The Social Security Payment scheduled for Nov. 19, 2025 will reach millions of retired and disabled Americans whose birthdays fall between the 11th and 20th of the month. The payment amount varies widely, with national data showing significant differences between the average and maximum amount you could receive, according to the Social Security Administration (SSA).

Social Security Payment

| Key Fact | Detail |

|---|---|

| Average monthly retirement benefit | Approximately $2,000 in mid-2025 |

| Maximum 2025 retirement benefit at age 70 | About $5,108 per month |

| Nov. 19, 2025 payment group | Beneficiaries born on the 11th–20th |

| Official Website | Social Security Administration |

How the Nov. 19, 2025 Social Security Payment Will Be Distributed

The SSA pays retirement, disability, and survivor benefits on a staggered monthly schedule tied to beneficiaries’ birthdates. Payments on Nov. 19, 2025 apply to individuals born between the 11th and 20th, a policy confirmed in the Social Security Administration’s official payment calendar.

An SSA spokesperson said in a 2025 administrative briefing that the schedule “helps ensure a consistent and predictable distribution framework for beneficiaries nationwide,” noting that the agency processes more than 70 million monthly payments across all programs.

Understanding the Average and Maximum Amount You Could Receive

Average Benefit Levels

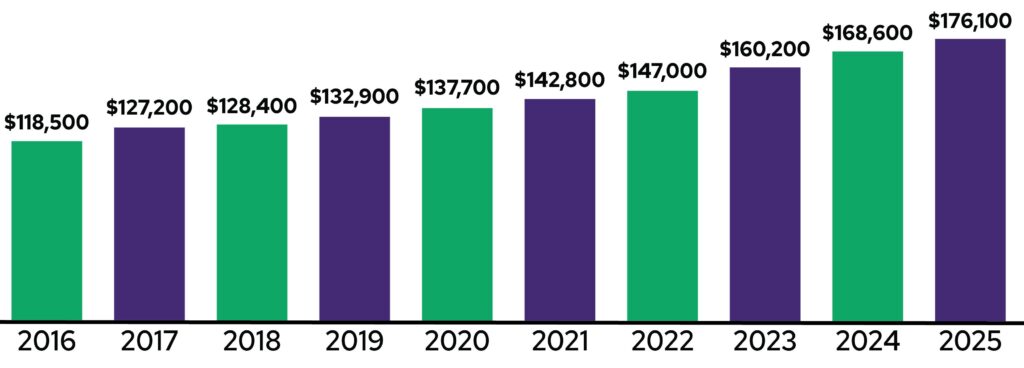

National data from the Social Security Administration (SSA) shows that the average retirement benefit in mid-2025 was slightly above $2,000 per month. The average benefit varies based on lifetime earnings, claiming age, and inflation adjustments.

A 2025 analysis by the Center for Retirement Research at Boston College reported that rising wages and cost-of-living adjustments (COLAs) helped lift average benefit levels over the last decade, though not evenly across all demographic groups.

Maximum Benefit Levels

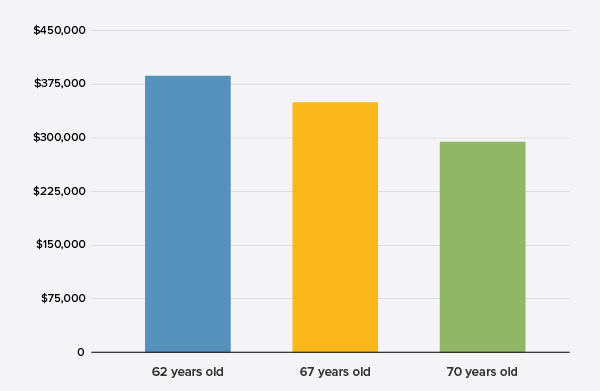

The maximum monthly benefit a retiree can receive in 2025 differs sharply depending on the age at which they claim:

- Age 62: Roughly $2,831 per month

- Full retirement age (67): About $4,018 per month

- Age 70: Up to $5,108 per month

These figures are based on SSA benefit parameters and assume the worker earned the maximum taxable income for at least 35 years. “Only a small share of retirees qualify for the top benefit,” said Dr. Nancy Altman, a Social Security policy expert at the nonprofit Social Security Works. “Most people receive far less, often because of shorter or lower-earning work histories.”

