The Social Security Administration (SSA) has set a late-November deadline for beneficiaries who want to access their updated cost-of-living adjustment notice online before 2026 payments increase by 2.8 percent. Retirees must activate or update their “my Social Security” accounts and opt out of paper mail by November 19, 2025. The decision aims to speed up delivery timelines and streamline communications for nearly 71 million Americans.

Late-November Date to Check Updated COLA Notices

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA Increase | 2.8% across Social Security and SSI benefits |

| Deadline for Online Notice | November 19, 2025 |

| Beneficiaries Affected | Nearly 71 million Americans |

| When New Benefits Begin | Jan. 2026 (Social Security); Dec. 31, 2025 (SSI) |

| Inflation Basis | CPI-W index, third-quarter average |

| Official Website | SSA |

Why the New Deadline Matters for Retirees

The Social Security Administration’s new November 19 deadline is the agency’s latest step toward prioritizing digital communication. Beneficiaries who want to see their updated cost-of-living adjustment online before paper notices arrive must confirm their online accounts and opt out of physical mail.

SSA officials say the change helps modernize the system at a time when the volume of printed notices has grown significantly. The agency notes that online delivery allows retirees to receive email or text alerts and view their personalized benefit changes more quickly.

“Digital access ensures that people get their updates as soon as they’re ready, without waiting for the postal delivery cycle,” an SSA spokesperson said in the agency’s annual benefits announcement.

Those who do nothing will still receive their COLA increase. The only consequence of missing the deadline is slower access to their personalized notice.

Understanding the 2.8% Cost-of-Living Adjustment

How the COLA Is Calculated

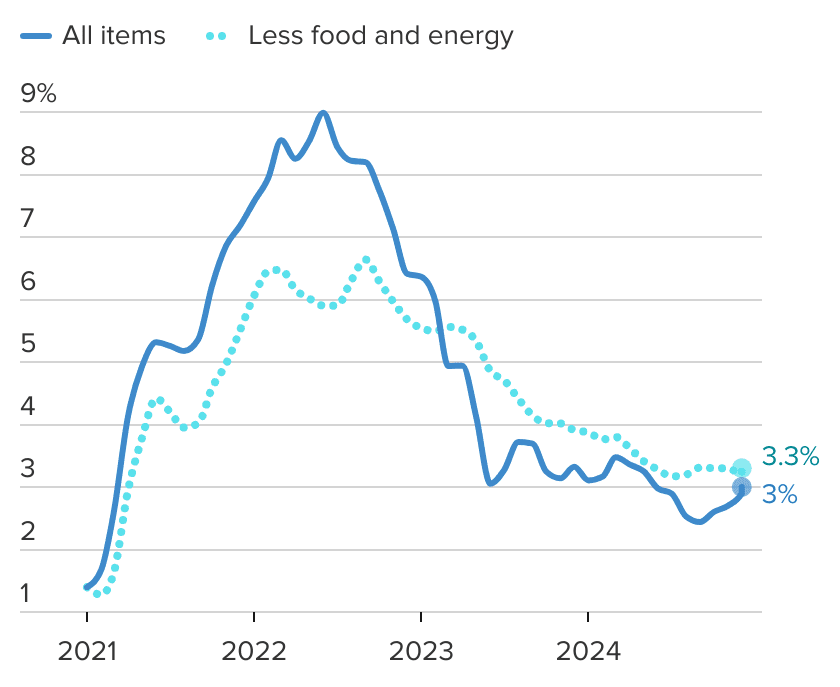

The 2026 increase is based on annual inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), measured in the third quarter of 2024 compared with the third quarter of 2025, as mandated by federal law.

Economists note that this year’s 2.8 percent increase reflects moderating inflation and a return to pre-pandemic economic patterns.

“Inflation has cooled compared with the extreme spikes of 2021 and 2022, but the CPI-W still captures enough price pressure to justify a moderate adjustment,” said Dr. Elaine Curtis, a professor of public policy at the University of Michigan.

What It Means in Dollar Terms

- A retiree receiving $1,700 per month in 2025 will see an increase of roughly $47.60, bringing their monthly benefit to about $1,747.60.

- Disabled workers receiving $1,537 per month will see an increase of about $43.

- Couples receiving survivor benefits or dual entitlements will see higher composite increases.

These adjustments, while helpful, often do not fully offset rising living costs for many older adults, particularly those facing higher healthcare and housing expenses.

Economic Context Behind the 2026 Increase

Inflation Pressures on Retirees

Although inflation has slowed, essential categories—health care, rent, utilities, and food—still rise faster than average. Several retiree groups argue that the CPI-W index underestimates seniors’ true expenses because it weighs transportation and consumer goods more heavily than medical care.

The Senior Citizens League, a nonprofit advocacy organization, maintains that retirees have lost roughly 36 percent of their purchasing power over the past two decades.

“Many older households continue to feel pinched, even when COLAs appear reasonably strong on paper,” said Mary Johnson, a Social Security policy analyst. “Real-world inflation behaves differently for retirees.”

