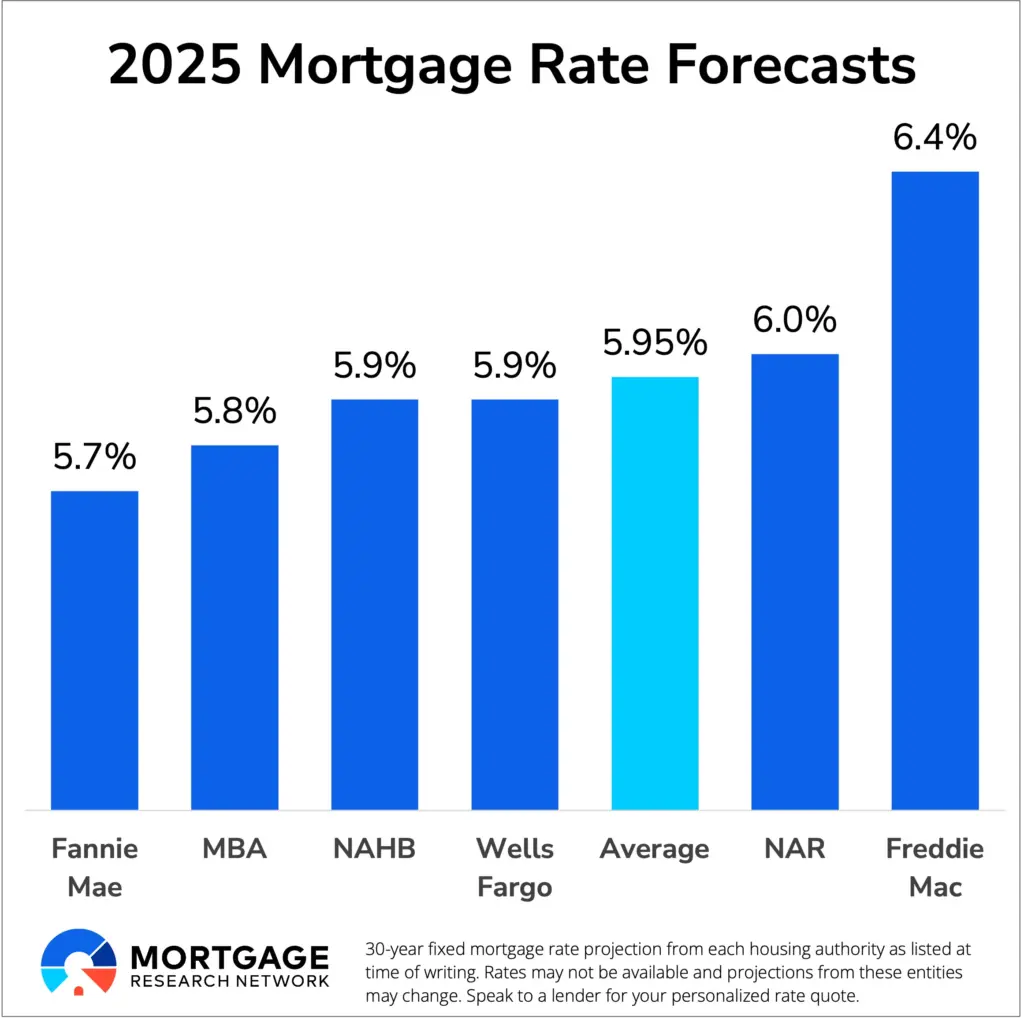

Following the latest Federal Reserve rate cut, homebuyers across the country are beginning to see the first signs of new lower mortgage rates after nearly two years of elevated borrowing costs. The shift, while modest, is meaningful for households financing a $600,000 loan, especially those relying on a 30-year fixed mortgage.

This article explains the payment changes, the economic forces behind the decline, and what buyers can expect in the weeks ahead.

New Lower Mortgage Rates

| Key Fact | Detail / Statistic |

|---|---|

| New average 30-year fixed mortgage rate | ~6.25% |

| Fed’s latest cut | 0.25 percentage points |

| Payment on $600,000 loan at 6.25% | ≈ $3,691 per month |

| Payment at 5.75% | ≈ $3,502 per month |

| Average U.S. home price | ~$420,000 |

How the Fed’s Move Led to New Lower Mortgage Rates

While the Federal Reserve rate cut (KW2) did not directly lower mortgage rates, its policy shift influenced broader market conditions. Mortgage lenders adjust rates based largely on movements in the 10-year Treasury yield, which fell in response to the Fed’s guidance on moderating inflation and cooling economic activity.

Federal Reserve Chair Jerome Powell noted in his statement:

“Our policy adjustment reflects progress on inflation and aims to support balanced economic conditions.”

That signal helped ease long-term borrowing costs, encouraging lenders to begin pricing new lower mortgage rates into 30-year loans.

