The Social Security Administration (SSA) will begin sending 2026 Social Security notices in late November and early December, outlining updated benefit amounts, deductions, and policy changes taking effect on January 1, 2026.

These annual notices will inform more than 72 million Americans—including retirees, disabled workers, survivors, and Supplemental Security Income (SSI) recipients—about their updated monthly payments, the 2.8% cost-of-living adjustment (COLA), and changes in earnings limits and taxable wage caps.

2026 Social Security Notices Coming Soon

| Key Fact | 2026 Update |

|---|---|

| COLA increase | 2.8% for all Social Security and SSI beneficiaries |

| Max taxable earnings | $184,500 |

| Earnings test limits | $24,480 (under FRA); $65,160 (year reaching FRA) |

| Notices distributed | Online late Nov; mailed in Dec |

What the 2026 Social Security Notices Will Contain

The 2026 Social Security notices provide personalized information showing how the COLA, Medicare deductions, and earnings adjustments affect each recipient’s payments. Those who use the my Social Security portal will access their updated COLA letters electronically before paper notices arrive.

Main components of the notice

- Updated monthly benefit amount, reflecting the 2.8% COLA

- Medicare Part B and Part D premium deductions

- Federal tax withholding indicators

- New earnings-test thresholds for early retirees

- Your lifetime earnings record, used for benefit calculations

- Instructions for correcting errors or updating banking details

SSA officials emphasize that electronic access offers faster delivery and avoids delays caused by holiday-season mail processing.

2026 COLA and Key Benefit Changes Explained

2.8% COLA increase

According to the SSA’s 2026 COLA fact sheet, the cost-of-living adjustment reflects inflation measures from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Although smaller than the unusually large COLAs seen between 2022 and 2024, the 2026 adjustment remains above the 20-year average.

- Average retired worker benefit: + $56 per month

- Average disabled worker benefit: + $49 per month

- Average survivor benefit: + $41 per month

Economists say that while inflation has moderated, retirees continue to face elevated costs in healthcare, rent, and food—major components of senior household spending.

“A 2.8% COLA provides stability during a period of moderate inflation, but many seniors will still feel cost pressure,” said Dr. Alicia Munnell of Boston College’s Center for Retirement Research.

Higher taxable wage limit

In 2026, wages up to $184,500 will be subject to Social Security payroll tax.

This $8,300 increase reflects broader wage growth trends.

Earnings test thresholds

For beneficiaries under full retirement age (FRA):

- Annual limit: $24,480 before benefit reductions apply

- For those reaching FRA in 2026: $65,160

These thresholds increase yearly to reflect wage expansion.

Medicare Costs and Their Effect on Net Benefits

The Centers for Medicare & Medicaid Services (CMS) will publish the final 2026 Part B premium amounts by fall. Early projections suggest another increase, following recent hikes driven by prescription drug and outpatient care spending.

Because Part B premiums are deducted directly from Social Security benefits, the net monthly increase for many older Americans will be smaller than the COLA.

“Healthcare inflation remains elevated relative to overall inflation,” said Dr. Bryan Whalen, an economist at Brookings. “For many retirees, medical deductions are the largest factor reducing net benefit gains.”

Administrative and Policy Updates Beneficiaries Should Expect

1. A larger push toward digital notices

SSA continues to encourage beneficiaries to use electronic delivery. Digital notices are accessible immediately and include downloadable versions for tax filing and income verification.

2. Fraud-prevention messaging expanded

The SSA has added more warnings about phone and email scams impersonating federal officials.

The Federal Trade Commission (FTC) reported a rise in government-impersonation scams in 2024 and 2025, prompting more direct messaging inside SSA mailings.

3. More review of earnings accuracy

With fraud cases rising in disability programs, SSA is increasing checks on self-reported work activity. This affects SSDI and SSI recipients but does not delay benefit payments.

4. Updated language for overpayment notices

Congressional pressure has resulted in clearer explanations and more lenient repayment guidance after widespread reporting on SSA overpayment issues.

How the SSA Determines 2026 Benefit Adjustments

To produce these annual changes, the SSA reviews several federal data sources, including:

- Bureau of Labor Statistics inflation figures

- National wage growth reports

- Trust fund projections

- CMS Medicare spending estimates

The combination of these data determines COLA, taxable wage limits, and Medicare deductions.

Why these updates matter

More than half of retirees rely on Social Security for at least 50% of their monthly income.

