A new tax measure enacted in Kansas will eliminate state taxes on Social Security benefits beginning in 2025, marking another milestone in the national movement to end the Social Security tax. The change places Kansas among 41 states that already refrain from taxing Social Security income, according to recent legislative announcements and major news reports. State officials say the policy aims to reduce financial pressure on older residents.

Another State Moves to Stop Taxing Social Security

| Key Fact | Detail / Statistic |

|---|---|

| Number of states not taxing Social Security | 41 (now 42 including Kansas) |

| Effective year of Kansas phaseout | Tax exemption begins 2025 |

| States that still tax some benefits | Fewer than 10 |

Kansas lawmakers indicated they will review the fiscal effects of the change over the next several years. Officials say they expect continued discussion about broader tax reforms as the state’s population ages and economic conditions evolve.

Kansas Joins National Movement to Eliminate Taxes on Social Security Income

Kansas lawmakers approved legislation in 2024 to remove state income taxes on Social Security benefits, a decision that affects hundreds of thousands of older residents. The change was confirmed by official state budget documents and widely reported by Reuters and the Associated Press.

Governor Laura Kelly said the measure would “help seniors keep more of their earned benefits,” according to a statement released by her office. The governor argued that rising living costs made the existing tax structure harder for retirees to manage.

Growing Public Pressure

State legislators reported increased constituent pressure in recent years as inflation and medical expenses rose. According to the U.S. Bureau of Labor Statistics, seniors have faced higher-than-average inflation in healthcare, housing, and utilities. Many Kansas residents told lawmakers they struggled to absorb state-level taxes on Social Security benefits while living on fixed incomes.

Rep. Susan Estes, who supported the bill, said during debate: “Retirees should not be penalized for the benefits they spent a lifetime earning.”

What Prompted the Statewide Change in Social Security Tax Policy?

State officials cited several pressures, including increasing retiree migration to states with lower tax burdens. According to a 2023 analysis from the Pew Charitable Trusts, states with lower or no taxes on retirement income have seen stronger population growth among residents aged 60 and above.

Economists note that Kansas had previously taxed Social Security benefits for residents whose income exceeded a specific threshold. “The structure was increasingly out of step with neighboring states,” said Dr. Helen Morris, a public finance scholar at the University of Kansas, in an interview with local media.

Historical Background

Kansas first implemented taxation of Social Security benefits in the 1980s, aligning with federal rules that allowed states to tax a portion of these benefits based on income.

However, many states began reversing course in the 1990s and 2000s, citing both political pressure and demographic changes. The pace accelerated following the Great Recession and again during the high-inflation period beginning in 2021.

“State governments are reacting to a retirement landscape that looks very different from 40 years ago,” said Dr. Paul Wickham, a retirement policy expert at the University of Michigan.

