Millions of New York residents may receive $400 payments under a new state initiative designed to ease household financial pressure. The one-time benefit, authorized in the most recent state budget cycle, aims to provide targeted relief to taxpayers who faced rising living costs.

State officials say the payments will be issued automatically to eligible individuals once income and filing qualifications are verified.

New York Residents May Receive $400 Payments

| Key Fact | Detail |

|---|---|

| Maximum Payment | Up to $400 per qualifying household |

| Who Qualifies | Residents who filed a 2023 NY tax return and meet income guidelines |

| Application Required? | No — payments will be issued automatically |

| Distribution Timeline | Expected distribution later this year |

What the $400 Payment Proposal Means for New York Households

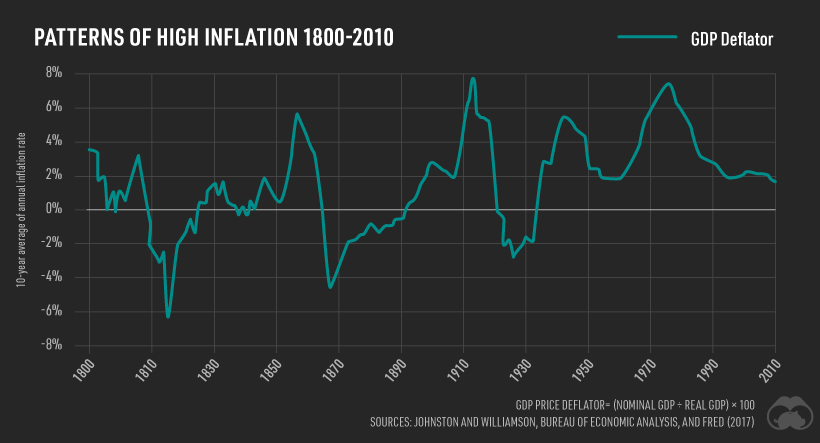

State lawmakers approved the payment program as part of a broader effort to address affordability issues affecting millions of residents. While inflation has cooled from its peak, essential expenses — including housing, utilities, transportation and groceries — remain elevated compared to pre-pandemic averages.

Policymakers say the $400 payment is intended to provide short-term financial support to help residents meet immediate needs. According to officials familiar with the rollout, the program is funded through a combination of revenue surpluses and reserved budget allocations from the previous fiscal year. Those reserves allowed the state to extend relief without increasing taxes or introducing new fees.

Who Is Eligible for the $400 Payment?

Eligibility for the payment is based primarily on 2023 tax return filings. State officials have outlined several criteria that determine whether an individual or household qualifies.

Filing Requirements

Residents must have filed a New York State Resident Income Tax Return (Form IT-201) for the 2023 tax year. Individuals who did not file taxes — including certain retirees, students or low-income residents — may not qualify unless they submit a late return that is accepted before payments are processed.

Dependents claimed on another person’s tax return are not eligible to receive the payment independently. This requirement aligns the program with other state tax-based benefits.

Income Thresholds

Although final income brackets may vary based on legislative adjustments, drafts of the program indicate the following proposed structure:

- Single filers below a set income limit would qualify for the full or partial amount.

- Married couples filing jointly would qualify up to a higher income threshold.

- Heads of household would fall between the two individual brackets.

The state has emphasized that payments will phase out gradually as income increases to ensure the benefit targets middle- and lower-income taxpayers.

Residency and Address Verification for $400 Payments

Only New York State residents are eligible for the payment. Checks will be sent to the most recently updated address listed with the Department of Taxation and Finance. Residents who have moved recently are encouraged to verify that their mailing information is current.

How and When the Payments Will Be Distributed

The state Department of Taxation and Finance will administer the distribution process. Officials have communicated the following core elements of the rollout:

Automatic Distribution

Residents do not need to apply. Eligibility will be determined using existing tax records. Automatic disbursement minimizes administrative delays and prevents confusion among taxpayers.

Distribution Timeline

Although a specific release date has not been finalized, officials anticipate issuing payments later this year, pending system testing and final budget reconciliation. Similar programs in the past — such as homeowner rebates — typically required multiple weeks of processing.

Payment Method

Checks will be mailed rather than issued through direct deposit. State administrators have stated that mail distribution reduces the risk of misdirected funds where bank account information may be outdated.

Why State Leaders Introduced the Payment Program

Economic conditions in New York continue to challenge many households, particularly those in urban areas where rent and transportation costs have increased at higher rates than national averages. The decision to introduce a one-time payment stems from several contributing factors:

Addressing Elevated Living Costs

Although inflation has moderated in the broader economy, New York residents continue to face higher-than-average prices. A recent analysis from a regional economic research group found that essential goods remain between 12% and 18% more expensive than five years ago. The payment aims to help residents offset these lingering expenses.

Supporting Households Vulnerable to Cost Shocks

Economic experts note that even modest increases in monthly expenses — such as utility rate adjustments or rising transportation fares — can strain households living paycheck-to-paycheck. One SUNY economist noted:

“A one-time payment is not a long-term solution, but it can provide meaningful relief for families experiencing acute financial pressure.”

