The Social Security Administration (SSA) is issuing the final round of monthly benefits this week, completing the staggered November payment cycle for more than 70 million Americans. These disbursements cover recipients of Old-Age and Survivors Insurance (OASI) and Social Security Disability Insurance (SSDI), providing a crucial source of income for retirees and disabled workers across the nation.

The payments, scheduled for Wednesday, November 26, target the last designated group in the SSA’s rotational payment schedule, ensuring timely delivery of vital funds.

Up to $5,108 in Social Security Payments

| Key Fact | Detail/Statistic |

| Maximum Monthly Benefit (Age 70) | $5,108 |

| Maximum Monthly Benefit (Full Retirement Age) | $4,018 |

| Average Retired Worker Benefit | $2,008.31 (As of Aug. 2025) |

| Maximum Taxable Earnings (2025) | $176,100 |

| Projected Trust Fund Depletion | 2035 (OASI and DI combined) |

This distribution is notable as it includes the maximum possible monthly retirement benefit, which stands at $5,108 for new retirees who claimed benefits beginning at age 70 in 2025. This maximum figure, however, remains an exception.

Eligibility Criteria for Up to $5,108 in Social Security Payments

The SSA divides monthly payments for most recipients into three distinct groups based on the day of the month the beneficiary was born. This logistical arrangement is designed to efficiently manage the disbursement of funds to the expansive list of beneficiaries.

Who Receives Payment on Wednesday, November 26?

The payment disbursed this week is specifically directed to individuals who receive retirement, SSDI, or survivor benefits and whose birthday falls between the 21st and 31st of any month.

- Payment Group 1 (Born 1st–10th): Received payment on the second Wednesday of the month (November 12).

- Payment Group 2 (Born 11th–20th): Received payment on the third Wednesday of the month (November 19).

- Payment Group 3 (Born 21st–31st): Scheduled to receive payment on the fourth Wednesday of the month (November 26).

An administrative exception applies to beneficiaries who began receiving Social Security before May 1997, or those who receive both Social Security and Supplemental Security Income (SSI). These individuals typically receive their payment on the third day of the month, regardless of their birth date.

The SSA strongly encourages all beneficiaries to utilize electronic payment methods, with over 99% of recipients receiving their funds via direct deposit (KW4) to minimize the risk of mail-related delays or fraud associated with paper checks.

The Path to the Maximum $5,108 Monthly Social Security Payments

Achieving the maximum monthly benefit of $5,108 is conditional upon meeting three strict criteria that span an individual’s entire working career and retirement planning choices. It is a benchmark of success for high-income earners who plan meticulously.

Criterion 1: The 35-Year Earning Requirement

The core of the Social Security payments calculation is based on the average of a worker’s highest 35 years of indexed earnings. To qualify for the maximum benefit, an individual must have worked for at least 35 years, and in every one of those 35 years, they must have earned at or above the maximum taxable earnings limit—the ceiling for earnings subject to the Social Security payroll tax.

For 2025, the maximum taxable earnings limit is $176,100. Earnings above this threshold are not taxed for Social Security purposes and do not contribute to the final benefit calculation.

Criterion 2: The Full Retirement Age and Delayed Claiming

The age at which a person begins receiving benefits is the most controllable factor influencing their monthly payment. The Full Retirement Age (FRA) is 67 for individuals born in 1960 or later. Claiming at age 70 is necessary to realize the primary-keyword figure of $5,108.

The benefit grows through Delayed Retirement Credits (DRCs), which accrue at a rate of 8% per year from the FRA until the age of 70. This results in a permanent monthly benefit that is 24% to 32% higher than the Primary Insurance Amount (PIA). The maximum benefits at other key claiming ages illustrate the incentive of delayed retirement:

- Claiming at Age 62 (Earliest Eligibility): Maximum reduced benefit is $2,831.

- Claiming at FRA (e.g., Age 67): Maximum full benefit is $4,018.

“The maximum monthly benefit serves as a potent illustration of the value of DRCs, emphasizing the program’s financial rewards for deferral,” noted Dr. Evan Gottlieb, a research fellow at the Economic Policy Institute. “However, the underlying requirement of a lifetime of maximal earnings restricts this top tier to a very small cohort of high-earning, strategic planners.”

Navigating the Taxation and Working Rules

The gross benefit amount advertised often differs from the net payment received due to the application of federal income tax and, for some, the Social Security Earnings Test.

Taxation on Social Security Benefits (KW5: Taxation)

Unlike many social programs, Social Security benefits may be subject to federal income tax. The amount taxed depends on the recipient’s “Combined Income,” which is calculated as:

The following fixed thresholds determine the level of benefit Taxation:

- Single Filers:

- Combined Income between $25,000 and $34,000: Up to 50% of benefits are taxable.

