U.S. officials are warning beneficiaries about a rapid rise in Social Security and VA scams 2025, a group of increasingly sophisticated fraud schemes targeting older Americans, veterans, and individuals with disabilities. Authorities say the scams—ranging from forged overpayment notices to advanced government impersonation tactics—have surged since January, prompting expanded advisories from both the Social Security Administration (SSA) and the Department of Veterans Affairs (VA).

Social Security & VA Beneficiaries

| Key Fact | Detail |

|---|---|

| Fraud increase | SSA fraud reports up nearly 20% in early 2025 |

| Top targeted group | Veterans receiving disability or pension benefits |

| Notable scam | Fake Supreme Court investigation letters |

| Official Website | SSA OIG , VA.gov |

Officials say more advisories will be issued as new fraud patterns emerge throughout 2025. Both SSA and VA stress that the best defense remains public awareness, consistent verification of communications, and timely reporting of suspicious activity.

Why Social Security and VA Scams 2025 Are Expanding Nationwide

U.S. agencies report that fraud groups are increasingly using professional-grade tools to create convincing letters, emails, and phone calls. According to the SSA Office of Inspector General, complaint volumes in early 2025 exceeded levels observed during the pandemic, when stimulus-related scams were widespread.

Experts say the advanced fraud spike is driven by three factors:

- The growing availability of stolen personal data, much of it circulating on dark web forums.

- Increased reliance on digital portals such as “my Social Security” and VA.gov.

- More organized international cybercrime networks specializing in government impersonation fraud.

Long-Term Trend (2021–2025)

Fraud involving federal benefits has risen steadily for four consecutive years. A 2024 Government Accountability Office (GAO) report noted that Social Security-related scams nearly doubled between 2021 and 2023, with 2025 on pace to exceed those numbers.

Government Impersonation Scams Are Becoming More Sophisticated

Among the most concerning developments are impersonation scams involving forged letters claiming to originate from the U.S. Supreme Court. CBS News reported several cases in which beneficiaries received documents alleging their Social Security numbers were “under legal review,” accompanied by instructions to call a provided phone number.

“These are classic government impersonation scams,” said Gale Stallworth Stone, Acting Inspector General for the SSA, in a January advisory. “Federal courts do not send letters demanding beneficiaries verify personal information or pay immediate fines.”

Fraud experts say criminals are now using high-resolution printers, stolen federal letterhead templates, and AI-generated signatures to mimic official correspondence.

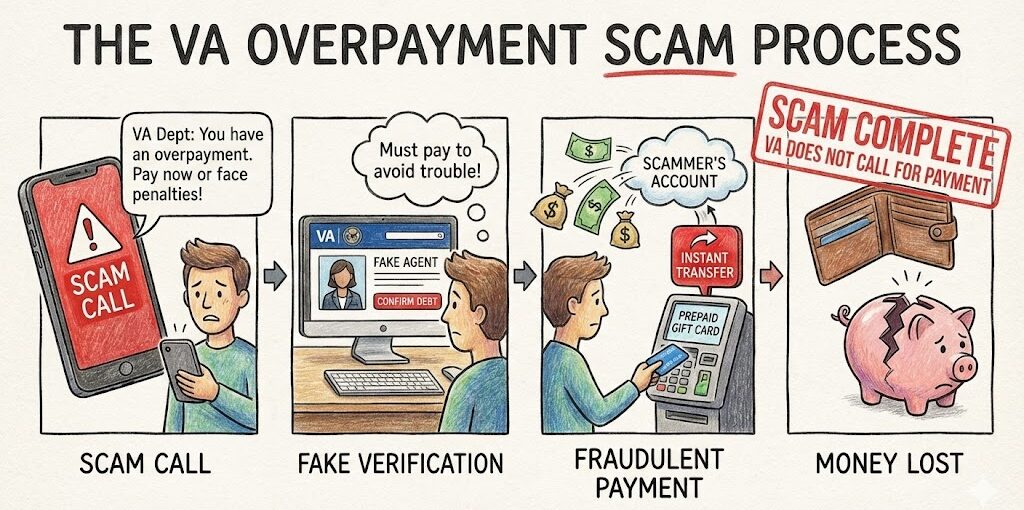

VA Beneficiaries Face New Overpayment Scam

The VA overpayment scam remains the most widespread fraud targeting veterans in 2025. Criminals impersonate VA officials and claim the agency mistakenly issued excess disability or pension benefits. Victims are instructed to repay the alleged debt using gift cards, wire transfers, cryptocurrency, or mobile payment apps—methods federal agencies do not use.

