For decades, waiting until age 70 to claim Social Security benefits has been touted as a sure-fire way to maximize monthly payments. However, financial experts are now warning that delaying may not always be the best option for everyone.

The strategy could come with hidden costs, such as potential loss of income, increased tax liabilities, health risks, and negative effects on spousal and survivor benefits. Understanding the trade-offs involved is crucial before making the decision to delay.

Delaying Social Security to 70 May Cost You More Than You Think

| Key Fact | Detail |

|---|---|

| Delayed Benefits Growth | Social Security benefits increase by approximately 8% for each year you delay past full retirement age (FRA) until age 70. |

| Potential Downsides | Delaying benefits may lead to a loss of income if you have a shorter lifespan or need to tap into savings. |

| Survivor Benefits Trade-Offs | Delaying can reduce the survivor benefits available to a spouse in the event of death. |

| Economic Impact of Early Claims | Early claims may be beneficial depending on health, lifespan, and individual financial needs. |

The Appeal of Delaying Social Security to Age 70

Why People Delay

The main reason retirees are advised to delay Social Security benefits until age 70 is the 8% increase in benefits for each year past their full retirement age (FRA). For example, if a retiree’s monthly Social Security benefit at FRA is $1,000, waiting until age 70 could increase that benefit to around $1,320, a 32% increase.

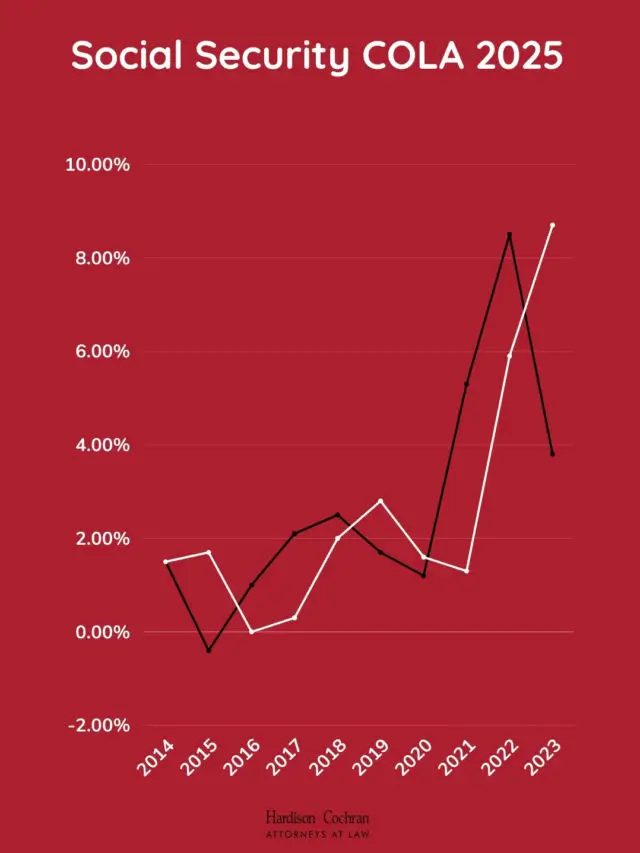

This extra income can provide a more stable financial foundation in later years when medical expenses tend to rise. Additionally, Social Security payments are inflation-adjusted, making them one of the few guaranteed income sources that rise with the cost of living, a key factor for retirees worried about outliving their savings.

Longevity Protection

For individuals who expect to live into their 80s or 90s, delaying Social Security benefits is often seen as a way to ensure financial security in later years. With healthcare costs and other expenses increasing with age, Social Security benefits provide a reliable income stream that helps offset these rising costs.

Why Delaying Social Security May Cost You More Than You Think

1. The Risk of Not Living Long Enough to Benefit

The primary downside of waiting until age 70 is the risk that you may not live long enough to make up the additional benefits you would have received had you started claiming earlier. If you claim at 62, you will receive benefits for a longer period of time, even though the monthly payments will be smaller.

According to a 2021 study by Kitces Financial Planning, individuals with a shorter life expectancy due to health issues, family history, or other factors might not benefit from delaying benefits. If a retiree dies prematurely, they may end up forgoing the extra benefits altogether.

Example: If a 62-year-old retiree with a life expectancy of 80 claims at 62, they will have 18 years of payments, potentially totaling more than waiting until 70 for 10 years of payments.

