The 2026 Social Security raise confirmed — why the increase might feel smaller next year reflects a 2.8% cost-of-living adjustment (COLA) announced by the Social Security Administration (SSA). While the increase outpaces the 2025 adjustment, many retirees may see only modest improvements in their monthly income due to Medicare premium increases, rising healthcare costs, and broader retiree cost-of-living challenges.

2026 Social Security Raise Confirmed

| Key Fact | Details |

|---|---|

| COLA Increase | 2.8% raise in 2026 monthly benefits |

| Expected Medicare Part B Increase | ~ $17.90 added to monthly premium |

| Average monthly retiree benefit | From ~$2,015 to ~$2,071 |

| Taxable wage base | Rising to ~$184,500 |

| Trust Fund Outlook | Insolvency projected mid-2030s without reforms |

Understanding the 2026 Social Security Raise

The SSA confirmed that the 2026 Social Security COLA will increase benefits by 2.8%, reflecting inflation patterns from the third quarter of 2024 to the third quarter of 2025. The adjustment is designed to preserve buying power for retirees, disabled workers, and survivors as part of the program’s statutory inflation-indexing requirement.

Why 2.8%?

The COLA is based on changes in the Consumer Price Index for Urban Wage Earners (CPI-W)—a metric critics argue underrepresents seniors’ expenses, particularly in healthcare.

Economist Dr. Teresa Ghilarducci, a leading retirement policy expert, said in a recent commentary:

“Even when COLA rises, most seniors won’t feel the full effect. Their expenses—especially healthcare—grow faster than the inflation index used to calculate Social Security adjustments.”

Why the Raise Might Feel Smaller Next Year (KW3: Medicare premium increases)

While the headline 2.8% increase sounds promising, several factors will reduce the net benefit many retirees receive.

Medicare Part B Premiums Expected to Rise

According to early estimates from the Centers for Medicare & Medicaid Services (CMS), Medicare premium increases will reduce the size of the COLA felt by many beneficiaries.

- Estimated Part B premium increase: ≈ $17.90 per month

- For retirees with above-average healthcare usage or supplemental plans, the reduction may be larger

- Nearly 70% of beneficiaries have premiums deducted from their Social Security checks automatically

This means that, even with a $55 monthly benefit increase, some retirees may see a net increase closer to $35–$40.

Inflation Still High in Retirement-Focused Categories

Although headline inflation has cooled, seniors face disproportionately high costs in key spending areas:

- Prescription drugs

- Medicare Advantage plans

- Out-of-network or specialist visits

- Home energy costs

- Rent or property insurance

According to the Bureau of Labor Statistics, older households spend nearly three times more of their income on medical care compared to younger adults.

Fixed Costs Continue to Outpace COLA

Housing and utility prices—especially in Sun Belt states where many retirees reside—remain elevated. This further complicates seniors’ ability to feel the benefit of a 2.8% increase.

“Retirees don’t buy a ‘basket of goods’ that looks like a working household,” said Mary Johnson, Social Security and Medicare specialist at the Senior Citizens League. “Their COLA will continue to lag behind their lived expenses.”

How the 2026 Increase Alters Monthly Benefits

Projected Benefit Changes

| Beneficiary Group | 2025 Avg Benefit | 2026 Avg Benefit | Increase |

|---|---|---|---|

| Retired worker | ~$2,015 | ~$2,071 | +$56 |

| Disabled worker | ~$1,537 | ~$1,580 | +$43 |

| Widow(er) | ~$1,780 | ~$1,830 | +$50 |

| Senior couple | ~$3,276 | ~$3,368 | +$92 |

These figures represent gross benefit increases, not accounting for deductions like Medicare or income tax withholding.

Structural Program Changes Also Affect What Retirees Receive

The SSA has confirmed several administrative and policy updates that will intersect with benefit changes in 2026.

