On December 17, 2025, millions of Social Security beneficiaries will receive their monthly payments, with some individuals receiving up to $4,018 depending on their work history, eligibility, and benefit type.

This distribution is part of the regular Social Security payment schedule and marks the last payment cycle for 2025 before the 2026 cost-of-living adjustment (COLA) takes effect. Here’s everything you need to know about who qualifies for these payments and what changes are coming in January.

December 17 Social Security Deposit

| Key Fact | Detail |

|---|---|

| Payment Date | December 17, 2025 (third Wednesday of the month) |

| Eligibility | Beneficiaries born between the 11th and 20th of any month |

| Maximum Payment | Up to $4,018 for those claiming at full retirement age |

| Average Payment | $1,500 to $2,000 for most retired workers and disabled beneficiaries |

| 2026 COLA Adjustment | 2.8% increase starting January 2026 |

Who Receives December 17 Social Security Deposit?

The Social Security Administration (SSA) follows a strict monthly payment schedule based on recipients’ birthdays. On December 17, those born between the 11th and 20th of any month will receive their monthly payments. These beneficiaries include retired workers, survivors, and people receiving Social Security Disability Insurance (SSDI).

Social Security payments are a lifeline for many Americans, especially seniors and those living with disabilities. For some, this payment is their primary source of income, and it is essential for basic needs such as food, housing, and healthcare.

Who Gets the Maximum $4,018 Benefit?

The $4,018 maximum benefit applies to individuals who:

- Have worked and paid Social Security taxes for a long career,

- Have reached the full retirement age (FRA), which is 67 for people born in 1960 or later, and

- Have earned the maximum taxable income over their working life, contributing to the highest possible benefit amount.

For those who retired at full retirement age (FRA), the maximum Social Security payment for 2025 will be $4,018 per month. However, this amount is typically for individuals who worked for 35 years or more and earned the highest wages throughout their careers.

How Much Will Most People Receive?

While $4,018 represents the highest benefit for full retirees, the average monthly benefit is much lower. According to SSA data, the typical retirement benefit in 2025 is around $1,500 to $2,000 per month. Benefits for disabled workers and survivors will vary but tend to fall within this range as well.

For example, a retiree who starts receiving benefits at 62 years old (early retirement age) will have their monthly benefit reduced based on the number of months they claim before reaching full retirement age. The reduction is approximately 0.5% for each month before the FRA.

Cost-of-Living Adjustment (COLA) in 2026

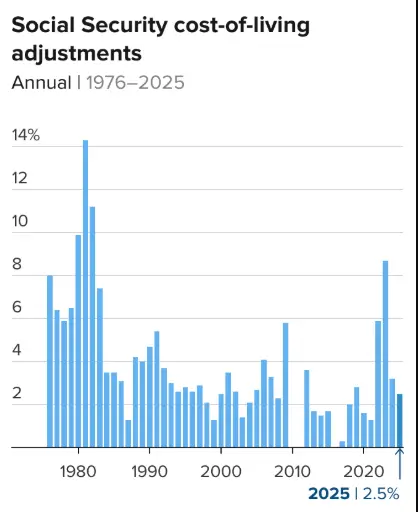

The COLA for 2026 is scheduled to increase by 2.8%, which will raise monthly payments starting in January 2026. This is a standard adjustment made each year to help beneficiaries keep up with inflation. While inflation has been a concern in recent years, this increase will be slightly higher than the 2025 COLA increase of 1.6%.

For example, if a retiree currently receives $1,500 per month, their payment will increase by about $42 in January 2026 due to the COLA increase. Though the COLA is helpful, experts warn that rising costs, particularly for healthcare, may continue to outpace the adjustment for many seniors.

For many beneficiaries, this increase can mean the difference between maintaining their purchasing power or falling behind, especially as prices for everyday goods, health insurance premiums, and utilities continue to rise.

How Payments Are Delivered

Social Security payments are typically made through direct deposit to beneficiaries’ bank accounts, but there are other ways beneficiaries may receive their payments:

- Direct Deposit: Payments are sent directly to the bank account associated with the recipient’s Social Security benefits.

- Direct Express Card: Those without bank accounts can opt for a Direct Express® Debit MasterCard, which is used to access Social Security payments.

- Paper Checks: Although paper checks have been largely phased out, some recipients may still receive their benefits by mail if they have not enrolled in direct deposit.

Recipients who do not see a deposit on the expected date should wait three business days before contacting the SSA, as some delays can occur due to weekends or holidays.

The Significance of Social Security Payments for Retirees and Disabled Beneficiaries

Retirees and Disability Beneficiaries

While the Social Security program is primarily seen as a retirement benefit, SSDI and survivor benefits are also a critical part of the equation. SSDI benefits provide financial support for individuals who have been diagnosed with a disability and are unable to work, while survivor benefits help family members of deceased workers.

Mary Thompson, an economist at Pew Research Center, emphasizes that “Social Security is one of the most reliable and crucial support systems for people with disabilities and retirees, particularly given the increase in life expectancy. Social Security benefits offer stability, which can be essential for families relying on a single income.”

How Social Security Benefits Are Calculated

The amount of Social Security benefits a person is eligible for depends on their work history and earnings record. The SSA uses a formula based on a person’s 35 highest-earning years to calculate their Primary Insurance Amount (PIA), which is the base amount of their benefit.

- Early Retirement: If a person chooses to retire before their FRA, their benefits will be reduced.

- Full Retirement Age (FRA): FRA varies depending on birth year. For those born in 1960 or later, the FRA is 67 years old.

- Delaying Retirement: By delaying retirement until age 70, individuals can increase their monthly benefit by 8% per year beyond their FRA.

This work history-based calculation makes Social Security benefits vital for individuals who have worked consistently over their lifetime, but it can disadvantage those who have faced interruptions in their work history, such as stay-at-home parents or those who had to leave the workforce due to illness or caregiving responsibilities.

Expert Opinions on the Future of Social Security

Challenges Facing the Social Security Trust Fund

Despite the importance of Social Security, experts warn that the Social Security Trust Fund is projected to face significant funding challenges in the coming decades. According to the Social Security Trustees 2025 Report, if no changes are made, the Trust Fund will be depleted by 2034, meaning that Social Security payments could face significant cuts.

Dr. John Hamilton, a professor of economics at Harvard University, notes, “Without addressing the long-term funding issues of the Social Security system, the future of these benefits could be jeopardized. Lawmakers will have to make decisions about increasing revenue or reducing benefits, both of which will significantly impact recipients.”

What Happens After December 17

The December 17 payments represent the last Social Security checks issued in 2025 under the current payment structure. Starting January 2026, beneficiaries will begin receiving their adjusted payments with the COLA increase. These increases will help offset rising living costs but may still fall short for many recipients, especially as healthcare costs rise.

The Shift in Payment Timing

For those whose payments fall at the end of the month, such as beneficiaries born between the 21st and 31st, their payments will be issued on December 24, 2025 (just ahead of Christmas). This payment is important for many recipients who rely on Social Security for essential holiday expenses.

Related Links

2026 Social Security Raise: Which Groups Receive the Increased Payment Before Everyone Else?

Florida SNAP Payments for December: Who Gets Benefits This Week?

Preparing for 2026 Adjustments

The December 17 payment is a critical financial lifeline for millions of Social Security recipients. As beneficiaries receive their checks this week, they are also preparing for the 2.8% COLA increase that will take effect in January 2026.

Although the increase will provide some relief, experts recommend planning ahead for any additional costs in the coming year. By understanding how benefits are calculated and the potential impact of future changes to the Social Security system, beneficiaries can better prepare for the financial challenges ahead.