Millions of Americans on Social Security are suddenly eligible for a $1,500 health care boost have circulated widely, raising hopes among retirees and people with disabilities facing rising medical costs. The figure has appeared frequently online, often framed as a new benefit tied directly to Social Security.

The underlying reality is more complex. The $1,500 amount refers to a proposed health care credit, not a Social Security benefit increase, and it has not yet been enacted into law. While some people who receive Social Security could qualify if the proposal passes, eligibility would depend on insurance status, age, and income—not simply on receiving Social Security.

This article explains what the $1,500 Health Care Boost actually refers to, where the proposal stands, who could benefit, who would not, and what remains uncertain.

$1,500 Health Care Boost

| Key Issue | What It Means |

|---|---|

| $1,500 amount | Proposed annual health care credit |

| Social Security link | Overlapping eligibility, separate programs |

| Automatic payment | No |

| Current status | Proposal only |

What the $1,500 Health Care Boost Refers To

The $1,500 Health Care Boost describes a potential annual health care credit of up to $1,500, discussed in recent congressional proposals addressing health insurance affordability. The funds would be restricted for health-related expenses and would not be paid as unrestricted cash.

Social Security retirement, disability, and Supplemental Security Income (SSI) benefits are administered by the Social Security Administration (SSA) and governed by long-standing federal law. None of the current proposals amend those statutes or authorize new payments through the SSA.

Instead, the $1,500 figure appears in health policy debates focused on replacing or supplementing Affordable Care Act (ACA) subsidies that help individuals purchase private health insurance.

Where the $1,500 Proposal Comes From

Several lawmakers have proposed health care credits as a response to the scheduled expiration of enhanced ACA premium subsidies. These subsidies, expanded during the pandemic, significantly lowered insurance costs for millions of Americans but are temporary unless Congress acts.

Under some proposals, eligible individuals would receive:

- A refundable health care tax credit, or

- A direct contribution to a health savings–type account, usable only for medical expenses.

Supporters argue this approach offers predictability and flexibility. Critics argue it may not fully offset rising premiums.

Why Social Security Recipients Are Mentioned

The confusion stems from overlapping populations, not overlapping programs. Many Americans who receive Social Security also:

- Are under age 65 and not yet eligible for Medicare,

- Rely on individual health insurance plans, or

- Receive Social Security Disability Insurance (SSDI) but obtain coverage outside Medicare.

In those cases, a person could be on Social Security and also qualify for a health care credit—without the credit being connected to Social Security itself. A senior health economist explained it this way: “The eligibility circles overlap, but the programs do not.”

Who Could Qualify If the Proposal of $1,500 Health Care Boost Passes

Although details vary, most versions of the proposal share common eligibility features.

Age and Insurance Status

The largest credits—up to $1,500—are typically aimed at adults aged 50 to 64, a group that includes many early Social Security claimants. Coverage would usually need to come from the individual insurance market, not Medicare.

Income Limits

Income thresholds would likely apply, often tied to a percentage of the federal poverty level. Higher-income households would receive reduced or no assistance.

Plan Requirements

Some proposals require enrollment in specific types of health plans, which would exclude many employer-sponsored or government plans.

Who Would Not Qualify for $1,500 Health Care Boost

Despite the attention, large groups of Social Security recipients would likely be excluded:

- Most Medicare beneficiaries (65 and older)

- Individuals on Medicaid

- People with employer-sponsored insurance

- Social Security recipients without qualifying health coverage

This distinction is critical. Medicare already subsidizes coverage heavily, which is why most Medicare enrollees are not included in these proposals.

Case Examples: How Eligibility Could Work

Case 1:

A 62-year-old woman receiving early Social Security retirement benefits buys her own ACA marketplace plan. If income and plan requirements are met, she could qualify if the proposal becomes law.

Case 2:

A 70-year-old man on Social Security and Medicare would almost certainly not qualify, because Medicare coverage is excluded.

Case 3:

A 55-year-old SSDI recipient with private insurance through the marketplace might qualify, depending on income and plan design.

These examples illustrate why eligibility depends on health coverage, not Social Security status alone.

How the Credit Would Be Delivered

If enacted, the credit would likely be administered by the Internal Revenue Service (IRS) or the Centers for Medicare & Medicaid Services (CMS), not the SSA. Delivery mechanisms could include:

- Advance monthly credits applied to premiums, or

- Annual credits claimed through tax filings.

