As millions of Americans move closer to retirement, Retirement Planning 2026 planning is becoming more constrained, with fewer ways to significantly boost Social Security benefits heading into 2026.

Structural changes to benefit rules, longer life expectancy, rising costs, and political caution are narrowing the strategies retirees once relied on to increase lifetime income from the program.

Retirement Planning 2026

| Key Fact | Detail |

|---|---|

| Full retirement age | 67 for workers born in 1960 or later |

| Maximum delayed credits | Stop accruing at age 70 |

| Benefit calculation | Based on highest 35 earning years |

| Policy outlook | No broad benefit expansion expected by 2026 |

A Structural Shift in Retirement Planning

Social Security remains the most reliable source of retirement income for many Americans, especially middle- and lower-income households. Yet the program was never designed to offer unlimited flexibility. As demographic and economic pressures mount, its structure increasingly prioritizes sustainability over benefit growth.

The result is a system that still delivers predictable income but offers fewer opportunities for individuals to meaningfully increase monthly benefits once retirement approaches. For workers planning to retire around 2026, that reality is becoming clearer.

Why Boosting Benefits Has Become Harder

Full Retirement Age Limits the Upside

The gradual rise in the full retirement age (FRA) has had a lasting effect. Workers born in 1960 or later must wait until age 67 to receive full benefits. Claiming earlier results in permanent reductions, while delaying boosts benefits only until age 70.

After that point, no additional credits are earned. This creates a narrow window in which delaying retirement meaningfully increases monthly income, reducing flexibility for those with health issues or limited job options.

Lifetime Earnings Are Difficult to Change Late in a Career

Benefits are calculated using a worker’s highest 35 years of inflation-adjusted earnings. For many people, especially those with career interruptions or years of lower wages, there is limited ability to replace low-earning years late in life.

Only earnings up to the taxable maximum count toward benefit calculations. While that cap rises annually, relatively few workers consistently earn above it, limiting how much benefits can grow.

Cost-of-Living Adjustments Preserve Value, Not Purchasing Power

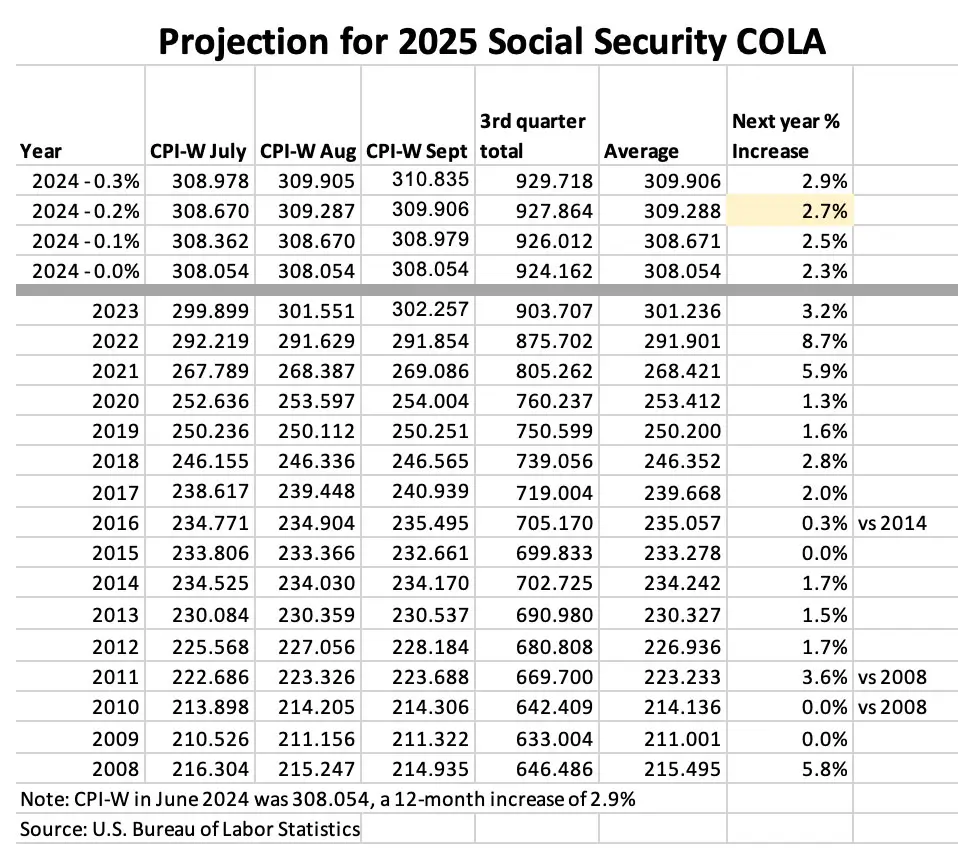

Annual cost-of-living adjustments (COLAs) protect benefits from inflation but do not raise real income. They are tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which reflects spending patterns of younger workers rather than retirees.

