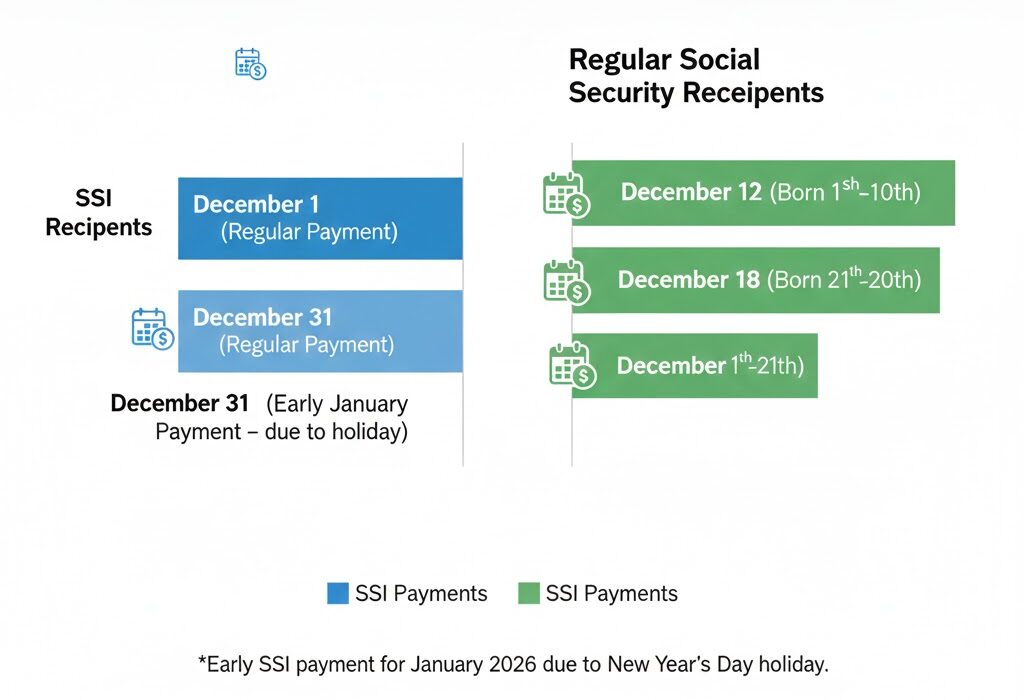

Millions of Americans who rely on Social Security payments will see two deposits this December as a year-end calendar shift moves the first payment of 2026 into the final days of 2025. The Social Security Administration (SSA) confirmed that the adjustment affects only Supplemental Security Income (SSI) beneficiaries, whose payments cannot be issued on federal holidays. New Year’s Day falls on a holiday, requiring the January disbursement to be advanced by one business day.

Two Social Security Payments

| Key Fact | Detail |

|---|---|

| Two SSI payments issued in December | Deposits on Dec. 1 and Dec. 31 |

| Early deposit replaces January 2026 payment | Advanced due to New Year’s Day |

| No change for retirement or SSDI payees | Regular schedules remain intact |

The SSA plans to release its full 2026 calendar in early autumn, allowing beneficiaries to review any additional schedule shifts before the next holiday season. Officials encourage recipients to subscribe to online updates to stay informed about payment changes.

Why Two Social Security Payments Are Being Issued in December

Under federal law, SSI benefits are paid on the first business day of each month. When that day falls on a weekend or a federal holiday, the payment must instead be issued on the preceding business day. Because January 1 is a federal holiday, the SSA advances the payment to December 31.

An SSA spokesperson said the agency’s policy “ensures that income support continues without interruption and that beneficiaries are not left waiting during holiday closures.”

This means the December 1 payment remains unchanged, while the January 2026 payment is placed at the end of December 2025—creating a double-payment month that can cause confusion for households planning their budgets.

A Common but Often Misunderstood Adjustment

Calendar-related payment shifts occur several times per decade, but many beneficiaries forget the pattern until the deposits arrive.

Dr. Elaine Cordova, a professor of public policy at the University of Minnesota, explained that such adjustments “appear infrequently enough that recipients may not recall previous cycles, even though the SSA follows a consistent statutory framework.”

The early payment does not represent additional benefits. Instead, it simply reassigns January’s income to an earlier date.

Who Receives the Double Payment in December

The two-payment schedule applies exclusively to SSI beneficiaries, a group exceeding seven million Americans. SSI supports individuals with very low incomes, including many older adults, adults with disabilities, and children with disabilities.

However, many SSI recipients also receive Social Security Disability Insurance (SSDI) or retirement benefits, which may cause additional deposits to appear in the same month. The SSA clarified that this overlap does not mean extra benefits were added; the deposits simply reflect each program’s separate schedule.

Retirement, survivor, and SSDI benefits will continue to follow their standard cycle, usually tied to the recipient’s birth date.

Populations Most Affected by the Adjustment

Groups likely to be impacted include:

- Older adults who rely on SSI as their primary source of income.

