The U.S. Social Security Administration (SSA) will issue December 2025 benefit checks over several dates — and for many Supplemental Security Income (SSI) recipients, December will bring two deposits thanks to the New Year holiday schedule.

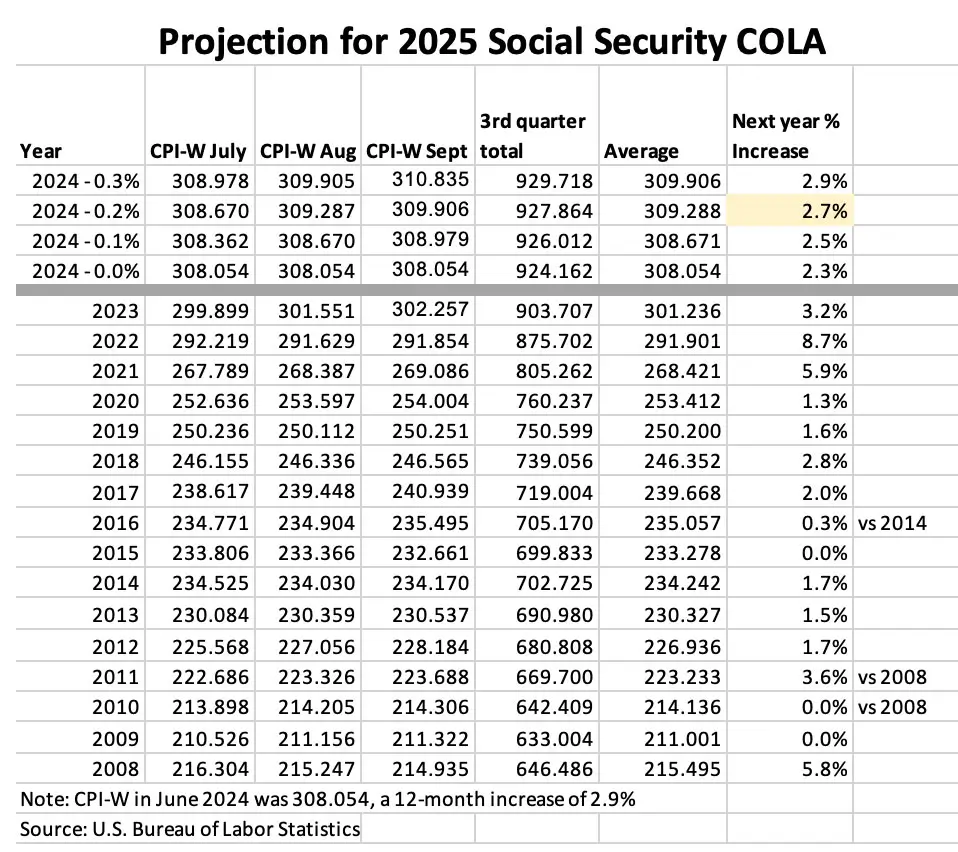

A 2.8% cost-of-living adjustment (COLA) will also raise monthly benefit amounts starting end-of-month or January 2026. This December is shaping up to be especially important for the 75 million Americans who depend on Social Security or SSI.

December 2025 Social Security

| Key Fact | Detail |

|---|---|

| SSI December payment date | December 1, 2025 |

| Early SSI/January 2026 payment date | December 31, 2025 (due to Jan 1 holiday) |

| Regular Social Security payments | Dec 3 (legacy), Dec 10, 17, 24 based on birth date |

| 2026 COLA increase | 2.8% for all Social Security & SSI benefits |

| New maximum SSI monthly benefit (single) | $994 (from $967) |

Understanding December’s Social Security Schedule

What changes in December 2025

Every December, the SSA issues its regular set of monthly payments. For 2025, there are no major structural changes — but calendar quirks lead to an unusual outcome: many SSI recipients will receive two deposits this month.

The standard monthly SSI payment will drop on Monday, December 1, as usual. Because January 1, 2026 falls on a federal holiday, the next SSI benefit is pulled forward to Wednesday, December 31, 2025.

That early December 31 deposit will include the new benefit amount after the upcoming 2.8% cost-of-living boost. For other beneficiaries — retirees, survivors, and disabled recipients — payments follow the regular weekday schedule:

- Wednesday, Dec. 3 for those receiving benefits prior to May 1997.

- Wednesday, Dec. 10 for birth dates 1–10

- Wednesday, Dec. 17 for birth dates 11–20

- Wednesday, Dec. 24 for birth dates 21–31

These dates align with the SSA’s annual payment calendar.