Economists note that older Americans spend disproportionately on healthcare and housing, costs that often rise faster than CPI-W. As a result, even years with noticeable COLAs may fail to keep pace with retirees’ actual expenses.

Claiming Mistakes Have Permanent Consequences

One underappreciated challenge is the long-term impact of claiming errors. Decisions made at or before retirement are largely irreversible. Claiming too early locks in lower monthly payments for life, while misjudging spousal or survivor benefits can significantly reduce household income.

Financial advisors note that many retirees still claim early due to job loss, health concerns, or misunderstanding the rules, even though delaying would yield higher lifetime benefits. Behavioral economists say this reflects a bias toward immediate income over long-term security, a tendency that becomes more costly as benefit growth options shrink.

Spousal and Survivor Benefits Offer Less Leverage Than Before

Spousal and survivor benefits remain important, especially for households with unequal earnings. However, rule changes over the past decade have eliminated strategies that once allowed couples to coordinate claims for higher combined benefits.

Today, most households face simpler but less generous options. Survivor benefits can still provide critical support, but they rarely compensate fully for lower individual benefits established earlier.

Longevity Risk Is Growing

Americans are living longer on average, increasing the importance of steady income deep into retirement. Yet longer life expectancy also means benefits must stretch further, making modest monthly differences more consequential over time.

For retirees who live into their late 80s or 90s, early claiming decisions can result in tens of thousands of dollars in lost lifetime income. This makes the shrinking set of benefit-boosting strategies more significant than ever.

The Policy Backdrop: Caution Over Expansion

Concerns about Social Security’s long-term finances continue to shape policy discussions. Trustees have warned that trust fund reserves could be depleted in the mid-2030s without legislative action, triggering automatic benefit reductions.

Lawmakers across parties acknowledge the issue but remain divided on solutions. Proposals to expand benefits typically require higher taxes or other offsets, making broad reforms politically difficult.

As a result, most recent legislation has focused on private retirement savings rather than expanding Social Security itself.

Geographic Cost Pressures Add to the Strain

Benefit formulas do not account for regional differences in living costs. Retirees in high-cost states face greater pressure, even when receiving the same monthly benefit as those in lower-cost areas.

Housing, property taxes, and healthcare costs vary widely by region, making Social Security less adequate in some parts of the country. This disparity further limits the program’s effectiveness as a standalone retirement solution.

Administrative Challenges Affect Planning

The Social Security Administration (SSA) has faced staffing shortages and rising workloads, complicating access to personalized assistance. While online tools have expanded, they do not fully replace individualized guidance.

Advocates warn that reduced access to in-person support may disproportionately affect older adults with complex situations, increasing the risk of suboptimal claiming decisions.

Adapting Retirement Strategies for 2026 and Beyond

With fewer ways to boost Social Security benefits, retirement planning increasingly emphasizes supplemental income.

Financial planners recommend:

- Delaying claiming when health and employment allow

- Maximizing employer-sponsored retirement savings

- Building emergency savings to avoid early claiming

- Considering guaranteed income products to hedge longevity risk

These strategies reflect a shift toward viewing Social Security as a stable foundation rather than a growth engine.

Related Links

December’s Final Social Security Checks Confirmed – Including a Holiday-Week Deposit: Check Details

What Comes Next

Absent major legislative change, the constraints facing Social Security will remain in place through 2026 and beyond. For future retirees, this means careful planning and realistic expectations about what the program can provide.

As one retirement economist observed, Social Security still delivers certainty—but certainty is no longer the same as flexibility.

FAQs About Retirement Planning 2026

Can working longer still increase benefits?

Yes, if additional earnings replace lower-earning years or allow delayed claiming credits.

Do COLAs increase real income?

COLAs protect against inflation but do not significantly raise purchasing power.