In December 2025, millions of Americans receiving benefits from the Social Security Administration (SSA) will experience an unusual payment schedule, with some recipients receiving two or even three deposits in the same month. This shift is due to the timing of monthly Supplemental Security Income (SSI) checks, birthdate-based payments, and a holiday-driven early deposit for January 2026. Meanwhile, a 2.8% cost-of-living adjustment (COLA) will boost benefits for all recipients starting in the new year.

December 2025 SSDI Payments

| Key Date | Who Receives Payment | Why It Matters |

|---|---|---|

| Dec 1, 2025 (Monday) | SSI recipients | Regular December SSI benefit |

| Dec 3, 2025 (Wednesday) | Social Security retirement, SSDI, or survivor beneficiaries who began receiving benefits before May 1997 | Legacy fixed-date payment schedule |

| Dec 10, 17, 24 (Wednesdays) | All other Social Security beneficiaries (birthdate-based) | Payments issued based on recipient’s date of birth |

| Dec 31, 2025 (Wednesday) | SSI recipients | Early January 2026 payment due to Jan 1 holiday |

| Jan 2026 | All beneficiaries | First checks reflecting 2.8% COLA increase |

Understanding the Unusual December 2025 Schedule

Why Are There Multiple Payments in December?

The SSA uses different schedules depending on when and what type of benefit a person receives:

- SSI benefits are generally paid on the first of each month. Because January 1 is a federal holiday, January’s SSI payment will be deposited on December 31, the prior business day.

- Social Security (retirement, disability, survivor) benefits are usually paid on a Wednesday based on the recipient’s birth date, unless they began collecting benefits before May 1997 — in which case they are paid on the third of each month.

Who Gets Two or Even Three Checks in December?

Some people may receive:

- Two SSI payments — one for December (Dec 1) and one early for January (Dec 31).

- SSI + SSDI/Retirement — beneficiaries eligible for both programs could receive three deposits:

- Dec 1: SSI

- Dec 3, 10, 17, or 24: Social Security

- Dec 31: Early SSI for January

It’s important to note: the December 31 payment is not a bonus, but an advance on January’s payment. No payment will be issued on January 1, 2026.

Social Security’s Cost-of-Living Adjustment (COLA) for 2026

What Is COLA?

The Cost-of-Living Adjustment (COLA) is an annual increase in Social Security benefits to account for inflation. It is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) during the third quarter of the previous year.

For 2026, the SSA has announced a 2.8% COLA. This adjustment will appear in January 2026 payments — or in the Dec 31, 2025 payment for SSI beneficiaries.

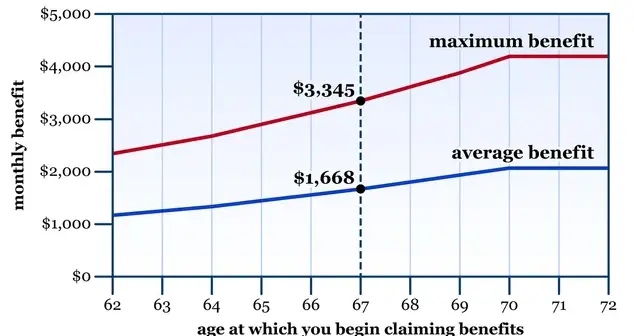

How Much Is the 2.8% Increase?

On average:

- Retired workers will see monthly benefits rise from about $2,015 to $2,071, a gain of $56 per month.

- Disabled workers will see benefits increase from around $1,586 to $1,630, a gain of $44 per month.

- SSI recipients may see the maximum federal benefit for individuals increase from $943 to approximately $969.

Note: These are national averages. Individual increases may vary depending on current benefit amounts and eligibility categories.

Why the COLA Matters — and Its Limitations

Inflation’s Erosion of Fixed Incomes

While the COLA is meant to protect purchasing power, critics argue that it often falls short. Many seniors and disabled Americans spend disproportionately on healthcare and housing — sectors where inflation often outpaces the CPI-W.

Some advocates have called for switching to the CPI-E, an inflation measure more tailored to older adults’ spending patterns.

Medicare Premiums May Offset Increases

For many retirees, increases in Medicare Part B premiums and out-of-pocket healthcare costs will eat into their COLA gains. In some cases, retirees may see only a net gain of $30–40 per month after premiums are deducted.

Benefit Verification and Budgeting Tips

How to Confirm Your Payment Dates

- Visit your my Social Security account at ssa.gov to verify your payment calendar and benefit amount.

- Direct deposit is now the default for most beneficiaries. Paper checks are increasingly rare and may be subject to delivery delays.

- For any missing payments, SSA recommends waiting three mailing days before reporting.

Budgeting Around December’s Double Payments

SSI recipients should remember:

- December 1 is their regular December payment.

- December 31 is the advance January 2026 payment.

They will not receive a payment on January 1 — so plan accordingly. For those on a tight budget, it’s important to not treat the December 31 payment as extra income.

Historical COLA Comparison

| Year | COLA % | Notes |

|---|---|---|

| 2022 | 5.9% | High inflation during pandemic recovery |

| 2023 | 8.7% | Largest increase in 40 years |

| 2024 | 3.2% | Inflation begins to moderate |

| 2025 | 2.6% | Further stabilization |

| 2026 | 2.8% | Reflects steady but persistent inflation |

Despite lower inflation in 2025, costs for essentials like rent, utilities, and groceries remain high for many fixed-income households.

Expert Insights

Dr. Laura Kendall, a public policy analyst at the Center for Retirement Research, said:

“The COLA is a critical lifeline for millions of older Americans, but it often lags behind the true cost pressures faced by seniors — especially in healthcare and housing.”

James Mateo, a financial advisor specializing in senior income planning, noted:

“While the COLA provides a modest raise, it’s important that beneficiaries also review other expenses — such as Part B premiums, prescription drug costs, and property taxes — to determine the real-world impact.”

What’s Ahead in 2026

- The 2.8% COLA will be reflected in all payments starting in January.

- SSI recipients will feel the change starting with the Dec 31, 2025 deposit.

- The SSA is expected to maintain the same birthdate-based payment structure throughout 2026.

- No major legislation affecting Social Security eligibility or structure is anticipated in early 2026 — but long-term solvency debates are likely to return to Congress.

December 2025 Social Security Guide: Payment Dates, Double SSI Checks, and Next Year’s COLA

Final Thoughts

For over 75 million Americans relying on Social Security and SSI, December 2025 will bring a unique cash flow pattern — including double SSI payments for many, and a modest benefit increase thanks to the 2026 COLA.

While the extra December deposit might ease short-term spending, recipients should remember it’s simply an early payment for January. The long-term purchasing power of benefits continues to be challenged by rising costs and uncertain future funding.

FAQs About December 2025 SSDI Payments

Q: Will I receive more money in December because of the COLA?

A: No, the COLA takes effect with January 2026 payments. However, SSI recipients receive their January check on Dec 31, which includes the COLA.

Q: Why am I receiving two payments in December?

A: If you receive SSI, you’ll get the January payment early due to the Jan 1 holiday. Some beneficiaries also receive Social Security retirement or disability checks — leading to three payments.

Q: Will there be a payment on January 1?

A: No. If you receive SSI, your January payment will be deposited on December 31, 2025.

Q: How do I find out when I’m paid?

A: You can log into your personal “my Social Security” account at ssa.gov, where your exact payment dates and benefit amounts are posted.