No proposal authorizes the SSA to issue payments related to this credit.

Budget and Fiscal Impact

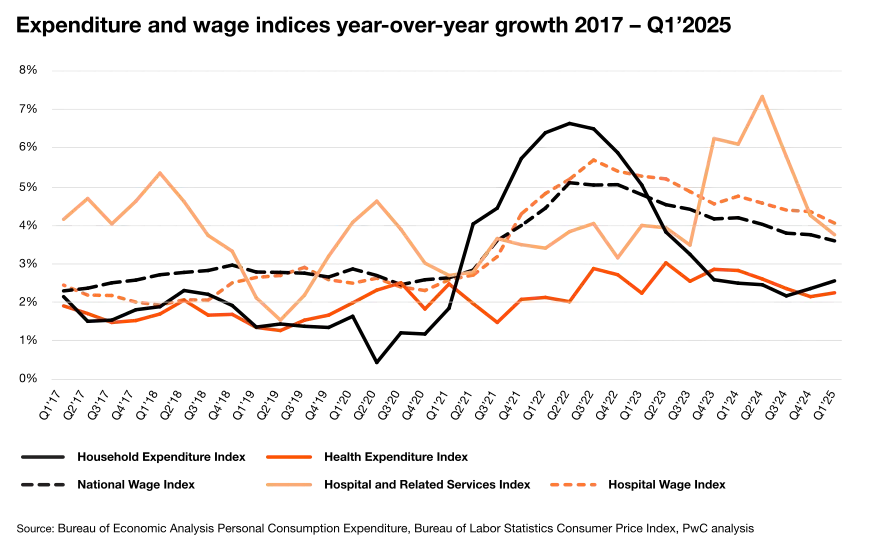

According to preliminary congressional estimates, a nationwide health care credit of this size could cost tens of billions of dollars annually, depending on enrollment and eligibility rules. Lawmakers remain divided over how to fund such assistance.

Fiscal conservatives argue fixed credits control costs better than open-ended subsidies. Others counter that fixed amounts may fail to keep pace with rising premiums.

Fraud and Scam Warnings

Federal agencies have warned repeatedly that misleading claims about “new payments” often lead to scams targeting seniors. The SSA has stressed that:

- It does not ask for personal information to issue surprise payments.

- Any new benefit would be announced through official channels.

Beneficiaries are urged to rely on ssa.gov and cms.gov, not social media claims or unsolicited messages.

How This Fits With Social Security Adjustments

For most beneficiaries, the only automatic annual increase remains the cost-of-living adjustment (COLA), which reflects inflation. Health care credits, by contrast, are policy tools debated separately from Social Security financing.

Experts note that while both affect retirees’ finances, conflating them leads to misunderstanding and unrealistic expectations.

Legislative Timeline: What Happens Next

Best-Case Scenario

Congress passes legislation extending or replacing ACA subsidies before they expire, and agencies issue guidance months later.

Likely Scenario

Negotiations continue, with temporary extensions or partial reforms debated well into the next legislative session.

Until a bill passes both chambers and is signed into law, no payments are authorized.

What Readers Should Do Now

- Treat claims of automatic $1,500 payments with caution.

- Monitor official announcements from Congress, CMS, and the SSA.

- Review current health insurance coverage and upcoming enrollment periods.

- Seek guidance from licensed health insurance counselors if unsure.

Related Links

Your First Social Security Check of 2026: Check Which Day It Will Be Sent

Two Social Security Payments Coming This Month Due to Year-End Calendar Shift – What You Should Know

Health care affordability remains one of the largest financial challenges for Americans on fixed incomes. Whether lawmakers extend existing subsidies or replace them with new credits will shape costs for millions—including some who rely on Social Security.

For now, the $1,500 figure represents a policy proposal, not a guarantee. Clear eligibility rules will exist only if Congress turns the idea into law.

FAQs About $1,500 Health Care Boost

Is this a Social Security benefit increase?

No. It is a proposed health care credit, not a Social Security payment.

Will everyone on Social Security qualify?

No. Eligibility depends on insurance coverage, age, income, and final legislation.

Has the proposal passed?

No. It remains under congressional debate.

Could some Social Security recipients qualify?

Yes, particularly those under 65 with individual health insurance.