Alaska will issue Alaska’s Final PFD of the Year on December 18, closing out the state’s primary dividend distribution cycle for eligible residents. The payment, administered by the Alaska Department of Revenue, follows strict residency and legal requirements and represents the last major opportunity this year for approved applicants to receive funds.

Alaska’s Final PFD of the Year

| Key Fact | Detail |

|---|---|

| Final 2025 payment date | December 18 |

| Program | Permanent Fund Dividend (PFD) |

| Eligibility year | Full prior calendar year |

| Payment methods | Direct deposit or paper check |

| Tax treatment | Federally taxable income |

Alaska’s Final PFD of the Year on December 18 marks the conclusion of the state’s annual dividend distribution for most eligible residents. While the payout reflects current fiscal priorities rather than past highs, it remains a critical source of financial support across Alaska. Officials encourage residents to verify eligibility, confirm deposit details, and remain vigilant against fraud as payments are issued.

What Alaska’s Final PFD of the Year Represents

The Permanent Fund Dividend, commonly known as the PFD, is one of Alaska’s most recognizable public policies. Established to ensure residents share in the state’s natural resource wealth, the dividend has become a predictable — though often debated — annual source of income for households across the state.

Alaska’s Final PFD of the Year refers to the last major batch of payments issued before year-end. While limited late approvals may still be paid in January, December 18 marks the practical close of distributions for most recipients.

Origins of the Permanent Fund Dividend

Why the PFD Exists

The Alaska Permanent Fund was created in 1976 through a constitutional amendment that directed a portion of oil revenues into long-term investments. Lawmakers later established the dividend program to distribute part of the fund’s earnings directly to residents.

The goal was twofold:

- Preserve wealth for future generations

- Provide residents with a tangible share of Alaska’s resource economy

Since the first payout in 1982, the PFD has become an enduring feature of Alaska’s fiscal identity.

How the PFD Is Funded and Calculated

The dividend is funded from investment earnings, not directly from oil production. Each year, legislators determine how much of the earnings will be distributed as dividends versus retained for government operations.

This political component explains why PFD amounts can vary significantly from year to year, even when market performance is strong.

Why December 18 Is the Final Major Payment Date

The Alaska Department of Revenue Permanent Fund Dividend Division processes applications year-round and issues payments in scheduled batches. Each batch corresponds to a status deadline, after which eligible applications are queued for payment.

The December 18 batch applies to applications that reached “Eligible-Not Paid” status by the early-December cutoff, making it the final large distribution before the calendar year ends.

Eligibility Criteria for Alaska’s Final PFD of the Year

To qualify, applicants must meet all statutory eligibility criteria, including:

- Continuous Alaska residency during the qualifying year

- Intent to remain an Alaska resident indefinitely

- No claim of residency in another state or country

- Physical presence in Alaska for required periods, unless covered by an allowable absence

- No disqualifying criminal convictions

- Submission of a timely and complete application

Children qualify if a parent or legal guardian files on their behalf and meets the same residency standards.

Allowable Absences Explained

Allowable absences are a critical part of PFD eligibility, especially for:

- College students

- Military service members

- Residents receiving medical treatment outside Alaska

Applicants must document the reason and duration of absence to avoid disqualification.

Eligibility Criteria for Alaska’s Final PFD of the Year

Before expecting payment on December 18, residents should verify:

- Application status shows “Eligible-Not Paid”

- Direct deposit information is accurate

- Mailing address is current (if receiving a check)

- Required documentation has been submitted

The official myPFD portal is the primary tool for checking and updating this information.

How Alaska’s Final PFD of the Year Payments Are Delivered

Direct Deposit

Most recipients receive funds via direct deposit. Deposits typically appear on December 18 or within one business day, depending on bank processing times.

Paper Checks

Paper checks are mailed shortly after the payment date. Delivery may take longer in rural areas due to postal logistics.