What a $600,000 Mortgage Costs Under Today’s Rates

A $600,000 mortgage is typical for buyers in high-cost regions like California, Washington, Colorado, and the Northeast. Small rate changes have outsized effects on payments.

Monthly Payments Across Four Rate Scenarios

| Interest Rate | Monthly Payment (P&I) | Difference vs 6.25% |

|---|---|---|

| 7.00% | ~$3,991 | +$300 |

| 6.25% (current avg) | ~$3,691 | baseline |

| 5.75% | ~$3,502 | –$189 |

| 5.50% | ~$3,405 | –$286 |

A drop from 6.25% to 5.75% saves roughly $2,300 per year. A drop to 5.50% saves nearly $3,400 per year.

Total Cost Over 30 Years Under New Lower Mortgage Rates

| Interest Rate | Total Paid (30 Years) | Total Interest Paid |

|---|---|---|

| 6.25% | ~$1.33 million | ~$730,000 |

| 5.75% | ~$1.26 million | ~$660,000 |

| 5.50% | ~$1.22 million | ~$620,000 |

A decrease of just 0.75 percentage points reduces lifetime interest by over $110,000.

Why Mortgage Rates Aren’t Falling Quickly

Despite headlines about new lower mortgage rates, declines have been measured. Experts cite several reasons:

1. Mortgage Rates Follow the Bond Market, Not the Fed Funds Rate

As KW2 indicates, the Fed only affects short-term rates. Long-term rates depend on:

- Treasury yields

- Investor demand for mortgage-backed securities

- Inflation expectations

Mortgage strategist Alan Boyer explains:

“Mortgage rates won’t fall meaningfully unless the bond market believes inflation will keep dropping.”

2. Lender Caution

Banks maintain wide rate spreads to protect against volatility.

Bank of America mortgage economist Lisa Noel notes:

“Lenders are reluctant to pass along rate savings quickly because market volatility remains high.”

3. Housing Supply Shortages

Even if mortgage rates fall, limited inventory keeps home prices elevated—limiting improvement in housing affordability (KW4).

Housing Affordability Remains Challenging (KW4)

Even with new lower mortgage rates, affordability is strained.

Key pressure points:

- Median prices remain 30–40% higher than in 2019

- Construction growth is slower than population growth

- Investors continue competing for entry-tier homes

Affordability has improved slightly, but buyers still face high total monthly costs when taxes, insurance, and maintenance are included.

Buyer Profiles Under New Lower Mortgage Rates

First-Time Buyer Scenario

- Buying a $750,000 home

- 20% down → $600,000 loan

- Payment at 6.25% → ~$3,691

- Total monthly with taxes/insurance → ~$4,800

Even with lower rates, this buyer faces significant affordability constraints.

Move-Up Buyer in High-Cost Market

- Existing equity helps with down payment

- Lower DTI ratio eases approval

- More sensitive to home-price gains than rates

Investor Borrower

- Typically pays higher rates

- Lower cash flow margins

- Sensitive to rent-growth slowdown

Historical Context — How Today’s Rates Compare

2000: ~8%

2010: ~4.7%

2020: ~2.7%

2024–2025: ~6–7%

Even with new lower mortgage rates, borrowers today face a much different environment than in the 2020 pandemic lows.

Should Buyers Lock or Wait? Expert Guidance

Reasons to Lock Now

- Rates may not fall below 5.75% soon

- Housing supply remains limited

- Buyer competition may increase after rate cuts

Reasons to Wait

- Some analysts expect gradual declines over next 6–12 months

- Bond market volatility could push yields lower

- Recession risk might pressure mortgage rates downward

Expert Quote

Financial planner Rachel Matthews says:

“Chasing the perfect rate is risky. Buy when the payment is comfortable—not when the headlines look exciting.”

Related Links

November Social Security Payout Calendar Released — Check Your Exact Deposit Date

2026 Social Security Increases Announced — New Monthly Amounts for All Benefit Groups

What to Watch Moving Forward

- Monthly inflation reports

- Treasury yield movement

- Housing inventory growth

- Wage trends and job market strength

- Future Fed communication

The next six months will determine whether lower rates meaningfully expand affordability.

Although new lower mortgage rates are beginning to offer relief, the national housing market remains shaped by steep prices, lean inventory, and uncertain inflation trends. The full effect of the Fed’s cut will depend on how the bond market responds in coming months. For now, buyers see modest but important savings—an early signal of potential improvement ahead.

FAQs About New Lower Mortgage Rates

1. Do mortgage rates drop immediately after a Fed cut?

Not necessarily. Changes are gradual.

2. Could rates fall below 5% again?

Experts say this is unlikely in the near term.

3. Is it better to lock or wait?

Lock if payment fits your budget; wait if timing is flexible.