2. Opportunity Costs: Using Savings or Assets to Bridge the Gap

Delaying Social Security means that retirees must use other savings, pensions, or investment income to cover living expenses. This could lead to a faster drawdown of assets that could have otherwise been preserved for future use. If the market doesn’t perform well or healthcare costs rise unexpectedly, relying on savings can be risky.

According to financial planners at Protected Income, retirees who delay Social Security could be eroding their savings faster than anticipated, especially if they face low returns in their portfolio during the delay years.

Example: A retiree who waits until 70 might need to use $1,000 per month of savings to bridge the gap, spending $12,000 per year for 8 years. If markets decline, that $12,000 per year could deplete their retirement savings more quickly than planned.

3. Survivor Benefits and Spousal Considerations

Delaying Social Security can also impact the survivor benefits available to a spouse. When a higher-earning spouse delays benefits, it can increase their monthly payments but reduce the survivor benefit for the spouse in the event of their death.

Sarah Thompson, a financial planner at Thompson Wealth Management, advises couples to consider how delaying one spouse’s Social Security may affect the financial security of the surviving spouse. “For couples, it’s not just about maximizing one person’s benefit, but also about ensuring that the surviving spouse isn’t left with reduced income,” Thompson explains.

4. Reduced Flexibility in Early Retirement

Delaying Social Security also means sacrificing flexibility in early retirement. Many retirees face unexpected costs in the first few years of retirement, such as healthcare expenses, home repairs, or travel costs. Having to delay Social Security benefits to age 70 could create financial strain during the initial retirement years, as other income sources may be limited.

Example: A retiree who wants to travel, take up hobbies, or care for aging parents in the early years of retirement may find it difficult without the extra monthly Social Security check. Using savings or investments to bridge the gap could quickly erode funds.

5. Tax Implications

Delaying Social Security can also have tax implications. Once retirees begin receiving Social Security benefits, those benefits are taxable, especially if they have other sources of income. For individuals who delay benefits and continue to work or draw income from investments, they may end up paying more in taxes when they eventually begin receiving larger Social Security payments at 70.

When Delaying Social Security Still Makes Sense

Despite the potential downsides, delaying Social Security may still be the best option under certain conditions:

- Good health and longer life expectancy: If you are healthy and expect to live into your 80s or 90s, waiting until 70 can provide a larger lifetime benefit.

- Adequate savings to bridge the gap: If you have sufficient retirement savings to cover living expenses while waiting, you may still benefit from delaying.

- Desire for guaranteed income later in life: For retirees who are risk-averse and want guaranteed income that will last throughout their lifetime, delaying can be a good option.

- Low reliance on survivor benefits: Couples who don’t rely heavily on survivor benefits may choose to delay to maximize one spouse’s benefits.

Real-World Case Studies: Early vs. Delayed Social Security Claims

Case Study 1: The Early Claimant

Jane, 62, retired early due to health issues. After consulting with a financial planner, she decided to claim Social Security at 62, given her health condition. Although her monthly benefit was smaller, claiming early allowed her to use the funds to cover her living expenses, without needing to dip into her savings. This decision, while reducing her lifetime Social Security benefit, proved to be financially advantageous given her shorter life expectancy.

Case Study 2: The Delayed Claimant

Mark, 67, in excellent health and with substantial savings, decided to wait until age 70 to claim Social Security. This decision meant relying on his savings for the next few years, but the 32% increase in benefits provided him with a higher monthly income later in life. This strategy worked well as he lived into his 90s and avoided the risk of outliving his savings.

Related Links

New Social Security Deposits Set to Arrive This Week — Millions Will See Payments in 48 Hours

2026 Social Security Payments Reach New High — What the Average Check Will Look Like

Government Policy and Future Social Security Reforms

Social Security reform continues to be a topic of debate in Washington, especially as the Social Security Trust Fund faces long-term solvency issues. While the current system still allows for the delay of benefits to age 70, future changes to the program may affect the timing and payout options.

As lawmakers continue to look at ways to ensure the future viability of Social Security, retirees may see changes in eligibility age, benefit amounts, or payout structures.

Delaying Social Security until age 70 remains a sound strategy for many retirees, particularly those with longer life expectancies and sufficient savings to bridge the gap. However, for others, waiting may come with significant costs — such as the loss of income in the early years, the erosion of assets, and reduced survivor benefits for spouses.

Each retiree’s situation is unique, and careful planning and consideration of all options are necessary to make the best decision. The decision to delay or claim Social Security should be based on personal health, finances, and retirement goals, and retirees are encouraged to consult with financial planners to understand all possible outcomes before committing to a strategy.