Pennsylvania has reopened the refund window for renters and homeowners through its Property Tax/Rent Rebate Program, giving eligible residents more time to apply for housing-related refunds.

The move allows qualifying seniors, people with disabilities, and widows or widowers to claim rebates on rent or property taxes paid, according to the Pennsylvania Department of Revenue.

Pennsylvania Reopens Refund Window

| Key Fact | Detail |

|---|---|

| Program name | Property Tax/Rent Rebate Program |

| Who qualifies | Seniors, people with disabilities, widows/widowers |

| Maximum rebate | Up to $1,000 (plus supplements in some areas) |

| Application methods | Online, mail, in person |

| Extended filing window | Through end of calendar year |

What Is the Property Tax/Rent Rebate Program?

Pennsylvania’s Property Tax/Rent Rebate Program is a state-funded initiative that provides annual rebates to eligible renters and homeowners with limited incomes. The program helps offset housing costs by returning a portion of property taxes paid by homeowners or rent paid by tenants.

Administered by the Pennsylvania Department of Revenue, the program operates independently of federal tax systems. Applicants do not need to owe Pennsylvania income tax to qualify, and the rebate does not affect eligibility for most other assistance programs.

State officials describe the rebate as a targeted form of housing stability support rather than a general tax refund.

Pennsylvania Reopens Refund Window for Renters and Homeowners: Why the Extension Matters

Reopening the application window reflects concerns that thousands of eligible residents miss deadlines each year. State officials and advocacy groups point to challenges such as limited internet access, complex paperwork, health issues, and confusion about eligibility rules.

By extending the filing period, Pennsylvania aims to reduce unclaimed benefits. According to prior state estimates, millions of dollars in available rebates go unclaimed annually.

“The rebate only helps people if they can actually apply,” said a policy analyst at a Pennsylvania nonprofit that assists older adults with benefits enrollment.

Who Is Eligible For Pennsylvania Refund?

Age, Disability, and Status Requirements

Applicants must fall into at least one qualifying category:

- Age 65 or older

- Widow or widower age 50 or older

- Person with a permanent disability age 18 or older

Eligibility is verified through documentation submitted with the application.

Income Limits

Household income must fall below a state-set threshold. Pennsylvania excludes certain income sources—such as a portion of Social Security benefits—when determining eligibility. Both renters and homeowners must occupy the property as their primary residence in Pennsylvania.

How Much Can Applicants Receive?

The standard rebate is up to $1,000, depending on income and housing costs.

Supplemental Rebates

Some homeowners may qualify for supplemental rebates if they live in areas with higher property taxes. These supplements are intended to reflect regional cost differences and are calculated automatically for eligible applicants.

How Renters’ Rebates Are Calculated

Renters often misunderstand how rebates are determined. Pennsylvania does not refund rent dollar-for-dollar. Instead, the state estimates that a portion of rent represents property taxes paid by landlords.

Under program rules, a percentage of annual rent is treated as equivalent to property tax. That figure is then used to calculate the rebate amount, subject to income limits.

Housing advocates say this formula allows renters to benefit from property tax relief without requiring landlords to participate.

What Documents Are Required for Refund?

Applicants typically must submit:

- Proof of rent paid or property taxes paid

- Proof of household income

- Documentation verifying age, disability, or survivor status

- Identification details, including Social Security numbers

Incomplete or missing documentation is the most common reason applications are delayed or denied, according to state officials.

Pennsylvania Reopens Refund Window But How Apply? Here Are Three Ways

1. Apply Online

Online filing is the fastest method. Applicants complete the Property Tax/Rent Rebate application through the state’s official tax portal, upload documents, and receive confirmation of submission.

State officials say online applications reduce errors because calculations are automated.

2. Apply by Mail

Paper applications can be mailed to the Department of Revenue. Forms are available online or at government offices and community organizations.

Applicants are advised to keep copies of all documents and ensure the application is postmarked by the extended deadline.

3. Apply In Person

In-person assistance is available through:

- Area Agencies on Aging

- Senior centers

- Local legislative offices

- Community assistance programs

Trained staff can help applicants complete forms and gather documentation.

What Happens After You Apply?

After submission, applications are reviewed by the Department of Revenue. Processing times vary depending on volume and whether documentation is complete.

Approved applicants receive their rebate by direct deposit or mailed check, depending on the option selected. Payments are often issued in waves rather than all at once. Applicants can check their status using official state tools.

Appeals and Reconsideration

If an application is denied, residents have the right to appeal or request reconsideration. Common appeal reasons include income miscalculations or missing documentation that can later be provided.

