The SSI COLA Increase 2026 will raise monthly benefits by 2.8%, according to the Social Security Administration (SSA). The change, designed to preserve purchasing power amid persistent inflation, will take effect with January 2026 payments. The increase offers modest financial relief to roughly 7.5 million Supplemental Security Income (SSI) recipients, many of whom live on fixed, low incomes.

Big News for SSI Recipients

| Key Fact | Detail/Statistic |

|---|---|

| COLA Percentage | 2.8% |

| Effective Date for SSI | December 31, 2025 (for January 2026 benefit) |

| Average SSI Payment (2025 → 2026) | $967 → $994 per month |

| Affected Recipients | ~7.5 million SSI beneficiaries |

| Average Retirement Benefit (2026) | $2,071 per month |

| Official Website | SSA.gov |

Understanding the 2026 COLA Adjustment

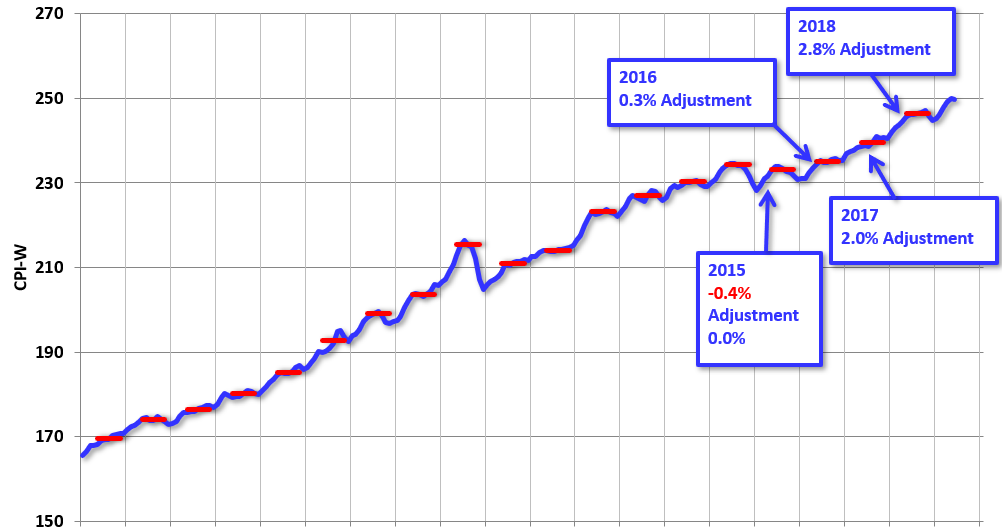

The cost-of-living adjustment (COLA) is designed to keep Social Security and SSI payments in line with inflation. The SSA bases the increase on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), comparing third-quarter averages from one year to the next.

For 2026, the 2.8% increase represents a moderate uptick after two years of higher inflation. The SSA said in a statement that the change “ensures that benefits continue to reflect real-world costs for seniors, people with disabilities, and low-income households.”

“This year’s COLA recognizes inflationary pressures without overstating them,” said Kilolo Kijakazi, Acting Commissioner of Social Security. “It’s part of our commitment to maintaining financial security for America’s most vulnerable.”

When and How the New Payments Arrive

Recipients of Supplemental Security Income will see their new benefit levels reflected in payments dated December 31, 2025, since January 1 is a federal holiday. Social Security retirement and disability recipients will receive their higher amounts starting with January 2026 checks.

Beneficiaries will receive official letters in December 2025, but those with a “my Social Security” online account can check their new benefit amount starting November 19, 2025. The SSA encourages online access to reduce mailing delays.

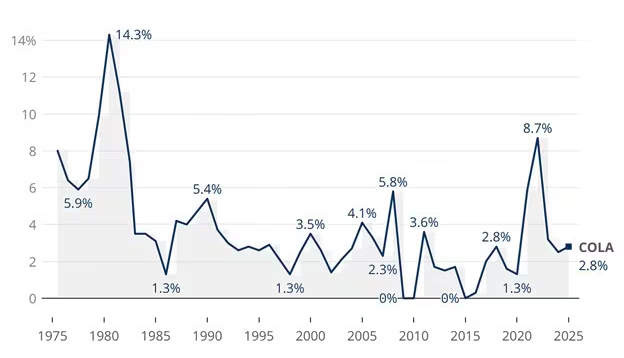

Historical Perspective: A Decade of COLA Trends

Over the past decade, COLA adjustments have fluctuated sharply due to economic cycles:

- 2016: 0.0% (no increase)

- 2018: 2.0%

- 2020: 1.6%

- 2022: 5.9%

- 2023: 8.7% (highest in 40 years)

- 2024: 3.2%

- 2026: 2.8%

Experts say the 2026 increase signals a return to pre-pandemic inflation levels, though prices for essentials remain elevated. “This reflects a cooling economy, but not necessarily relief for low-income beneficiaries,” said Dean Baker, senior economist at the Center for Economic and Policy Research.

Impact on SSI Recipients

In 2026, the federal SSI payment standard will increase to $994 per month for individuals and $1,490 for couples. Some states supplement these benefits, meaning actual payments vary.

“This adjustment helps, but it’s not a windfall,” said Mary Johnson, policy analyst at the Senior Citizens League. “Even modest rent increases can outpace COLA, especially in high-cost regions.”

Example: For a single recipient receiving $967 in 2025, the 2.8% increase equals an extra $27 per month, or about $324 per year—barely covering one month’s groceries in many cities.

For millions who depend on SSI as their sole source of income, that gap matters. “It’s a small cushion, not a raise,” said Harold Davis, a 67-year-old retired bus driver in Ohio. “But when you live check to check, any increase helps.”

