

- Track post-installation savings to validate performance.

Energy analysts emphasize proper system sizing and professional installation as the most important factors for long-term reliability.

Environmental and Policy Outlook

The Inflation Reduction Act is projected to cut U.S. greenhouse-gas emissions roughly 40 percent below 2005 levels by 2030. Widespread adoption of efficient home technologies like heat pumps is central to reaching that target.

Policy experts anticipate congressional debate over whether to extend the tax credit beyond 2025. If extended, future revisions could expand eligibility to rental properties and multifamily buildings, or replace tax credits with point-of-sale rebates for faster relief.

Manufacturers are preparing next-generation “cold-climate” heat pumps that perform efficiently below freezing, making the technology viable in northern states once dominated by oil and gas furnaces.

Risks and Pitfalls to Avoid

- Improper sizing: An oversized system cycles inefficiently; an undersized unit struggles to maintain comfort.

- Unverified contractors: Always choose certified installers. Poor workmanship can void warranties and reduce efficiency.

- Incomplete documentation: Missing receipts or model certifications may disqualify the claim.

- Ignoring local codes: Electrical panel upgrades or permits may be required.

- Delaying installation: Projects begun after 2025 may not qualify unless the program is extended.

Broader Global Context

Other nations—including the United Kingdom, Germany, and Japan—also subsidize residential heat pumps. The U.S. approach, however, combines federal tax credits with industrial policy aimed at domestic manufacturing, aligning environmental goals with economic competitiveness.

By linking consumer incentives with supply-chain investment, the United States hopes to accelerate innovation and reduce reliance on imported equipment.

What Experts Say

“The $2,000 heat pump rebate isn’t just about tax relief—it’s about accelerating clean-energy adoption in America’s homes,” said Ali Zaidi, White House National Climate Advisor, in an official briefing.

“Replacing old systems with efficient electric heat pumps can lower energy bills and improve indoor air quality. It’s a win for households and for the planet,” he added.

Independent economists agree that electrification incentives remain among the most cost-effective ways to reduce residential carbon emissions while stimulating local employment.

Looking Forward

If current policies remain, analysts expect heat pump sales to double by 2027, representing nearly half of all new HVAC installations in the United States. Extending the federal credit would likely accelerate that trajectory further.

For now, the advice from energy experts is clear:

- Act before the 2025 deadline.

- Verify that equipment is certified and installed properly.

- Combine federal and state incentives wherever possible.

Veterans Day Surprise — Dunkin’ Rolls Out a Free Treat for Those Who Served