Eligible residents of Alaska will receive a $1,000 dividend on December 18, 2025, under the state’s unique oil‑revenue program. The “$1,000 Payments Arrive December 18” payout is available only to Alaskans meeting residency and application criteria — a form of natural‑resource wealth sharing not offered by any other U.S. state.

$1,000 Payments Arrive December 18

| Key Fact | Detail |

|---|---|

| 2025 Dividend Amount | $1,000 per eligible resident |

| Number of Beneficiaries (approx.) | ~660,000 residents |

| Payment Schedule | Payments began Oct. 2; final wave scheduled for Dec. 18 for pending cases |

| Payout Change from 2024 | 2024 dividend was ~$1,702 — 2025 is a sharp reduction |

| Program Funding Source | Returns from the Alaska Permanent Fund Corporation (oil and mineral revenues) |

What Is the Alaska Permanent Fund Dividend — And Who Qualifies

Why Alaska Has a Dividend

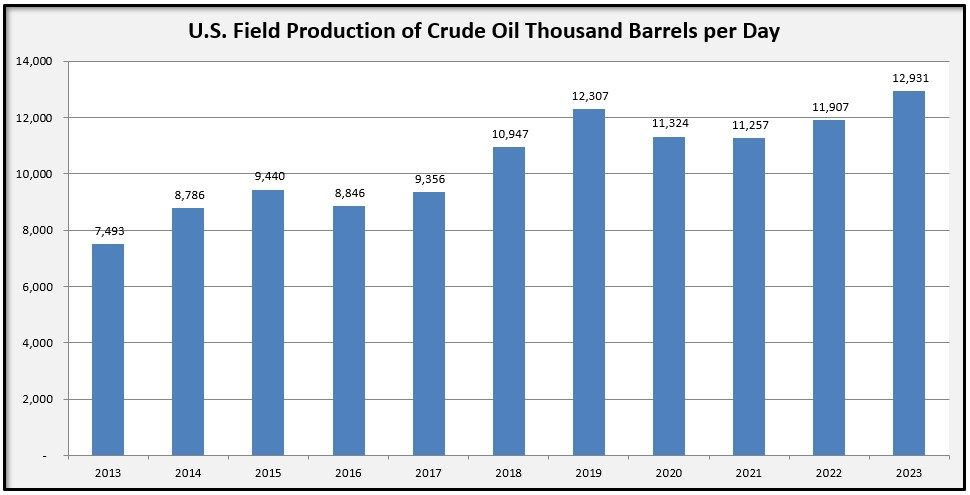

The Alaska Permanent Fund was established in 1976 after the discovery of major oil reserves, with the aim of preserving a portion of mineral‑revenue windfalls for future generations. The fund invests across global assets — stocks, bonds, real estate, and private equity — under the management of the Alaska Permanent Fund Corporation.

Each year, a portion of the fund’s earnings is distributed via the PFD — making Alaska the only U.S. state with this form of citizen’s dividend from natural‑resource wealth.

Eligibility Requirements for 2025

For 2025, the following conditions apply for individuals to qualify for the PFD: residency in Alaska throughout 2024; intent to remain a resident indefinitely; no disqualifying criminal record; and no disqualifying long-term absence unless exempt (e.g., military, education, medical).

Applicants must also have been physically present in Alaska for at least 72 consecutive hours in 2023 or 2024. Dependents, including children, qualify if claimed by an eligible adult. This ensures the payout reaches residents genuinely connected to the state, avoiding duplication or out-of-state claims.

Why the Payout Dropped to $1,000 in 2025 — Budget Pressures and Legislative Decision

The 2025 $1,000 dividend represents the smallest PFD in five years (in nominal terms) and the lowest ever when adjusted for inflation. State legislators, facing a severe budget deficit, opted for a fixed contribution of $1,000 in the 2025–2026 operating budget, rejecting larger payouts that had previously been proposed.

Proponents of the cut argued fiscal prudence was necessary — sustaining the state’s long-term finances without draining savings or jeopardizing essential public services. Critics, however, say the reduction erodes a core benefit for households that count on the PFD for seasonal or emergency expenses.

The Payment Schedule — Who Gets Paid When

As per the official timeline from the PFD Division:

- First wave of payments (direct deposit) began October 2, 2025.

- Second wave (paper checks / later approvals) followed on October 23, 2025.

- A third disbursement went out November 20, 2025 for cases marked “Eligible–Not Paid.”

- A final payment is scheduled December 18, 2025 for any remaining eligible recipients whose status remains unchanged by December 10.

Residents who have moved or changed banking information are advised to update their details promptly to avoid missing the payout.

