As Claiming Social Security at 62 becomes increasingly common among near-retirees, financial planners warn that choosing this early option in 2025 may trigger the steepest lifetime benefit reduction in the history of the program. With the Full Retirement Age (FRA) rising to 67 for those born in 1960, early claimants will absorb a permanent 30% cut compared with waiting until their FRA.

This final stage of the FRA hike, combined with higher inflation, fragile retirement savings, and evolving workforce trends, makes 2025 a defining year for retirement decisions in the United States.

Claiming Social Security at 62

| Key Fact | Detail |

|---|---|

| Claiming Social Security at 62 Impact | Claiming Social Security at 62 in 2025 triggers a ~30% permanent reduction |

| FRA for 1960-born workers | Final increase to 67 in 2025 |

| Typical FRA monthly benefit | ~$2,000 per month baseline |

| Benefit at age 62 (born 1960+) | ~$1,400 per month — $600 less monthly |

| Lifetime income loss | ~$144,000 over 20 years; ~$216,000 over 30 years |

| Portion relying on Social Security for majority of income | Nearly 50% of retirees |

| Early-claiming common? | Yes — ~35% of Americans claim at 62 |

| Earnings test | Applies until FRA; can temporarily withhold benefits |

Why Claiming Social Security at 62 Is More Risky in 2025

The financial consequences of claiming early have always been significant, but 2025 marks a new threshold. The final step of the legislative FRA increase — originally mandated by the Social Security Amendments of 1983 — now fully applies to all new claimants born in 1960.

Under these rules, Claiming Social Security at 62 now results in the maximum early-claiming penalty allowed:

- 60 months early

- ~30% reduction

- Permanent effect

In practical terms, a retiree expecting a $2,000 monthly benefit at FRA will instead receive about $1,400 if they file at 62. That reduction carries forward every month for life and influences every future cost-of-living adjustment (COLA). Experts say many Americans dramatically underestimate how large the penalty has become.

The Final FRA Increase — What It Means

Background of the Change

FRA was originally 65 for all workers. The 1983 reforms increased it gradually to strengthen long-term solvency.

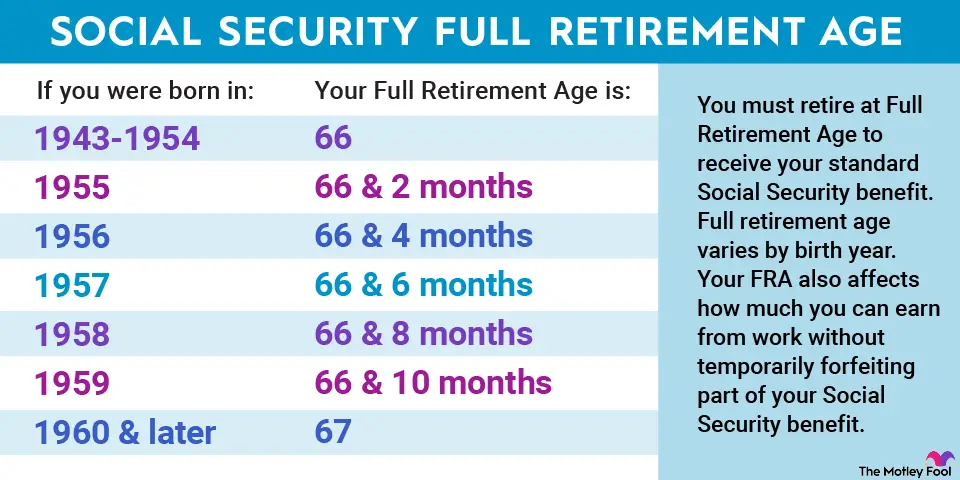

The timetable:

| Birth Year | FRA |

|---|---|

| 1937 or earlier | 65 |

| 1943–1954 | 66 |

| 1955–1959 | 66 + 2–10 months |

| 1960+ | 67 |

2025 is the first year the entire newly eligible population is subject to the FRA of 67.

Why the Final Hike Matters

A higher FRA automatically deepens the early-claiming penalty because reductions are calculated based on the number of months before FRA. In the earlier system, age 62 meant a four-year early claim. In the new structure, it is five years early.

A Permanent Cut That Compounds Over Time

The initial reduction becomes the baseline for all future COLAs. For example:

- 3% COLA on $2,000 = $60 increase

- 3% COLA on $1,400 = $42 increase

This creates a widening lifetime gap.

What Claiming at 62 REALLY Does to Your Retirement Finances

The Reduction Schedule Explained

SSA formulas reduce benefits for each month claimed early. For 1960-born workers:

- 60 months early

- 5/9 of 1% for the first 36 months

- 5/12 of 1% for the remaining months

- Total reduction: ~30%

Spousal and Survivor Benefits Are Also Cut

Survivor benefits depend heavily on the deceased spouse’s claiming age. If the higher earner claims early, the surviving spouse inherits a permanently reduced benefit. AARP notes this as “one of the most overlooked long-term consequences.”

COLA Effects and Inflation Risk

Inflation over the past three years has been the highest in four decades. Early claimers “lock in” a smaller benefit that COLA cannot fully correct. For 2023–2025 alone, COLAs totaled >14%. A smaller starting point magnifies the gap.