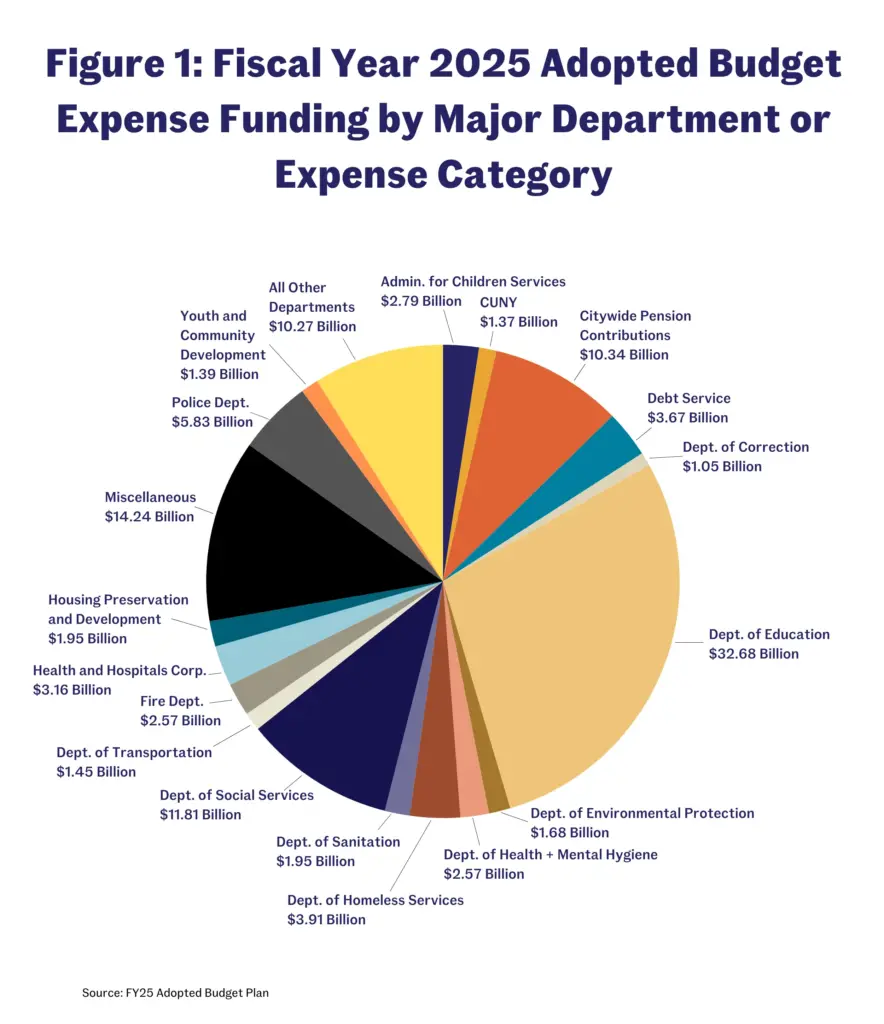

Utilizing Revenue Surpluses Responsibly

State budget reports indicate that New York ended the previous fiscal year with higher-than-anticipated revenues, partly due to strong income tax receipts and improved economic activity. Legislators decided to allocate a portion of those funds to immediate relief rather than long-term projects, arguing that residents should benefit directly from the surplus.

Criticisms and Concerns About the Program

As with any large-scale public initiative, the proposed $400 payments have prompted discussions among lawmakers, budget analysts and community organizations.

Concerns About Long-Term Impact

Some analysts argue that a single payment may not significantly improve financial stability for families facing persistent cost pressures. They contend that structural reforms — such as housing affordability initiatives or permanent tax relief — may offer more sustainable solutions.

Questions About Fiscal Sustainability

Critics have questioned whether the current surplus represents a long-term trend or a temporary spike. If revenues fall in coming years, the state may face pressure to scale back relief programs or make difficult budgetary trade-offs.

Risk of Confusion and Fraud

Government agencies have warned residents about potential scams linked to relief payments. Officials stress that the state will not call, email or text individuals requesting personal information. All legitimate communication will come by mail or through official channels only.

What Residents Should Do Now

Officials recommend the following steps to ensure smooth delivery:

- Confirm your 2023 state tax return was filed and accepted.

- Update your mailing address if you relocated after filing.

- Monitor official announcements from the Department of Taxation and Finance.

- Avoid scams, especially unsolicited requests for personal or financial details.

- Keep your tax documents accessible in case verification is required.

These preparations will help ensure that eligible residents receive their payments without delay.

Related Links

Social Security Boost Coming in 2026 — What You Must Do Now to Get Your Increase on Time

Retirement Checks Could Rise by $200 — Congress Weighs New Plan for Seniors and Veterans

Comparison to Past State Relief Programs

New York has issued targeted financial relief previously, including homeowner rebates, earned income credits and pandemic-era payments. Experts note that the proposed $400 program is smaller than pandemic stimulus checks but larger than some annual tax credits.

This positions the payment as a mid-level relief measure — significant enough to help with immediate bills but not large enough to profoundly alter household finances.

State officials are expected to finalize distribution dates in the coming months. While the one-time payment offers limited relief, it reflects broader efforts to ease financial pressure on residents across the state. Lawmakers say additional policy measures may follow as they evaluate the state’s evolving economic conditions.

FAQs About $400 Payments

Will every New York resident receive $400?

No. Eligibility is determined by income, residency status and 2023 tax filings.

Do I need to apply?

No. Payments will be issued automatically.

Is the payment taxable?

The state has not indicated any taxable status, but residents should consult a tax professional.

Can non-filers receive the payment?

Only those who filed a 2023 resident tax return qualify. Non-filers will not receive payments unless they file a return.