Factors That Determine Your Social Security Payment

Earnings History and Work Credits

Benefits are calculated using a worker’s highest 35 years of earnings. According to the Congressional Budget Office (CBO), gaps in employment, lower wage years, or part-time work can significantly reduce monthly benefit amounts.

Claiming Age

Choosing when to claim remains the most influential factor. SSA data shows that delaying benefits from 62 to 70 permanently increases payments by as much as 76 percent.

Cost-of-Living Adjustments (COLA)

Annual COLAs, published by the SSA each October, adjust benefits for inflation. The 2025 COLA helped offset higher prices on essential goods, according to the Bureau of Labor Statistics (BLS) inflation reports.

How COLA Trends Are Shaping 2025 Payments

Cost-of-living adjustments have increasingly played a crucial role in stabilizing benefit values during periods of high inflation. Between 2021 and 2024, the United States experienced some of the highest inflation rates in four decades. The SSA responded with significant COLAs, including the 8.7% COLA in 2023, the largest increase in more than 40 years.

Economist Dr. Mark Reynolds, from the University of Michigan’s Retirement Research Center, noted that COLAs “function as a necessary lifeline for lower-income retirees who spend a larger share of their monthly income on housing, food, and healthcare.”

Demographic Groups Most Dependent on Social Security Payments

A 2025 report from the Pew Research Center shows that:

- 57% of retirees rely on Social Security for at least half their total income.

- 25% of retirees depend on Social Security for 90% or more of their income.

- Older Americans with limited work histories, especially women, have lower average benefits due to historic wage gaps.

- Black and Hispanic retirees are statistically more reliant on Social Security benefits as their primary income source.

Dr. Linda Jackson of the AARP Public Policy Institute said, “Social Security serves as an economic stabilizer not just for individuals, but for communities where older Americans drive local spending.”

Who Will Be Paid on Nov. 19, 2025?

Anyone receiving retirement or disability payments whose birthday falls between November 11 and November 20 will receive their monthly benefit on Nov. 19, 2025. This group includes retirees, disabled workers, and eligible survivors.

The payment date excludes Supplemental Security Income (SSI), which follows a separate schedule.

The Future of Social Security Funding

The long-term financial outlook of Social Security remains a central concern in policy discussions. The Social Security Trustees Report projects that trust fund reserves may be depleted by the mid-2030s without legislative action. If Congress does not intervene, future benefits could face an automatic reduction of roughly 20%.

Lawmakers from both parties have proposed reforms, including:

- Adjusting the payroll tax cap

- Gradually increasing the full retirement age

- Introducing targeted benefit increases for low-income retirees

No changes have been enacted as of 2025, but analysts expect renewed debate as the insolvency date approaches.

Payment Timing and Banking Delays

The SSA releases payments on schedule, but deposit timing can vary based on financial institution practices. Most payments arrive on the scheduled Wednesday, though some banks process deposits earlier or later depending on their internal policies.

A 2024 Federal Reserve survey found that 94% of Social Security recipients receive their payments through direct deposit, which remains the fastest and most secure option.

Economic Context Behind the 2025 Benefit Levels

Economists note that Social Security payments have become increasingly important for households facing higher housing, food, and healthcare costs. A 2025 report by the Pew Research Center found that nearly half of retirees rely on Social Security for at least half of their income.

Dr. Patricia Lin, a senior economist at the Urban Institute, said the program remains “the single most effective anti-poverty tool for older Americans,” though she warned that long-term funding challenges continue to loom.

What Beneficiaries Should Expect Going Forward

The SSA is expected to release updated guidance later this year on projected COLA changes, which could influence payments in early 2026. Analysts from the Brookings Institution anticipate that inflation trends will remain a key factor in future benefit adjustments.

FAQ About Social Security Payment

1. Who receives the Social Security Payment on Nov. 19, 2025?

Beneficiaries with birthdays on the 11th–20th of any month, except those receiving SSI, which follows a different schedule.

2. What determines the average and maximum amount you could receive?

Your work history, lifetime earnings, and the age at which you claim benefits determine your final monthly amount.

3. Will the Nov. 19 payment include the 2025 COLA?

Yes. The COLA for 2025 is applied to all payments distributed throughout the year.

4. What if my payment does not arrive on time?

The SSA recommends waiting three full mailing days before contacting them. Banking delays are more common than SSA processing delays.

5. Do disability and survivor beneficiaries follow the same schedule?

Yes, unless they receive both SSI and Social Security. Dual recipients are always paid on the 1st of each month.