The Behavioral Side — Why Millions Still Claim Early

Psychological Triggers

Researchers at the Center for Retirement Research identify several cognitive factors:

- Fear of leaving money “on the table”

- Loss aversion

- Misunderstanding of FRA

- Desire for immediate certainty over future benefit maximization

Economic Necessity

More than 40% of Americans over 55 have less than $100,000 in retirement savings. Early claiming often fills income gaps created by:

- Job loss

- Age discrimination

- Health issues

- Caregiving responsibilities

Misinformation Remains Rampant

Surveys show more than half of adults incorrectly believe:

- FRA is 65

- COLA offsets early-claim penalties

- Earnings-test withholding means losing benefits permanently

The SSA has repeatedly tried to dispel these myths.

The Earnings Test Trap — A Bigger Issue in 2025

Workers who claim before FRA face an earnings test that temporarily withholds part of their benefits if they earn above set limits.

2025 Earnings Test Estimates:

- Under FRA: ~$22,320

- Year of FRA: ~$59,520

For every $2 earned above the threshold, SSA withholds $1 in benefits.

Why 2025 Makes the Test More Important

Because FRA is now 67, early claimants face an additional year of earnings-test exposure. Yet benefits are not lost — they are recalculated after FRA. The problem arises because many retirees rely on steady monthly income.

Break-Even Ages — When Delaying Pays Off

Break-even analysis helps determine when higher delayed benefits outweigh the lower early benefits.

Typical Break-Even Ages:

- 62 vs. 67: Break-even ~78–80

- 62 vs. 70: Break-even ~82–84

- 67 vs. 70: Break-even ~82

Given rising life expectancy among higher-income Americans, delaying often increases lifetime income.

Disparities in Early Claiming — Income, Gender, Race, and Occupation

Income-Based Differences

Higher-income workers claim later, increasing lifetime benefits. Lower-income workers often cannot delay.

Gender Differences

Women live longer and are more harmed by early claiming. Yet women are more likely to claim early due to workforce gaps and caregiving responsibilities.

Racial Disparities

The National Academy of Social Insurance reports earlier claiming is more common among Black and Latino workers, who face:

- Lower lifetime earnings

- Higher disability rates

- Reduced access to employer-sponsored retirement plans

Occupational Impact

Workers in physically demanding jobs — construction, caregiving, transportation — often cannot work to 67, forcing earlier retirement.

Policy Context — Why FRA Increased and What May Come Next

The FRA increase was designed to:

- Reflect longer life expectancy

- Slow benefit growth

- Improve trust fund solvency

Solvency Outlook

The Social Security Trustees Report projects:

- OASI trust fund depletion ~early 2030s

- 20–25% automatic benefit cuts if Congress does nothing

Proposals Under Debate

- Increasing wage caps

- Raising payroll taxes

- Introducing a minimum benefit floor

- Modifying COLA to reflect senior-specific inflation

- Offering flexible early-claiming rules based on occupation

No major reforms have passed, but pressure is mounting.

Global Comparison — How Other Countries Adjust Retirement Age

Countries facing demographic aging have taken action:

- U.K. FRA rising to 67 by 2028

- Germany: Retirement age increasing to 67 by 2031

- Japan: Staged increases to encourage later retirement

- France: Recent controversial increase from 62 to 64

The U.S. FRA is now consistent with similar OECD nations.

What Future Retirees Should Do Now — Expert Strategies

1. Confirm Your FRA on SSA.gov

Many still assume FRA is 65. For 2025 claimants, it is 67.

2. Run Multiple Claiming Scenarios

Use SSA calculators or speak with a certified financial planner.

3. Consider Delaying to 70

Delaying from 62 to 70 increases benefits by ~76%.

4. Evaluate Spousal and Survivor Benefits

Delaying the higher earner’s claim can substantially protect a surviving spouse.

5. Plan for Medicare at 65

Medicare eligibility is not tied to FRA, creating a planning gap.

6. Prepare for Inflation Risk

Ensure your benefit strategy accounts for rising medical and housing costs.

Related Links

Medicare Rates for 2026 Set to Surge — What Will Your New Monthly Cost Be?”

New Social Security Proposal Targets High-Income Beneficiaries — Major COLA Cuts on the Table

As Americans increasingly explore Claiming Social Security at 62, the 2025 FRA hike brings the trade-offs into sharper focus. The combination of rising inflation, extended lifespans, fragile savings, and deeper penalties for early claiming creates a challenging landscape for new retirees.

Experts emphasize that informed planning, careful timing, and a clear understanding of long-term consequences remain the most powerful tools for securing a stable retirement.

FAQ About Claiming Social Security at 62

Q: Is early claiming ever the best choice?

Yes — especially for those with health concerns, inadequate savings, or limited work capacity.

Q: Does early claiming affect spousal benefits?

Yes. Reductions apply to several benefit types, including survivor benefits.

Q: Will COLA increases reduce the penalty over time?

No. COLA applies proportionally to your reduced amount.

Q: Does the earnings test permanently remove benefits?

No. They are recalculated at FRA.

Q: Is FRA likely to rise again?

Some proposals suggest it could, but no law has passed.