Why SSI Recipients Get Two Payments

The double payment arises solely due to how SSI scheduling works. SSI benefits are delivered on the first of each month — unless that date falls on a weekend or federal holiday. In that case, the payment is issued on the preceding business day.

Because January 1, 2026 is a holiday, the January benefit is deposited on the last business day of December (Dec 31). This ensures beneficiaries do not go without a check — though it means no SSI payment will arrive in January 2026.

Financial advisers caution recipients not to treat the second check as a bonus — it simply represents the January payment being made early.

2026 Cost-of-Living Adjustment: What It Means for Beneficiaries

Why COLA matters

Every year, the SSA adjusts Social Security and SSI benefits for inflation through the cost-of-living adjustment (COLA). This aims to preserve the purchasing power of payments as consumer prices rise. For 2026, Congress has approved a 2.8% COLA, affecting nearly 75 million beneficiaries.

New Benefit Rates

- The maximum monthly SSI benefit for an individual rises to $994, up from $967 in 2025. For couples, the cap increases to $1,491.

- On average, Social Security retirement and disability beneficiaries will see their monthly payment increase by about $56.

SSI recipients get this increase immediately with the December 31 payment, while regular Social Security checks reflect the increase in January 2026.

Official SSA Statement

“Social Security is a promise kept, and the annual cost-of-living adjustment is one way we are working to make sure benefits reflect today’s economic realities and continue to provide a foundation of security,” said SSA Commissioner Frank J. Bisignano.

Budget and Financial Planning Considerations

What beneficiaries should do now

- Mark payment dates. Beneficiaries should note the December 1 and December 31 SSI deposits or their regular Wednesday benefit date based on their birth date.

- Plan for a January 2026 gap. SSI recipients won’t get another payment until February 1, 2026 (unless the 1st is a weekend/holiday). Budget accordingly.

- Watch for COLA notices. SSA mails 2026 benefit notices throughout December. Recipients with a mySocialSecurity account can view them online beginning early December.

Broader economic and program contexts

Though the 2.8% COLA helps offset inflation, some advocates argue it remains insufficient, especially amid rising costs for housing, healthcare, and living expenses.

Additionally, the SSA warns that beneficiaries who began receiving payments before May 1997 or receive both SSI and Social Security may see three payments in December — a scenario that could complicate budgeting.

Possible Risks and What to Watch For

Payment delays or banking issues

While SSA disburses payments on schedule, banks may delay posting depending on holiday closures or internal processing times. Recipients who do not see a deposit should contact their bank first. If problems persist, they can reach out to SSA directly.

Tax and Medicare deductions

The COLA increases overall benefit amounts, but individual net receipts may be affected by deductions for Medicare Part B premiums, taxes, or collateral debts such as overpayments. Experts note that some beneficiaries may see a smaller net increase than the headline COLA suggests.

Long-term sustainability concerns

While COLA adjustments help maintain dignity for retirees and vulnerable populations, the underlying funding challenges for Social Security remain a concern. The program’s long-term solvency depends on a stable workforce and balanced contribution rates, as noted in recent actuarial analyses.

Related Links

USDA Prepares Major Overhaul of SNAP — What Changes Could Mean for EBT Users

The Penny Era Ends — What the U.S. Decision Means for Cash, Payments, and Shoppers

Looking Ahead: What to Watch in Early 2026

As the year ends, many households will benefit from the early SSI payment and the COLA boost. However, the absence of a January payout for SSI recipients and potential deductions for taxes or Medicare remind beneficiaries to budget carefully.

The SSA will monitor inflation and cost-of-living trends to determine future adjustments — making 2026 an important year for program solvency and benefit stability.

FAQs About December 2025 Social Security

Q: Does December 2025 mean two SSI checks for everyone?

A: No. Only SSI beneficiaries get two checks — regular beneficiaries receive their normal one payment based on their birthdate schedule.

Q: Is the December 31 SSI payment extra money?

A: No. That payment is the regular benefit for January 2026, issued early because January 1 is a holiday. No SSI check will arrive in January.

Q: When does the COLA increase take effect?

A: SSI recipients see increased benefits with the December 31, 2025 payment. Social Security retirement and disability beneficiaries receive the increase starting January 2026.

Q: How much more will I get after COLA?

A: For SSI, the maximum monthly individual benefit rises to $994 (up from $967). For Social Security retirees and disability recipients, the average increase is about $56 per month.

Q: Do I need to do anything?

A: No. The increase is automatic. SSA will mail notices in December. Beneficiaries with a mySocialSecurity account can view their new amounts.