The U.S. Department of the Treasury said that the proposed $2,000 Tariff Checks championed by former President Donald Trump cannot be delivered without new legislation from Congress, marking the clearest confirmation yet that the payments are not executable under existing executive authority.

The statement comes amid rising public interest in whether tariff-funded rebates could offer near-term financial relief to millions of Americans.

$2,000 Tariff Checks

| Key Fact | Detail |

|---|---|

| Treasury confirms requirement | Congress must approve legislation before any $2,000 payments are issued |

| Proposed funding | Revenue from increased tariffs on imports |

| Estimated revenue | ~$195 billion in FY2024, up from $77 billion prior year |

| Eligibility discussions | Payments may target working families under income thresholds |

| Earliest possible rollout | Early 2026 if legislation passes |

Treasury Clarifies the Legal Foundation Behind the $2,000 Tariff Checks Proposal

The Treasury’s confirmation that $2,000 Tariff Checks cannot move forward without congressional approval significantly reshapes expectations surrounding the policy. Speaking to Axios, Treasury Secretary Scott Bessent stated, “We will see; we need legislation for that,” underscoring that the payments are not currently authorized under federal law.

The statement represents the administration’s most definitive description of the legal framework to date, arriving after weeks of public debate and several social-media commitments from Trump suggesting that Americans would receive tariff-funded dividends without delay.

Treasury officials said the revenue exists but emphasized a legal distinction between collecting tariff funds and distributing them as consumer rebates, which requires Congress to enact a new appropriations measure.

Background: How the Tariff-Funded Payment Proposal Took Shape

Trump’s Pledge of a “Tariff Dividend”

Former President Trump has repeatedly asserted that American households would receive what he called a “tariff dividend,” describing it as a rebate of at least $2,000 per person, excluding upper-income earners. His public posts framed the proposal as a mechanism to ensure “foreign nations, not Americans,” pay for broader economic relief measures.

The idea gained attention as inflation, consumer debt, and rent burdens placed increased strain on household budgets. Supporters argue that the plan channels the financial gains from tariff expansion directly back to American taxpayers. Critics counter that tariffs are ultimately paid by importers and passed through to consumers in the form of higher prices.

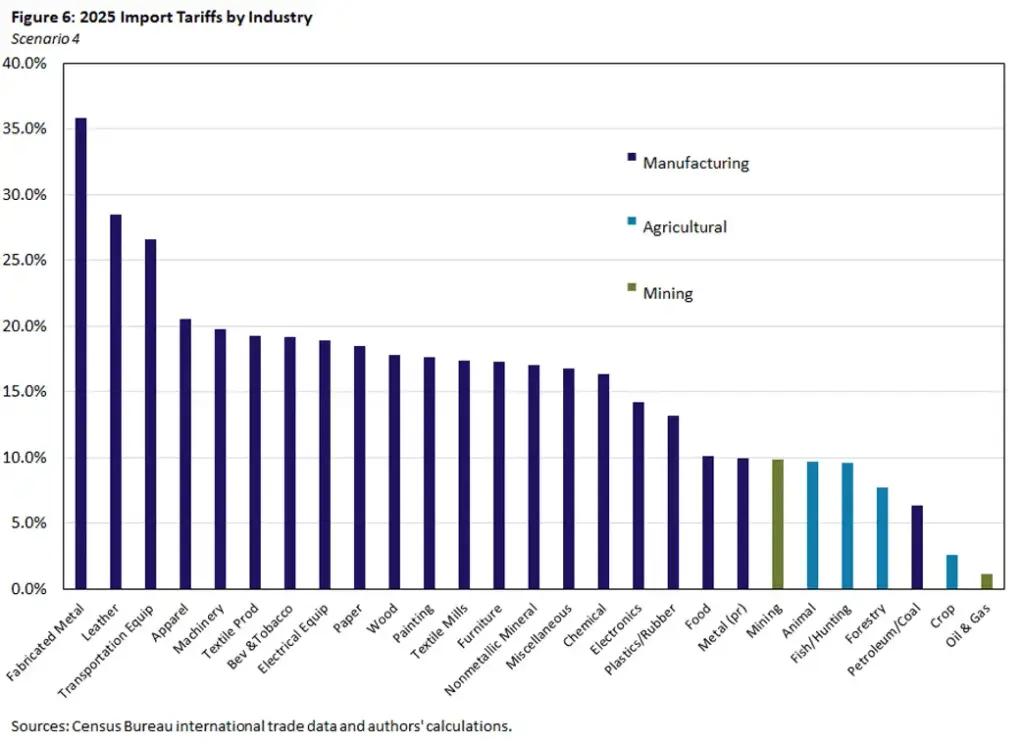

Rapid Growth in Tariff Collections

According to Treasury data, tariff revenue reached roughly $195 billion in the fiscal year ending September 30, a significant rise from the previous year’s $77 billion. Administration officials have cited this increase as evidence that a dividend structure is possible.

