The Social Security Administration (SSA) will implement a series of important changes in 2026 that significantly increase how much beneficiaries can earn while still keeping their monthly retirement payments.

Under the Social Security 2026 Update, Americans who draw Social Security before reaching full retirement age will see higher income thresholds, fewer reductions and more flexibility to combine work and benefits. The updates follow inflation trends, wage growth and shifting workforce patterns across the United States, forming one of the most consequential Social Security adjustments in recent years.

Key Changes Under the Social Security 2026 Update

Higher Earnings Limits for 2026

Beginning 1 January 2026, Social Security beneficiaries who have not yet reached full retirement age may earn up to US$24,480 per year—or US$2,040 per month—without triggering benefit reductions. According to the Social Security Administration, this marks an increase from the 2025 limit of US$23,400. These thresholds are adjusted annually to reflect wage inflation.

For those who reach full retirement age during 2026, the earnings limit rises to US$65,160, up from US$62,160 in 2025. In this case, the SSA only counts income earned before the month in which a person reaches their full retirement age. After reaching that month, beneficiaries may earn unlimited income without affecting benefits.

Economist Dr. Laura Jensen from the Urban Institute told Reuters, “The increased limit under the Social Security 2026 Update acknowledges that older workers are staying employed longer. It gives them more economic room without penalising them for working.”

Under current rules:

● SSA withholds US$1 in benefits for every US$2 earned over the limit for individuals under full retirement age.

● SSA withholds US$1 for every US$3 earned above the higher limit for those reaching FRA during the year. Once a beneficiary reaches FRA, withholding stops entirely.

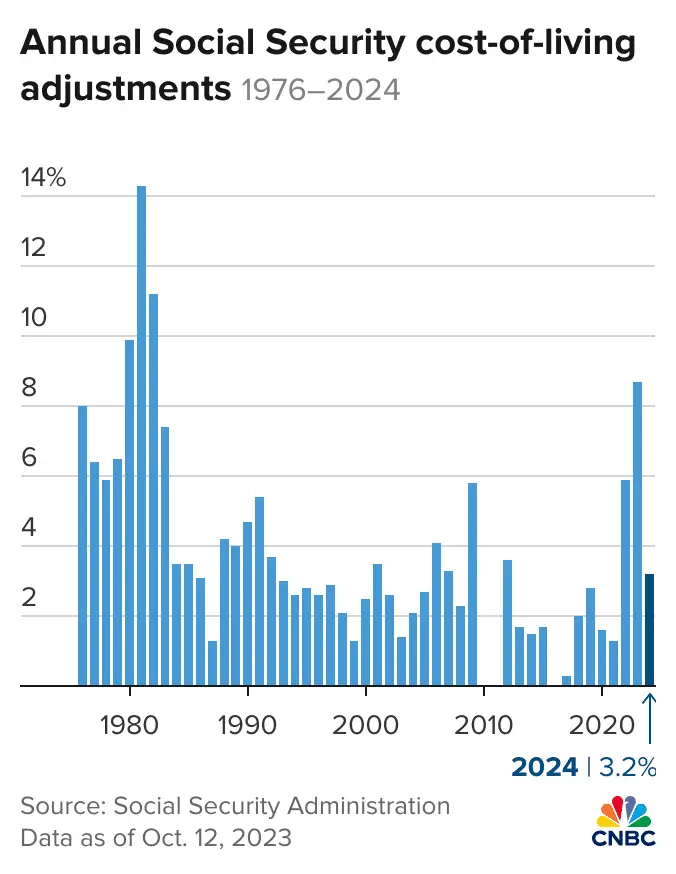

Updated COLA and Taxable Wage Base (H3)

The SSA has confirmed a 2.8% cost-of-living adjustment (COLA) for 2026. This increase is based on the U.S. Bureau of Labor Statistics’ Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), reflecting inflation trends.

Additionally, the maximum taxable earnings—the amount on which workers pay Social Security payroll tax—will rise to US$184,500 in 2026. This ensures the program remains aligned with wage inflation and helps bolster long-term fund contributions.

The Associated Press noted that this COLA will raise the average retired worker’s benefit from US$2,015 to roughly US$2,071 per month.

Why the 2026 Changes Matter

A Workforce That Is Changing

More Americans aged 55 and above are remaining in or re-entering the workforce. A study published by the Pew Research Center found that participation among older workers has grown steadily, due in part to increased life expectancy, rising healthcare costs and a desire for continued financial independence.

