Social Security recipients across the United States will see significant updates in December 2025. These include double Supplemental Security Income (SSI) payments, an early deposit for January 2026 benefits, and a 2.8% cost-of-living adjustment (COLA) set to take effect in 2026.

As the holiday season approaches, the Social Security Administration (SSA) also warns beneficiaries about an increase in scams targeting those receiving Social Security benefits. Here’s a detailed breakdown of these key updates.

December 2025 Social Security

| Key Fact | Detail/Statistic |

|---|---|

| Double SSI Payments | SSI recipients will receive two payments in December: one for December and another for January. |

| 2026 COLA Increase | A 2.8% increase in benefits will start with January 2026 payments, including early payments on Dec. 31, 2025. |

| Social Security Payment Schedule | Regular payments based on birth dates; SSI payments on Dec. 1 and Dec. 31. |

| Scam Alerts | SSA warns about scams, especially related to COLA and holiday benefits. |

December Social Security Payments: Double SSI Payments and Holiday Schedule

Each year, Social Security adjusts its payment schedule for December to account for holidays like New Year’s Day, which falls on January 1, 2026. This year, the Social Security Administration (SSA) has confirmed that January 2026 SSI payments will be made early on December 31, 2025. As a result, many SSI recipients will receive two payments this month:

- The regular December payment will be issued on December 1.

- An early January payment will be issued on December 31.

These early payments are a regular feature when January 1 is a holiday. However, this advance does not constitute an additional payment—it’s simply the January deposit paid in advance. No other payments will be issued in January 2026.

How the 2026 COLA Increase Will Affect Payments

A key highlight for Social Security recipients this year is the 2.8% COLA increase that will be implemented starting in January 2026. This adjustment is designed to help recipients keep pace with inflation, particularly in housing, healthcare, and food costs.

How the 2.8% COLA Will Impact Social Security Beneficiaries:

- Retired workers will see an average increase of $56 per month, raising the average monthly benefit from $2,015 to $2,071.

- Disabled workers will experience an increase from $1,586 to $1,630 per month.

- Couples receiving Social Security will see their monthly benefits rise by about $88, from $3,120 to $3,208.

This increase will be reflected in the early payment for January 2026 on December 31, 2025, for SSI recipients. Regular Social Security beneficiaries will see the increase starting with their first payment of the new year. This COLA increase is a vital boost, particularly for those who rely heavily on fixed incomes and face rising costs.

December Payment Schedule for Regular Social Security Beneficiaries

The SSA issues Social Security payments based on birth dates. Here’s how the payment schedule breaks down in December:

- December 3, 2025: Payments for those born between the 1st and 10th of the month.

- December 10, 2025: Payments for those born between the 11th and 20th.

- December 17, 2025: Payments for those born between the 21st and 31st.

For SSI recipients, the December 1 and December 31 deposits will cover the December and January benefits, respectively.

Scam Warnings: Protecting Social Security Beneficiaries

The SSA has issued important fraud warnings due to an uptick in scams targeting Social Security beneficiaries, especially around the COLA increase and holiday season.

Common Social Security Scams to Watch Out For:

- Phishing emails or phone calls claiming to be from the SSA, asking for sensitive personal information.

- Fraudulent claims that you must pay a fee to receive COLA adjustments or to confirm your eligibility for benefits.

- Scammers who promise extra benefits for a fee or threaten to suspend benefits if personal information is not provided.

The SSA has advised recipients to never give personal information over the phone or in response to unsolicited emails or texts. Any legitimate correspondence from the SSA will come through official channels, such as the SSA.gov website or secure direct mail.

Report Social Security Scams:

- If you receive a suspicious call or message, report it immediately to the SSA.

- You can use the SSA’s fraud reporting hotline or visit the official website to file a complaint.

- Never provide payment or personal information without verifying the authenticity of the request.

Implications for Low-Income and Disability Beneficiaries

The COLA increase is particularly crucial for low-income and disabled beneficiaries, many of whom depend on Social Security or SSI for their primary source of income. With the rise in living costs, the COLA adjustment helps offset the inflationary pressures faced by these individuals, making it easier for them to maintain a basic standard of living.

In addition to COLA, SSI payments are critical for those with disabilities who are unable to work. The early December 31 deposit provides an important buffer for those who rely on timely benefits to cover essential needs, including food, utilities, and housing.

Social Security’s Role in Economic Security

Social Security plays a significant role in economic security for millions of Americans, particularly older adults, low-income individuals, and people with disabilities. With more than 60 million Americans relying on Social Security in 2025, including over 8 million SSI recipients, it is a vital component of the nation’s safety net. The COLA increases are crucial in helping recipients manage inflation and rising costs.