However, economists note that tariffs still represent a relatively small share of total federal revenue—around 4 percent—which complicates any plan to use them as the sole funding source for broad cash payments.

The Key Requirement for $2,000 Tariff Checks: Why Congressional Legislation Is Mandatory

Constitutional and Statutory Constraints

The U.S. Constitution grants Congress the exclusive power of the purse. While a president can impose tariffs under existing statutes, distributing federal funds to households requires congressional authorization.

Legal scholars say that even if tariff revenue is placed into government accounts, it does not unlock automatic authority to spend it. According to federal appropriations law, a specific statute must direct the Treasury to issue payments of any kind, including rebates.

This requirement holds true regardless of the funding source. Whether payments originate from general funds, tariffs, or a special revenue account, the appropriations framework remains the same.

Administrative Practicalities

Beyond legislation, the Treasury and the Internal Revenue Service (IRS) would need time to design payment mechanisms, verify eligibility, and complete modeling on the economic impact. Payment distribution systems built for previous stimulus rounds could be reactivated, but officials have not indicated whether that option is under consideration.

Who Might Qualify for $2,000 Tariff Checks? Early Discussions Reveal Key Eligibility Debates

Income Thresholds Under Consideration

Various reports suggest the White House is examining income caps for the payments, potentially limiting direct checks to working families below specific thresholds such as $100,000. The aim, officials said, is to target support to middle- and lower-income earners most affected by recent price increases.

No final eligibility framework has been proposed publicly, and Treasury emphasized that such details ultimately depend on Congressional negotiations.

Cash Payment or Tax Credit?

Treasury Secretary Bessent stated that a “dividend” may not necessarily come in the form of a physical check. It could instead appear as a tax credit, tax cut, or refundable offset during filing season.

This mirrors past federal relief programs, which have used multiple formats to distribute aid.

Timeline of Possible Payments

If Congress approves legislation, some analysts project the earliest distribution date would fall in early 2026, although this estimate is preliminary and depends heavily on legislative speed, administrative readiness, and fiscal scoring.

Expert Analysis: Economic, Legal, and Political Considerations

Economic Risks and Inflationary Pressures

Economists have warned that creating a large, ongoing payment program funded by tariff revenue carries significant economic risk. Erica York, vice president of federal tax policy at the non-partisan Tax Foundation, said, “If the goal is relief for Americans, just get rid of the tariffs,” noting that tariffs can raise consumer prices and feed inflationary cycles.

Some budget analysts estimate that issuing $2,000 to all eligible Americans could cost hundreds of billions of dollars—far exceeding current tariff revenue.

Legal Challenges to Tariff Authority

Legal scholars note that portions of the tariff regime underpinning the revenue may be challenged before the U.S. Supreme Court. Should the Court strike down key tariff provisions, the funding mechanism for the payments could be severely weakened.

Political Dynamics in Congress

Members of Congress remain divided. Some Republicans strongly support the plan as a way to transfer financial gains from foreign competitors to American households. Others in both parties express concern about deficits, inflation, and the logistical complexities of launching another federal payment program.

Party leadership has not yet introduced a formal bill, suggesting negotiations remain in preliminary stages.

Implications for American Households

Potential Relief Amid Economic Pressure

For families struggling with rent increases, rising debt service, and ongoing inflation, the promise of a $2,000 payment is appealing. Consumer advocates say such aid would help stabilize household budgets and support demand in key sectors.

Importance of Legislative Clarity

Financial advisors caution that households should not plan their budgets around the expectation of receiving these payments until Congress passes a clear law. Historically, stimulus payments follow a formal legislative process and require months of preparation by federal agencies.

Related Links

November Payments Set — Government Releases Three Key Deposit Dates for the Month

What Happens Next? Steps Before Any Payment Reaches Americans

For the $2,000 Tariff Checks to become reality, several steps must occur:

- Introduction of a bill in the House or Senate detailing eligibility, amount, funding, and payment methods.

- Passage by both chambers of Congress, likely requiring bipartisan support.

- Presidential signature to enact the law.

- Budget scoring by the Congressional Budget Office (CBO) and the Office of Management and Budget (OMB).

- Administrative preparation by the Treasury and IRS.

- Resolution of legal challenges if tariff authority is contested.

For now, the administration’s proposal faces a decisive legal and legislative hurdle, and the timeline remains uncertain. As Congress weighs economic risks against political and public-interest pressures, the coming months will determine whether Americans see the proposed tariff-funded payments or whether the idea remains a campaign-era concept awaiting formal authorization.

FAQ About $2,000 Tariff Checks

Q1: Are the $2,000 Tariff Checks approved?

No. Treasury confirmed that Congress must pass new legislation before payments can be issued.

Q2: Will every American receive the payment?

Not necessarily. Eligibility details are still under discussion and may include income caps.

Q3: What is the earliest possible date for payments?

Analysts believe early 2026 is possible only if Congress moves swiftly.

Q4: Does tariff revenue fully fund the proposal?

Current projections indicate tariff revenue alone may not cover the program’s full cost.