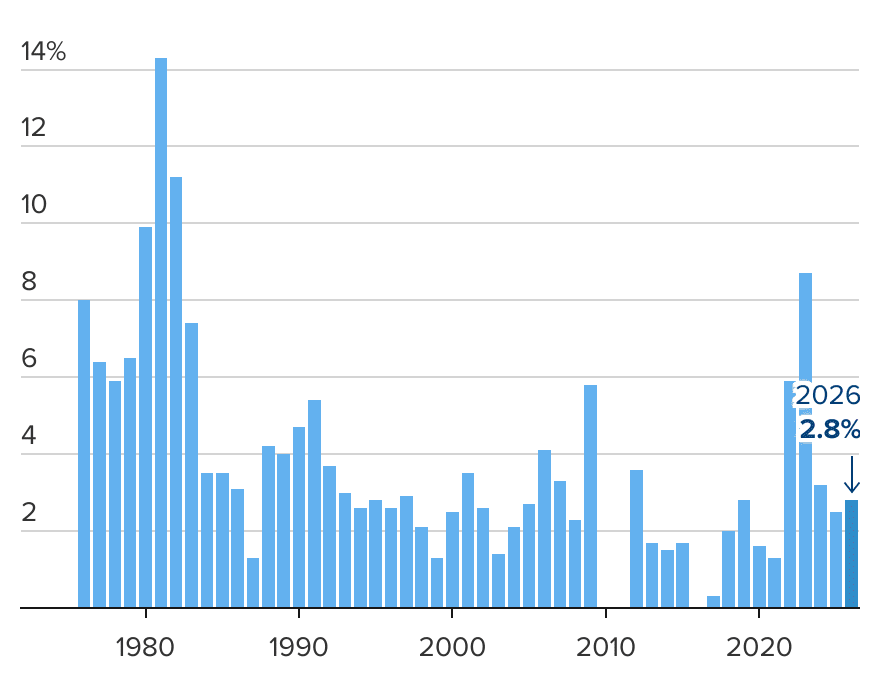

Historical Comparison

- 2023 COLA: 8.7%—largest since 1981

- 2024 COLA: 3.2%

- 2025 COLA: 2.5%

- 2026 COLA: 2.8%

The last decade has alternated between unusually low and unusually high adjustments, reflecting economic turbulence.

What Beneficiaries Should Do Before November 19

1. Create or update a “my Social Security” account

Users must verify their identity, enable two-factor authentication, and ensure their email and phone number are current.

2. Opt out of paper notices

This step is critical. Online notice delivery occurs only if paper mail is disabled before the November 19 deadline.

3. Check banking and address information

Accurate direct-deposit information prevents payment delays in January.

4. Review your earnings record

Errors in the SSA earnings history can impact benefit calculations.

5. Prepare for deductions

Net benefits may differ depending on:

- Medicare Part B premium adjustments

- Income-related monthly adjustment amounts (IRMAA)

- Federal tax withholding preferences

Impact on Households With Financial Vulnerabilities

The modest increase highlights growing concerns about financial security among America’s aging population.

Older Single Retirees

Single retirees—especially women—are more likely to rely on Social Security for at least 90 percent of their income.

Disabled Beneficiaries

Disabled workers often face medical and caregiving expenses that outpace compensation adjustments.

Rural Retirees

Rural seniors face higher transportation costs and more limited healthcare access, stretching fixed incomes further.

Retirees with Mortgages and Renters

Persistent housing inflation continues to erode COLA gains.

Expert Debate Over Changing the COLA Formula

The Case for the CPI-E Index

Some researchers argue for switching to the CPI-E (Consumer Price Index for the Elderly), which weighs healthcare and housing more heavily.

Proponents say CPI-E would generally produce higher COLA increases.

The Case for Maintaining CPI-W

Governance and budget analysts warn that adopting CPI-E could strain Social Security finances, accelerating solvency challenges.

Budget Hawk Perspective

“It’s important to balance benefits with long-term financial sustainability,” said Andrew Feldman, senior analyst at the Committee for a Responsible Federal Budget. “Any change to COLA calculations affects the trust fund’s lifespan.”

Long-Term Challenges Facing Social Security

Demographic Shifts

The number of Americans over age 65 is growing faster than the working-age population, placing pressure on payroll tax revenue.

Trust Fund Solvency

The Social Security Trustees Report projects that the Old-Age and Survivors Insurance (OASI) trust fund could face shortfalls within a decade if Congress does not act.

Fiscal Implications

Benefit formulas—including the cost-of-living adjustment—play a significant role in determining future obligations.

Steps Retirees Can Take to Preserve Purchasing Power

1. Review Medicare Options Annually

Medicare Advantage or Part D drug plan changes can affect costs.

2. Consider adjusting withholding

Beneficiaries can reduce surprise tax bills in April by updating withholdings with SSA Form W-4V.

3. Track essential expense categories

Budgeting for health care and utilities helps retirees understand how far COLA increases truly go.

4. Seek housing-cost support programs

State and local programs may help with rent freezes, tax relief, or utility credits.

Looking Ahead

Although the 2026 cost-of-living adjustment provides modest relief, many older Americans say benefits still struggle to match real-world price increases. As Congress continues debating Social Security reforms, retirees are watching for potential changes to COLA formulas and trust-fund financing.

“The COLA helps maintain stability, but it’s not a cure-all,” said Dr. Curtis. “Retirement security depends on broader economic conditions, healthcare policy, and long-term Social Security reforms.”

FAQ About Retirees Get New Deadline

Q1. What happens if I miss the November 19 deadline?

You will still receive your COLA increase, but your personalized notice will be mailed rather than delivered to your online account.

Q2. Does COLA increase my eligibility for Medicare or tax credits?

No. COLA affects benefit amounts only, not eligibility rules.

Q3. Does COLA ever go down?

COLAs cannot be negative. If inflation falls, the adjustment is simply zero.

Q4. Will 2026’s COLA offset rising Medicare costs?

Not fully for many beneficiaries, depending on annual Medicare Part B premium adjustments.

Q5. Do I need a my Social Security account?

Not required, but necessary for early access to your electronic notice.