What the Payout Means — Economic and Social Impact

Poverty Reduction and Support for Vulnerable Communities

Recent research suggests the PFD plays a substantial role in reducing poverty in Alaska, especially among rural, Indigenous, elderly, and low-income households. According to a 2024 study, the dividend reduced the number of Alaskans living below the U.S. poverty threshold by 20–40 percent.

Another report found that, without the PFD, 2–3 percent of Alaska’s population would fall below the poverty line each year. For many families, the $1,000 provides critical support for essentials like heating, food, utilities, and other seasonal costs. In a state with high living and energy costs — especially outside urban centers — the payout can make a significant difference.

Universal Cash Transfer — A Model with Broader Significance

Because the PFD is unconditional and distributed universally (subject to eligibility), it is often cited as a real-world example of a “citizen’s dividend” or a kind of universal basic income (UBI).

Economists and social‑policy analysts note that such dividends can simplify welfare, reduce stigma, and ensure all residents share in the benefits of collective resource wealth. One such supporter described Alaska’s model as a benchmark for resource-rich regions considering equitable wealth distribution.

Economic Stimulus and Local Spending

Because the payout goes to hundreds of thousands of households simultaneously, there is often a surge in local spending following the distribution. This can stimulate retail, heating fuel sales, and other goods and services in communities large and small across Alaska — especially in remote and rural areas where cash influxes are infrequent.

Criticisms, Trade-Offs, and Risks

Smaller Dividend May Undermine Program’s Effectiveness

Some analysts argue that reducing the dividend amount undermines the PFD’s capacity to mitigate poverty and provide meaningful relief — especially for households that rely heavily on it. Compared with past payments, the 2025 amount may not sufficiently address rising costs of heating, housing, or basic goods — particularly in remote or isolated communities.

Mixed Evidence on Long-Term Equality and Income Distribution

While research points to substantial poverty reduction, other studies raise concerns about the PFD’s effect on income inequality or economic behavior over time. One paper found that the PFD may worsen income inequality in both short and long term for Alaska.

Likewise, a labor‑market study concluded that the annual cash transfer had no significant negative effect on employment — but did increase part-time work by 1.8 percentage points. Critics say these outcomes show that a universal dividend cannot substitute for structural policy interventions (education, jobs, housing) required for sustained social mobility.

Fiscal Dependence on Oil Revenues — Volatility and Sustainability

Because the Permanent Fund and subsequent dividends derive from oil and mineral revenues, PFD amounts are subject to global commodity-price volatility, and state budget constraints. As the 2025 reduction highlights, fiscal shortfalls may force legislators to lower payments.

Therefore, relying on the PFD as a stable income source carries risk — particularly for vulnerable residents who may have limited other options in tough years.

Not a Substitute for Comprehensive Social Safety Nets

Though valuable, the PFD is a one-time annual payment, not a steady income stream. It cannot replace programs for housing, healthcare, unemployment, or long-term support for disadvantaged populations. Many social‑policy experts argue that structural investments are still needed to tackle inequality and poverty at root.

What Recipients Should Do — Practical Advice

- Check eligibility and status: Residents should log into the official PFD portal (myPFD) to confirm their application status. If marked “Eligible–Not Paid” by December 10, they should expect payment on December 18.

- Update banking or mailing information: Any changes should be reported promptly through the approved forms, to avoid payment delays or returns.

- Use payout strategically: Given the modest amount, consider using funds for essential needs — heating, food, utilities, debt, or contingency funds — rather than non-critical spending.

- Beware of scams: Authorities warn of increased phishing and fraud attempts as PFD payments process. Residents should rely only on official channels; ignore unsolicited calls or messages promising “special advances.”

Related Links

Texas SNAP Recipients: December Benefits May Hit Accounts This Week – Are You on the List?

What the Payout Reflects — And What It Foretells

The 2025 PFD — while smaller — underscores Alaska’s distinctive approach to distributing resource-generated wealth directly to residents. The dividend continues to play a meaningful role in reducing poverty, supporting low-income households, and offering seasonal financial relief.

Yet, the drop in payout exposes vulnerabilities: the state’s dependence on volatile commodity revenues, shifting political priorities, and budget constraints that can quickly erode the value of the dividend.

As one long-term study put it, the PFD “is a rising tide that lifts all boats” — but only when the water level remains high.

Looking ahead, Alaskans and policymakers face important questions: Should the PFD be restored to larger amounts when fiscal conditions improve? Can the state find a stable, diversified revenue base to sustain the dividend over decades? And can the PFD coexist with broader social-support systems to ensure long-term stability for vulnerable populations?

For now, the December 18 payment offers tangible relief — but the larger debate over sustainable wealth sharing and social equity in Alaska continues.