- Individuals with disabilities who manage multiple benefit streams.

- Families caring for children receiving SSI-related disability support.

- Households living on fixed incomes with monthly expenses aligned to benefit dates.

According to the National Council on Aging, more than 40% of older adults living alone depend on SSI to meet basic needs such as housing, utilities, and food.

How the Calendar Shift Affects Household Budgets

Advocacy organizations say the dual-payment month often leads recipients to underestimate the long gap between the December 31 payment and the next regular payment on February 1.

Dr. Marcy Patterson, a senior analyst at the Center on Budget and Policy Priorities, noted that “even routine shifts can create a financial strain when households depend on precise, predictable income. The early January payment essentially compresses two months of expenses into a shorter budgeting window.”

Winter months come with additional financial challenges. Utility bills increase, medical co-payments are more common, and transportation costs often rise due to weather disruptions. With inflationary pressures still affecting many households, the timing of benefits can matter almost as much as the amount.

Guidance from Nonprofit and Federal Agencies

Community assistance groups often increase outreach efforts around the holidays to remind SSI beneficiaries of the two-payment pattern.

Nonprofits recommend that recipients:

- Record payment dates on calendars or mobile devices.

- Set spending limits for January to avoid running short before February 1.

- Contact local agencies if the shift creates hardship.

The SSA provides monthly calendars and automated text alerts to help beneficiaries track changes. Advocates emphasize that awareness helps households prepare for the gap and reduces the risk of missing rent or utility deadlines.

Economic Context Behind SSI and Social Security Payments

Although the early-payment shift is procedural, it comes at a time when many low-income households are experiencing increased costs.

Recent inflation reports from the U.S. Bureau of Labor Statistics show gradual cooling in national inflation rates, but essentials such as housing, medical care, and food remain elevated compared with pre-pandemic levels.

Dr. Samuel Ortiz, an economist at Georgetown University, said the timing highlights the underlying vulnerability of SSI beneficiaries. “Many recipients rely entirely on a modest benefit amount, so even a predictable shift can disrupt their budget. The conversation also reminds us that SSI benefit levels have not kept pace with the cost of living in many regions.”

SSI benefits will increase modestly in 2026 due to the annual Cost-of-Living Adjustment (COLA), which is tied to inflation. More details on the 2026 adjustment are expected from the SSA in October.

Historical Background on Early SSI Payments

Early SSI payments have occurred in previous years, including 2017, 2018, 2023, and 2024.

Federal budget analysts note that the system was designed this way because SSI, unlike other Social Security programs, is partly rooted in federal benefit timing rules established in the 1970s.

Payments cannot be issued on:

- Weekends

- Federal holidays

- Days when banking systems are closed

This rule distinguishes SSI from retirement and SSDI benefits, which use a different schedule introduced in 1997.

Congressional Discussions on Updating the System

In recent years, some members of Congress have questioned whether the payment schedule should be modernized to reduce confusion. Proposals have included:

- Allowing SSI payments to occur on non-business days

- Increasing notifications and outreach

- Updating the payment calendar annually for clearer transparency

No legislative changes are currently scheduled for debate, but advocates argue the issue resurfaces each time a double-payment month occurs.

How Beneficiaries Can Confirm Their Payment Dates

The SSA recommends that SSI recipients verify payment dates through the mySocialSecurity online portal. The site lists upcoming deposits, projected benefit amounts, and banking details.

SSA field offices, national hotlines, and authorized third-party providers can also confirm payment schedules.

Beneficiaries who receive payments through Direct Express debit cards can view deposit notifications through the mobile app or automated phone system.

What To Do If a Payment Does Not Arrive

The SSA advises beneficiaries to wait at least three business days before reporting a missing payment.

If the payment still does not appear, recipients should:

- Confirm bank or Direct Express account details.

- Contact the SSA directly.

- Report any suspected fraud or identity theft immediately.

Most delays, according to SSA representatives, stem from bank processing issues rather than agency errors.

$2,000 Stimulus Talks Explained: What’s Being Proposed and What’s Still Uncertain

Looking Ahead to 2026 and Beyond

The early payment issued on December 31 will not affect eligibility, COLA increases, or benefit amounts for 2026.

SSA calendars show that additional holiday-related shifts are expected in 2027 and 2028.

Economists say the recurring discussions surrounding early payments may bring renewed attention to broader reforms for SSI, including proposals to increase benefit levels, adjust asset limits, or streamline eligibility reviews.

FAQs About Two Social Security Payments

Why are SSI recipients getting two payments in December?

New Year’s Day is a federal holiday, so January’s payment must be issued on the previous business day.

Is the second payment extra money?

No. It is the January 2026 benefit paid early.

Are retirement or SSDI recipients affected?

No. Only SSI follows the first-of-month rule.

Will there be a long gap before the next payment?

Yes. The gap between Dec. 31 and Feb. 1 can exceed four weeks.

How can I prepare for the shift?

Track payment dates, plan January expenses carefully, and seek assistance if necessary.