Experts note that while Social Security provides a foundation of financial support, it is often not enough to cover all living expenses, which is why it is essential for beneficiaries to supplement their benefits with savings, pensions, or other sources of income.

Related Links

Florida SNAP Payments for December: Who Gets Benefits This Week?

2026 Social Security Raise: Which Groups Receive the Increased Payment Before Everyone Else?

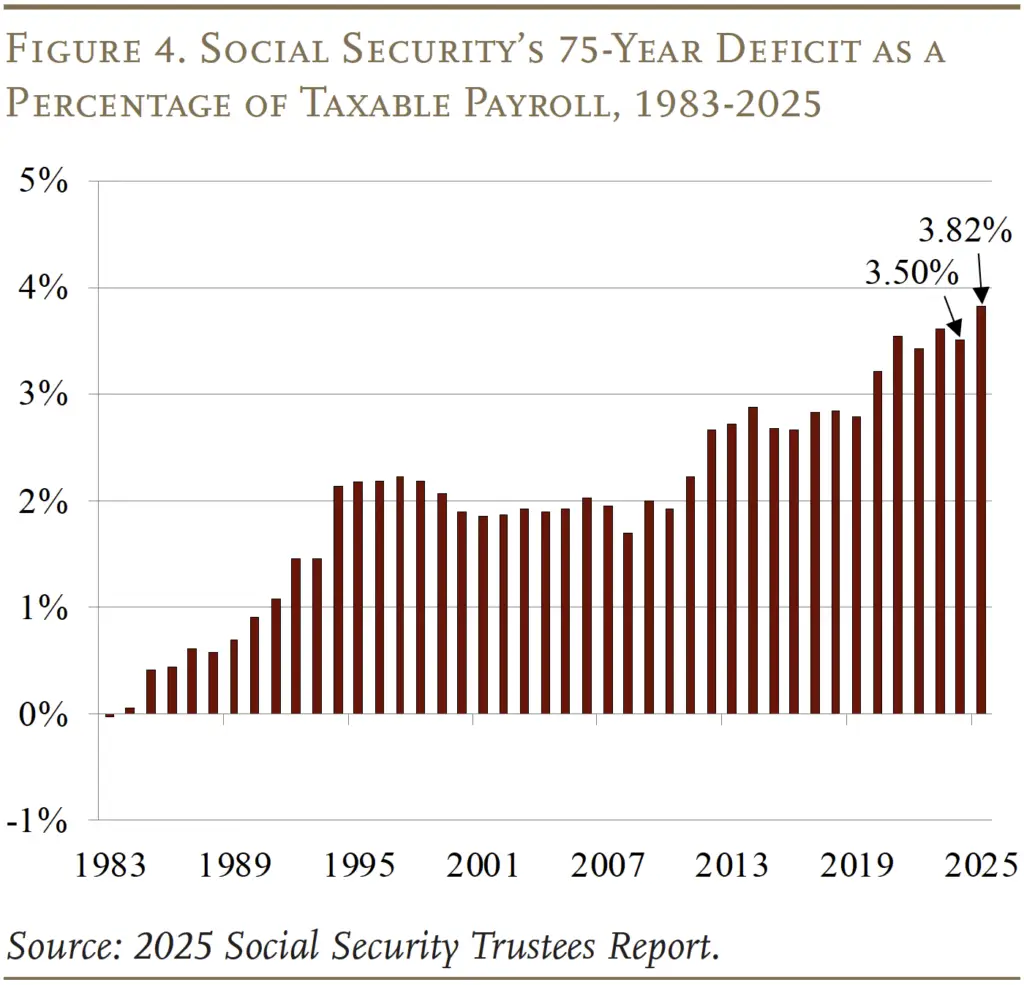

Future Projections for Social Security

Looking ahead, the Social Security Administration has made it clear that changes in policy and benefit structures may be necessary as the aging population continues to increase. Discussions about the long-term solvency of the Social Security program are ongoing, and there may be further adjustments to benefits or taxes in future years to ensure that the program remains viable.

For now, however, the 2026 COLA and other updates reflect the SSA’s ongoing efforts to address inflation and support beneficiaries in an increasingly expensive environment.

December 2025 marks a significant period for Social Security and SSI recipients, with double payments, the 2026 COLA increase, and heightened fraud warnings for beneficiaries.

As the year ends, it is important for beneficiaries to be aware of the early payment schedule, plan for the COLA adjustment, and protect themselves from scams. By staying informed and vigilant, Social Security recipients can navigate these changes and ensure their financial well-being in the coming year.