- Combined Income above $34,000: Up to 85% of benefits are taxable.

- Married Filing Jointly:

- Combined Income between $32,000 and $44,000: Up to 50% of benefits are taxable.

- Combined Income above $44,000: Up to 85% of benefits are taxable.

Because these thresholds are not indexed for inflation, a greater percentage of beneficiaries are gradually pulled into the tax net over time, a phenomenon known as “bracket creep,” according to the Center on Budget and Policy Priorities.

The Social Security Earnings Test (KW6: Earnings Test)

- In 2025, beneficiaries under FRA will have $1 deducted from their annual benefit for every $2 earned above $22,320.

- In the year the beneficiary reaches FRA, $1 is deducted for every $3 earned above a higher threshold ($59,520 in 2025), until the month they reach FRA.

- The earnings test vanishes entirely once a beneficiary reaches their FRA; from that point on, no amount of earnings will reduce their Social Security benefit.

Benefits Beyond the Retiree: Spousal and Survivor Payments

- Spousal Benefit: A spouse is generally eligible for up to 50% of the worker’s full retirement benefit (PIA). If the spouse claims benefits before their own FRA, the benefit will be reduced, similar to the worker’s benefit reduction rules.

- Survivor Benefit: A surviving spouse can be eligible for up to 100% of the deceased worker’s benefit, if the survivor has reached their own FRA. If the survivor claims early, the benefit is reduced.

- Children’s Benefits: Unmarried children under age 18 (or up to age 19 if a full-time elementary or secondary school student) are also generally eligible for benefits based on the worker’s record.

The maximum amount a family can receive is subject to a Family Maximum Benefit limit, which is typically between 150% and 180% of the worker’s PIA.

Related Links

SNAP Delays Continue — Millions Still Waiting for Benefits Despite Federal Court Order

2026 Social Security Notices Coming Soon — Key Benefit Changes to Look For

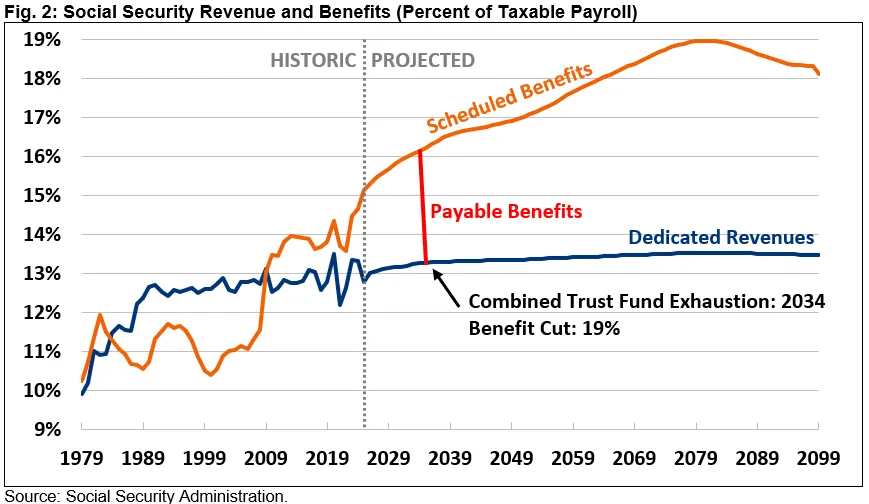

The Program’s Long-Term Funding Challenges (KW4: Funding)

The focus on the size of the monthly checks is inseparable from the long-term financial health of the program. Social Security is primarily funded through dedicated payroll taxes collected under the Federal Insurance Contributions Act (FICA).

According to the 2025 annual report by the Social Security Board of Trustees, the combined OASI and DI Trust Fund reserves are projected to become exhausted by 2035.

- Implication of Exhaustion: Should Congress take no action to shore up the program’s finances before the projected depletion date, the SSA would still be able to pay approximately 83% of scheduled benefits using ongoing tax revenue. This would mean an automatic and significant across-the-board benefit cut.

- Proposed Solutions: Restoring full solvency for 75 years would require a combination of legislative changes, such as increasing the maximum taxable earnings limit, raising the payroll tax rate, or further adjusting the Full Retirement Age. The Trustees Report indicates that an immediate 3.82 percentage point increase in the payroll tax (split between employee and employer) or an immediate 23% reduction in all scheduled benefits would be necessary to achieve long-term balance.

The complexity of the program, coupled with its profound impact on the financial security of tens of millions of Americans, ensures that the size and stability of Social Security payments remain a central issue in national economic policy debates.