Millions of Americans will receive their monthly retirement or disability payments on the December 10 payment date, one of the key disbursement days in the federal calendar. For a relatively small group of high-earning retirees, this deposit may reach up to $4,018, the top amount available at full retirement age under current Social Security rules.

Because the national retirement system plays a central role in household stability, understanding who qualifies for this figure — and why — remains vital for workers, retirees, and policymakers alike. The Social Security Sends Up to $4,018 benchmark demonstrates how decades of earnings, federal benefit formulas, and timing rules intersect to determine individual outcomes.

Social Security Sends Up to $4,018 on December 10

| Key Fact | Details / Explanation |

|---|---|

| Maximum benefit of $4,018 | Top payment possible at full retirement age for 2025 |

| December 10 payment date | Applies to birthdays between the 1st and 10th |

| Requirements for maximum benefit | High lifetime earnings + 35-year record + FRA claiming |

| Average Social Security benefit | Roughly $1,900–$2,000 monthly |

| 2026 COLA increase | Raises benefits beginning January 2026 |

Why the Social Security Sends Up to $4,018 Maximum Matters to Millions

The maximum Social Security benefit is often misunderstood. While headlines highlight the top number, very few beneficiaries actually receive it. Still, the figure is significant because it illustrates how the Social Security system rewards workers who:

- Earn at or above the taxable wage maximum for many years

- Continue working consistently without major gaps

- Delay claiming until full retirement age or later

The number is also a point of comparison. Average retirees earn less than half of the maximum. As Dr. Elaine Porter, a senior economist specializing in retirement systems, explains:

“The $4,018 figure is symbolic. It shows the upper boundary of the program’s design, but real-world financial planning depends on understanding your own earnings record and claiming decisions.”

How the Social Security Payment Schedule Shapes the December 10 Deposit

The Social Security payment schedule determines when beneficiaries receive their monthly payments. This system, adopted in 1997, divides recipients into three groups based on birthdate.

December 10 Applies to Birthdays Between the 1st and 10th

This group receives benefits on the second Wednesday of each month, which is December 10 this year.

Early Beneficiaries Follow a Different Schedule

People who first received Social Security before May 1997 — often older retirees or long-term disability beneficiaries — are paid on:

- December 3

Other December Dates

- December 17: Birthdates 11–20

- December 24: Birthdates 21–31

This staggered system reduces strain on SSA processing and ensures more reliable distribution across banking networks.

Understanding How the Maximum Social Security Benefit Is Calculated

The maximum Social Security benefit — the basis for the Social Security Sends Up to $4,018 threshold — results from multiple formula components.

The 35-Year Earnings Rule

The SSA considers your highest 35 years of indexed earnings. Lower-earning years pull down your average.

Example: A worker with 33 high-earning years and two near-zero years may qualify for thousands less.

Indexed Earnings Explained

Indexed earnings adjust past wages for long-term inflation. This enables SSA to compare earnings fairly across decades.

Taxable Wage Base Requirement

To receive the maximum benefit, workers must earn at or above the Social Security wage base limit for many years. In recent years this limit has exceeded $160,000.

Claiming Age — FRA vs. Early Retirement vs. Age 70

- Full Retirement Age (FRA): 66–67, depending on birth year

- Early retirement (age 62): Up to a 30% permanent reduction

- Delayed retirement (age 70): Up to 24–32% permanent increase

The Social Security Sends Up to $4,018 figure applies at FRA, not at age 70.

How the December 10 Payment Impacts Different Beneficiaries

Retirees

Retirees constitute the majority of December 10 recipients. For them, this payment supports end-of-year expenses, holiday travel, and rising winter utility costs.

SSDI Recipients

Disability beneficiaries often face higher medical costs. While SSDI benefits rarely reach the maximum, timely payments are crucial for budgeting.

Survivor and Dependent Beneficiaries

Survivor benefits follow the same payment schedule, but amounts are calculated differently. Widows, widowers, and dependent children are not eligible for the maximum benefit in most circumstances.

SSI Recipients (Separate Schedule)

Social Security Sends Up to $4,018 does not apply to SSI, which is need-based.

SSI follows:

- December 1 (regular payment)

- December 31 (January 2026 payment issued early)

Common Misconceptions About the $4,018 Benefit

Misconception 1 — “Everyone paid December 10 could receive $4,018”

False. Only a small subset of high-earning workers qualifies.

Misconception 2 — “$4,018 is the highest benefit possible”

Incorrect. The highest benefit is available at age 70, not at FRA. That number exceeds $4,700.

Misconception 3 — “Benefits automatically reach the maximum after long careers”

Not necessarily. Benefits depend on earnings levels, not just years worked.

Real-Life Scenarios — How Different Workers Might Experience the December 10 Payment

Scenario 1 — High-Earner Retiring at FRA

- Career earnings near taxable maximum for 35+ years

- Claims at age 67

- December 10 payment: ~$4,018

Scenario 2 — Middle-Income Worker Claiming at Early Retirement

- Typical earnings

- Claims at age 62

- December 10 payment: $1,400–$1,500

Scenario 3 — Worker With Mixed Income History

- Career interruptions

- Some low-earning years

- December 10 payment: $1,800–$2,100

These examples reflect national averages and SSA calculation frameworks.

How Taxes, Premiums, and Earnings Can Change Your December 10 Amount

Medicare Part B Premiums

For many retirees, Medicare premiums are deducted directly from Social Security payments, reducing net deposit amounts.

Federal Income Tax Withholding

Retirees who opt in may see automatic withholding reduce the visible deposit.

