As inflation, rising consumer debt, and economic uncertainty continue to pressure U.S. households, the $2,000 Stimulus Talks have resurfaced online and in policy discussions—even though no active federal proposal currently exists.

Much of the public debate stems from economic advocacy groups, social media speculation, and memories of past direct payments. Understanding what is actually being discussed, what is merely rumor, and what barriers remain is key to interpreting the growing national conversation about potential new federal relief.

$2,000 Stimulus Talks Explained

| Key Fact | Detail / Statistic |

|---|---|

| Active $2,000 stimulus proposal | None in Congress |

| Last federal stimulus | $1,400 checks (March 2021) |

| Households experiencing financial strain | ~60% report difficulty affording essentials |

| Inflation status | Still above pre-pandemic baseline |

| Public support for new payments | ~67% in recent polls |

Why the $2,000 Stimulus Talks Are Gaining Attention Again

The return of the $2,000 Stimulus Talks reflects several concurrent economic pressures:

- Inflation remains higher than pre-2020 norms.

- Rent and housing affordability have worsened.

- Credit card and auto loan delinquencies continue to rise.

- Wages for lower-income households have not kept pace with rising costs.

- Pandemic-era savings buffers have largely disappeared.

These issues have led advocacy groups, economic researchers, and some members of the public to revisit the idea of direct federal assistance—even though Congress itself has not initiated comparable proposals.

The Historical Context Behind Today’s Stimulus Conversations

The Great Recession (2008–2009)

The federal government authorized recovery payments of $250 to certain Social Security beneficiaries and instituted large-scale stimulus programs aimed at stabilizing employment and credit markets.

Pandemic-Era Direct Payments (2020–2021)

Three rounds of checks were issued:

- $1,200 (CARES Act, March 2020)

- $600 (December 2020 appropriations)

- $1,400 (American Rescue Plan Act, March 2021)

These payments dramatically reduced poverty and helped prevent mass eviction and unemployment impacts, according to the Census Bureau and multiple academic studies.

Why this matters now

Direct payments set a precedent: Americans now understand the speed and scale of relief the federal government can provide under crisis conditions, which informs current expectations—even when policy conditions differ.

What’s Actually Being Proposed Now?

It is critical to distinguish between real policy proposals, informal discussions, and online rumor cycles.

No formal $2,000 stimulus bill exists.

A search of Congressional records confirms there is no active legislation proposing $2,000 checks.

However, several adjacent proposals influence the debate:

1. Expanded Child Tax Credit (CTC) restoration

Championed by bipartisan lawmakers, this would provide monthly or yearly payments to families with children—though not universal stimulus checks.

2. Targeted relief for seniors

Gerontology groups advocate for support for Social Security recipients, pointing to high medical and housing costs.

3. Inflation offset payments

Some think tanks argue for one-time payments to offset cumulative inflation since 2020.

4. Automatic stabilizers

Economists propose legally binding triggers that automatically release direct aid during recessions or emergencies.

5. State-level rebate programs

Some states continue providing selective rebates with leftover pandemic funds. These are often mistaken for federal stimulus checks online. None of these amount to a $2,000 across-the-board payment.

Why the $2,000 Stimulus Rumor Keeps Spreading

1. Misinterpretation of old Congressional proposals

Bills introduced in 2020 and 2021 called for recurring $2,000 monthly checks, but none passed.

2. Viral social media posts

Some creators boost engagement by sharing unverified claims about “approved” payments.

3. Outdated news articles recirculated

SEO-based websites often republish old stimulus information without clear date context.

4. Confusion between federal and state legislation

State tax rebates (e.g., California, Colorado) are often mislabeled as “stimulus checks.”

5. High economic anxiety

Economic stress makes people more susceptible to believing relief is imminent.

A public policy professor explains: “When households face persistent financial pressure, rumors about direct payments gain traction even when no official policymaker has endorsed them.”

Where Congress Actually Stands

Political division remains the largest barrier.

The federal legislature is deeply divided on budget priorities. Stimulus checks require broad bipartisan support—and significant funding.

Key obstacles:

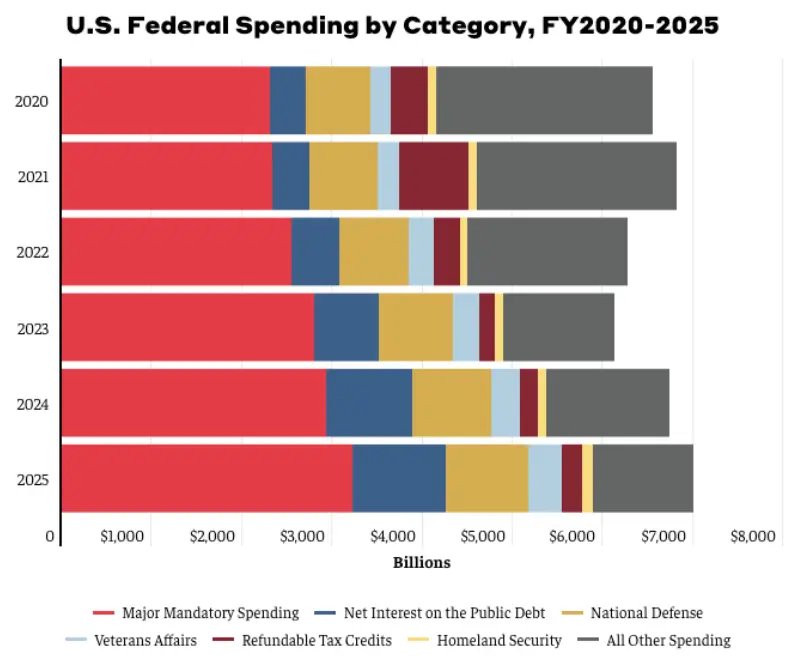

- Deficit concerns: The Congressional Budget Office projects rising long-term deficits.

- Inflation fears: Some lawmakers argue new direct payments could reignite inflation.

- Shift in political priorities: Congress is focused on appropriations, border policy, and foreign aid—not household stimulus.

- No major recession present: Stimulus checks are typically deployed during severe economic contraction.

Leadership from both parties has offered no indication that direct payments are on the legislative agenda.

Economic Conditions Driving Public Concern

Several economic factors shape the renewed interest in stimulus:

1. Housing affordability crisis

Rent remains historically high, and mortgage rates are elevated.

2. Healthcare and prescription drug inflation

Costs have risen steadily, particularly for seniors.

3. Consumer debt at historic highs

According to the Federal Reserve:

- Credit card debt has surpassed $1 trillion.

- Auto loan delinquencies are rising fastest among borrowers aged 18–29.

4. Slowing job growth

Hiring has cooled in several industries, even as layoffs remain low.

5. Stagnant real wages

When adjusted for inflation, wage gains for many workers remain flat.

These pressures explain why many Americans support the idea of additional federal relief—even absent government momentum.

Public Opinion on New Stimulus Checks

Polling from Morning Consult, Quinnipiac University, and Data for Progress consistently shows:

- 67% of Americans support a new stimulus if inflation remains high.

- Nearly 75% support payments targeted to low-income households.

- Over 70% of seniors favor cost-of-living relief outside of Social Security.

However, strong public support does not guarantee congressional action.

Expert Views: Would a $2,000 Stimulus Help or Harm?

Potential Benefits

Economists who support the idea argue that:

- Direct payments provide immediate stabilizing effects.

- Stimulus checks in 2020–2021 significantly reduced poverty.

- They help households facing emergency financial pressure.

- They can offset inflation’s cumulative impact on purchasing power.

Potential Risks

Critics argue:

- Additional stimulus could increase demand and worsen inflation.

- Funding would add to federal deficits.

- Broad payments may be less effective than targeted assistance.

- The economy is not in a state requiring large-scale emergency relief.

A Brookings Institution economist summarizes: “Stimulus can be powerful, but timing matters. Inappropriate timing risks creating new economic instability.”

If Congress Ever Passed a $2,000 Stimulus, How Would It Work?

This is hypothetical, but past stimulus distribution provides a predictive model:

Eligibility Likely Based on:

- Adjusted gross income (AGI)

- Filing status

- Citizenship or residency

- Tax return information

Income thresholds would likely mirror past checks:

- Individuals earning under $75,000

- Married couples earning under $150,000

- Phased-out eligibility above those limits

Distribution Method

- Direct deposit first

- Paper checks and prepaid debit cards second

- IRS online portal for non-filers

This process took 1–3 weeks during past stimulus rounds.

Related Links

2026 Social Security Rewrite: New Rules That Could Influence Your Monthly Income

Texas SNAP Benefits for December: Updated Deposit Dates Now Available

Why There Is Still So Much Uncertainty

Even if economic indicators worsen, several factors limit the likelihood of new federal payments:

- Budget constraints

- Political gridlock

- No current recession

- Focus on inflation reduction

- Low appetite for broad fiscal stimulus

The $2,000 Stimulus Talks reflect public interest, but not government action.

While the $2,000 Stimulus Talks continue circulating online, experts and lawmakers agree that no new federal stimulus checks are currently under consideration. The discussion reflects ongoing economic stress rather than imminent federal action.

Policymakers say future stimulus would depend on economic conditions, fiscal capacity, and political consensus—none of which are settled today.

FAQs About $2,000 Stimulus

Is a new $2,000 stimulus approved?

No. No proposal is active.

Could a new stimulus happen soon?

Only if severe economic deterioration occurs and bipartisan support emerges.

Why are people talking about this now?

Economic stress, past stimulus memories, social media rumors.

Do any states offer similar payments?

Some states offer targeted rebates, but not federal stimulus checks.

Where should I check for real updates?

IRS.gov, Treasury press releases, and Congress.gov—not social media posts.