Fewer Than 10 States Still Tax Some Social Security Benefits

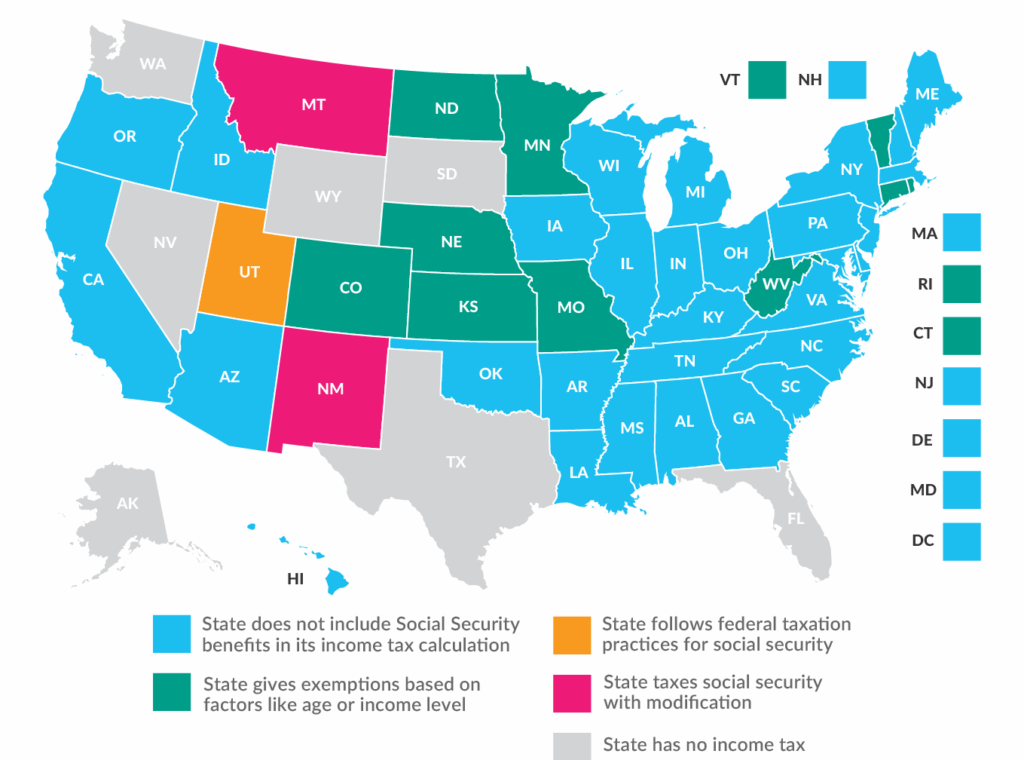

Most U.S. states have moved away from taxing Social Security income over the last decade. According to the Associated Press, only a small group—including Colorado, Minnesota, Montana, Rhode Island, Utah, Vermont, and West Virginia—continue to tax some portion of benefits, often with income-based exemptions.

Tax analysts say the shift reflects a broader trend toward reducing the financial burden on older Americans. “States are responding to demographic realities,” said Andrew Fine, a senior policy analyst at the nonpartisan Tax Foundation. “Retirees are both a growing constituency and highly sensitive to tax policy.”

Comparison With Other States

• Nebraska and Missouri eliminated their Social Security taxes in 2024.

• West Virginia is currently phasing out its tax, with full repeal expected in coming years.

• Minnesota continues to debate full repeal due to budget impacts.

This shift suggests a bipartisan desire to attract and retain older residents, especially in states that have struggled with population declines.

How the New Policy Affects Kansas Residents

Under the new law, Kansas residents receiving Social Security benefits will no longer pay state income tax on those benefits beginning with the 2025 tax year. According to projections from the Kansas Legislative Research Department, the change is expected to reduce state revenue but increase disposable income for seniors.

The department estimated that the typical Kansas retiree could save several hundred dollars per year, depending on income levels. Officials say the fiscal impact will be offset by long-term growth and increased consumer activity among older residents.

Economic Ripple Effects

Economists say retirees often spend a greater share of income locally than younger workers. Increased spending on food, medical care, transportation, and home services could have measurable effects on small businesses across the state.

A report from the Kansas City Federal Reserve has shown that retiree-driven spending plays a growing role in regional economies, especially in rural areas where younger populations have declined.

Reactions From Advocacy Groups and Citizens

Organizations representing older Americans, including AARP (American Association of Retired Persons), welcomed the change. In a press release, AARP Kansas said the policy would “provide immediate relief for many residents living on fixed incomes.”

Some budget analysts, however, expressed concerns about long-term fiscal pressures. Experts at the Kansas Center for Economic Growth warned the reduction in tax revenues could strain essential services unless offset by new revenue or spending adjustments.

Public Reaction

Interviews with residents published by local newspapers highlight a mixed response:

• Retirees overwhelmingly expressed support, saying the savings will help cover costs such as prescription drugs.

• Younger residents questioned how the state will maintain school funding and infrastructure if revenues decline.

“People are relieved, but they also want transparency about how the budget will adjust,” said Mark Holland, a local political analyst.

Broader Implications for U.S. Social Security Tax Trends

States have accelerated efforts to remove taxes on Social Security benefits as inflation, healthcare costs, and housing prices place additional stress on retirees. According to a 2024 report from the U.S. Census Bureau, Americans aged 65 and older are one of the fastest-growing demographic groups.

Policy experts note that decisions by states such as Kansas may influence upcoming legislative debates elsewhere. “This momentum could encourage more states to reconsider their policies,” said Dr. Samuel Ortiz, a senior economist at the Brookings Institution.

Social Security 2025 Summary — Key Policy and Benefit Changes Announced by SSA

Federal Context: Social Security Reform Debates

At the federal level, Social Security has faced increased scrutiny as policymakers debate long-term funding challenges. The Social Security Trustees Report projects that the federal trust fund may face shortfalls within the next decade.

While state taxation changes do not directly affect federal solvency, they shape public expectations about retirement income security.

“State tax policy can influence how retirees view the reliability of Social Security overall,” said Anne Peterson, a senior researcher at the Center for Retirement Research at Boston College.

FAQ About Another State Moves to Stop Taxing Social Security

Why did Kansas eliminate its Social Security tax?

Lawmakers cited rising retiree costs and competition with neighboring states that do not tax Social Security income.

Which states still tax Social Security benefits?

Fewer than 10 states, including Colorado, Minnesota, Montana, Rhode Island, Utah, Vermont, and West Virginia, continue taxing some benefits.

When does the Kansas change take effect?

The exemption begins with the 2025 tax year.