Working While Receiving Benefits

If you are under full retirement age and earn more than the annual limit, SSA may temporarily withhold part of your benefit.

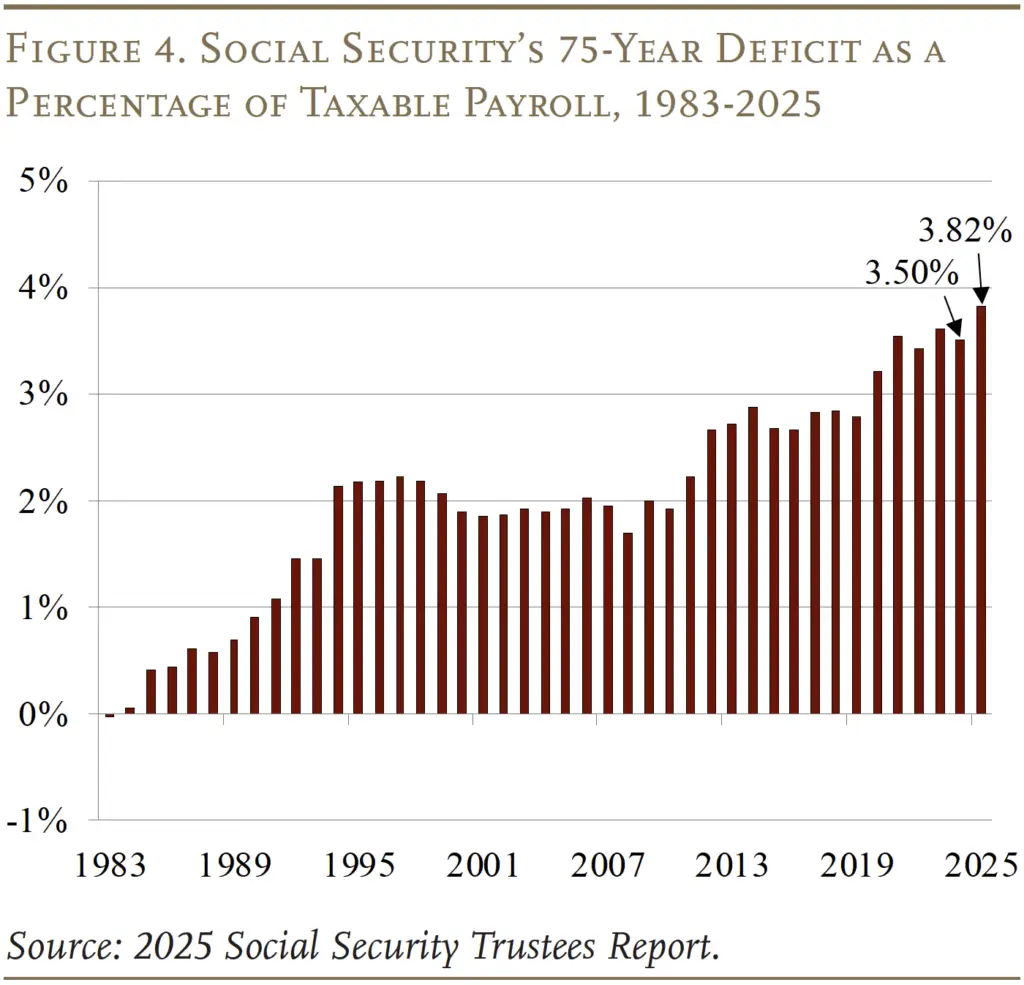

Social Security Solvency and Policy Debates Heading Into 2026

The December 10 payment arrives as Congress debates future financing of Social Security.

Key proposals include:

- Raising the payroll tax cap

- Adjusting full retirement age

- Reforming the COLA formula

- Increasing payroll tax rates

Dr. Marcus Wendell, a policy analyst at the Brookings Institution, explains:

“The maximum benefit highlights how Social Security supports high earners, but the broader debate concerns long-term solvency and fairness for average workers.”

Trust fund projections estimate depletion in the mid-2030s without legislative action.

Protecting Your December 10 Payment — Fraud and Security Guidance

SSA warns of increased scam attempts near major payment dates.

Protective Steps

- Enable two-factor authentication on your “my Social Security” account

- Never respond to unsolicited calls requesting bank details

- Check for account-change notifications regularly

- Report suspicious activity immediately to SSA’s Office of the Inspector General

Related Links

Social Security & VA Beneficiaries Alert: New 2025 Scams You Need to Watch For

SSDI Payments for December 2025: The Three Deposit Dates You Should Mark Now

With the December 10 benefit date approaching, millions of Americans are preparing for one of the final Social Security payments of the year. While only a small group qualifies for the top-tier amount, the Social Security Sends Up to $4,018 benchmark underscores the importance of earnings records, claiming decisions, and federal benefit rules.

As households balance rising costs and prepare for the 2026 COLA increase, clarity about eligibility and payment timing remains essential for financial planning.

FAQs About Social Security Sends Up to $4,018 on December 10

Will everyone receiving payment on December 10 get the maximum amount?

No. Most will receive the average benefit, not $4,018.

Why do some people receive earlier payments on December 3?

They began receiving Social Security before May 1997.

Does the maximum benefit include SSI?

No. SSI is separate and cannot reach $4,018.

When does the COLA increase begin?

January 2026 for Social Security; December 31 for SSI.

Can the December 10 amount be higher than $4,018?

Not at full retirement age. Higher amounts apply only to age-70 claimants.