The Social Security error affecting a growing number of retirees involves miscalculating or misreporting income under the Social Security Administration’s (SSA) earnings limit rules. This often-overlooked mistake can sharply reduce or temporarily eliminate monthly benefits, especially for early claimants who continue earning income. Financial analysts say the issue is accelerating due to rising part-time work among retirees and widespread confusion about how the system works.

One Small Social Security Error Could Reduce Your Entire $2,000 Benefit

| Key Fact | Detail / Statistic |

|---|---|

| Annual earnings limit before full retirement age | $23,400 in 2025 |

| Benefit reduction formula | $1 withheld for each $2 earned above the limit |

| Early-claiming penalty | Up to a 30% permanent reduction |

| Beneficiaries affected by overpayments in 2023 | 1 million+ |

| Percentage of Americans claiming early (age 62) | ~30% |

| Official Website | SSA.gov |

Understanding the Social Security Error That Can Reduce Benefits

A growing number of Americans are discovering that working after claiming early Social Security benefits can lead to unexpected payment reductions. The most common Social Security error occurs when retirees unintentionally exceed the annual earnings limit or fail to report income accurately.

According to Stephen Goss, chief actuary for the Social Security Administration (SSA), the retirement earnings test “remains one of the most misunderstood parts of the program.” He explained in a recent briefing that confusion surrounding wage reporting leads to preventable benefit reductions and, in some cases, costly overpayment notices.

This issue is especially relevant as older Americans stay in the workforce longer. Data from the Bureau of Labor Statistics (BLS) show that nearly 27% of Americans aged 65–74 are working or seeking work—one of the highest rates in U.S. history.

Why Early Earners Face the Highest Risk

The Earnings Limit Explained

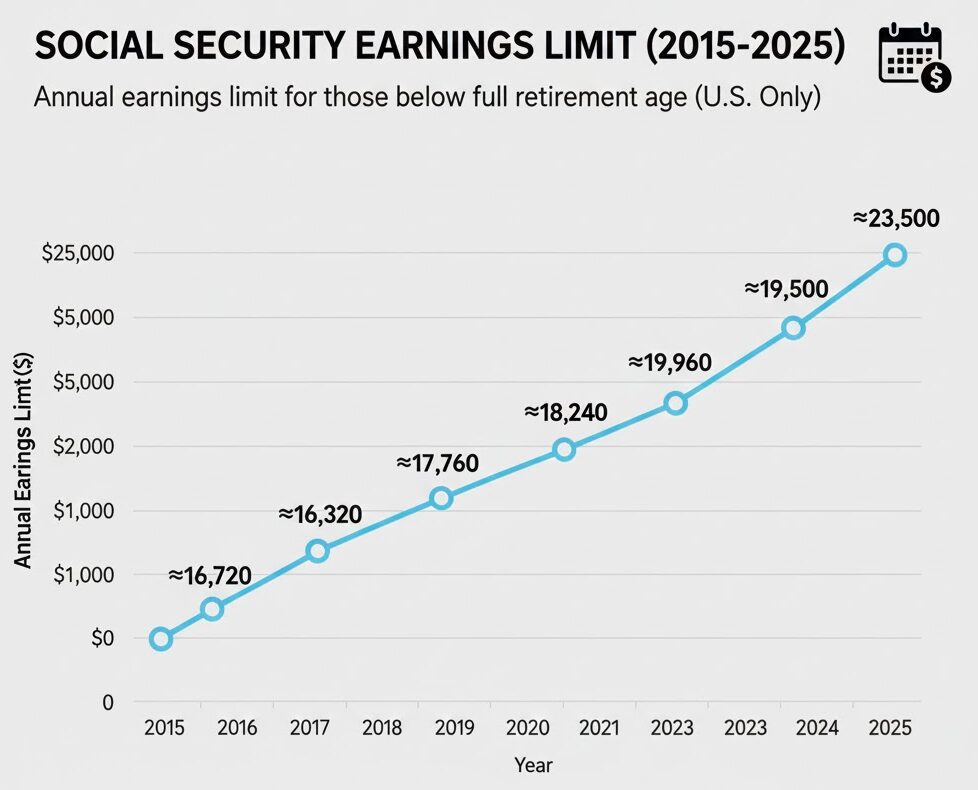

The earnings limit applies to anyone who collects Social Security before reaching their full retirement age (FRA), which varies by birth year but currently ranges from 66 to 67.

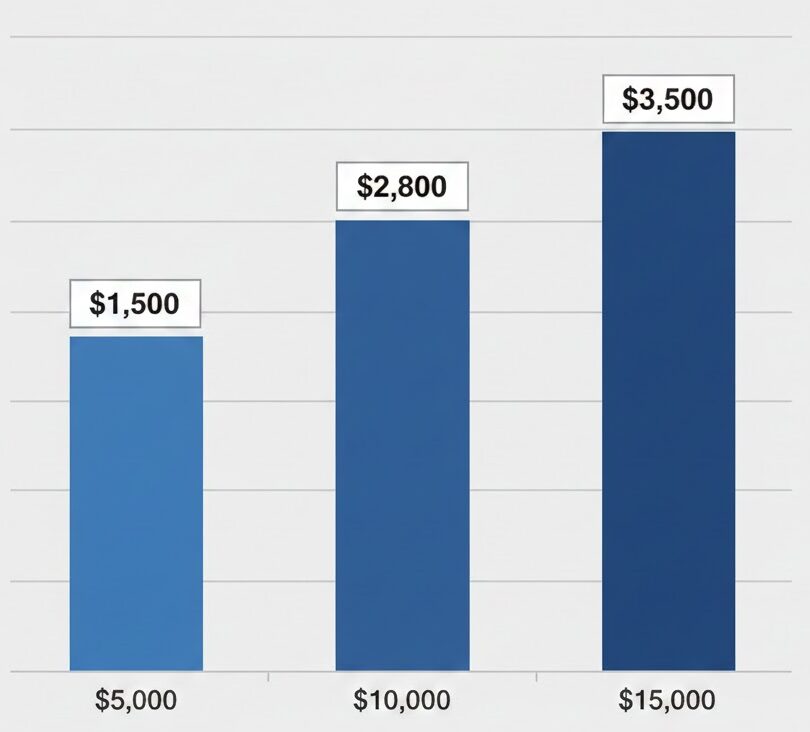

In 2025, the limit is $23,400. If a retiree earns more than that amount from wages or self-employment, the SSA will withhold $1 for every $2 above the limit.