These demographic shifts help explain the increased thresholds under the Social Security 2026 Update. Many retirees are no longer withdrawing from employment entirely; instead, they are seeking part-time work, consulting roles or flexible gigs.

Reducing the Penalty for Working

Historically, the Social Security earnings test discouraged some older workers from remaining employed. Even though withheld benefits are later recalculated and restored at FRA, the process was not widely understood. Beneficiaries often interpreted withheld payments as “losing benefits,” discouraging work altogether.

The 2026 adjustments may reduce this confusion. As Kathleen Romig, a retirement policy expert from the Center on Budget and Policy Priorities, stated:

“Higher earnings limits give older workers more breathing room. It encourages them to stay active in the labour market without the fear of abrupt benefit reduction.”

Policy Background and Legal Framework

The Social Security earnings test was established as part of the 1939 Amendments to the Social Security Act, originally intended to prevent older Americans from retiring early while continuing full-time work. Over time, it evolved to balance program sustainability and beneficiary rights.

Key legislative milestones include:

● 1983 Amendments raising retirement age and modifying tax and benefit structures.

● 1999 Senior Citizens’ Freedom to Work Act, which eliminated the earnings test for individuals over full retirement age.

● Annual inflation-based updates administered by the SSA.

Understanding this legal context helps explain why updates under the Social Security 2026 Update occur and how they maintain the program’s financial and social integrity.

Implications for Beneficiaries

Financial Planning Considerations

Financial planners recommend beneficiaries reassess their income mix for 2026. With more generous thresholds, combining Social Security income with part-time earnings may become more viable. Yet, they caution that higher income could still impact tax liabilities and Medicare premiums.

Recalculation of Withheld Benefits

Benefits withheld due to excess earnings are not lost. The SSA recalculates monthly benefits at full retirement age, crediting back the months during which benefits were withheld. This mechanism ensures actuarial fairness.

Interaction with KW2, KW3 and KW4

Although placeholder terms, these secondary concepts may refer to:

● Broader welfare programmes (KW2)

● Earnings-related tax calculations (KW3)

● Wage-indexed adjustments in retirement (KW4)

Their interaction with Social Security earnings is complex, but beneficiaries often experience overlapping impacts on taxation, healthcare deductions and income-based thresholds.

Challenges, Risks and Criticisms

Modest Increases Relative to Inflation

While the earnings limit has increased, critics note that the rise—just over US$1,000 from the previous year—may not fully compensate for rising food, housing and medical costs.

Program Solvency Remains Unresolved

The Social Security Trustees Report warns that the program faces serious long-term fiscal challenges. Without legislative action, trust funds could be depleted by the early 2030s. Some experts argue that increasing earnings limits under the Social Security 2026 Update may help workforce participation but does not resolve structural funding issues.

Complexity of the Earnings Test

Even with raised thresholds, many beneficiaries still find the earnings-test framework confusing. A lack of understanding leads to mismanaged expectations, misreported earnings and unexpected withholding.

Global Context and International Comparisons

Countries worldwide are adapting retirement systems in response to demographic ageing.

● Canada allows pensioners under the Canada Pension Plan to work and earn without full benefit cuts, but certain clawbacks apply.

● Australia operates an income test under its Age Pension system, where work may reduce payments.

● UK pension rules allow unlimited earnings while receiving State Pension.

The U.S. adjustments place it among countries attempting to modernise benefit systems while preserving fiscal balance.

Related Links

Deadline Today — Octapharma Data Breach Claims Worth Up to $5,000 Close Shortly

New York Residents May Receive $400 Payments — Full Eligibility Details Inside

What Beneficiaries Should Do Now

Review Your Earnings Plan for 2026

Beneficiaries expecting to work should estimate their annual income to avoid unnecessary withholding.

Create a Balanced Budget Plan

Allow for changes in Medicare premiums, possible tax implications and the impact of the KW2, KW3 and KW4 factors on overall retirement income.

Seek Expert Guidance

The SSA’s online earnings test calculator, combined with independent financial advice, can help optimise decisions.

The 2026 update under the Social Security 2026 Update marks an important evolution in balancing retirement income and workforce participation among older Americans. As rising living costs and demographic pressures reshape work and retirement, the new rules provide more earning flexibility and greater clarity for millions of beneficiaries.

While these changes do not address all long-term issues facing Social Security, they offer meaningful relief and reflect the SSA’s efforts to modernise its benefit framework.