Historical Perspective: How This Year Compares

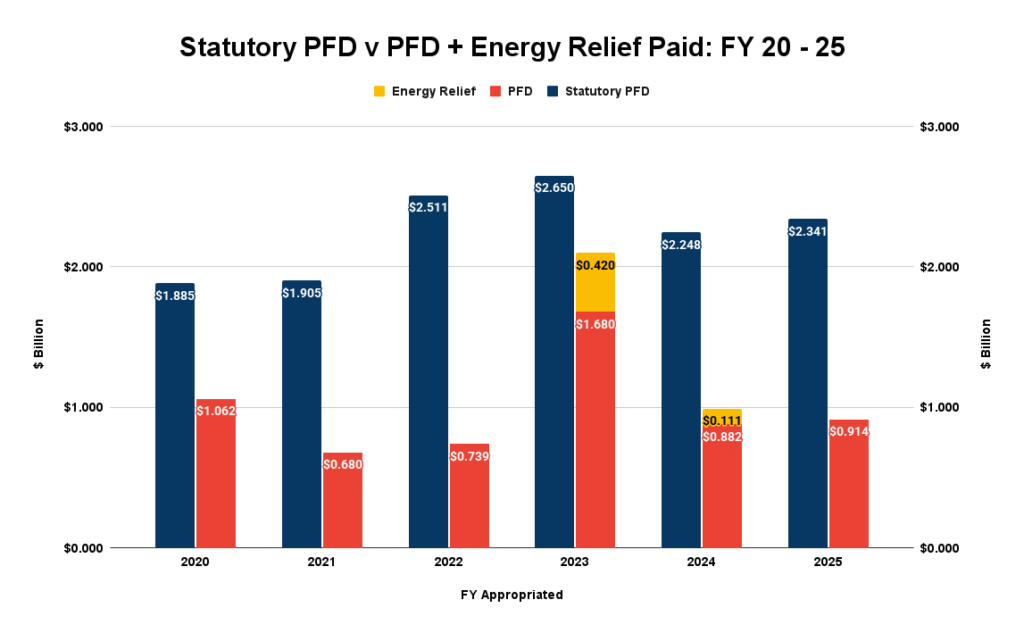

Over the past decade, PFD amounts have ranged widely, influenced by market conditions and legislative choices. Some years included supplemental energy relief payments, while others reflected reduced payouts during budget shortfalls.

Economists note that the current dividend level, while lower than historical peaks, remains significant when adjusted for Alaska’s cost of living.

Urban vs. Rural Impact

In rural Alaska, where food, fuel, and transportation costs are often substantially higher, the PFD plays an outsized role in household budgeting. Many residents rely on the December payment to cover winter heating and supply expenses.

Urban households, while facing lower logistical costs, often use the dividend for debt reduction, savings, or education expenses.

Tax Treatment and Reporting Obligations

Although Alaska does not impose a state income tax, the PFD is federally taxable income. Recipients receive a Form 1099-MISC, which must be reported on federal returns.

Failure to report the dividend can result in IRS notices or penalties. Some applicants choose voluntary federal withholding during the application process.

Interaction With Federal Assistance Programs

Receiving the PFD may affect eligibility for federal programs such as:

- Supplemental Nutrition Assistance Program (SNAP)

- Medicaid

- Supplemental Security Income (SSI)

Because the dividend counts as income, recipients should consult benefit administrators to understand potential impacts.

What to Do If Payment Is Delayed or Missing

If payment does not arrive as expected:

- Check application status on myPFD

- Verify banking or mailing information

- Allow several business days for processing

- Contact the PFD Division if issues persist

Officials advise against relying on unofficial third-party information sources.

Fraud Prevention and Security Warnings

State officials warn that scammers often target residents around payment dates. Common scams include fake emails or messages requesting login credentials or claiming additional “bonus” PFD payments.

The Department of Revenue emphasizes that it does not request sensitive information through unsolicited communications.

Related Links

Trump Pushes Bold Social Security Reform in 39 States—Massive Policy Changes Could Be Coming

December’s Final Social Security Checks Confirmed – Including a Holiday-Week Deposit: Check Details

Future Outlook: What Comes Next for the PFD

Debate over the size and structure of the PFD continues in Alaska’s legislature. Some lawmakers advocate for restoring higher payouts, while others prioritize funding public services and maintaining fiscal stability.

Policy analysts expect discussions around the 2026 dividend to intensify during the next legislative session.

FAQs About Alaska’s Final PFD of the Year

Is December 18 the last payment ever?

No. It is the final payment of the year, not the end of the program.

Can late applicants still be paid?

Yes, if eligibility is resolved before the final cutoff, payment may occur in January.

Is the PFD guaranteed every year?

No. The amount and structure depend on legislative decisions.