Advocates recommend responding promptly to denial notices and seeking assistance if the reason is unclear.

Equity and Access Challenges

Policy experts note that eligible residents are not evenly able to access the program. Barriers include:

- Limited internet access in rural areas

- Language barriers for non-English speakers

- Disabilities that make paperwork difficult

- Lack of awareness among renters

Community organizations play a critical role in bridging these gaps, particularly for older adults living alone.

Historical Context: How the Program Evolved

Pennsylvania’s rebate program dates back several decades and has expanded over time. Income limits and maximum rebates have increased periodically in response to rising housing costs and inflation.

Recent legislative changes broadened eligibility and increased maximum rebates, reflecting bipartisan recognition of housing affordability challenges for fixed-income residents.

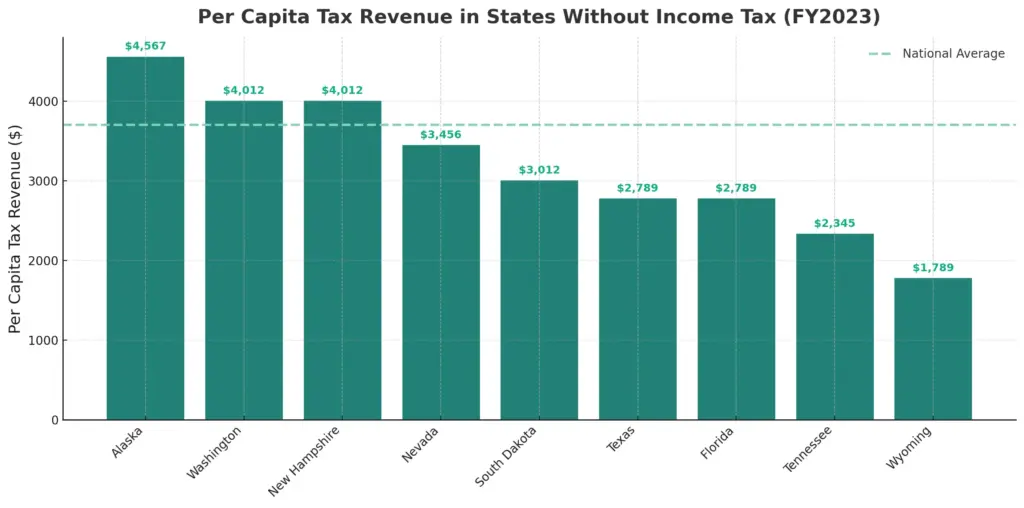

How Pennsylvania Compares to Other States

Several U.S. states operate similar programs, including New Jersey, New York, and Massachusetts. Pennsylvania’s program is notable for including renters and offering supplemental rebates tied to regional tax burdens.

Policy analysts say such programs can help older residents remain in their homes longer, reducing pressure on social services.

Fiscal Impact on the State

The rebate program represents a significant annual investment by Pennsylvania. Funding is allocated through the state budget and supported in part by lottery and gaming revenues.

Budget officials say the program is designed to be predictable and sustainable, though funding levels are reviewed each year.

Fraud Prevention and Consumer Warnings

The Department of Revenue warns residents to avoid scams. There is no fee to apply, and state officials do not request sensitive information through unsolicited calls or messages. Applicants should use only official state websites or recognized community partners.

What If You Miss the Extended Deadline?

If the extended deadline passes, rebates for that claim year are generally forfeited. Retroactive claims are limited under state law, making timely application essential. Officials stress that reopening the window does not change eligibility rules—only the time allowed to apply.

Looking Ahead

The Property Tax/Rent Rebate Program is reviewed annually as part of Pennsylvania’s budget process. While lawmakers from both parties have expressed support, future funding and eligibility levels depend on legislative decisions. Advocates continue to push for expanded outreach to ensure eligible residents are aware of the benefit.

Related Links

January 2026 SSI Will Arrive Early — Why the Payment Comes in December Instead

The Social Security Rule Many People Miss and How It Can Lower Your Payment – Check Details

By reopening the refund window, Pennsylvania is giving renters and homeowners another opportunity to claim housing relief amid ongoing cost pressures. State officials urge eligible residents to apply promptly and seek help if needed, emphasizing that the rebate can provide meaningful support for those living on limited incomes.

FAQs About Pennsylvania Reopens Refund Window

Do I need to file a state income tax return?

No. The rebate program is separate from income tax filing.

Can renters apply if utilities are included in rent?

Yes, as long as rent payments can be documented.

Is the rebate taxable income?

Generally, no for most recipients.

Can someone apply on my behalf?

Yes, authorized helpers may assist with applications.