For someone who exceeds the limit by $5,000, this could mean a reduction of $2,500, enough to eliminate an entire month of benefits—often around $2,000 for many households.

How Reductions Occur

The SSA adjusts benefits based on:

- employer wage reports

- annual tax filings

- direct statements from workers

However, the timing of adjustments often leads to confusion. The SSA may reduce payments months after income is earned, resulting in sudden shortfalls that retirees did not anticipate.

Common Reporting Errors That Trigger Benefit Losses

Incorrect or Missing Wage Records

Wage reporting errors are among the most frequent causes of benefit miscalculations. According to a 2024 audit by the SSA Office of Inspector General, discrepancies often arise from:

- incorrect employer wage reports

- delayed payroll submissions

- mismatched Social Security numbers

A misreported year can permanently change a retiree’s benefit amount because the SSA calculates payments using a 35-year average wage index.

Failing to Report Return to Work

Many retirees assume that part-time or seasonal work does not affect benefits. Yet the SSA requires reporting all earnings. Failure to do so can lead to:

- retroactive benefit reductions

- large overpayment letters

- payment suspensions

In 2023 alone, the SSA issued more than $21 billion in new overpayment notices, according to agency records.

Misunderstanding Spousal or Survivor Benefits

Retirees sometimes claim a benefit early without understanding how it interacts with spousal or survivor benefits. According to Dr. Linda Marcus, a retirement policy expert at the Urban Institute, “Choosing the wrong benefit sequence can reduce household income for years. Many families do not realize that early claiming permanently lowers spousal or survivor benefits as well.”

The Scope of the Problem: How Many Americans Are Affected?

More than 50 million Americans receive retirement benefits, and an increasing share of them continue working. Analysts say the issue is intensifying due to:

- rising inflation pushing retirees back into the workforce

- delays in claiming full retirement age

- lack of financial literacy on Social Security rules

A 2024 survey from the National Institute on Retirement Security found that 43% of older workers could not correctly explain how the earnings limit works.

Historical Context: Why the Earnings Limit Exists

The retirement earnings test was established in 1939 and has been modified several times. Originally, it was designed to:

- encourage workers to leave the labor force during the Great Depression

- maintain solvency of the Social Security program

- adjust benefits for early claimants

Although often misunderstood as a “tax,” the earnings test is not permanent. Once a retiree reaches FRA, the SSA recalculates benefits to credit months in which payments were withheld.

However, the temporary reductions can still cause significant short-term financial strain, particularly for households relying on monthly payments to cover essential expenses like food and housing.

How Retirees Can Protect Their Social Security Benefits

1. Track All Work-Related Income

Retirees should maintain detailed records of wages and self-employment income. Contract work, bonuses, and seasonal jobs must all be included in earnings calculations.

2. Review Earnings Statements Annually

The SSA recommends checking your my Social Security account each year to ensure that wage records are correct. Errors older than three years can be difficult to correct.

3. Consult Financial Experts Before Claiming Early

The Center for Retirement Research at Boston College advises individuals to run long-term projections before claiming early. Delaying benefits until age 67 or 70 can significantly increase lifetime income.

4. Report Work Changes Immediately

Notifying the SSA of any return to work helps prevent large overpayments and reduces the risk of surprise benefit suspensions.

Policy Debate: Should the Earnings Limit Be Reformed?

Public policy researchers are increasingly questioning whether the earnings limit discourages older Americans from staying in the labor force. The Brookings Institution has argued that the system “effectively penalizes work at a time when the U.S. economy needs experienced labor.”

At the same time, conservatives warn that eliminating the earnings limit without adjusting funding could create long-term solvency issues. The latest Social Security Trustees Report projects that the program’s retirement fund could be depleted by 2033 without legislative action.

Members of Congress from both parties have proposed reforms, including:

- raising or eliminating the earnings limit

- enhancing SSA communications and notifications

- simplifying benefit formulas for early claimants

These proposals remain under review, with no final action expected until after the next major budget session.

This Week’s Social Security Payouts Reach $4018 — Check If Your Deposit Is Included

Voices From Retirees: Real-Life Impact

Advocacy groups say the adjustment letters often arrive with little warning.

One retiree from Ohio, Mark Ellison, shared his experience with a local community organization: “I thought I understood the rules. Then I got a notice saying I owed back two months of benefits. It put real pressure on my budget.”

Another retiree in Florida described her overpayment notice as “devastating,” saying she had never been told how bonuses would affect her earnings limit.

FAQs About One Small Social Security Error Could Reduce Your Entire $2,000 Benefit

Does the earnings limit apply to pension income or investment income?

No. The earnings limit applies only to work income, including wages and self-employment.

Can benefits withheld because of the earnings test be recovered?

Yes. Once a worker reaches full retirement age, the SSA recalculates benefits to credit months in which payments were withheld.

Should retirees avoid working altogether?

Not necessarily. Many retirees benefit financially from continued work, but planning and accurate reporting are essential.