Among single retirees, that figure rises above 70%. Small adjustments can significantly affect a beneficiary’s ability to pay for housing, utilities, food, and medical care.

What Happens If You Don’t Receive Your 2026 Notice?

Non-receipt of the notice does NOT affect your benefits. The COLA is applied automatically.

However, older adults should:

- Log into their my Social Security account (available late November).

- Confirm address and direct-deposit information.

- Review their earnings record for accuracy.

- Contact SSA if no notice arrives by January.

Paper notices may be delayed due to holiday mail volume or USPS staffing shortages.

Fraud Risks and Security Guidance for 2026

The SSA warns beneficiaries that it never:

- Calls unexpectedly

- Demands payment by gift card, wire transfer, or cryptocurrency

- Threatens arrest

Beneficiaries should verify all communication through the SSA’s official phone number (1-800-772-1213) or their online account. The FTC’s most recent annual report listed government-impersonation scams as the top fraud category targeting seniors.

Related Links

SNAP Overhaul Announced — 42 Million Americans Required to Reapply Under New Rules

California Sets 2026 Deadline to Remove Plastic Bags — Stores Face Fines Up to $5,000

Long-Term Outlook — How 2026 Fits Into the Bigger Picture

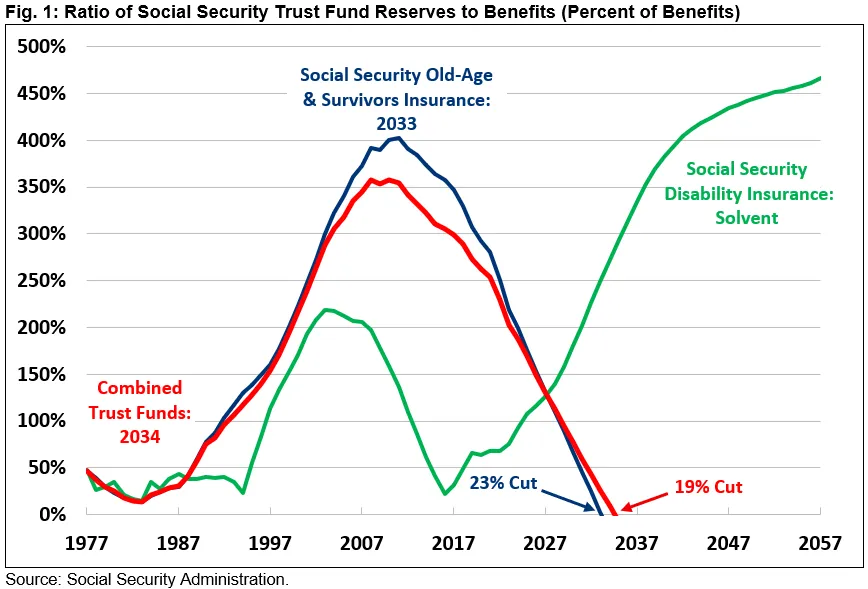

The 2026 notices come amid heightened congressional debate about the long-term solvency of Social Security. According to the Congressional Budget Office, the Old-Age and Survivors Insurance (OASI) Trust Fund could face depletion in the mid-2030s without legislative action.

While depletion does not mean the program ends, it would trigger across-the-board cuts unless Congress intervenes.

Economists say the modest 2026 COLA and increased taxable wage base show how the SSA attempts to balance inflation protection with trust-fund preservation.

“The 2026 adjustments reflect a cautious approach,” said Dr. Hannah Lewis, a public-policy professor at Georgetown University. “But without broader reform, Social Security’s finances will remain under strain.”

As the SSA rolls out its 2026 notices, beneficiaries are encouraged to review their updated amounts, deductions, and eligibility rules closely. While the 2.8% COLA and associated program changes provide stability for the year ahead, retirees and disability recipients must stay informed to understand how federal policy shifts affect their financial planning and long-term security.

FAQs About 2026 Social Security

Will the 2026 notices affect my January payment?

Yes. The new amounts begin with payments issued in January 2026.

Will all beneficiaries get the same increase?

No. The percentage increase is the same, but the amount varies based on your current benefit.

Do SSI beneficiaries also receive notices?

Yes. SSI recipients receive both COLA and income/resource updates.

Can I access my notice online?

Yes. Notices are posted in my Social Security accounts before mailed copies arrive.