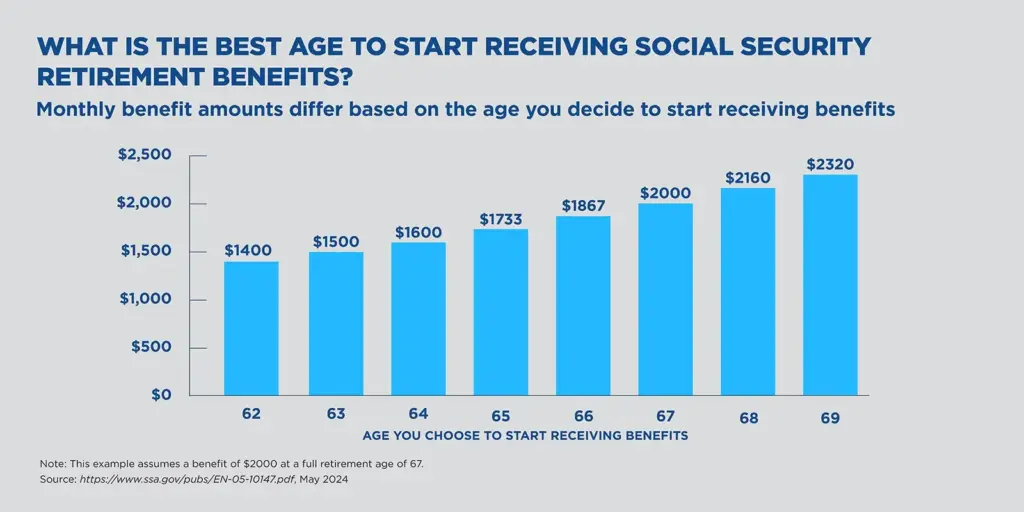

Full Retirement Age (FRA) Remains Unchanged

The FRA for those turning 67 in 2026 remains stable, but congressional debate continues around whether to:

- raise the FRA to 68

- index it to longevity

- or create a “soft FRA” that gradually phases in adjustments

Proposals remain under evaluation.

Higher Taxable Wage Base

The maximum earnings subject to Social Security taxes will rise to approximately $184,500, up from $176,200 in 2025.

This change:

- increases payroll tax revenue

- boosts future benefits for high earners

- strengthens the trust fund marginally

Earnings Limits Increasing

Beneficiaries who work while receiving Social Security will see updated earning thresholds:

- Under FRA: $24,480

- In FRA year: $65,160

These adjustments help working seniors retain more income.

Trust Fund Pressures and Long-Term Outlook

The Social Security Trustees Report warns that the combined trust funds may face insolvency in the mid-2030s unless Congress intervenes. Insolvency does not mean benefits stop—it means automatic cuts of 20–25% would occur.

Analysts argue that:

- Raising payroll taxes

- Adjusting benefits

- Increasing immigration

- Modifying retirement ages

…will likely be required to maintain solvency.

State-Level Impacts: Why Some Retirees Will Feel the Increase Less

States with High Medical Inflation

- Florida

- Nevada

- Arizona

States with Higher Insurance Premium Growth

- California

- Colorado

- Louisiana

States Where Rent Inflation Is Outpacing COLA

- New York

- Texas

- North Carolina

Retirees in these states may see minimal net gains from the 2026 increase.

Related Links

November 2025 Social Security Payments — SSA Confirms Early Deposit Dates: Check Details

SSI November Update — Will Payments Be Delayed During the Shutdown?

Budgeting Guidance for Retirees (KW4: retiree cost-of-living challenges)

To navigate retiree cost-of-living challenges, experts recommend:

- Reviewing Medicare plans during Open Enrollment

- Anticipating premium changes early

- Evaluating whether to delay Social Security claiming

- Considering part-time or seasonal work

- Adjusting discretionary spending categories

- Monitoring local assistance or benefit-enhancement programs

Financial planner Dr. Alicia Munnell summarizes:

“Inflation doesn’t stop at the COLA announcement. Retirees should plan assuming expenses will rise faster than benefits.”

The 2026 Social Security raise confirmed — why the increase might feel smaller next year illustrates the gap between statutory inflation adjustments and the rising costs older Americans face. For many retirees, careful planning will remain essential as healthcare and housing pressures continue to outpace benefit gains.

FAQ About 2026 Social Security Raise

Q1: When will the 2026 COLA take effect?

January 2026 for all monthly Social Security payments.

Q2: Why does it feel like the raise is smaller than reported?

Rising Medicare premiums and senior-specific inflation reduce the net improvement.

Q3: Does every retiree get the same increase?

No. The adjustment is percentage-based but deductions vary for each individual.

Q4: Will Medicare premiums wipe out the entire raise?

Not for most, but they will significantly reduce the net benefit.

Q5: Will Social Security run out of money?

Not immediately. Without reform, insolvency may occur mid-2030s, triggering automatic cuts.