Inflation and the Purchasing Power Problem

Although the COLA protects against inflation, many economists argue it does not reflect the actual spending patterns of older and disabled Americans. The CPI-W, used in the COLA formula, tracks working-age households rather than retirees—who often face higher medical and housing costs.

“Healthcare inflation has outpaced general inflation for years,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “As a result, seniors experience higher real costs even when headline inflation is moderate.”

According to the Bureau of Labor Statistics, medical expenses have risen more than 4% annually since 2022, while average rent costs have climbed about 5% per year.

Comparing the U.S. System to Other Nations

The United States is one of several advanced economies that ties social benefits to inflation. Other nations, including Canada, the United Kingdom, and Germany, use similar mechanisms, though with key differences:

- Canada adjusts its Old Age Security (OAS) payments quarterly, offering more frequent protection against rapid inflation.

- The U.K. uses a “triple lock” formula, raising pensions by the highest of inflation, wage growth, or 2.5%.

- Germany indexes pensions partly to wage growth, helping maintain parity with working incomes.

“The U.S. model focuses narrowly on inflation,” said Richard Johnson, a senior fellow at the Urban Institute. “That’s fair in principle but less generous than systems that consider broader living standards.”

Fiscal and Policy Implications

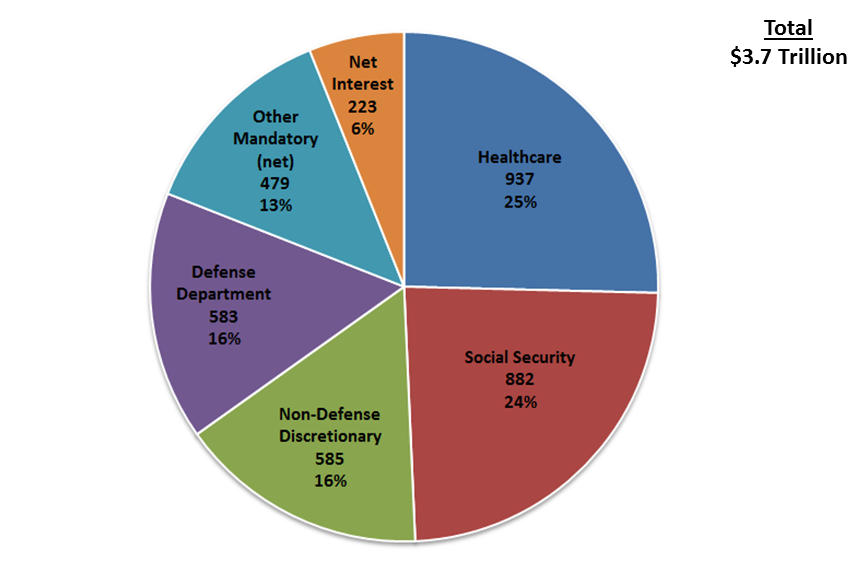

While COLA adjustments help maintain economic stability for households, they also strain federal finances. According to the Congressional Budget Office (CBO), Social Security and SSI programs consumed about $1.5 trillion in federal spending in 2025, roughly one-fourth of the total U.S. budget.

Lawmakers in Congress continue to debate long-term solvency. The Social Security Trust Fund is projected to face depletion by 2035 unless reforms are enacted. Options under discussion include adjusting the payroll tax cap, modifying benefit formulas, or gradually increasing the full retirement age.

“The COLA is not the cause of the program’s financial imbalance,” noted Andrew Biggs, senior fellow at the American Enterprise Institute. “But it highlights the tension between fiscal sustainability and the promise of income security.”

The Human Impact: Life on the Edge

For millions of Americans, SSI payments are more than a benefit—they are a lifeline.

“SSI is what keeps me from homelessness,” said Patricia Lane, 58, who relies on monthly disability payments after losing her job due to chronic illness. “When rent goes up, I cut back on food or medication. A 2.8% raise doesn’t close that gap, but it’s something.”

Data from the Center on Budget and Policy Priorities (CBPP) show that SSI lifts roughly 2.6 million people above the poverty line each year. Still, nearly half of all beneficiaries live below the poverty threshold even after benefits are included.

What Recipients Should Do Next

The SSA advises all recipients to:

- Check their benefit amount using their “my Social Security” account.

- Update direct deposit information to prevent delays.

- Report any changes in income or living situation to maintain accurate payments.

Financial planners recommend reviewing monthly budgets now. “A 2.8% increase may seem small, but over time these adjustments compound,” said Janice Towne, a certified financial planner based in Denver. “Beneficiaries should treat it as a chance to catch up on essentials or start an emergency fund.”

Looking Ahead: The 2027 Outlook

The next COLA adjustment will be announced in October 2026, based on inflation data from mid-2025 to mid-2026. Analysts expect continued modest increases if inflation remains stable, though global supply and energy costs could influence outcomes.

As policymakers consider reforms to strengthen the system, public trust remains critical. “Social Security is the backbone of American retirement,” said Nancy Altman of Social Security Works. “Ensuring its stability means safeguarding not just benefits but dignity for millions.”

Veterans Day Surprise — Dunkin’ Rolls Out a Free Treat for Those Who Served

FAQ About The Big News for SSI Recipients

1. When will I see the new SSI COLA payment?

SSI recipients will receive their increased benefit on December 31, 2025, covering the January 2026 benefit period.

2. How is the COLA calculated?

The COLA is based on the CPI-W, a federal inflation measure comparing average consumer prices across two years.

3. Will my state supplement increase too?

Some states offer additional SSI payments. These may or may not increase automatically—check with your state’s human services department.

4. Do I need to reapply for the increase?

No. The COLA is automatic for all eligible recipients.

5. How can I confirm my new benefit amount?

Log into your “my Social Security” account online or wait for your mailed notice in December 2025.