A VA spokesperson emphasized in a public briefing, “The Department of Veterans Affairs never directs beneficiaries to repay debts through untraceable transactions.”

Why Veterans Are High-Value Targets

Fraud researchers at the AARP Public Policy Institute say veterans receive multiple overlapping benefit streams, making fabricated payment narratives easier to construct. Veterans living with disabilities may also experience higher stress levels, making them more vulnerable to coercive messages that demand immediate action.

Several cybersecurity firms have also reported that criminal groups often market “military data packages,” which include stolen names, addresses, and service details—information that can make scam calls highly convincing.

Real Cases Highlight the Human Impact

Although federal agencies avoid naming individuals, several documented cases illustrate the scale of damage:

Case Study: Retired Veteran in Texas

A 67-year-old Army veteran lost more than $14,000 after receiving a call from someone posing as a VA debt specialist. The caller cited the veteran’s real service dates, likely obtained from a data breach, and pressured him to repay an “urgent overpayment” using gift cards.

Case Study: Widow in Florida

A Social Security survivor benefits recipient received a forged letter claiming a Supreme Court investigation into her Social Security number. She called the number listed and provided her full SSN, bank details, and a copy of her driver’s license, enabling identity theft within days.

Case Study: Disabled Beneficiary in Ohio

A man on Social Security Disability Insurance (SSDI) received a text message with a link to a fake “my Social Security” login portal. Once he entered his credentials, thieves redirected his monthly benefit to a prepaid debit card.

Each of these incidents was later cited by local law enforcement or news organizations as examples of rising 2025 fraud patterns.

Technology Behind Modern SSA Fraud

Cybersecurity analysts say that scammers are increasingly using advanced tools:

1. Caller-ID Spoofing Technologies

Criminals can make phones display “Social Security Administration” or “Department of Veterans Affairs,” even though the calls originate overseas.

2. AI-Generated Voice Calls

Researchers at Stanford University published findings showing criminals now use AI-generated voices to impersonate officials. Some fraudsters mimic the tone and cadence of SSA agents using short audio samples.

3. AI Text Generators for Email Phishing

Emails are becoming grammatically accurate, with fewer of the errors once used to identify scams.

4. Fake Login Portals

Cybersecurity professor Dr. Marcia Lang notes that criminals now create “pixel-perfect replicas” of .gov websites. “Consumers must check URLs carefully. Even minor spelling differences indicate fraudulent pages,” she said.

How Beneficiaries Can Protect Themselves

Federal agencies provide several steps to avoid falling victim to Social Security and VA scams 2025:

- Hang up on unsolicited calls and contact SSA or VA directly.

- Never respond to messages threatening arrest, license suspension, or benefit termination.

- Avoid paying any debt through gift cards, cryptocurrency, or cash apps.

- Enable multi-factor authentication on “my Social Security” accounts.

- Regularly check bank accounts for unauthorized activity.

Fraud-Prevention Checklist

- Confirm official communications through SSA.gov or VA.gov.

- Save official SSA and VA phone numbers.

- Report suspected fraud immediately.

- Secure mailboxes to prevent theft of physical letters.

- Update antivirus and device security settings.

How to Report Fraud

Social Security Scams

Report to the SSA Office of Inspector General at: https://oig.ssa.gov

VA Scams

Veterans can report fraud through the VA Office of Inspector General hotline.

Identity Theft

The Federal Trade Commission (FTC) recommends filing an identity theft report at: https://identitytheft.gov

Local Law Enforcement

Beneficiaries who have lost money should also file a police report to support financial recovery efforts.

December 2025 SSDI Payments: The Three Deposit Dates Every Recipient Should Check

Policy and Legislative Responses

Members of Congress held two early 2025 hearings on rising government impersonation scams. Lawmakers are reviewing proposals to:

- Increase penalties for overseas fraud operations

- Expand funding for digital identity verification tools

- Require telecom companies to strengthen caller ID authentication

- Improve public awareness efforts targeting seniors and veterans

The SSA has also begun testing a biometric verification pilot intended to reduce unauthorized account access.

“We are focusing on modernizing identity systems while balancing user privacy,” an SSA spokesperson said during a February briefing.

What Officials Expect for the Remainder of 2025

Fraud analysts expect these tactics to evolve as criminals adapt to new security measures. The SSA is expanding fraud education campaigns, while the VA is updating communication guidelines to reduce confusion around legitimate contact methods.

“The challenge is that scammers innovate quickly,” said Kimberly Brandt, a former senior federal program administrator who now consults with the Brookings Institution. “Vigilance from both agencies and beneficiaries is essential.”